Hello crypto lovers, it feels good to be back again this week 8, this is my home work task post for professor @fredquantum Lecture. This week he taught about zethyr finance and I will be attempting all the questions asked below.

Question one

What is Zethyr Finance?

There is a popular platform we all known as instagram, instagram is a social platform where we can upload our pictures and videos, however on this platform pictures and videos cannot be downloaded, hence another developer developed a platform where pictures and videos on instagram can be downloaded. Zethyr finance also act this way just that it's deals with money on the blockchain not pictures and videos.

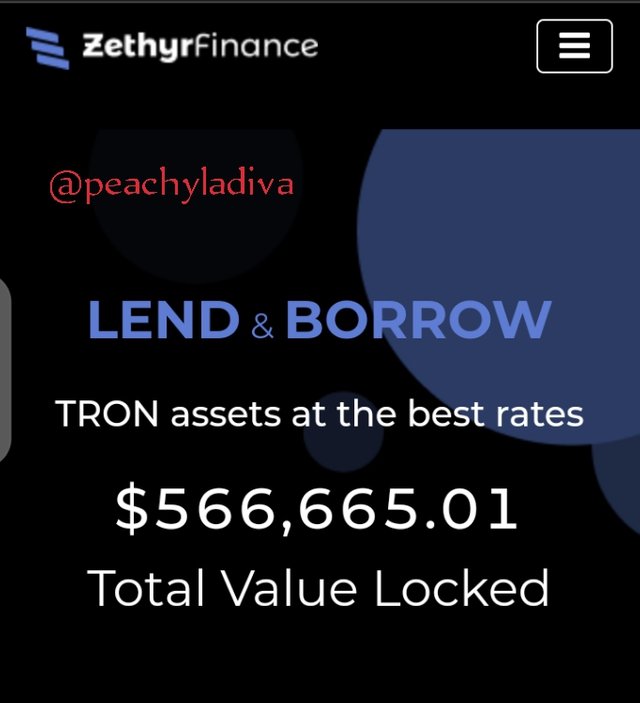

Zethyr finance is a dApp built on the tron blockchain in essence it brings in features that the tron blockchain does not have the same way steemworld.org have features steemit.com does not but it's steemit.com that makes steemworld relevant. Zethyr finance major goal is to make your money work for you. No token sit idle on the platform they invest it for you and the main purpose of the platform is to lend and borrow TRX, USDT, WIN and BTT which are tron asset. At this point it's important to note that zethyr finance has other features but it's major feature is lending and borrowing.

Whenever anyone borrows from the bank, most of the time there is always collateral and interest involved same thing applied to zethyr finance, borrowers use their tron asset as collateral and pay back whatever they loan with interest. Interest are paid to the lenders in ztoken which is the token for the platform. It's is advisable to pay loan interest daily as if not paid in a particular day it will be added to the principal and the interest rate will keep increasing. One amazing feature of zethyr finance I love is no asset sit idle it's invested for profit making.

Question two

What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

The features of zethyr finance includes :

- stable swap

- lend and borrow

- ztokens

- DEX Aggregator

Stable Swap

The crypto market is a very volatile space, you can loose all you asset within secs thus bring about stable coins that you can swap your asset with. The stable swap on zethyr finance is known as cross swap, it enables you to be able to swap your tron USDT to Ethereum USDT though the transaction fee is a bit on the high side, it's still a great feature that can be used based on investment choice.

Lend and borrow

This is the major feature of the zethyr finance, its a feature where by the users enable the platform to lend out their assets so as to gain profit as form of interest. The platform is both for those that wants to lend and borrow. It works in a way where by the borrowers pay interest and they lenders get profit from the interest paid by the borrower.

ztokens

Ztokens is another great feature of the dApp as it act as a way to pay back the profit to the lenders and also it can act as collateral when the borrower wants to borrow any asset from the platform.

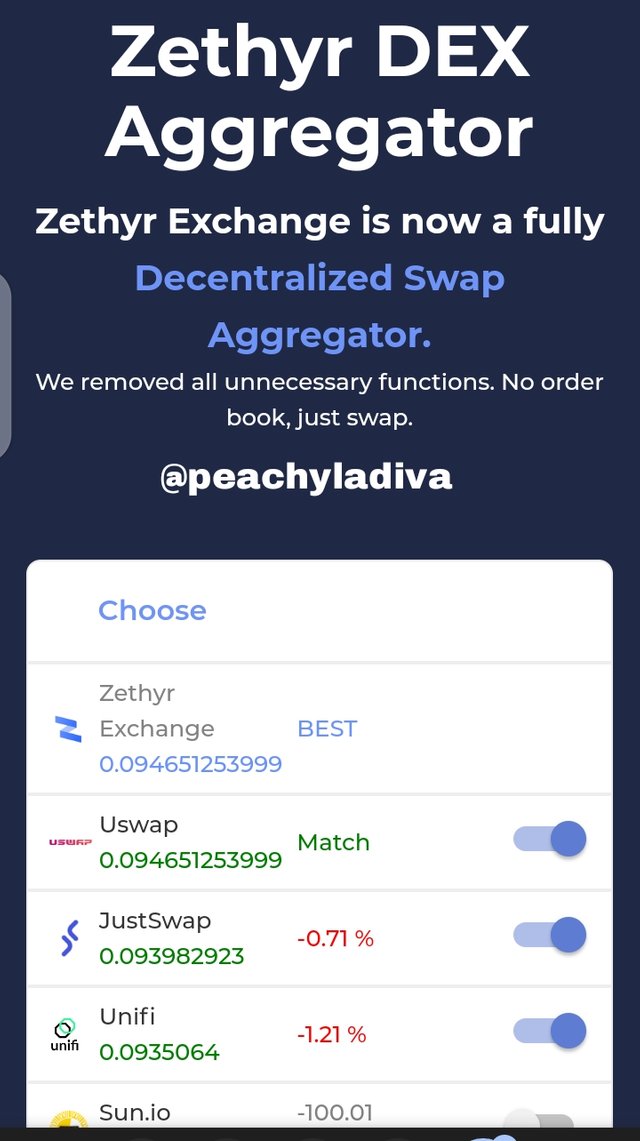

DEX Aggregator

In simple terms DEX Aggregator is zethyr exchange + zethyr swap. July 30th, 2021 zethyr finance announced the upgrade from order book model to Dex aggregator . Technology keeps advancing daily and developers are finding various ways to do things better and DEX aggregator bring ease of transactions on zethyr finance, instead of going from one place to another you can get all your transaction done on Dex aggregator as its gathers different exchanges and swaps to come up with best price for users. This is done instantly with zero charges.

Question three

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

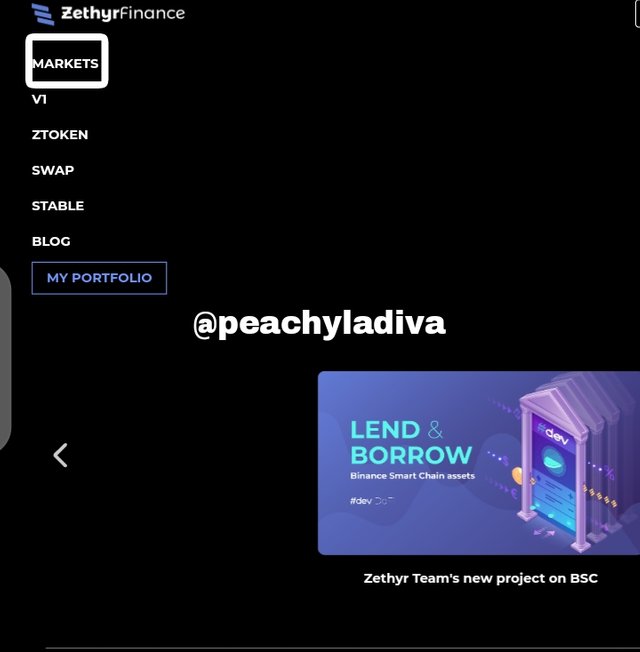

Explore the zethyr market using this link https://zethyr.finance/#/

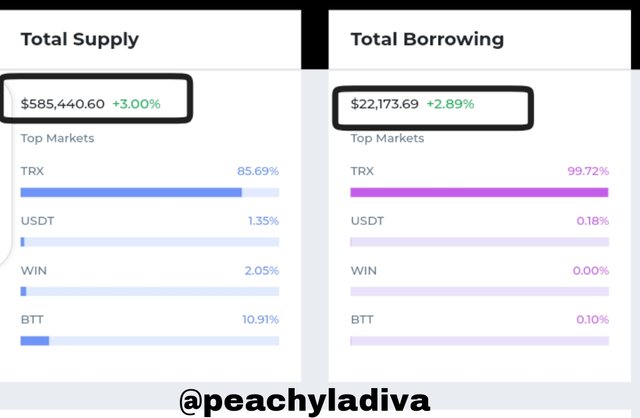

From the interface I click on market, can be seen from the screenshot above, clicking on market took me to the market interface where I can clearly see the total supply and total borrow assets.

As of the time of writing this post, the total supply market is $585,440.60 while the total borrow market is $22,173.69. I think this is a good balancing as its better for the supply market to be much than the borrow market. We can also clearly see from the screenshot that tron is dominating both the supply market and the borrow market with 85.69% and 99.72% respectively. This shows alot of users relate more with tron than other three tokens (USDT, WIN, BTT) available in zethyr finance.

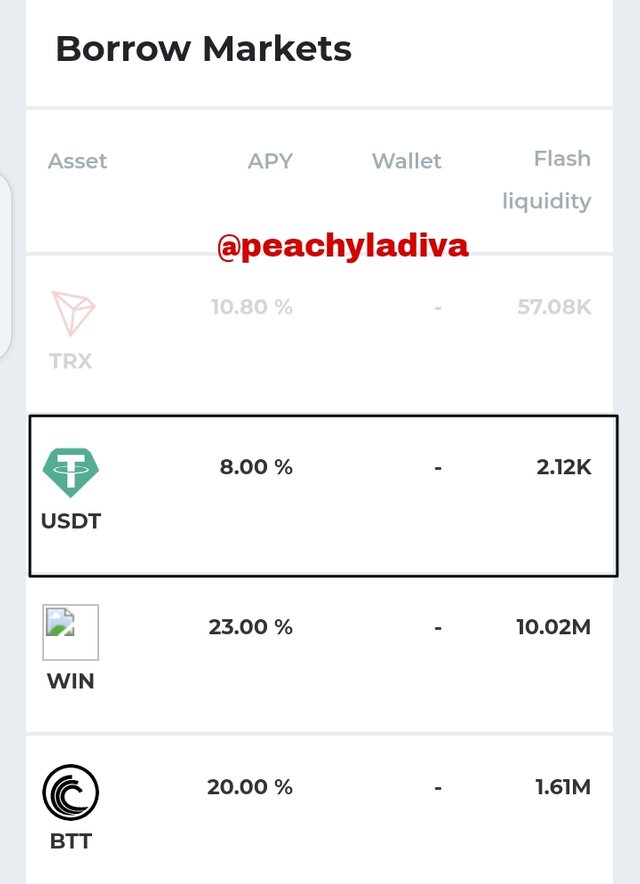

This is the screenshots of the market and this clearly shows the annual percentage yield know as APY. The APY shows us the most profitable when it comes to supply and borrow. One would have thought because tron is the one dominating the supply and borrow market it will be the one with the most profitable APY but the data shows otherwise with USDT taking the lead in both the supply and borrow APY, with a percentage of 24.39% and 8.00% respectively.

Question four

Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

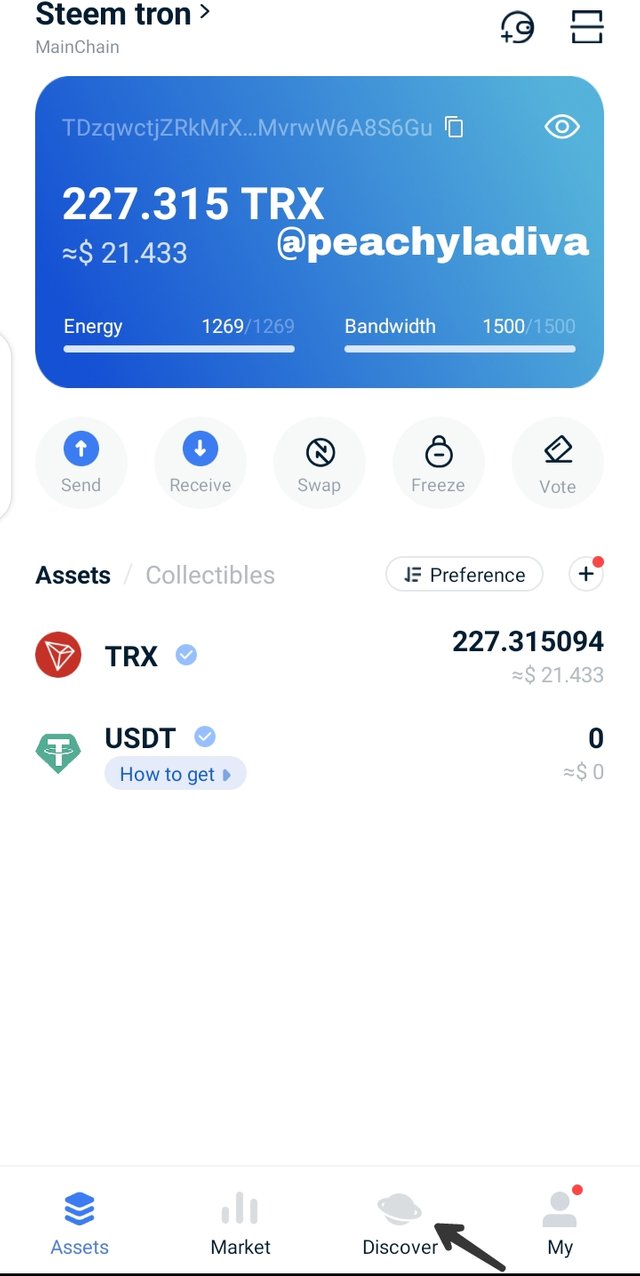

I used my Tronlink wallet app to connect to zethyr finance and below are the easy steps to connect it.

- I opened my tronlink wallet (you can easily download one on Google Play Store for Android users and App Store for iOS users) and click on discover as displayed in the screenshot below.

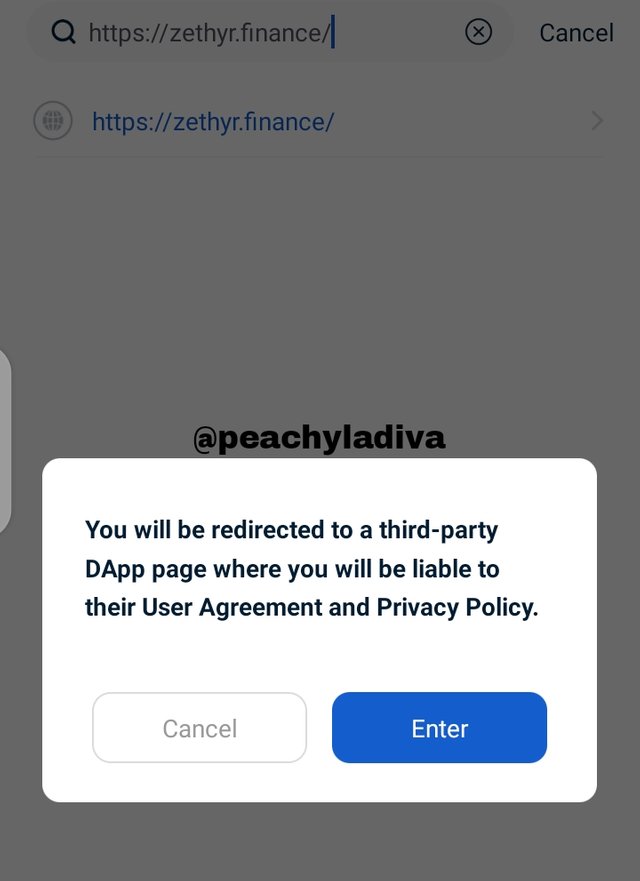

- clicking on discover is the same as clicking on the browser part of the app, so I was directed where I input the link for zethyr finance. https://zethyr.finance/ and I click on enter and that automatically link my tronlink wallet and zethyr finance.

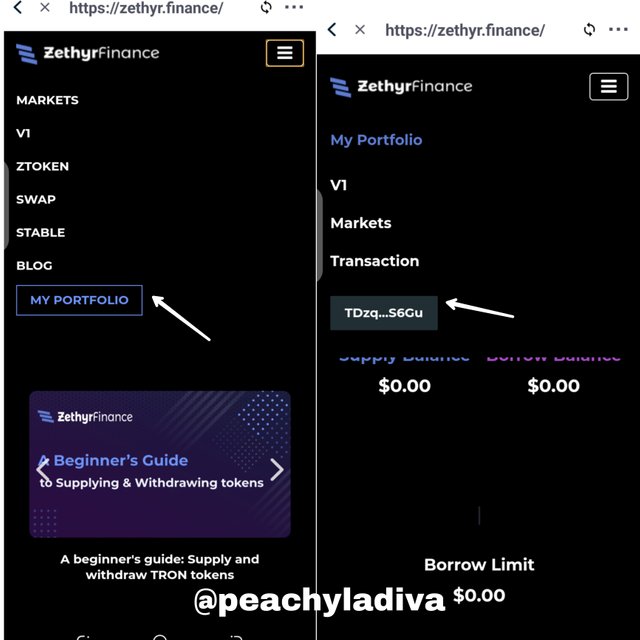

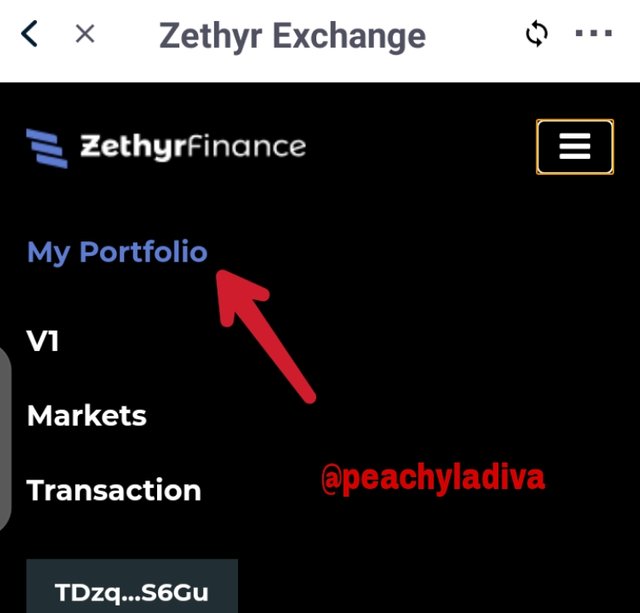

- to check if truly the two account have been link, I click on my portfolio and I can clearly see my tronlink wallet address showing.

Question five

Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

Ztoken (ZTR) is a native token to zethyr and it's a way to give the community power as holders of ztoken in zethyr protocols have the power to make decisions and cast votes concerning any issues on the protocol, it's important to note that ztoken is also used to pay users APY whatever interest accumulates during supply is automatically paid in users wallet as ztoken.

Whatever we supply to the zethyr protocols we get 1:1 ration of it in ztoken. That's to say when we supply tron for instance we get ztron and this also applies to all the acceptable supply in the protocol.

Anothet similar token that serve same purpose

Jtoken is another token that have similar characteristics as ztoken. Jtoken is a token native to Justlend platform and it's also built on tron ecosystem and also have the lend and borrow feature just like the zethyr protocol,interest are also paid in jtoken.

Question six

Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

My tronlink wallet is already connected to zethyr finance from question four, so I will just pick up from there.

open my tronlink wallet and click on discover, search for zethyr finance, the wallet is already connected, so I click on my portfolio.

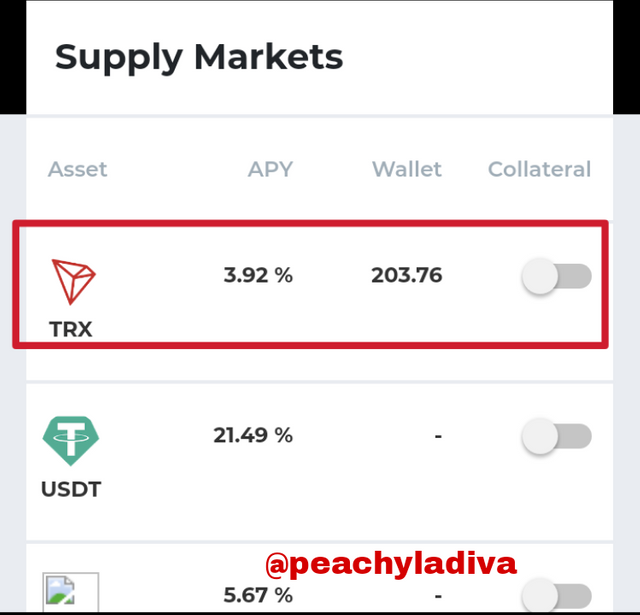

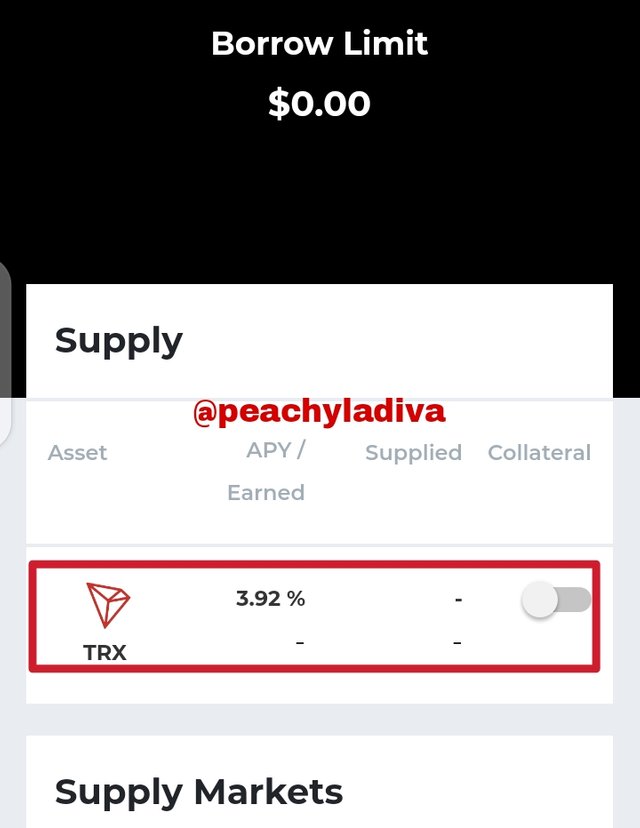

go to the supply market and click on tron, since I only have tron asset in my wallet I will use tron to perform the transaction.

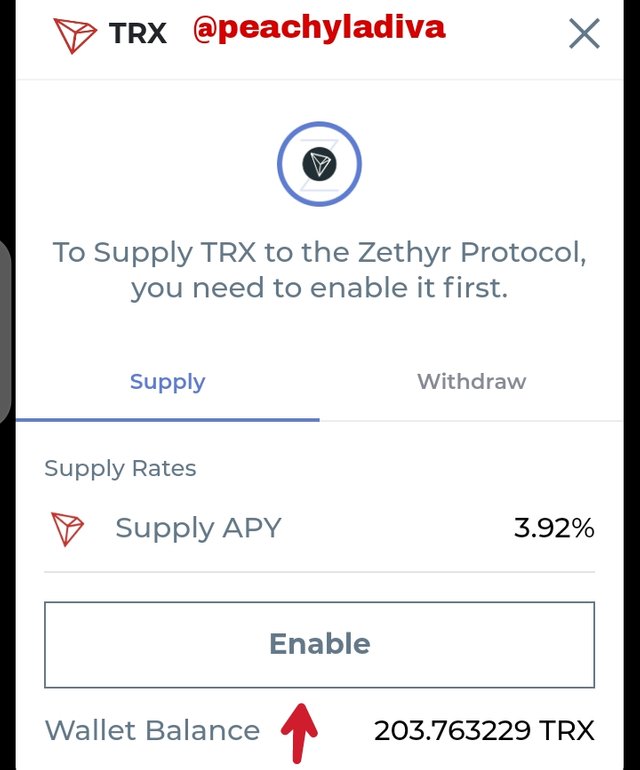

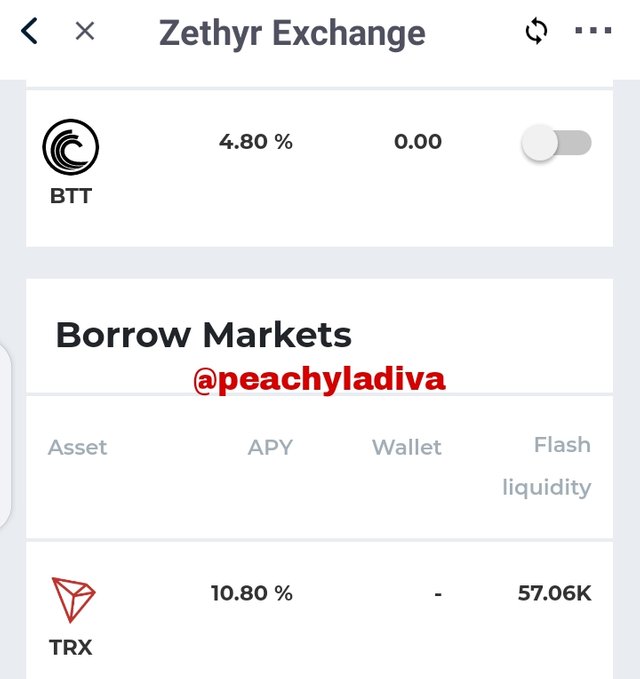

- to be able to supply in zethyr finance I have to enable tron in both the supply and borrow market.

|  |

|---|

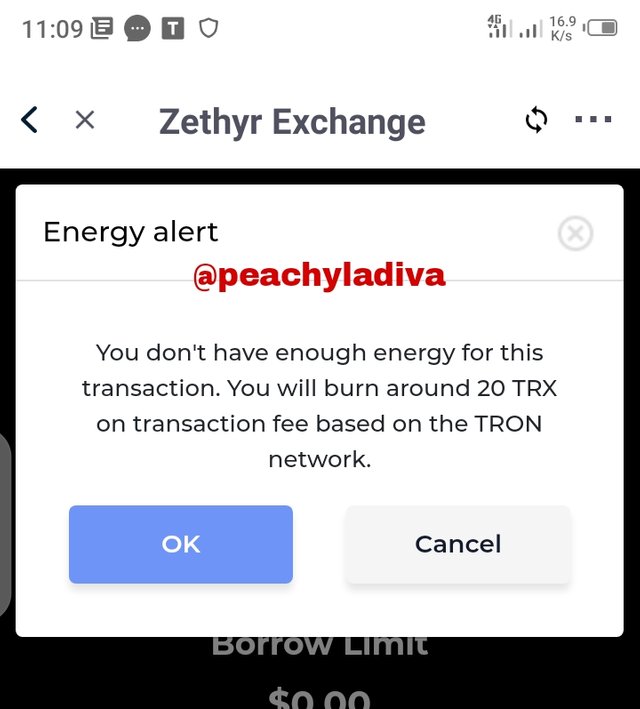

- to enable, I click on the tron asset and it asked me to enable. I didn't have enough energy to complete the transaction, so 20 trx was burned to carry out the transaction

|  |

|---|

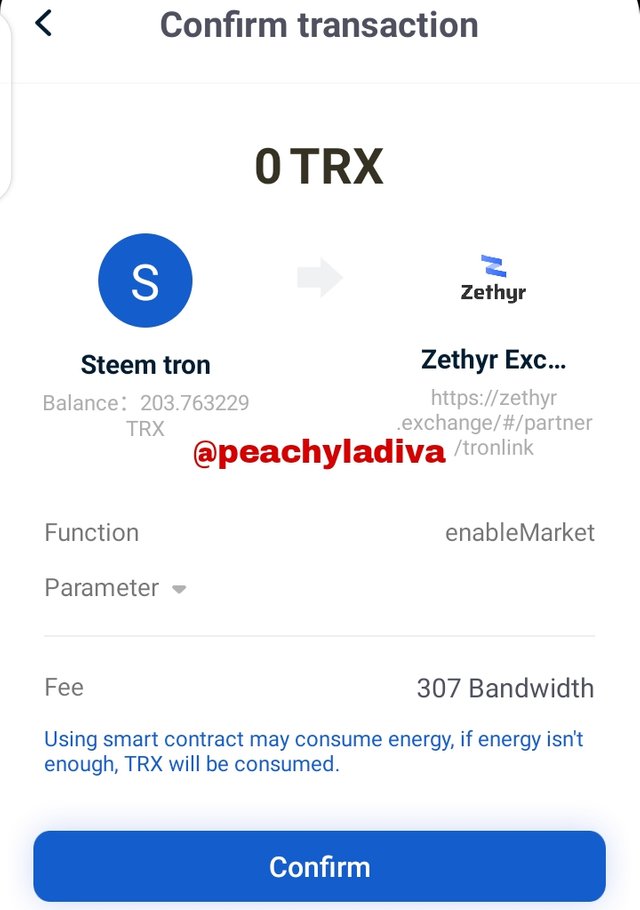

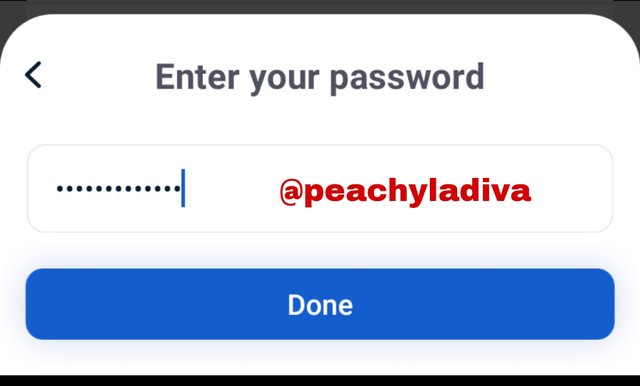

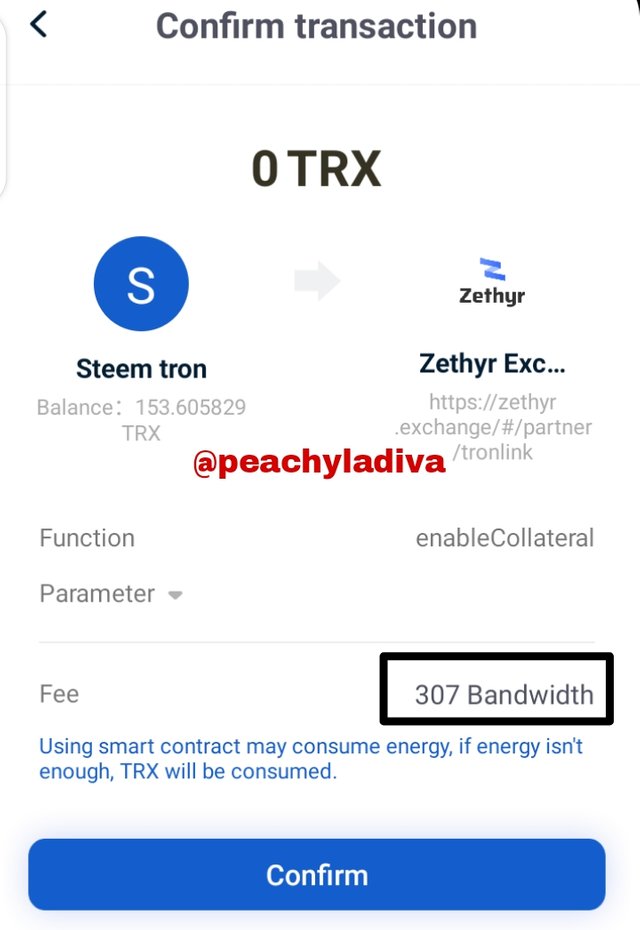

- it takes 307 bandwidth to carry out the transaction, I click on confirm and enter my password to complete the transaction

|  |

|---|

- repeat the same process in the borrow market(that is enable your tron asset also in the borrow market) , with that you have successfully enable your tron for supply in zethyr protocol

How to supply tron asset in zethyr finance

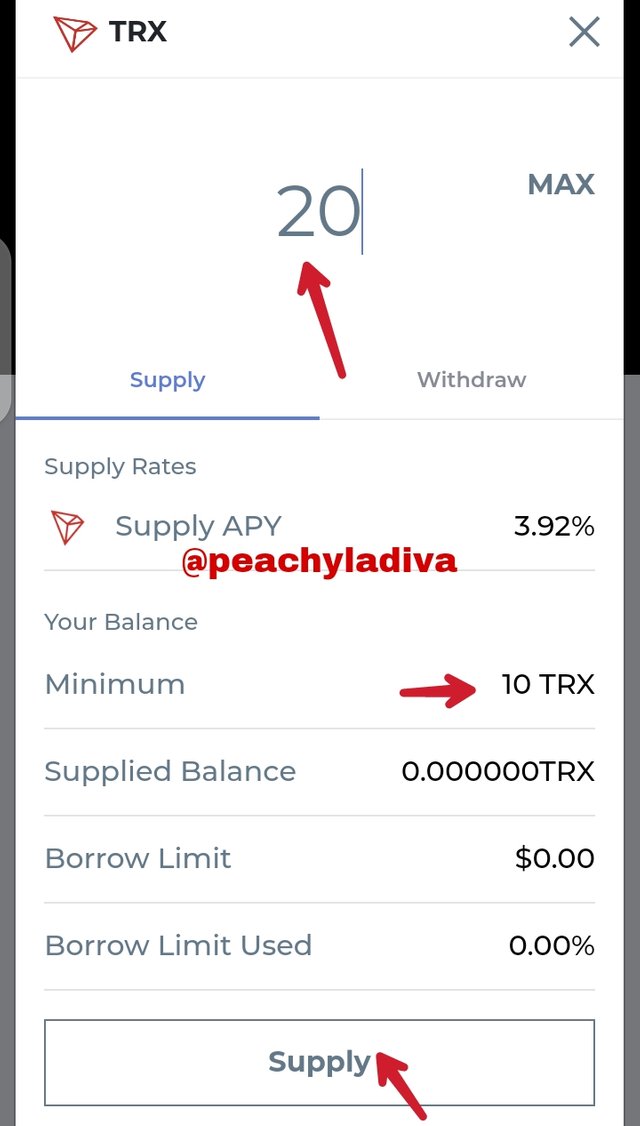

- click on tron in the supply section and input the amount you want to supply to the zethyr finance. The minimum you can supply is 10 tron and I choose to supply 20 tron

|  |

|---|

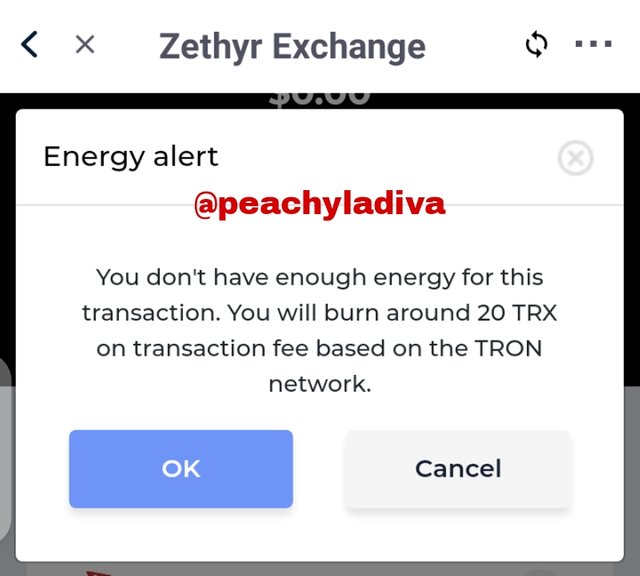

it brings to my attention again that I don't have enough energy and 20 tron will be burnt to carry out the transaction.

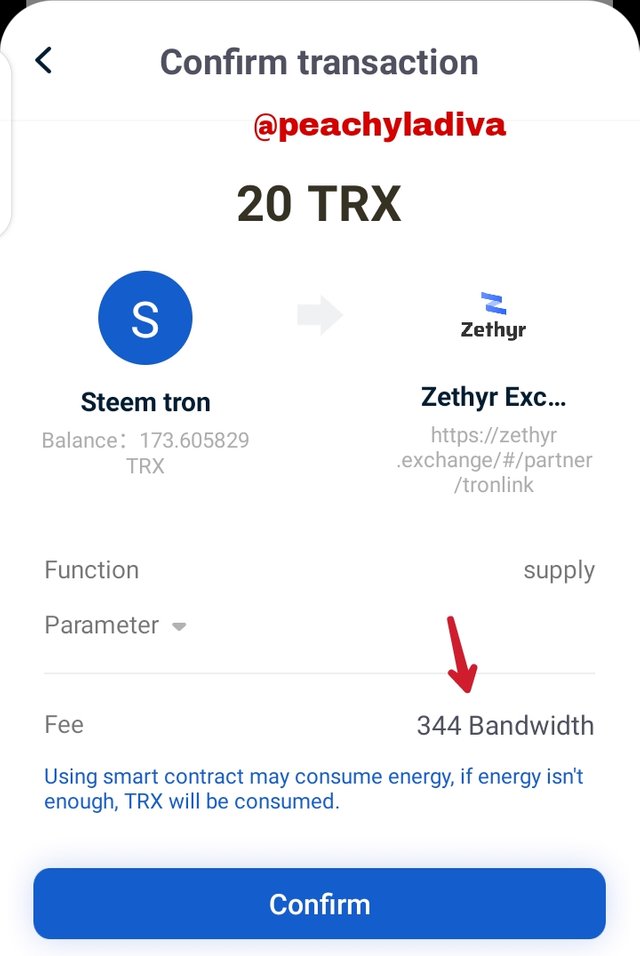

click on confirm and input your password word to complete the transaction.

|  |

|---|

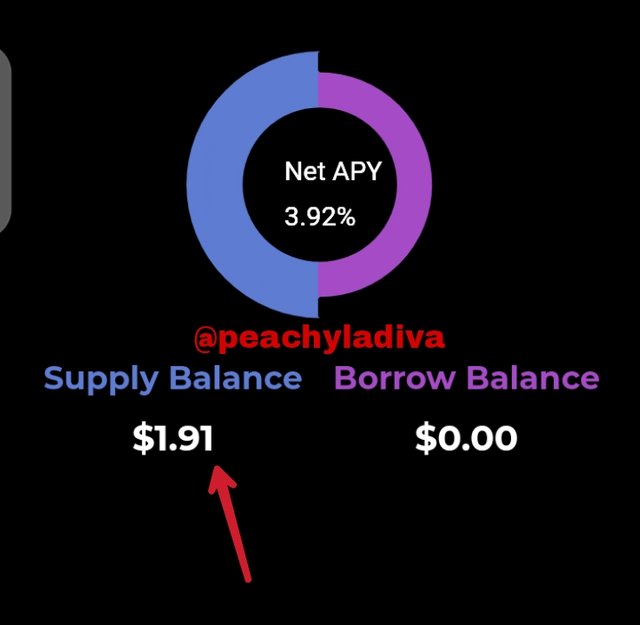

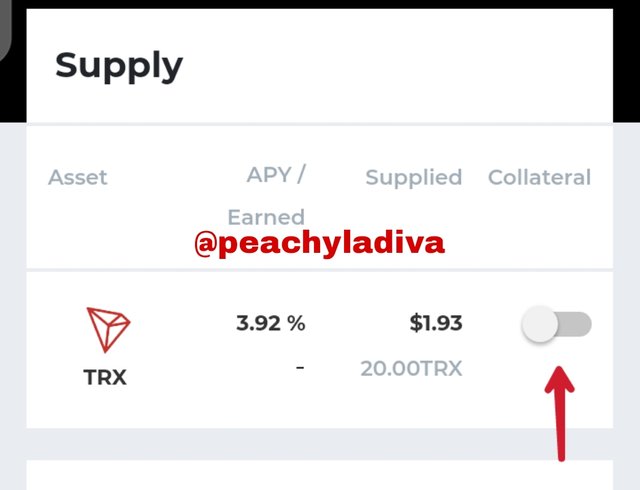

- 344 bandwidth was used to complete the transaction and you can see from the screenshot below that the 20 tron has already reflected in the supply section.

Question seven

Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

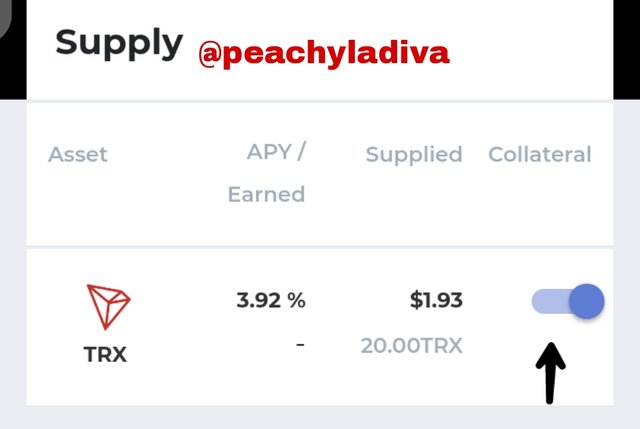

Collateralize of asset

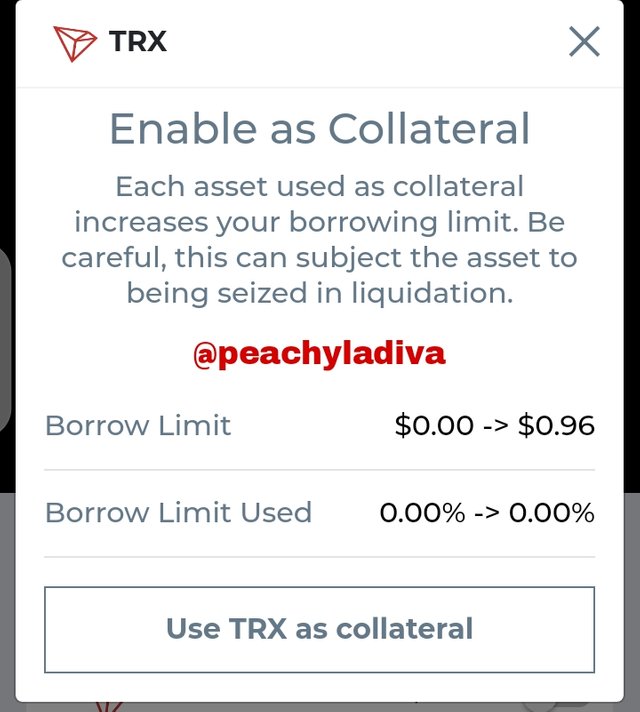

- click on the asset supplied, my asset supplied is tron. I have to enable it to be able to collateralize it and this will cost another 20 tron to be able to enable. Once enabled, the asset can be collateralize.

|  |

|---|

|  |

|---|

Transaction link

https://tronscan.io/#/transaction/c5e8c097d5da51ac579debe6385661777dcfe55f58792b912cc6d144c349be2b

Borrow on Zethyr finance

once you have an asset for supply on the protocol then you can borrow from the protocol just not your supplied asset and also you can only borrow 50% worth of what you supplied.

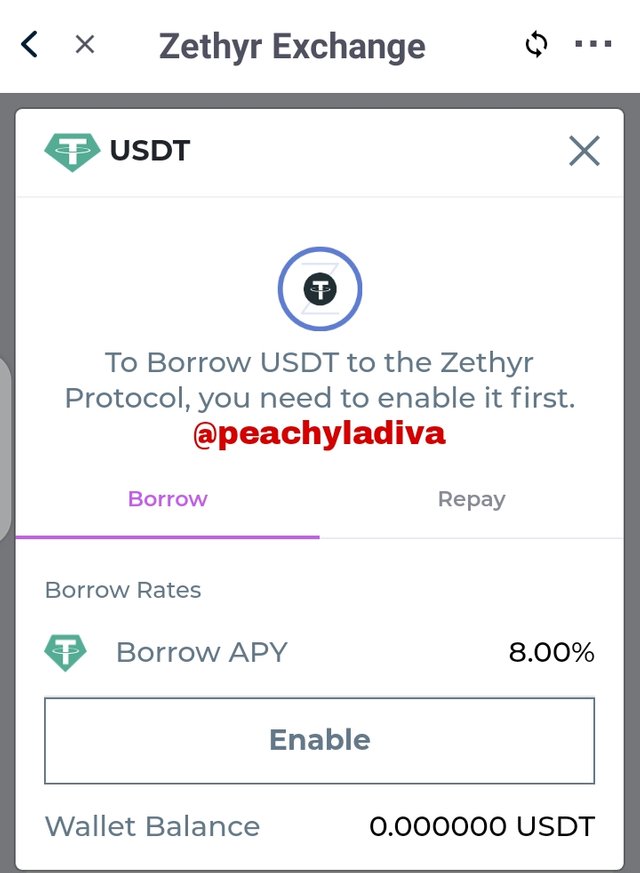

to borrow you have to enable the asset you want to borrow, one thing I have noticed from zethyr protocol is before you perform any transaction you have to enable.

I want to borrow USDT, so we will go through the same process to enable it as we have some for other asset above.

|  |

|---|

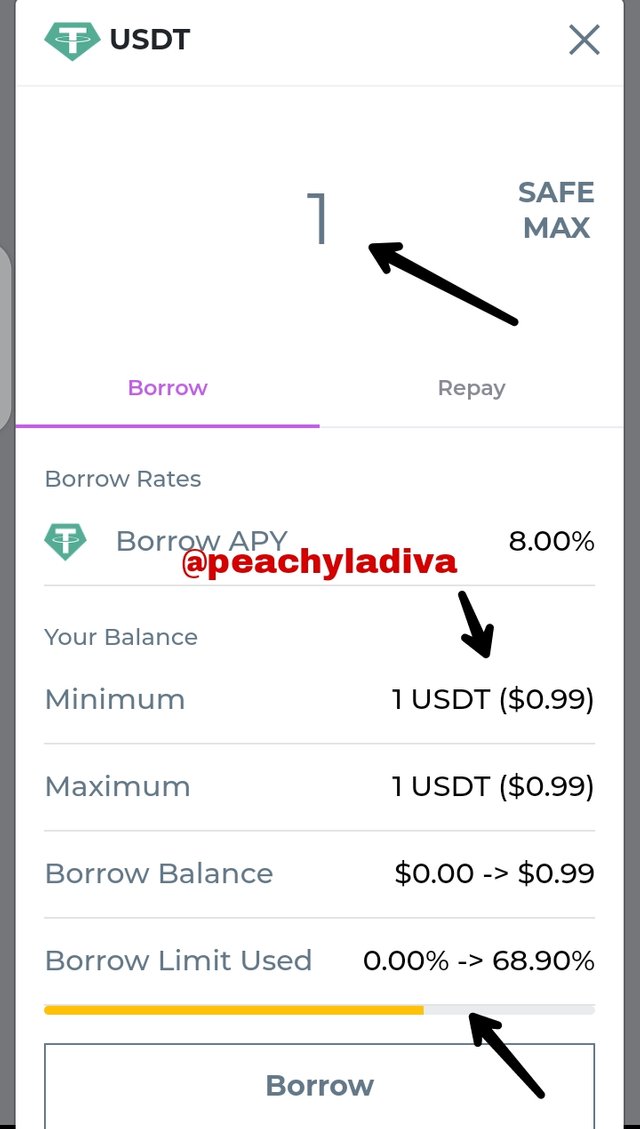

- the minimum I can borrow from the platform is $1.00, so I have to ensure I have supply asset worth $2.00 to be able to borrow at least be dollar.

|  |

|---|

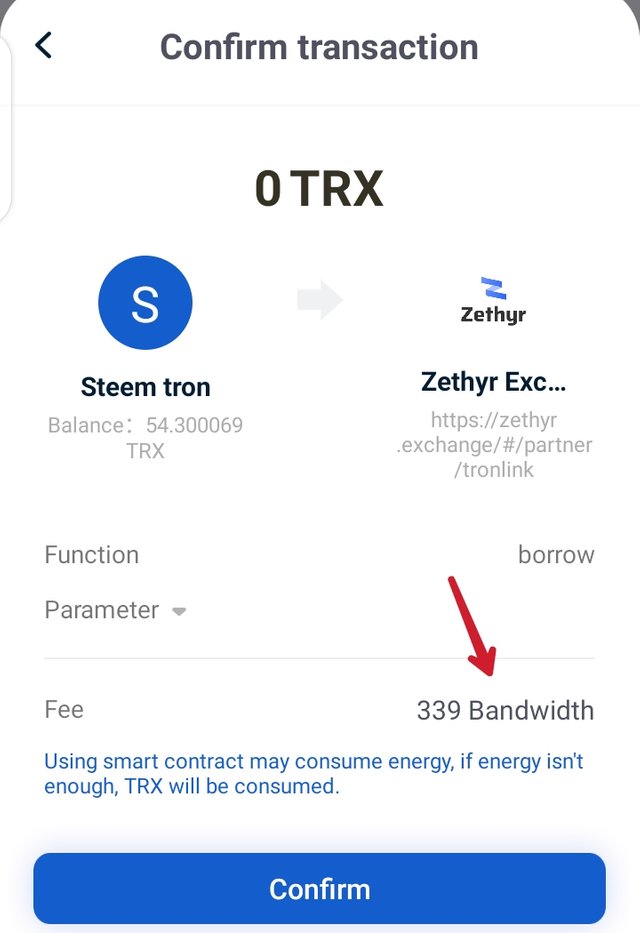

- as always 20 trn will be needed to perform the transaction and a total of 339 bandwidth. Confirm the transaction by inputing your password. Then the transaction is complete.

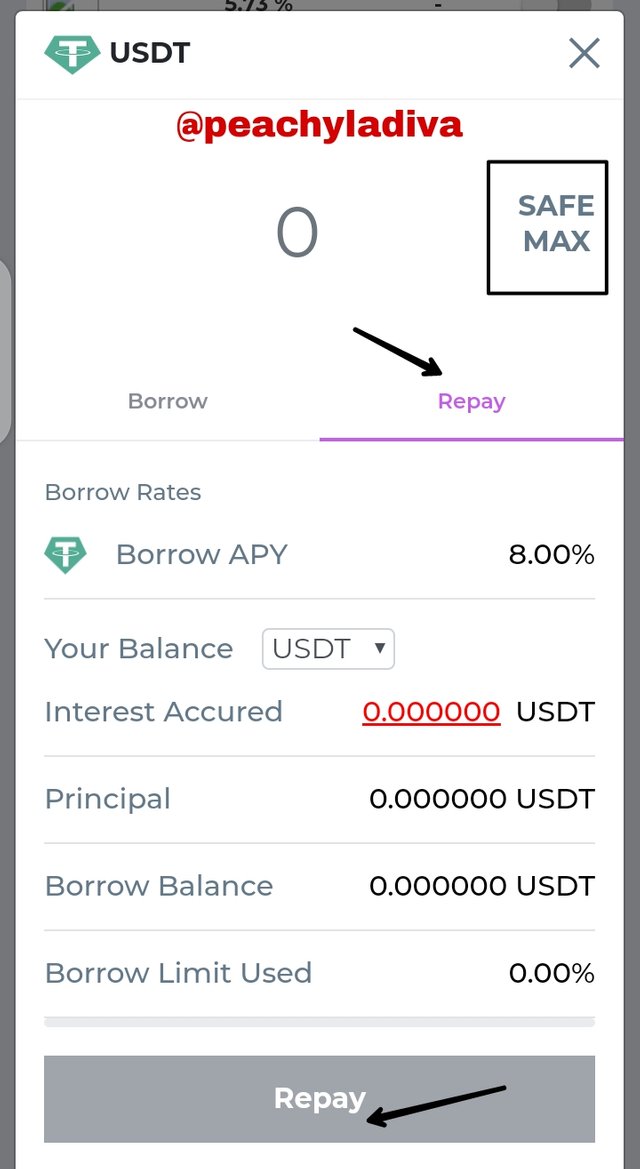

To repay your debt on zethyr finance, you have to follow the same process as of the borrow process just change borrow to repay. Check the screenshot below.

Note: I was not able to complete this transaction because I ran out of tron and I also noticed you need at least 20 tron to carry out any transaction, anything you want to do on the platform requires at least 20 tron which I think it's even more than what you want to borrow

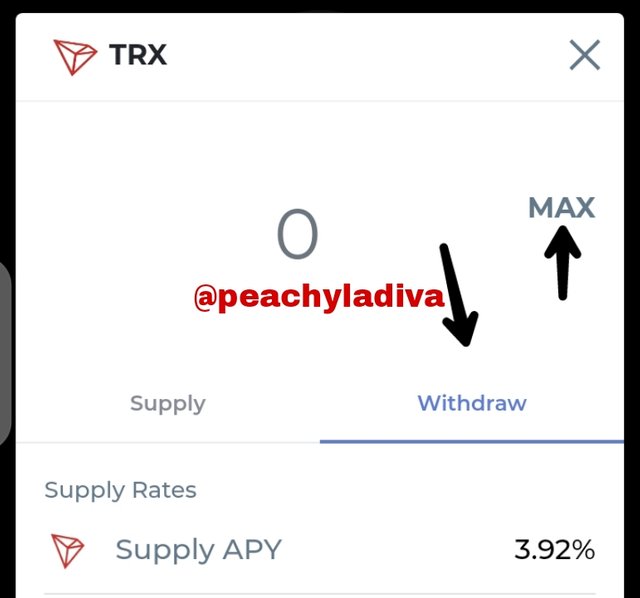

To withdraw supplies

It takes the same process just as supplying asset this time around you changed from supply to withdraw.

- I click on the withdraw and click on maximum, that's to say I want to withdraw all my asset. Then I click to confirm withdraw, it requires energy to perform the task which it will burn 20 tron. Confirm your transaction and input your password to complete the transaction. The supply will go back to your wallet.

Question eight

What do you think of Zethyr Finance? Is it great or not? State your reasons

I think it's a great platform and the DEX aggregator gave it a major advantage. Zethyr finance is a great platform to engage any of your idle asset to bring in profit for you. If you don't know what to do with your idle asset then zethyr finance is surely a platform to keep them. My major issue with this platform will be the transaction fees, for every transaction done on the platform energy is required and you need at least 20 tron to perform each transaction, if care is not taking you would have spent so much to borrow so little and yet pay interest on your borrowed asset. So it's better to know how the platform works and perform transactions that are worth it.

Conclusion

I will like to conclude by talking about the last transaction I made on the platform. The last transaction I performed I didn't have up to 20 tron, the little tron I had got lost and yet the transaction was not successful.

In as much as this protocol is a great one there is need to take time to study it and also the transaction fees so as not to run in loss.Indeed experience is a best teacher.

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

💃💃💃

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit