Hello buddies,

I hope you are doing great.

Below is my presentation for this week's homework.

1 Define and Explain in detail in your own words, what is a "Trading Plan"?

These rules and standards guide the actions of the trader or investor in the market in order to ensure that success is achieved.

Building a trading plan is very essential and crucial to traders and investors because it helps them to manage their wins and losses rate prior to the entry of the market.

Traders and investors with a trading plan depend on it to open their positions in the market.

A trading plan includes every important aspect of the investor's intentions towards the market. This includes drawing a budget of our capital in order to gain more with less losses.

A Trading Plan serves as a disciplinary tool that guides the actions of the investor in the market in order for the investor not to go wayward or follow his or her emotions in the market.

2 Explain in your own words why it is essential in this profession to have a "Trading Plan"?

It is very essential for traders and investors to build and have a trading plan in the trading profession because it helps to maximize profits and minimize losses.

A trading plan helps to guide the actions of the investors through the rules and standards initiated by them. With this, the investor don't experience a market shock either being a positive or negative because the trade outcomes are somehow forecasted.

Traders and investors without trading plans have a higher probability of not succeeding in the cryptocurrency market, this is because their actions are not guided and therefore they are carried away by their emotions or the market trend which most at times lead them to excessive losses.

Having a trade plan saves the investor's time to do other essential things since the entry and exit point of the market is being planned.

A trading plan ensures a trade success due to the control investors have over their capitals and trade outcomes, therefore it is very necessary to have one.

A Trading Plan serves as a disciplinary tool for the investor's actions and success in the market therefore it is very essential to have one.

I perceive a trading plan as a form of antidote for the challenges associated with the higher volatility level of the cryptocurrency market.

3 Explain and define in detail each of the fundamental elements of a "Trading Plan"

Below are the list and my explanations of the fundamental elements of a Trading Plan.

- Risk Management

- Capital Management

- Trading psychology

- Planning and control of one's trading account

Risk management; this is one of the essential fundamental elements of a trading plan. Investors need to manage their level of losses by ensuring their profits outweigh their losses. There is surely going to be a loss since no one win 100% in their market entry, therefore there should be a risk management plan whereby the win percentage would be higher than the loss.

It is used to take control of the number of trades the investor does in order to ensure there are many wins over the losses in the market.

Investors who posseses a good risk control are much successful and profitable in the market than those who don't.

The investor exit the market based on the number of wins or losses initiated.

For instance, an investor can set a rule of 8 trades per day of which if the investor wins 5 out of 8 the investor exit the market for the day whiles if the investor make a loss on 3 trades out of the 8 trades the investor will as well exit from the market for the day.

Capital management; this is also a very important aspect of a trading plan because it tells the amount of capital the investor is willing to lose or gain in each operation that is carried out in the market.

Over here the percentage to win or lose is being initiated willingly by the investor based on the total available capital.

It is used to control the investor's capital in the market.

The percentage of profits and losses are taken into account including the operation days.

For example, an investor can establish a 2% loss and 4% win per each trade together with 3 days operations per week.

Meaning the investor will be willing to lose 2% of the total capital on a single trade as well as wishing or willing to win 4% of the total capital on a single trade and the operation will only last for 3 days in a week making it 12 operation days per month.

The percentage of profit or loss on a single trade is established based on the investor's interest but the profit percentage should always be higher than the loss percentage.

Trading psychology; this is about sticking to the already established rules in order not to be carried away or be over exposed in the market due to one's emotions which can lead to a massive loss.

The investor must therefore follow the vivid rules stated earlier in the plan, thus risk management and capital management.

Greediness or emotions of the investor in the market shouldn't be tolerated because it wouldn't let the investor comply with the established rules therefore making the investor more prone to losses.

This element of a trading plan doesn't apply to a demo trade because the investor wouldn't be affected by the market trend either negatively or positively since the investor doesn't use a real capital. Investors should be emotionally and psychology stable in order limit their actions in the market based on the established standards or rules. Making a list of additional or personal rules is very crucial here.

The planning and control of one's trading account; this element is all about managing the monthly capital the investor earns. At this stage the investor carry out the necessary calculations in order to increase his or her capital on monthly basis to the point that the investor can make enough profits daily.

Profits gained at the end of each operation or month are being added to the initial capital in order to gain more profits.

This element can be facilitated with the help of using a Microsoft Power point or Excel and taking into account the minimum investment requirements by the exchange platform.

Practice (Remember to use your own images and put your username). Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and your own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10. Remember the plan you build should have the following: Your own Risk Management. Your own Capital Management. Say in detail, what are the rules or Psychology that you yourself would use to fully comply with said plan and be able to operate the cryptocurrency market. Finally, make a table with the strategic planning of your capital, covering at least 6 months.

screenshot from Microsoft power point

screenshot from Microsoft power point

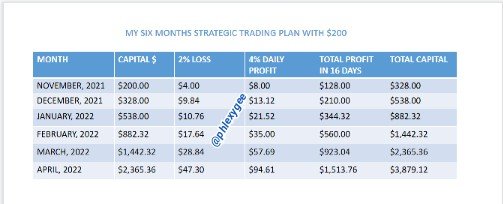

The above is a self explanatory table of my trading plan.

The first column comprises of the months

The second column comprises of each capital used for the investment at the initial stage of the month.

The third column contains the 2% loss percentage.

The fourth column contains the 4% profit percentage.

The fifth column comprises of the total profit in sixteen days.

The last column comprises of the total capital of each month which includes the startup capital and the total profits made for the sixteen days.

The ratio keeps changing per the months due to compound interest or the increase of the profits and losses.

My Risk management

I will initiate a maximum of 8 entries per each of the sixteen days in a month of which I will exit from the market if I either win 5 or lose 3 out of the 8 entries.

My Capital management

I will invest $200 with a profit percentage of 4 and a loss percentage of 2 (4:2) and I will operate in four days a week from Monday to Thursday because I will reserve Fridays and the weekends for hangouts and other relevant things making it 16 days of trading per month.

The psychology or rules I will use in order to fully comply with my established trading plan.

No trading whiles feeling stressed; I will not bother myself to engage in a trade if I am stressed out. Stress will lead me to make decisions that wouldn't go in line with my trading plan.

Only midnight operations; my perations will be done in the midnight because during that time my mind and the internet connection will be much stable.

No violation of the fundamental trading elements; I will try my best not disobey any of the fundamental trading elements more especially the Risk management and Capital management. Avoiding the fundamentals means avoiding the trading success of which I wouldn't tolerate.

Avoidance of greediness or Emotions; I will try my possible best to avoid greediness. Being emotional or greedy towards the market increases the risk of loss so I will stick to the trading plan instead of being selfish and greedy.

Allocation of time for family, trading and personal things; I will not switch my family time for trading and vice versa. Family is very important therefore I will allocate some time to take care of family issues as well as make some time for myself and trading so that I will be emotionally stable for the market or trade.

Conclusion

It is very necessary to have a Trading Plan because without it an investor is less likely to witness a success in his or her trading endeavors.

Therefore we should try our best to plan our trades in order to ensure our success in the cryptocurrency market or trading.

As there is a saying that " if you fail to plan, you plan to fail"

I have learned a lot and thank you Prof. @lenonmc21 for sharing this interesting topic with us.