Made with iMarkup

1. What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

Risk Management

Traders use Risk Management tools such as Take profit and Stop loss, Risk-reward ratio and 1% Rule to ensure the minimization of loss and maximization of profit.

With Risk Management, traders somehow get the opportunity to predefine their trading outcomes, through the usage of the Risk Management tools.

The crypto market is highly volatile which means there is a high possibility of making a huge loss as well as profit, therefore Risk Management serves as a check on traders activities in order to limit their level of loss, in case the market didn't go in their favor, and limit their profit level as well.

In the crypto market, every trader is prone to running at a loss, but proper Risk Management helps to limit or minimize such loss that might occur.

Importance of Risk Management

The essence of Risk Management in trading cannot be looked down upon, and below are some reasons.

Reduction of loss rate; as mentioned earlier, a good Risk Management helps traders to limit their level of running at a loss in the market, since they predefine what they are willing to lose as well as win according to their capital.

Emotional check; Risk Management helps to control traders emotions which would expose them to run at a loss in their trading endeavors and this is because traders have a trading plan they follow.

High probability of making profits; as traders plan to escape loss, they also increase their chances of making profits in the market.

It enhances traders confidence; traders who have good Risk Management plan have confidence in their trading activities, and they are not carried away by the market or their emotions, which in turn increase their chances of success.

2. Explain the following Risk Management tools and give an illustrative example of each of them.a) 1% Rule. b) Risk-reward ratio. c) Stoploss and take profit.

2 a) 1% Rule

The 1% Rule implies that, a trader is willing to risk or lose only 1% of his or her total entry capital, just in case there happened to be a loss instead of profit.

For example, a trader who has $150 entry capital will only lose $1.5 (1/100×150) of his or her trading capital as 1% of $150, in case the market didn't align with his or her prediction.

In case this trader loses 3 trades in a row, it means the trader will lose $4.5 out of $150 (1.5×4 = 4.5) and that does not cause much harm as compared to a trader who risked about 10% of his or her $150 capital, thus (1.5×10 =15) the trader will lose $15 incase the market go against his or her prediction. So, in case such trader losses 3 trades in a row (15×3 = 45) he or she will lose $45 out of the $150 capital which is very bad.

The illustration above means, the more traders stick to the 1% Rule, the lesser their loss percentage, just incase the market go against their predictions.

Therefore, the 1% Rule is one of the vital tool of Risk Management.

2 b) Risk-reward ratio

Another important tool of Risk Management is the Risk-reward ratio.

As the name suggests, the trader initiates a risk ratio together with a win or reward ratio based on the available trading capital.

It is recommended for a trader to set a reward ratio or percentage that is higher than the Risk ratio in order to make profit.

Therefore, the Risk-reward ratio should be 1:2 or above, but the reward ratio should always be higher than the risk ratio, since we trade for profits.

The 1:2 Risk-reward ratio implies that, the trader is willing to gain twice as the risk ratio, and the figures depend on the trader's preference, but 1:2 is normal for most traders, which is good because they trade for profits.

For example (1:2), if a trader is risking $2 on a trade, the trader should initiate or aim for $4 as profit.

Similarly, a 1:3 Risk-reward ratio means the trader will aim for a profit of $6 with a risk of $2 on the initiated trade.

Meaning, the potential loss amount and profit depends on the ratio configured, and it is recommended that the risk ratio shouldn't be above 1.

2 c) Stoploss and Take profit

Stoploss and Take profit are two forms of auto exit orders, and traders depend on the various technical analysis to initiate them.

Stoploss automatically closes a position at a loss when the market goes against one's prediction, whiles Take profit closes an order at a profit, in case the market goes in one's favor.

For instance, if a trader enters the market at a price of $2 and place a sell Stop loss order of $3 and a Take profit of $1, either way the order will be executed, but it depends on market and analysis of the trader. The order will be closed with profit, if the price hit as expected by the trader, similarly it will be closed with a loss, if the market go against the trader's prediction.

Stop loss and Take profit goes hand in hand with Risk-reward ratio, therefore the take profit should always be twice or higher than the Stop loss.

3. Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).a) Trend Reversal using Market Structure.b) Trend Continuation using Market Structure.The following are expected from the trade.Explain the trade criteria.Explain how much you are risking on the $100 account using the 1% rule.Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions. Place your stoploss and take profit position using the exit criteria for market structure.

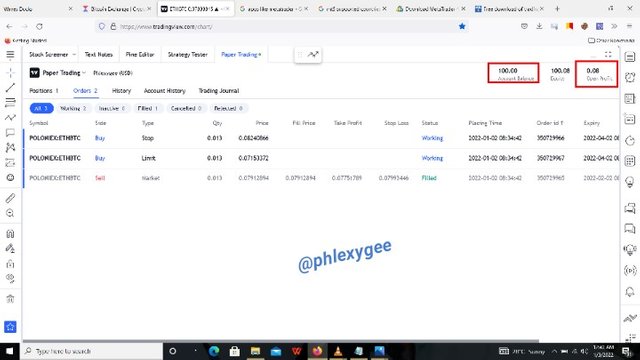

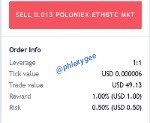

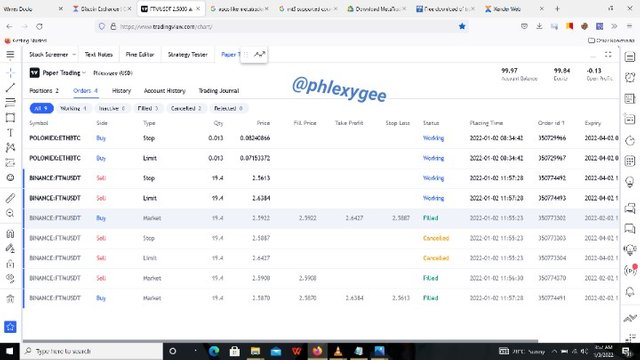

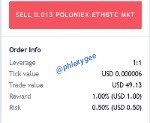

I have $100 in my account and I will be using it to place two orders, meaning I need to divide my fund into two, for the two orders. In total my Risk-reward ratio is 1:3 for the $100, but I have shared a Risk-reward ratio of 0.5:1 for two $50 orders in order to make up the total 1:3 Risk-reward ratio.

I applied the 1% Rule. Thus, 1/100 × 100 = 1 ($1). Which means I am risking $1 for a profit of $3

My Risk-reward ratio is 1:3 and that means, I have risked $1 and hoping for $3 as profit on my trades.

Each of the orders have a Risk-reward ratio 0.5:1 = 1:3

3 a) Trend Reversal using Market Structure

I placed a ETHBTC pair sell order in a bullish trend reversal using market structure as recommended.

Entry criteria

The price failed to create a new high and it reversed back down to break the previous low which confirms the break of market structure.

After the break of the market structure, the price bounced back and retest the broken low and formed a resistance. After the retest, I executed a sell trade.

Exit criteria

I placed the Stop loss above the new found resistance whereby the trade will be considered invalid in case the price comes back to the stoploss position and I used the nearest support as a take profit.

Below is my trade for the bullish trend reversal, as we can witness the Risk-reward ratio and the progress of the order.

.png)

3b) Trend continuation using market structure

I initiated a buy order of SXPUSDT pair, as the market was in moving higher highs and higher lows.

Just like the trend reversal, there has to be a breakout of the market structure and a retest of the breakout.

The market should be trending either upwards or downwards. Thus creating higher-highs and higher-lows or lower-highs and lower-lows.

In uptrend, the new low point need to be higher than the previous low point, and I considered these factors before placing my buy order.

The exit criteria is to exit the market when the price reach take profit.

.png)

All the screenshots were taken from www.tradingview.com

Conclusion

The crypto market is highly volatile, therefore every trader is prone to encountering some loss, so it very necessary to put up proper Risk Management procedures in order to minimize our level of loss, whiles we increase our success rate respectfully.

Note that once you don't manage your risk, you are ready to risk it all.

Thank you Prof. @reminiscence01 for wrapping it up for this season.

Hello @phlexygee , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

These 3 images are not in correspondence with each other. The chart analysis is different from the position opened. This is totally wrong.

Please pay attention a d spend quality time to perform your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Prof.

Talking of the position, it corresponds.

I opened a sell order. That is how tradingview paper trading works for stop-loss and take-profit orders.

Thank you once again, I knew I wouldn't get better grades, because I had a struggle with the question three.

But am glad I participated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit