Good day everyone, a big congratulation to my new professor on your appointment. A big applaud for the nice first lecture.

Explain the Japanese Candlestick Chart?

We all know without a chart, there can be no Japanese candlestick chart, so with that I would like to start by sharing my knowledge on what a chart and candlestick in the Cryptocurrency market means.

Chart in the crypto market are visual lines that displays the price movement of a crypto and it helps in knowing, keeping track, and predicting the movement of the market over a period of time and in the future using lines, symbol, or even box to represent the movement.

Candlestick is mostly compared to a bar chart, it shows the open, high, low and closing point of price in the market. It is mostly used by traders to predict the movement of the market because of its nice represention and usage of colours to specifically show the trend of a market. For example the Red and Green colours are mostly used to the represent the bullish and bearish trends. The Green stands for the bullish trend, while the Red stands for the bearish trend.

.png)

The are different types of crypto chart, we have the Linear line chart, Logarithmic Line and the Candlestick which we are talking about and under that candlestick I will be explaining the Japanese Candlestick chart because that is what we are focusing on.

Japanese candlestick chart

The Japanese Candlestick is an ancient method developed by Munehisa Homma, a rice trader in Japan in 1700s based on the understanding of demand and supply, but it was popularized by a US broker Steve Nixon in 1990s . It got accepted and widely used because of its good display and overview of the market. It also shows the emotion of the two influence of buyers and sellers in the market with the Green and Red candlestick. When the Buyers are in full control in the market, the market will be in a bullish trend which is represented by lots of upward green candlestick. On the other hand, when the sellers are in full control the market will be in the bearish trend this will be represented with the continuous downward movement of the Red candlestick.

In other to attain a Bullish or Bearish trend in the market there are four different points a market must attain, these are the Open, high, low, close point.

Open (Opening price) -This is the start of the price movement. This is the price where the candlestick start moving from .

High (Highest price)-This is the highest price the candlestick reached in its movement at a specific time.

Low (Lowest price) -This is the lowest price point reached and recorded in the movement of a candlestick.

Close (closing price) -This is gotten when a Candlestick movement is completed and a new Candlestick is formed. The last price of the candlestick is our closing price

Describe any other two types of charts? (Screenshot required)

Line Chart

Line Charts are basic kind of crypto chart used to show price movement that changes with time. Line chart display information and price movement using a straight continuous line. It is simple and easy to understand. The critics around it is that it only shows closing price and it doesn't show the Open, high, low in the market, and so many traders don't rely on it.

Bar Chart

Bar Chart are chart made up of multiple price bars, with each showing how the price moved over a specific time. Each bars shows open, high, low and the closing price and this help traders to be aware of any retracement in the market. Colours are also shown in a bar chart, when the closing price is above the opening price the bar shows either black or green, but when the closing price is below the opening price the bar shows red.

In your own words, explain why the Japanese Candlestick chart is mostly used by traders.

Good Representation Of Price Movement

The Japanese candlestick gives a well visual representation of the influence of buyers and sellers in the market. It shows the Opening, High, low, and Closing price points on every candlestick. It also uses colours to indicate and emphasize the market trend and also help traders if a movement is actually a continuous movement or just a retracement to confuse traders.

Different Trading Patterns

The Japanese candlestick provides different trading patterns for the traders use in analysing the market correctly. The market trend can come in different ways, but with the different patterns, a trader can easily identify and known which pattern to use in predicting the market trend. For example, we have the Hammer pattern, Shooting star pattern, and the Doji pattern and a lot more.

Easy to Understand Very Effective

The Japanese pattern because of the contemporary ideal behind it, it is easy to study, understand and to use. The candlestick form and the colour representing each trend makes it quite easy for traders to use in studying the market.

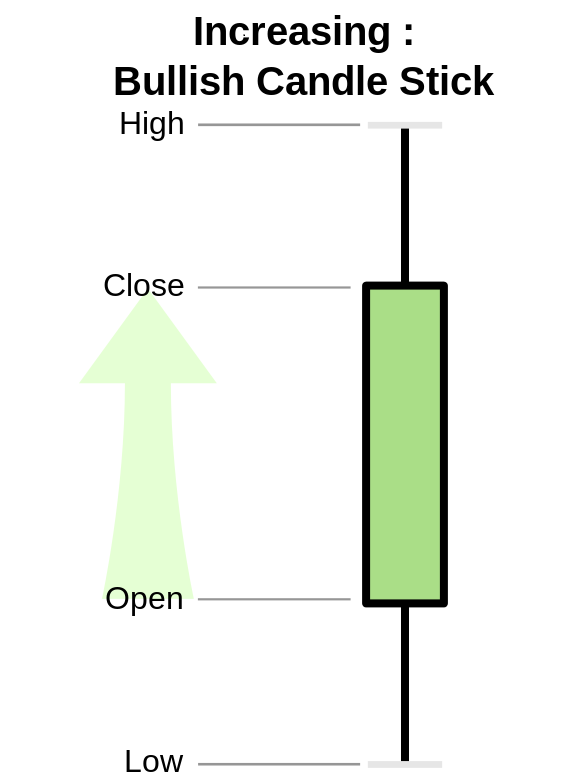

Describe a bullish candle and a bearish candle identifying its anatomy? (Screenshot is required

Bullish Candle

A bullish candlestick is a price movement representation that displays an upward movement or increament in the price of a Cryptocurrency.

A bullish candlestick can be obtained when the closing price is higher than the opening price and this is well represented with a green coloured candlestick.

A bullish candlestick has 4 different price point and these are,

Opening Price -The is the exact price where a bullish candlestick starts from.

Highest price - This is the maximum point price reached by a bullish candlestick before another candlestick is formed.

Lowest price - The lowest price reached by a bullish candlestick over a period of time.

Closing price - This is the last price point reached by a bullish candlestick over a period of time before forming a new candlestick.

There are three main parts to a bullish candlestick:

Upper Shadow - This is the verrtical line between the highest price of a candlestick and the closing price in a bullish candle.

Real Body - This is the part of a candlestick between the opening price and closing price. This is normally the coloured part and it is usually Green in a bullish.

Lower Shadow This is the vertical line between the lowest price and the opening price in a bullish candle.

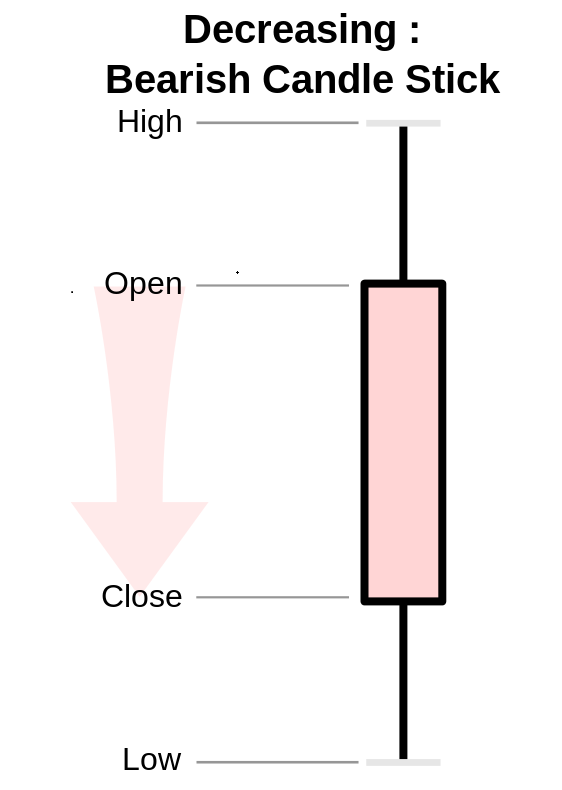

Bearish Candle.

A bearish candle is a price movement representation that display a downward movement or a decreament in the price of a Cryptocurrency. A bearish candle can be formed or identified when the closing price of a candlestick is below the opening price.

A bearish candlestick has 4 different price point and these are,

Opening Price -The is the exact price where a bearish candlestick starts from.

Highest price - This is the maximum point price reached by a bearish candlestick before another candlestick is formed.

Lowest price - The lowest price reached by a bearish candlestick over a period of time.

Closing price - This is the last price point reached by a bearish candlestick over a period of time before forming a new candlestick.

There are three main parts to a bearish candlestick:

Upper Shadow - This is the verrtical line between the highest price of a candlestick and the opening price in a bearish candle.

Real Body - This is the part of a candlestick between the opening price and closing price. This is normally the coloured part and it is usually Red in a buearish.

Lower Shadow This is the vertical line between the lowest price and the closing price in a bearish candle.

Conclusion

A good understanding of the Japanese candlestick is a big boost to traders, because it is one of the best if not the best chart pattern in analysing the crypto market correctly. It offers a lot of good feature to traders and i cant wait to continue learning more in the next lecture.

Cc. @Reminiscence01

.png)

Hello @phenomenal1052 , I’m glad you participated in the 2nd week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observation

This is not a bar chart. This is a candlestick chart. Please change it and add a bar chart.

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit