Made with iMarkup

Made with iMarkup

1 Explain Confluence trading. Explain how a trade setup can be enhanced using confluence trading.

Confluence Trading

Confluence trading serves as an antidote to decrease traders risk of loss in the market, since they use multiple strategies and tools for signal confirmation, which enhances their rate of success in their trading endeavors.

With confluence trading, traders use two or more tools from the technical analysis tools such as Trading patterns, Trendlines and Indicators to confirm a trend Continuation or reversal signal before they open their position in the market.

How a trade setup can be enhanced using confluence trading

Any trade setup can be enhanced by using confluence trading, and that is ensured by the proper signal confirmations from the usage of the multiple technical analysis strategies and tools, which enable traders to make good decisions and decrease the rate of their losses.

Confluence trading helps to eliminate false signals which in turn minimizes the rate of loss and maximizes the profit rate, which is very essential for any trade setup

A trade setup that is based on a single technical analysis tool has a low probability of succeeding as compared to a confluence trading setup, because the signal from a single tool has higher probability of being false, unlike that of a confluence trading whereby even if one tool exhibit false signal the others may provide more accurate signal confirmation.

-1.png)

The above is a BTC/USD pair chart of a 2-level confirmation confluence. I applied the Relative Strength Index (RSI) and Exponential Moving Average (EMA) indicators as a confluence to confirm the market trend. After the application, the two tools gave different signals, the RSI initially signaled a bullish trend reversal by showing an overbought of 70, whiles the price kept moving above the EMA which also signaled a strong uptrend instead of a bullish reversal. Although a bullish reversal took place, it didn't happen at the overbought region of the RSI but rather took place after the price broke below the EMA, and this means there's a possibility that any trader who depended on the RSI alone as a signal confirmation tool didn't make the best out of the market, since price continued in bullish for while before the actual reversal.

Therefore, high rate of confluence from different tools and strategies gives a more effective and efficient trading setup.

2 Explain the importance of confluence trading in the crypto market?

With the above explanations, there is no doubt that confluence trading is very essential in the crypto market, and below are some of the reasons.

Confluence trading maximizes traders winning rate; a trader who employs confluence trading has a high probability of making profits in his or her trading endeavors, due to the better trading decisions the trader makes as a result of using multiple technical analysis tools for confirmation.

It boost traders confidence in the market; confluence trading gives traders and investors some form of confidence in their trading endeavors and decisions, due to the interpretations and confirmations they gain from the multiple tools or techniques.

It helps traders to filter out false signals and fake-outs in the market; the application of multiple technical analysis tools helps traders to fish-out false breakouts, reversal and trend continuation signals.

Confluence trading helps traders to minimize their losses and enhance their trading success; thus, it ensures the culture of good risk management, whereby traders get the opportunity to place their stop-loss and take-profit entries with the help of the signals from the tools.

Confluence trading enhances trading skills and accuracy; traders who have interest in confluence trading learn about the various technical analysis tools which in turn help them to build upon their trading skills and accuracy.

It promotes good trade setups; confluence trading enable traders and investors to identify good trading setups through the utilization of two or more trading strategies.

3 Explain 2-level and 3-level confirmation confluence trading using any crypto chart.

2-level Confirmation Confluence trading

A 2-level confirmation confluence trading is the method of using a minimum of two trading techniques or tools in order to confirm a trade setup.

.png)

The above is an ALGO/USDT pair chart with a 2-level confirmation confluence trading. I applied Rectangle Bottom pattern and Moving Average Convergence Divergence (MACD) indicator as a trading confluence.

The Rectangle Bottom signaled a breakout of the resistance trendline, whiles the MACD Indicator confirmed it. A trader can therefore utilize the upward breakout signal by the two tools to confirm an uptrend and open a buy position at the initial stage of the breakout in order to make future profit.

3-level Confirmation Confluence Trading

On the other hand, a 3-level confirmation confluence trading is the process of using a minimum of three trading strategies or tools to confirm a trade setup. The difference between 3-level confirmation confluence trading and 2-level confirmation confluence trading is quite simple, in the sense that 3-level confirmation confluence trading has confluence that is 3 or greater than 3 which increases signal confirmation accuracy as compared to 2-level confirmation confluence trading.

.png)

The above is a XRP/USDT pair chart with a 3-level confirmation confluence.

On the chart, EMA (Exponential Moving Average), RSI (Relative Strength Index), Mom (momentum) indicator and a Bearish Trendline was used as a confluence. As displayed, the price broke below the EMA just after an uptrend, and although the RSI and Mom didn't indicate a possible bullish reversal, there was a bullish reversal as signaled by the EMA. The bullish reversal led to an oversold of 29 as signaled on the RSI, and a bearish reversal took place as a result of the oversold. In the bearish reversal process, the price action broke above the EMA indicator and bearish Trendline, whiles on the same spot the RSI and Mom was signaling an uptrend instead, which means the RSI confirmed or signaled a bearish reversal before the EMA and bearish Trendline.

In simple terms, on the above chart the initial bullish reversal was signaled by EMA and the bearish reversal was signaled by RSI, whiles the bearish Trendline and EMA indicator later confirmed the bearish reversal after the RSI showed an overbought.

Although some strategies gave mixed signals at some point, but at the latter part all of them helped to identify the market as an uptrend, which is good for a trader to capitalize on, in order to make good trading decisions, such as opening a buy entry, after price broke above the Trendline and EMA indicator.

As mentioned earlier, the higher the confluence the higher our chances of succeeding and that is the reason why I applied four technical analysis tools.

4 Analyze and Open a demo trade on two crypto asset pairs using confluence trading. The following are expected in this question. a) Identify the trend. b) Explain the strategies/trading tools for your confluence. c) What are the different signals observed on the chart?

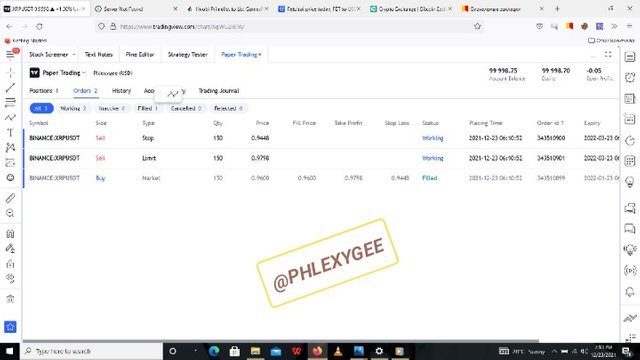

Buy Order (150 XRT/USDT)

I opened a buy position on XRP/USDT pair, using 3-level confirmation confluence trading.

.png)

The two images displayed above provide more information about my buy market order.

4a) I applied four technical analysis tools (Bearish Trendline, EMA, RSI, and Mom Indicator) and all of them have signaled an uptrend, although the tools have some differences, they tend to be helpful for trend identification.

As shown on the chart, there is an upward movement of the price after the oversold signal by RSI.

.png)

Therefore, the market is in uptrend, and that has made me to open a buy position in order to sell in the future for profit.

4b) For my confluence trading, I utilized the RSI, EMA and Mom indicator, as well as a bearish Trendline. I employed RSI and Mom because they are leading indicators, and they show the strength, weakness and direction of the market.

The bearish Trendline served as a price resistance of which an upward break signals a possible bearish reversal and the EMA also performed a similar function, whereby a downward break signals a bearish reversal and an upward break signals a bullish reversal.

Two of the four, thus RSI and Mom was serving as a check on each other with regard to the market strength and weakness, whiles the bearish Trendline and EMA was purposely for signaling breakouts.

4c) Out of the four tools, only the EMA indicator signaled a bullish trend reversal during the initial uptrend, and of course the bullish reversal took place, and there was a follow-up of a bearish reversal which was only signaled by the RSI when the price reached the overbought, whiles only the bearish Trendline and EMA indicator signaled a bearish trend reversal after the RSI gave out the bearish reversal signal.

The good thing is that, at the time of my trading, all the tools were exhibiting an uptrend and I used the opportunity to placed my buy market order.

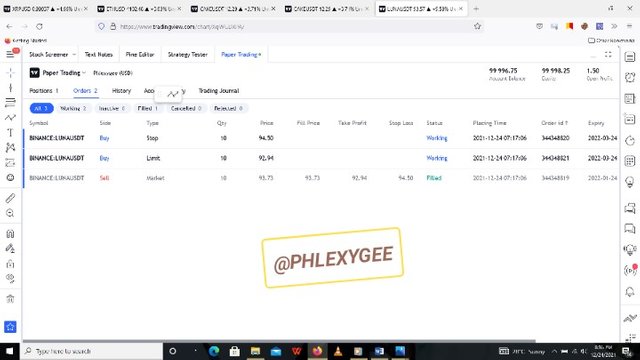

Sell Order (10 LUNA/USDT)

.png)

I applied RSI and EMA indicator for confirming my sell position, which indicates a 2-level confirmation confluence trading.

The RSI signaled an overbought, whiles price broke above the EMA and all these signals confirmed a strong uptrend of which a bullish reversal is bound to take place.

As a trader or investor, this is the best time to place a sell order for profit and exit the market, since price is in overbought and there is a high possibility of a bullish reversal.

.png)

The images above entails the details of my sell order.

All the screenshots were taken from www.tradingview.com

Conclusion

The crypto market highly volatile and proportional to its risk of loss, therefore we should encourage confluence trading in order to increase our chances of succeeding with our trading endeavors.

No technical analysis tool gives 100% accurate prediction, so it is necessary to combine multiple of them in order to filter out false breakouts and attain more accurate signals.

Thank you Prof. @reminiscence01 for this week's interesting lesson.

I have done the needful. Please professor don't let my effort be in vain.

Thank you once again.

Hello @phlexygee, I’m glad you participated in the 6th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

Correct.

Correct.

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much Prof.

I appreciate your remarks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit