Introduction

Hello @awesononso, I am delighted to be part of steemit Crypto Academy season 4 which has always been a dream that has finally come to reality.

Homework Tasks

- Properly explain the Bid-Ask Spread

I, @patience90 budgeted 150 steem to purchase a Samsung television set from David and that amount is the highest insult can offer because that's my budget. David on the other hand is selling at the price of 200 steem and nothing less.

From the above illustration

The Bid-Price

@patience90 highest price for buying the TV set is 150 steem and that makes it the Bid-Price.

It simply explains that as the highest amount a buyer can be able to buy goods

The Ask-Price

David on the other hand is selling the TV set at the least price of 200 steem, which makes it the Ask-Price. That's the amount the seller wants to sell.

The Spread

The Spread-Price is the difference that exists between the Bid-Price and Ask-Price. That is the difference between the amount @patience90 wants to buy and the amount David wants to sell.

Bid-Price - Ask-Price

Bid-Price = 150 steem

Ask-Price = 200 steem

Therefore, 200-150 =50

Spread-Price = 50

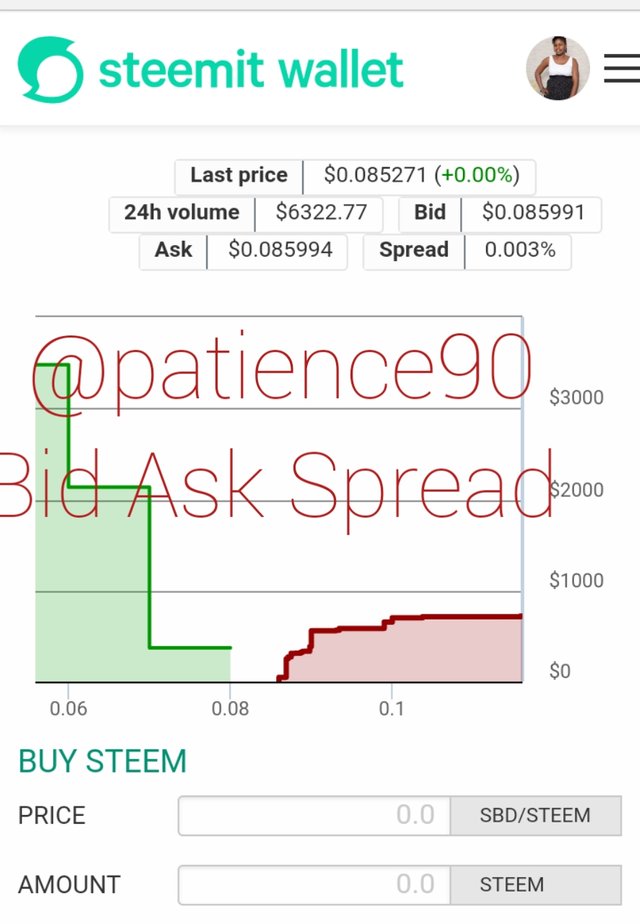

a screenshot from my wallet

From the above picture, colour green represents the Ask-Price while colour red represents the Bid-Price and below it is the Spread.

The difference between the Ask-Price 0.085994 and Bid-Price 0.85991 which is the Spread is 0.003%

2 . Why is the Bid-Ask Spread important in a market?

The Bid-Ask Spread is important in the market because:

- It guides the trader in the market to make good decisions when it comes to buying and selling.

- Bid-Ask Spread helps the trader to understand the differences from what the last price a seller is willing to sell and how much the buyer has budgeted.

3 . If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

a.) Ask-Price - Bid-Price =Spread

Ask-Price = $ 5.20

Bid-Price = $5

Spread = $5.20 - $5.00

Spread = $0.20

The difference there is $0.20

b.) Spread / Ask-Price x 100

Spread = $0.20 / $5.20 x 100

Ask-Price = $0.20 / $5.20 =$0.0384

$0.0384 x 100 = 3.84 %

4 . If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

a.) Spread = Ask-Price - Bid-Price

Ask-Price = $8.80

Bid-Price = $8.40

Spread price = $8.80 - $8.40

Spread Price = $0.40

b.) $0.40 / $8.80

= $0.0455

$0.0455 x 100

= $4.55 %

5 . In one statement, which of the assets above has the higher liquidity and why?

Crypto X has higher liquidity than crypto Y because Y has much more than X.

6 . Explain Slippage.

Assuming I budgeted to buy a pair of shoe worth 10 steem and on getting to the market, I discovered it is worth 15 steem. That means there is a slippage.

Therefore, slippage is the difference between an amount that is being estimated and the cost of actual transaction.

7 . Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive Slippage

This is a favourable outcome of the price of a commodity in the market.

For example, I budgeted 9 steem to buy a chair and on getting to the market, I realized it costs 7 steem.

The positive slippage in this situation will be

9 - 7 = 2 steem

Negative Slippage

This is a direct opposite of positive slippage. That is the negative outcome of a budget.

For instance, I ordered for a bottle of wine worth 21 steem and on arrival, it costs 23 steem.

The negative slippage will be

23 -21 = 2 steem.

This scenario is always unfavorable to a trader and has negative impact on the wallet.

Conclusion

This study of Bid-Price, Ask-Price Spread is highly important in buying and selling in the market. This will help the trader to understand the risk in every business which can either be positive or negative slippage.

this will enable the trader avoid some unnecessary loss.

Best regards

@patience90

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit