Source

I understood correctly the lecture of professor @imagen right now I am going to start my participation in the task by answering each of his questions and making an effort to have a good presentation so that everyone can understand in the best way and understand each of the following topics:

On how many occasions has "halving" been performed in Bitcoin?

To better understand this question let me first say what is a "Halving" then a halving is a process that occurs every 210,000 blocks mined, this aims to halve the rewards of miners thus increasing the complexity of solving the complicated mathematical algorithms, thus preventing inflation of the currency.

The first BTC block was created in 2009 and resulted in 50 BTC of rewards to miners when it reached 210,000 block, the first halving occurred and a total of 10.5 million Btc was distributed as rewards to miners at that time.

In the course of history there have been 3 halvings since the creation of BTC, on November 28, 2012 the first BTC halving occurred. before the halving 50 BTC were distributed for each mined block, after November 28, 2012 the reward was halved to 25 BTC per block. in this halving 5,2500,000 BTC were distributed as reward to the miners.

The second halving occurred on July 9, 2016 when 210,000 blocks were mined and by this time the reward was halved from 25 to 12.5 BTC per mined block and 2,625,000 BTC of reward was distributed to miners.

At the third halving which was in May 2020 the mining reward was halved from 12.5 to 6.25 btc per block mined. at this point 1,312,500BTC of reward was produced to miners.

When is the next Halving expected?

For the next Halving is expected to reach 840,000 with approximately 136,000 blocks left to be mined. by April or May 2024 this event is expected to occur and the reward will be reduced from 6.25 to 3.125BTC per block mined. the total to be distributed is going to make 656,250BTC to the miners.

and a fifth halving for the year 2028 where we will see the creation of 1,050,000 blocks, the reward will be 1.5Bitcoin per mined block and an approximate of 318,125 BTC for the miners.

What is the current amount that Bitcoin miners receive?

miners receive for bitcoin reward for each mined block 6.25 BTC, for the year 2021, expecting for the year 2024 as I said above the next halving where a total of 1,312,500BTC will be distributed over the course of these years.

.

Mention at least 2 cryptocurrencies that perform or have performed halving.

Verge "XVG"

The XVG harving occurred in September this year (2021) when the block hit 500,000 the reward was halved from 100XVG to 50XVG, the next halving is expected in 2022 when it will drop from 50 to 25XVG per reward for miners, with a speed of 34 second per block creation it is extremely very fast.

Ethereum:

Ethereum's harving occurred On August 5, 2021 called london Hard Fork which implemented a code called EIP-1559 which will be responsible for increasing the difficulty of mining and in turn saving or taking ETH out of circulation.

What are consensus mechanisms, how do the Proof of Work and Proof of Participation differ?

The consensus mechanisms are those that are responsible for distributing the information of the ledger to have greater control and avoid double spending of transfers . with the use of interconnected nodes or other protocols can be made this type of mechanisms that are used to validate transactions on the network, actually the consensus mechanisms verify the networks and transactions so that these are valid.

What is the difference between Proof-of-Work and Proof-of-Staking?

The Pow consensus mechanism is a group of nodes interconnected by means of software that is able to solve multiple complex mathematical equations which exchanges energy to solve complex mathematical algorithms, in order to validate transactions and thus create new blocks, this is called consensus.

This mechanism gives us a lot of security and speed to transfer in return the commissions are somewhat high depending on the network currently there are huge companies that have large machines of latest technology. which are connected to electrical sources that these same companies have in all parts of the world and through these machines use their enormous power to mine these are rewarded very well for each block mined for example mining btc is very lucrative taking into account already a company formed. The only drawback is the high consumption of electricity and damage to the environment due to the heat produced by these machines.

The "PoS" consensus mechanism is a centralized mechanism and it works by creating blocks through the participation method, which means that a huge group of users or simply an organization buys large amounts of an asset to be blocked for a certain period of time, after which both the platform that blocks the assets and the investor win, as they receive great benefits and even participation rights in the project.

The most recent project that announced the change of the consensus mechanism was Ethereum, which said that in its 2.0 update it will change the mechanism from proof of work to proof of participation, which means that ETH mining as we knew it is over, one of the benefits.

The most common differences are the following, Decentralization is the main ally of all since the cryptocurrency or for example the BTC was born to be free and not depend on any entity or government, the Pos mechanism is centralized and depends on a leader or boss to perform all the protocols required for it to remain stable.

Pow: needs energy equipment and maintenance is extremely expensive and in many cases to locate a technician is currently very difficult.

Pos: unlike the Pos, it does not need equipment and any person or computer with a hard disk and some RAM can connect to the network and start performing operations.

Pow: due to the amount of equipment it gives off heat and needs to be 100% connected to electricity if the power goes out for any reason or any equipment is damaged you have to perform the required maintenance which will cost time which translates into lost money.

Pos: you only need to be connected to the network from any device.

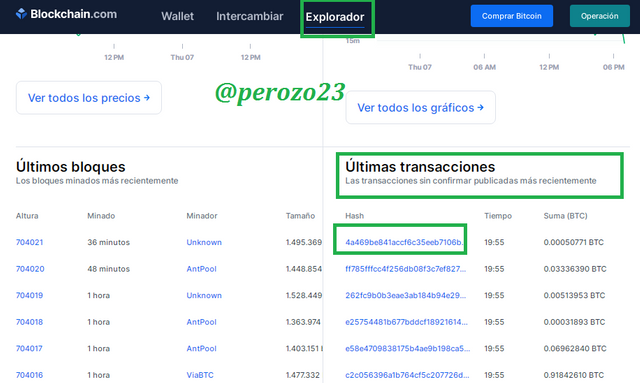

Enter the Bitcoin browser and indicate the hash corresponding to the last transaction. Show Screenshot.

We have to go to the following link: https://www.blockchain.com/es/explorer

Then we click on Explorer:

Subsequently we go to the "LAST TRANSACTIONS" part.

We visualize the last transaction and the hash.

Source

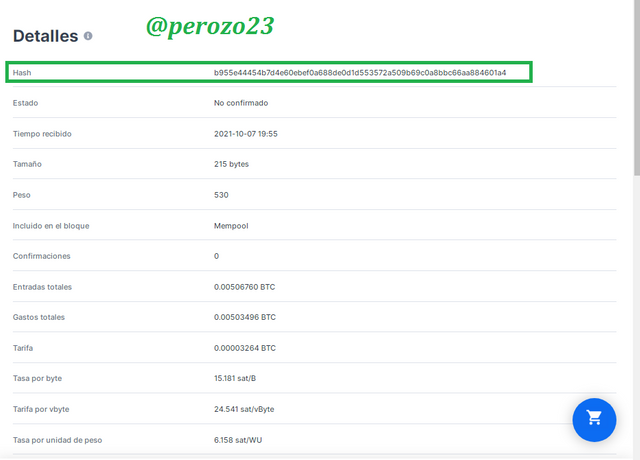

We can see the following hash:

b955e44454b7d4e60ebef0a688de0d1d553572a509b69c0a8bbc66aa884601a4

Time received 2021-10-07 19:55

Value when transaction 270.57 US$

(https://www.blockchain.com/btc/tx/b955e44454b7d4e60ebef0a688de0d1d553572a509b69c0a8bbc66aa884601a4)

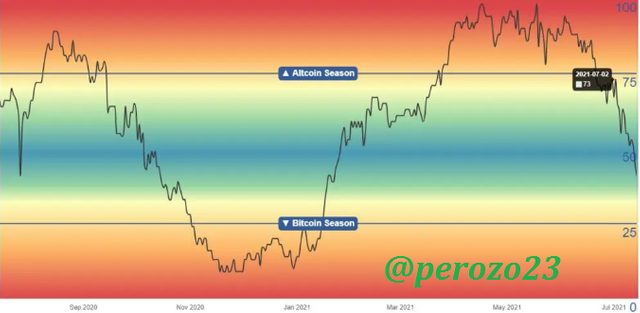

What is meant by Altcoin Season and are we currently in Altcoin Season?

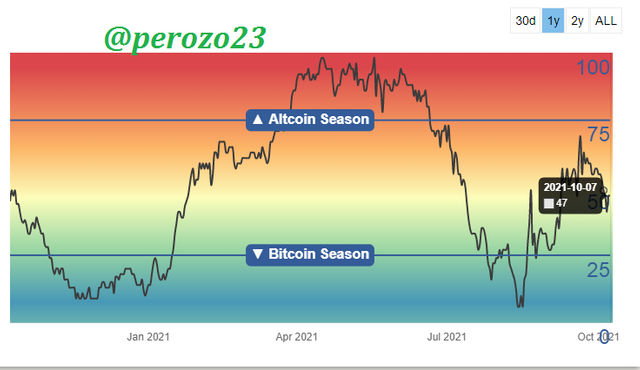

According to research I found several websites The altcoin is when we find a higher yield or more than 75% of cryptoassets alternative to BTC all Cryptocurrencies Tokens that are below the BTC are called Altcoin, currently we are in a statistics of 45% to 48% yield in cryptocurrencies alternative to Bitcoin,

Source

Are we currently in Altcoin Season?

We are not in an Alcoint season currently very probably we will have a new Alcoint season very soon as the statistics want to tell us that very soon we can have a new season near, many investoristan is looking at other cryptomnedas or tokens for which they can get much more profit than the same BTC for say something Doge, shib, are the main tokens of the moment also TRX and ADA are two Coins very well seen by the community.

When was the last Altcoins Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

Source

The Last season according to my research happened at the end of March 2021 and lasted just about 3 months ending at the end of June 2021, so based on the above graphs. we are at 41% altcoin at the moment we have to wait how BTC behaves in this month and next month but we are expecting one to happen very soon. with the uptrend of BTC will boost some Cryptocurrencies and so you see this will awaken ambition to several investors try to invest in some existing project to take profits X3 or X10 even.

The two Cryptoassets we are going to use are the following:

Fantom "FTM"

It is a decentralized platform Defi is aimed at developers using its own consensus algorithm It started in 2018 and was created with the aim of competing with the blockchain through smart contracts. currently has a value of $ 2.01 its currency and is in Rank #36 and a market capitalization of $ 5.1 Billion. with a high growth this last month.

Source

AXS is a governance token of a crypto-game called axie infinity, this token has had a great growth during this last year, currently costing $124 per token it is at number #26 on coninmarketcap with a market cap of $7.5 Billion state of nesting. The token is gaining so much popularity that it has peaked as high as $188 or more in the market.

Source

Make a purchase from your verified account of the Exchange of your choice of at least 15 USD in any currency that is not in the top 25 of Coinmarket (SBD, tron or steem are not allowed).

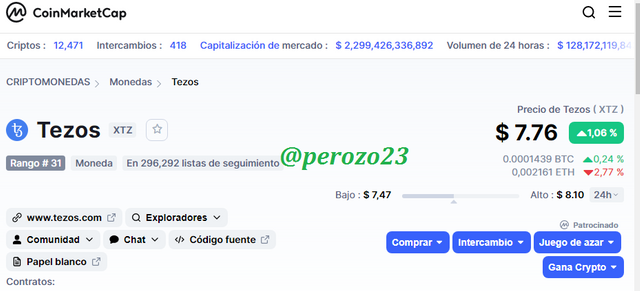

I am going to make a purchase through my personal verified Binance Exchange. i am going to buy Tezos (TEZ).

The next coin I am going to choose is Tezos, This cryptoasset Start operations in July 2018 is created to manage different digital assets, it uses its own blockchain and this offers us security and innovation is born to improve the fork DEFI ecosystem, The Tezos blockchain was developed from 0 without copying other blockchain, so it makes it unique has its own token called Tez, the platform using the POs consensus mechanism which makes it quite green and works without mining, it is designed to save and create applications and assets the community or investors are in charge of managing the updates using the main protocol.

The tezos team is composed of:

FOUNDER: Arthur Breitman worked several years at Google.

C. FOUNDER Kathleen Breitman

Source

Current coin value in coinmarketcap

Source

The reasons why I choose this token is the following.

It has a very original and technologically advanced project.

It has Developers with great trajectories in their careers throughout their lives.

I like the PoS ecosystem for its ecology and high technology.

In the past it saw peaks up to $10 per token, currently it is in a correction but its project and fundamental analysis take it on the path where it can acquire much more value in the not too distant future.

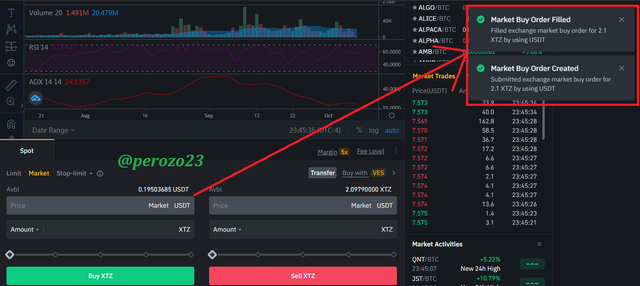

Buy the tokens:

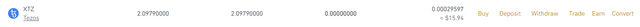

Showing my verified Binance account:

Showing Purchase Order in Market:

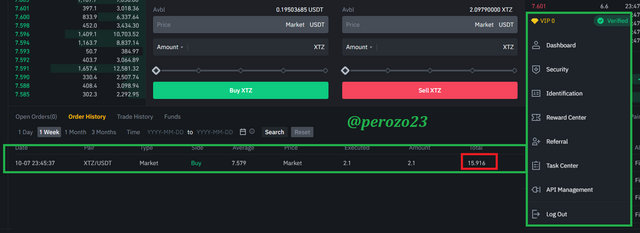

Showing Purchase History: TEZ quantity

Source

Source

Source

Conclusion:

Culminating this assignment which I tried my best answering each of the question it was quite long but very educational, We see that Ethereum wants to implement the PoS Protocol which is quite important to try to lower energy consumption when you don't have a profitable source of energy. we also saw the differences between jobs and participation mechanism. it was quite dynamic we learned a lot in this class already once answered all the questions I want to give my very personal opinion Defi technology every day is growing and is at a point where many people users or investors with large companies that did not believe in the power of decentralization are looking right now a strong opportunity of their lives to invest this is the future and what is coming is very big.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit