Hello everyone...

I am very glad to be part of this week's lecture with Professor @pelon53. I have been made to understand what wrapped tokens are, and the various ways they can be used to make the most out of the Blockchain ecosystem. My entry for the homework task is detailed below:

Q1: Name at least 2 Blockchains that use the Wrapped BTC, excluding Ethereum, and show screenshots. Explain.

Apart from the Ethereum network, which happens to be the most robust smart contract blockchain. Several other blockchains have have found their way around the interoperability problem of blockchains, and incorporated the wrapped version of Bitcoin into their ecosystem in order to reap benefits of Liquidity. Two of these blockchains are explored below:

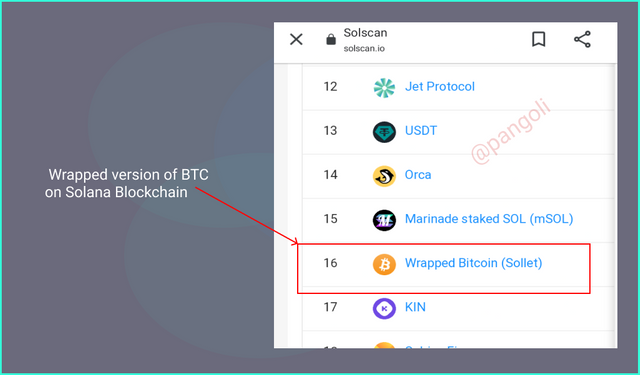

1.) Solana

Image source

The Solana blockchain uses the sollet.io platform as a cross-chain bridge to tokenize non-native cryptocurrencies into SLP tokens that can be used for transactions in Solana's DeFi protocols.

Sollet.io acts as a custodial authority that mints the wrapped SLP versions of non-native assets like BTC and ERC-20 standard tokens.

Image source

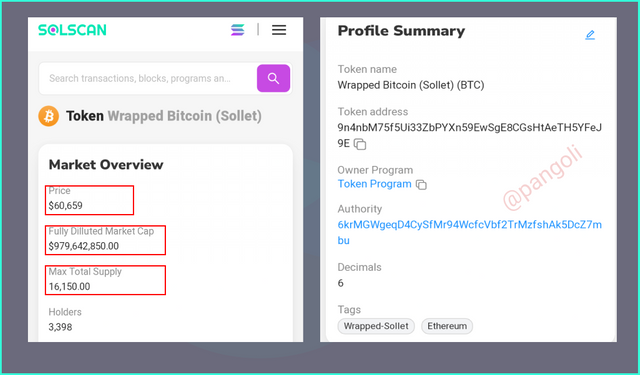

The Wrapped version of Bitcoin on the Solana blockchain is called "BTC Sollet" with the symbol "sBTC."

We can see here that the price is the sameas the original bitcoin's price. The market capitalization and total supply here is different the original bitcoin's because they represent only the bitcoins that are on the Solana blockchain.

Note: There are some other wrapped versions of BTC with the symbol wBTC on the Solana blockchain from other bridges like the Wormhole protocol. It is advisable to always use the sollet.io bridge as it has good volumes of convertions and there is a lesser risk of a Liquidity crunch.

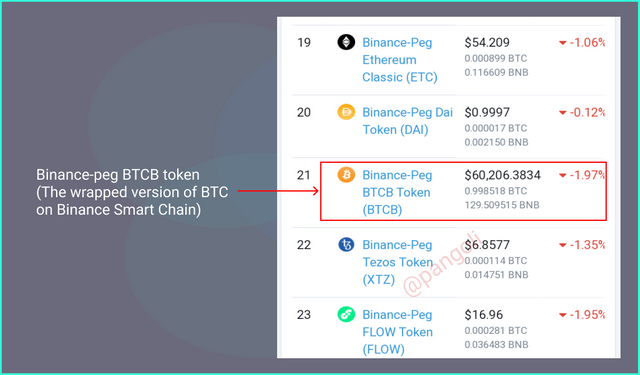

2.) Binance Smart chain (BSC)

Image source

The Binance Smart Chain is another blockchain that uses the wrapped version of BTC called the Binance-peg BTC (BTCB). Since the DeFi protocols on Binance Smart Chain are built according to the BEP-20 token standard, it means that an original BTC cannot be exchanged on the platform.

__

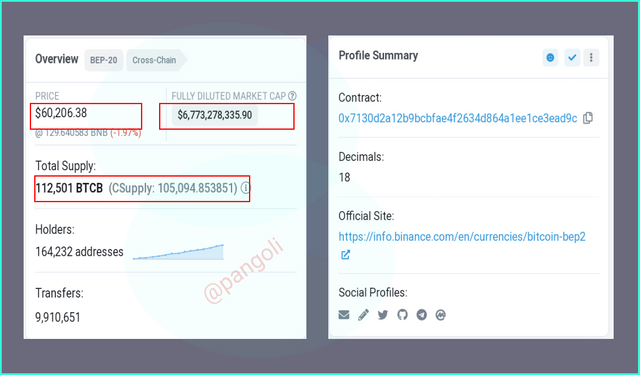

Image source

Hence, through the Binance bridge, original bitcoins are wrapped and made to be compatible with the BEP-20 standards. This wrapped version of BTC can easily be exchanged on the Binance Smart Chain for use in the numerous DeFi protocols. From the screenshot above, we can see that the value of BTCB is the same as that of the original bitcoin. The difference in the market capitalization and total supply is different from the original bitcoin's because it is calculated from the number of bitcoins on the Binance Smart Chain only.

Q2: What is the difference between the wETH of the Ethereum platform and the wETH of the TRON platform? Explain.

There are some outstanding differences to note about the wrapped versions of ETH belonging to the Ethereum platform and Tron platform.

A little due diligence on the Ethereum platform reveals that the currency -ETH, was in existence before the ERC-20 protocol got developed. However, the decentralized applications built on the Ethereum network are built according to the ERC-20 standard.

For the native currency -ETH to be easily exchanged for other assets in the Ethereum ecosystem, it had to be wrapped and upgraded to an ERC-20 compatible token with the symbol WETH. Having established this context, let's proceed to ascertain the difference between the Ethereum platform's WETH and the Tron platform's WETH

| Ethereum platform's WETH | Tron platform's WETH |

|---|---|

| Created according to the ERC-20 standard | Created according to the TRC-20 standard |

| Created as an upgrade of the original coin to service the DApps built with the ERC-20 standard on the Ethereum network. | Created to foster cross-chain transfer of value between the Ethereum blockchain and Tron blockchain. |

| WETH is minted by a smart contract within the Ethereum network | WETH is minted by a third-party custodian (Bitgo) |

| Subject to the high gas fees of the Ethereum network. | Utilizes the low gas fees and scalability of the Tron blockchain. |

Q3: Make an investment of at least $ 5 of a Wrapped token. Explain the process with screenshots.

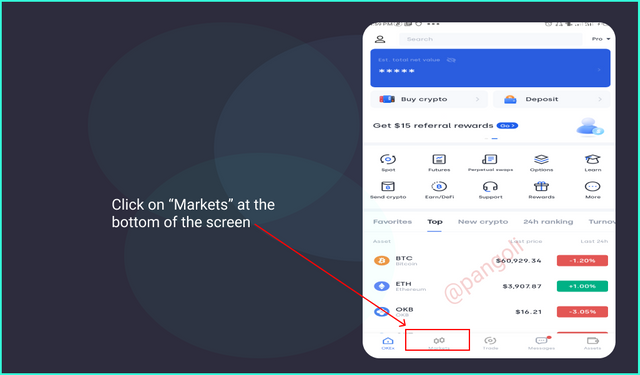

I will be using the OKEX exchange platform to initiate my purchase of a wrapped token in the spot market segment. My process is explained in the following steps:

Step 1:

Image source

Open the exchange platform and navigate to Markets at the bottom of the screen.

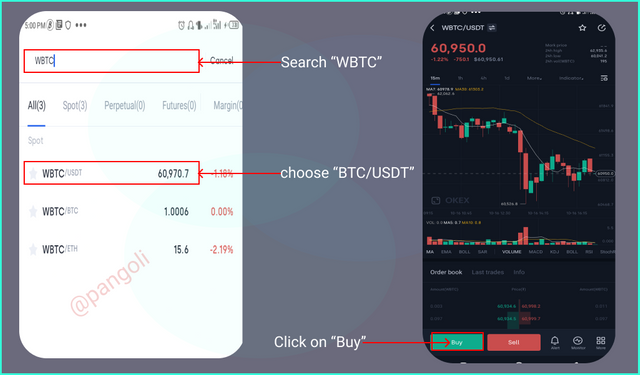

Step 2:

Image source

On the resulting page, search for WBTC using the search box and click on WBTC/USDT. Click "Buy" on the resulting chart screen.

By default a purchase form will appear with spaces to fill the necessary details for a spot market order.

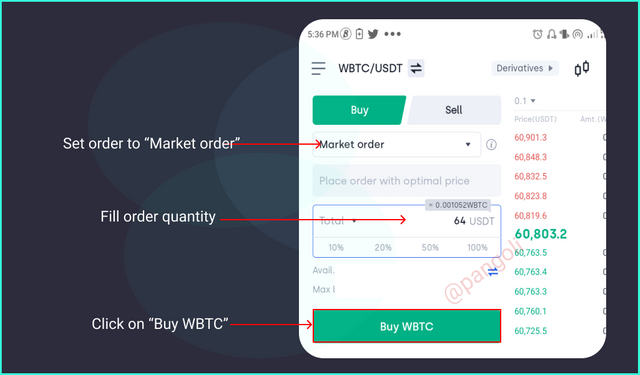

Step 3

Image source

Fill in the required details accordingly:

- Set order type to "Market order"

- Input purchase amount (Mine is $64)

- Click on "Buy WBTC" and confirm purchase on the resulting pop-up menu

Once the order is successfully executed, it will be displayed among the filled orders in the transaction history.

Image source

Q4: Explain in detail the Wrapped token of the TRON Blockchain. Show screenshot.

Through the alliance of the Tron blockchain with the Bitgo platform, several non-native cryptocurrencies have been onboarded onto the Tron blockchain. This characteristic of the Tron network goes to validate the value proposition given by its creators, to provide users with a platform where they can exchange any crypto asset at scale and with very low gas fees.

The Bitgo custodial authority acts as the bridge between the Tron network and other blockchains. It takes the role of holding the original coins from other blockchains, and minting the TRC-20 standard equivalent of these tokens for the Tron blockchain. It serves as the channel through which value is exchanged across these blockchains.

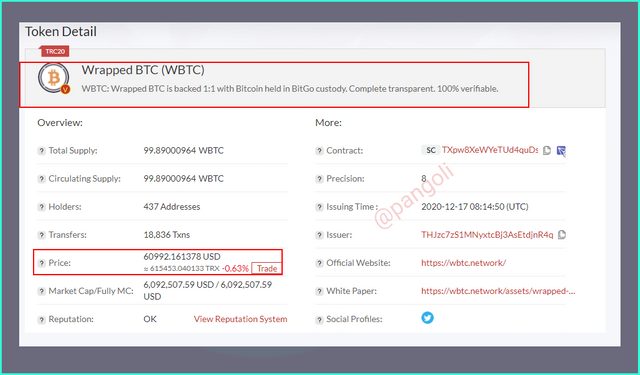

By exploring the the Tron block explorer, we can see the list of several tokenized cryptocurrencies on the blockchain from the primary coins -WBTC and BETH, to other coins like WTT and WTRX. Let's attempt brief explanations on each of these tokenized cryptocurrencies below:

WBTC

Image source

This is a TRC-20 version of Bitcoin created for use within the Tron blockchain. This wrapped version of Bitcoin has its value pegged to the original coin, but bears the characteristics of a TRC-20 standard token. In this case, the WBTC on the Tron network benefits from the scalability and low gas fees of the Tron network.

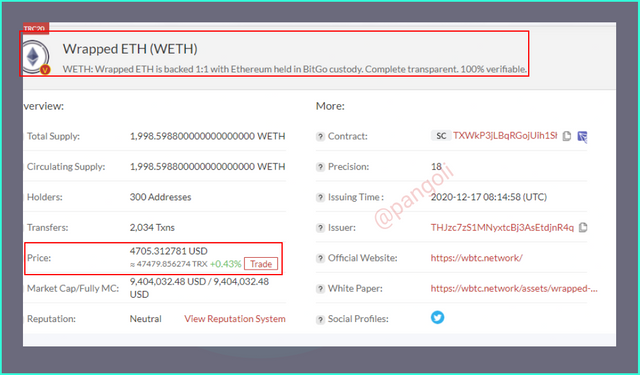

WETH

Image source

ERC-20 tokens like ETH are, by default, unable to be used on a TRC-20 blockchain like Tron. For this reason, the WETH is created to enable cross-chain transactions between the Tron blockchain and the Ethereum network. WETH is a wrapped version of ETH that is compatible with the TRC-20 standards, and can be used in the various DeFi protocols on the Tron Network.

This tokenized version of ETH maintains the same value as the original coin, as it is pegged 1-to-1 with the Eth in the reserves of the Bitgo platform.

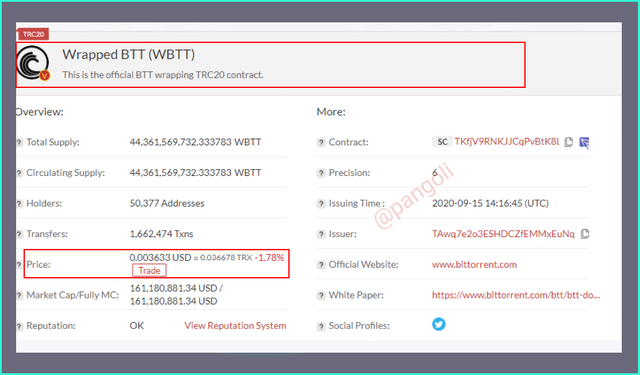

WBTT

Image source

BTT is a TRC-10 standard Token on the Tron blockchain. It could be assumed that there is no need for a wrapped version of this token to be minted, since it already belongs to the Tron blockchain. However, this token is not compatible with the TRC-20 standards of the smart contracts on the Tron network. Hence, the need to create a wrapped version of the BTT token with the symbol WBTT.

As is the case with every other tokenized cryptocurrency, WBTT retains the same value as the original asset, but with a new protocol that makes it compatible with the TRC-20 standards.

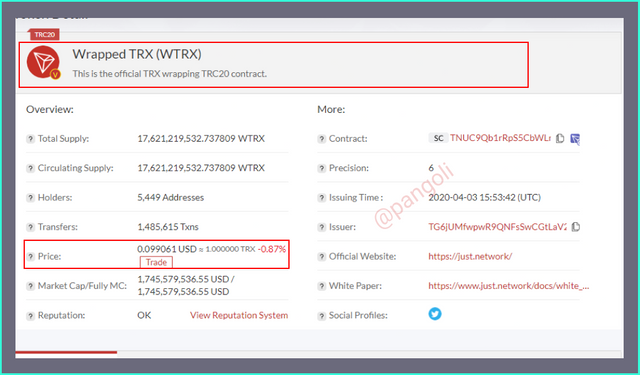

WTRX

Image source

Just like the situation on the Ethereum network where the native currency did not meet the ERC-20 standard of Smart contracts built on the network, the TRX token of Tron blockchain faces a similar fight.

The TRX token was created according to the TRC-10 standards, just like BTT. Hence, to enable an easy flow of liquidity between the Tron network and its smart contract platforms, the Tron network created a wrapped version of its native currency that is compatible with the TRC-20 as the WTRX token.

Note that; since BTT and TRX already belonged to the Tron network, creating a wrapped version of these coins did not follow the same route as WBTC and BETH. Here, the Wrapped tokens are created by a smart contract on the Tron blockchain.

Q5: What is to mint a Wrapped token? What is burning a Wrapped token? What is the function? Create an example explaining the process.

To begin with, let us get some perspective on the key terms in this question: Minting and Burning. The TL;DR of this section is as follows:

Minting

This is the process of creating a replica of a cryptocurrency using protocols that are different from its native blockchain, in order to facilitate the transfer of value across different blockchains. The replicated-wrapped coin here is pegged one-on-one with value of the original coin.

Burning

The burning process reverses the minting process. That is, burning occurs when a replicated coin is exchanged for the original. It is an automated process through which a replicated coin is taken out of circulation, and the original gets released to the owner.

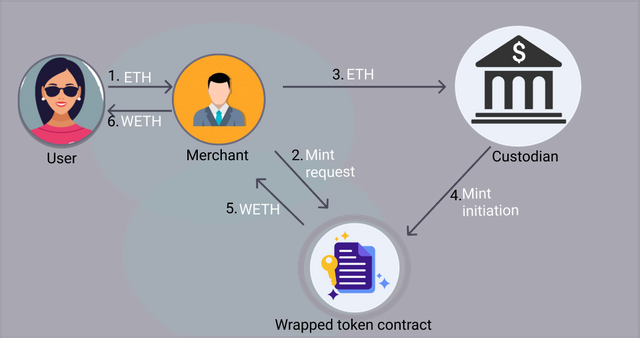

Minting and Burning of wrapped tokens takes a series of coordinated processes, and a number of participants which include a custodian, a merchant, and a user.

- Custodian: these are often Decentralized Autonomous Organizations (DAOs), Multi-sig wallets, or Smart contracts, who carry out the wrapping/unwrapping of coins for merchants and keep a Proof-of-Reserve for the original asset.

- Merchants: these are mostly exchange platforms where users get to transact and exchange value.

Let's take a case study on ETH and the Binance Smart contract platform, the Binance Smart Chain. The ETH token, which is the native currency of the Ethereum ecosystem is built for compatibility with the ERC-20 protocol; while the Binance Smart Chain token (BSC) is built to be compatible with the BEP-20 standard.

Here, for users of Ethereum to be able to take part in the numerous DeFi protocols on the Binance Smart Chain, they will need a version of ETH that conform to the BEP-20 standard. Hence, the need for a wrapped ETH.

A graphic illustration of this process will follow this format:

Image | Made with Figma

- A user has ETH(ERC-20) and Wants the wrapped version -WETH (BEP 20)

- User requests for the wrapped tokens to the merchant and transfers the original token

- The merchant submits request and releases the original coins to the custodian.

- Custodian mints the wrapped version of token according to the merchant's request and reverts back to the merchant.

- User received wrapped version of token

To burn wrapped tokens, the process is simply reversed:

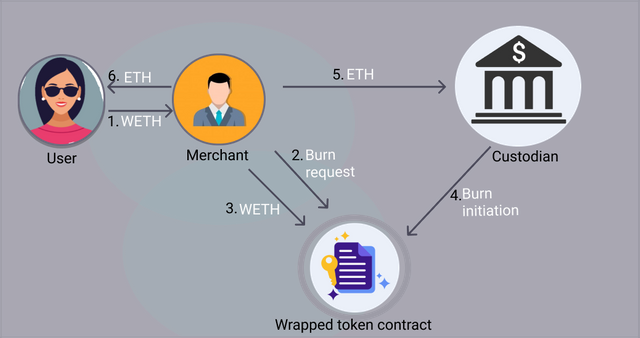

Image | Made with Figma

- A user has WETH (BEP-20) and wants the original coin ETH (ERC-20).

- User submits request for the original tokens to the merchant and sends wrapped tokens

- The merchant submits a burn request and releases the wrapped coins to the custodian.

- Custodian burns the wrapped version of token according to the merchant's request and reverts back to the merchant.

- User received the original version of the coin.

What is the function of wrapped tokens?

Blockchains have always been known to exist in a stand-alone form, with no available infrastructure to enable communication and exchange of value between different blockchains.

The concept of wrapped tokens solves this inter-operability puzzle by creating a channel for non-native cryptocurrencies to be deployed and used in different blockchains.

Through wrapping, the case of liquidity crunch and idle capital has been resolved because tokens can be easily shuttled across many blockchains.

Also, wrapping had enabled tokens from cost demanding Blockchains to trade at a more cost effective rate on other blockchains.

Conclusion

The blockchain revolution has been on for a good number of years already, and there have been significant adoptions that have resulted through the finance use case on Smart contract platforms.

However, a lack of infrastructure to facilitate cross-chain exchange of value hindered the participation rate in the various DeFi protocols that have been created; and there were many cases of assets laying idle.

With the introduction of wrapped tokens, the problem of cross-chain transfer of value has been resolved, and greater utility has been discovered for crypto assets.

Thanks for reading...

CC:-

@pelon53

@steemcurator2