Hello fam,

Hope you are doing great.

Here is my presentation for this week's homework.

Made with iMarkup

1. Explain why Stability is important in Digital currencies.

To me, Stability is the process or instance whereby something (Digital Currency) has a lower probability of changing from its original state or value.

The high volatility (risk) level of cryto or digital currencies often scare most people to invest or involve themselves in the activities of digital currencies, so therefore I think Stability is very essential in Digital currencies because it would give many people who are interested in the activities of digital currencies hope and high morale to pursue their interest since there is a lower chance of making a loss which in turn would contribute to the total growth of the Digital currencies.

Stability in Digital currencies would serve as a motivation to crypto lovers and it would curb away the high risk of asset loss.

Stability will therefore ensure the people's trust and also contribute to the positive development of Digital currencies.

2. Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

I think the development and employment of CBDCs by some States is a great move which would go through some positive development and be of good use in the near future.

So therefore I think all States should work on such great policy just like what Nigeria is doing by coming up with the eNaira which would have same value with the local currency (Naira).

Merits

States wouldn't spend much resources to print paper or physical money which most at times depreciate due to aging, carelessness and accidents.

people will enjoy some form of privacy on their daily transactions without being accountable to a third party.

Legal tender; I see this to be the biggest advantage because the activities of CBDCs will be backed by State laws unlike that of normal cryptocurrencies. Therefore trust would be ensured.

There will be a decrease of money theft that often takes place since most people will be handling their money digitally.

There will be low cost of transactions as compared to the traditional banking system.

People around every sphere of the State and outside the state will have easy access to their funds to make the necessary transactions in the absence of Banks.

This development would contribute to the overall growth and development of the State's GDP due to the effective and smooth daili transactions.

People will have the total freedom to utilize their funds whenever they want because there wouldn't be holidays and closure time on transactions.

High level of security; there will be some high level of security because fraud and other scamming activities can easily be tracked down by the central government.

Demerits

The introduction of this currencies will cut-down the employment rate at the banking sector because there will be less need for intermediaries at the Banking sector.

This development requires technology and therefore States that lag behind technology or don't have the necessary resources can't employ It.

Technology illiterates would find it difficult to work with such system therefore putting them behind.

Cost of operation; Digital currencies as the name suggests requires internet connection which comes at a cost. Meaning if you can't purchase data, you can't do transactions.

Network issues and power outages; some people may have money in their account but due to poor network and power outage such people wouldn't get access to their money.

There will be the influence of the central government since the Digital currency is initiate by the State which will in turn oppose to the decentralised objective of Digital currencies.

Upon weighing the Pros and Cons of Central Bank Digital Currencies (CBDCs) I think it is a good policy with great future and the currencies should be embraced although there are some disadvantages attached to them.

After all they serve as complement or alternative to the normal or traditional currencies so there wouldn't be the need to place much focus on the demerits.

Even my submission of many merits over the demerits justify that I will probably go for the motion.

3. Explain in your own words how Rebase Tokens work. Give an illustration.

A rebase also known as price-elastic token is designed in such a way that the circulating token supply adjusts automatically according to a token’s price fluctuations. This increase and decrease is what is refered to as a rebase mechanism.

Rebase tokens are somehow similar to stablecoins, because they both posses price targets. But unlike stablecoins, rebase tokens’ have an elastic supply which means that the circulating supply adjusts accordingly in terms of demand and supply without changing the value of the tokens in users’ wallets.

Some examples of Rebase tokens are: AMPL, YAM, RMPL and etc.

For example, If I have a specific rebase token with the quantity of 10 that is worth $5 in my wallet and there happens to be either an increase or decrease in the market, the value of my asset that is $5 wouldn't change but the quantity of my rebase token will change to fit in the current market trend. The 10 can increase to 15 or it can decrease to 5 but the value will still remain $5.

In simple terms the amount of the Rebase tokens can increase or decrease but yet the total value of the wallet doesn't change.

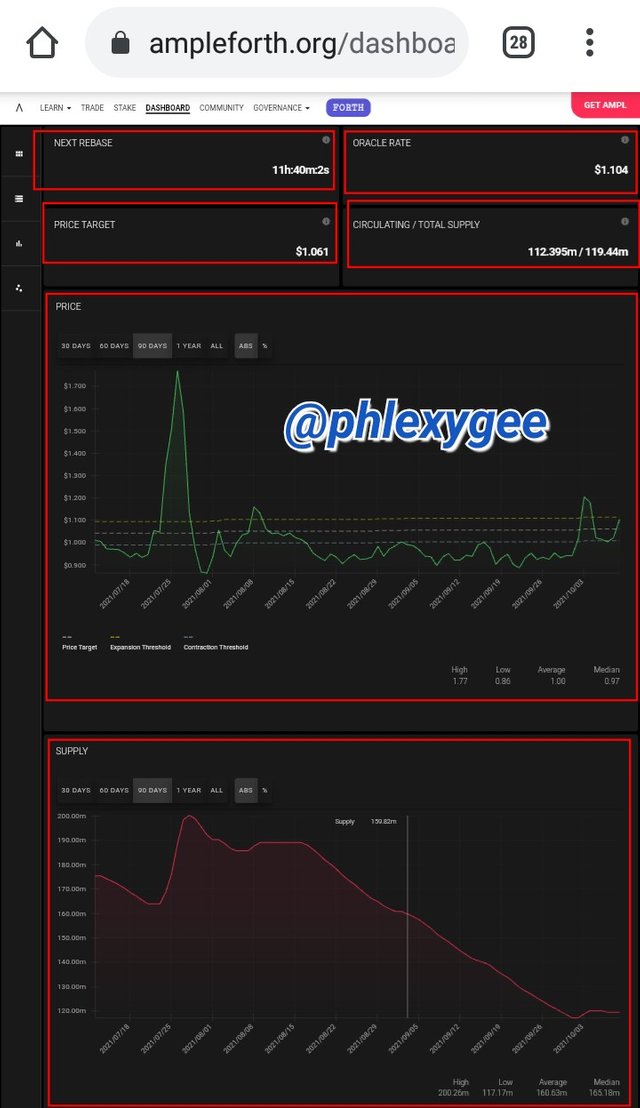

4. Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

Solution:

Oracle Rate = $1.104

Price Target = $1.061

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

={[(1.104 - 1.061) / 1.061] x 100} / 10

= [(0.043/1.061) x 100] / 10

= (0.04052 x 100) / 10

= 4.052 / 10

= 0.405%

Therefore the Rebase is 0.405%

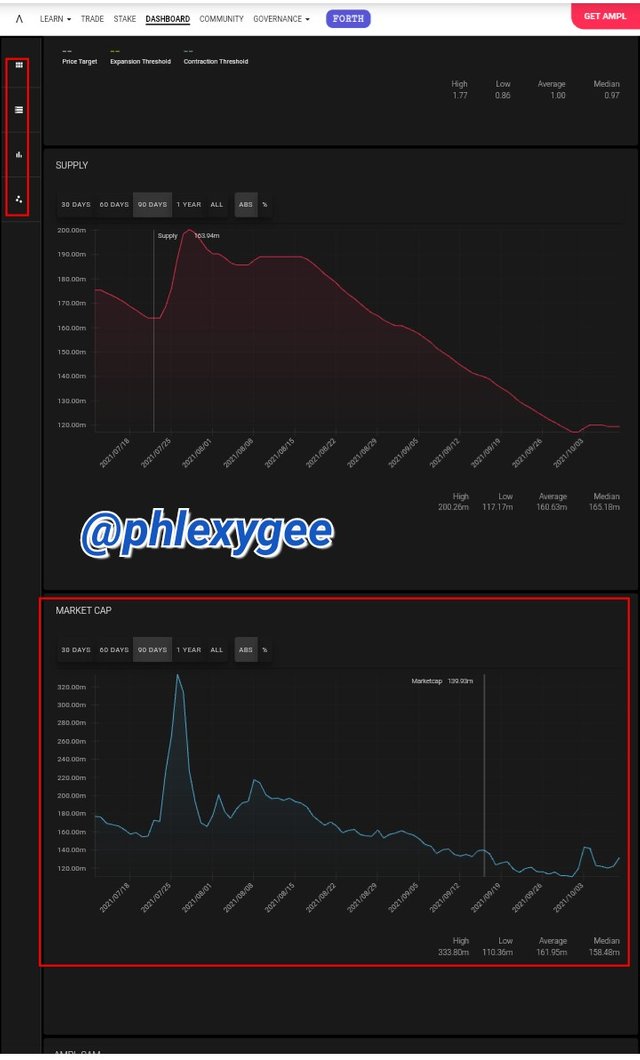

On the ampleforth.org web page I had the opportunity to see other relevant informations such as the Next Rebase, Circulating/Total supply, Price chart, Supply chart, Market cap chart and some menus on the left top corner.

5. Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

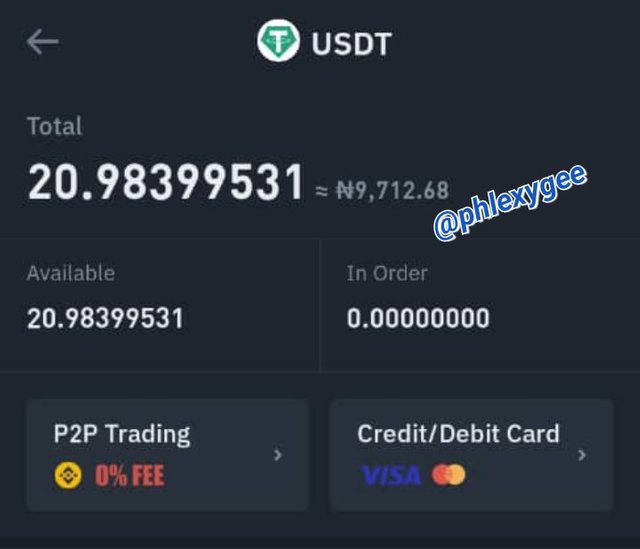

In order to make the trade a successful one, I logged-in into my Binance account and went to the Trades section.

I chose BTC/USDT pair because I intended to sell some BTC for the USDT token.

I went ahead to sell 0.00038 BTC which had the worth of 21 USDT and after the trade got filled I received 20.9 USDT due to slippage.

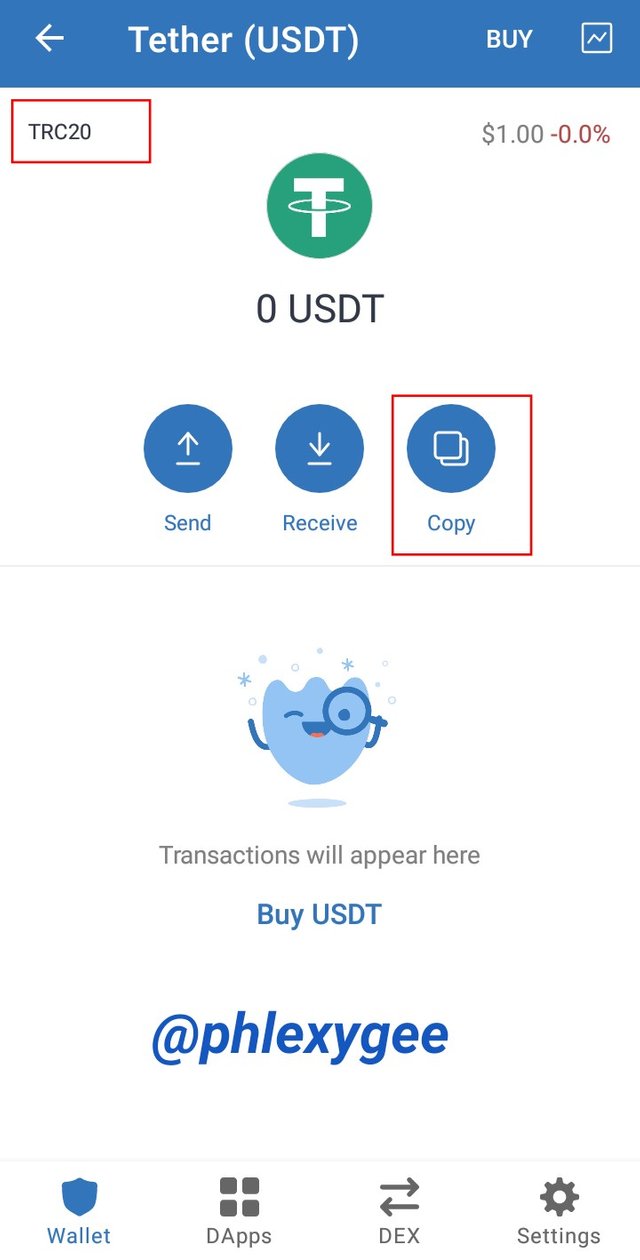

6. Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

After receiving the 20.9 USDT on the trade, I wanted to send 20 USDT to a different wallet using the Tron Network as recommended.

So I went to my Trust wallet and copied the address of the USDT.

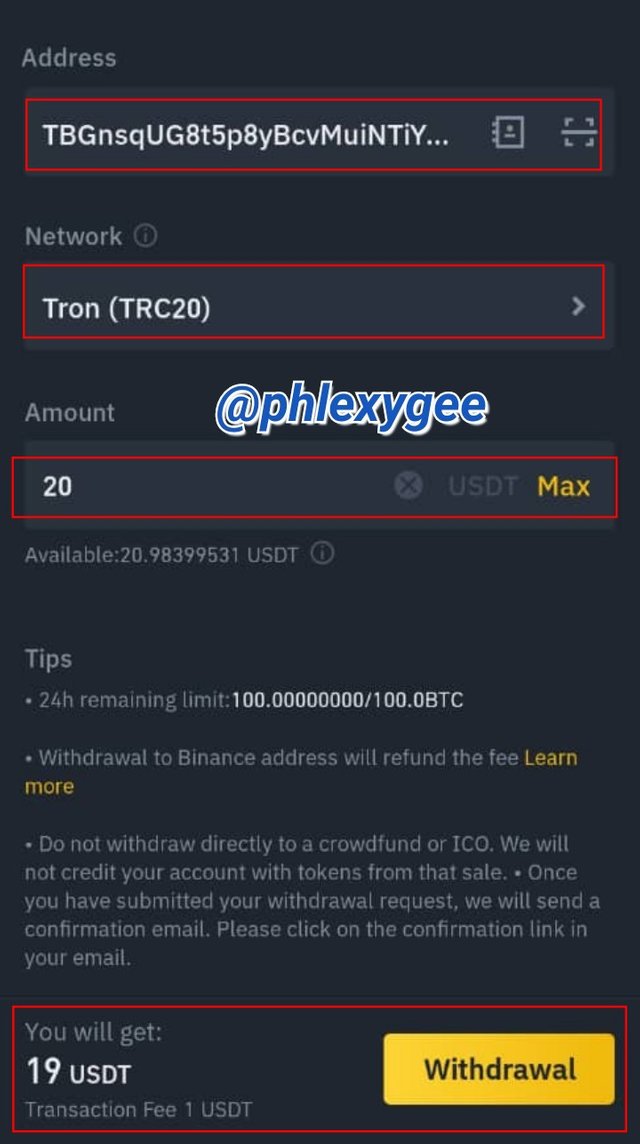

I came back to my Binance Wallets (spot). Selected withdraw. Searched USDT and filled the necessary information by inputting 20 as the amount, pasting my Trust wallet address and choosing the TRC20 as the Network.

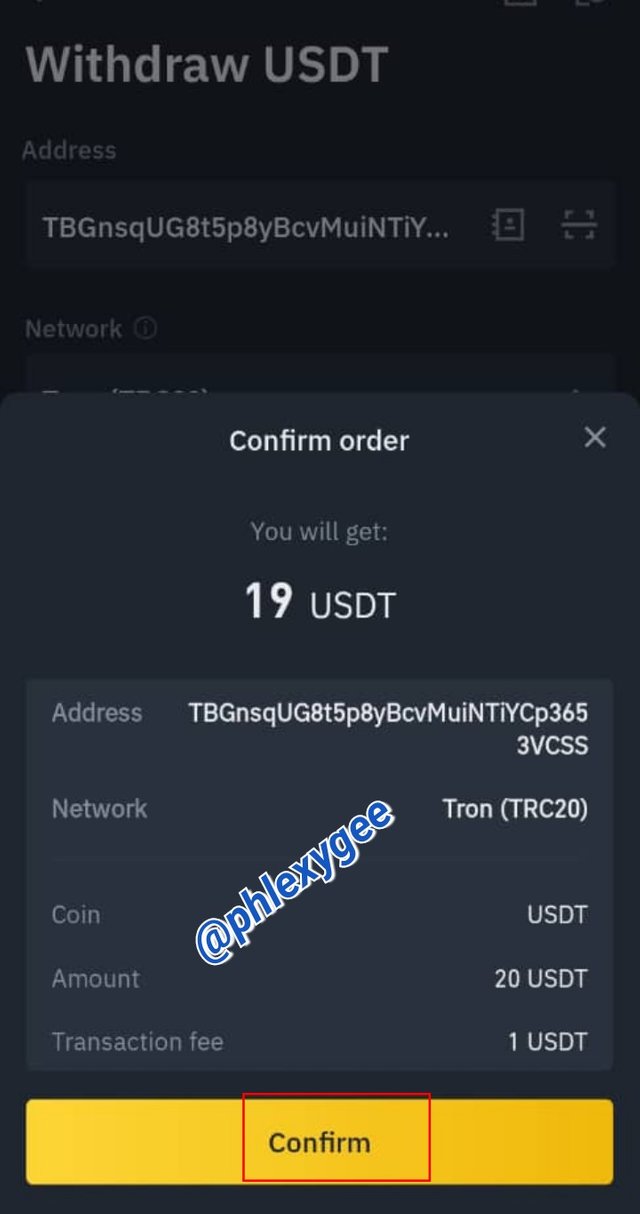

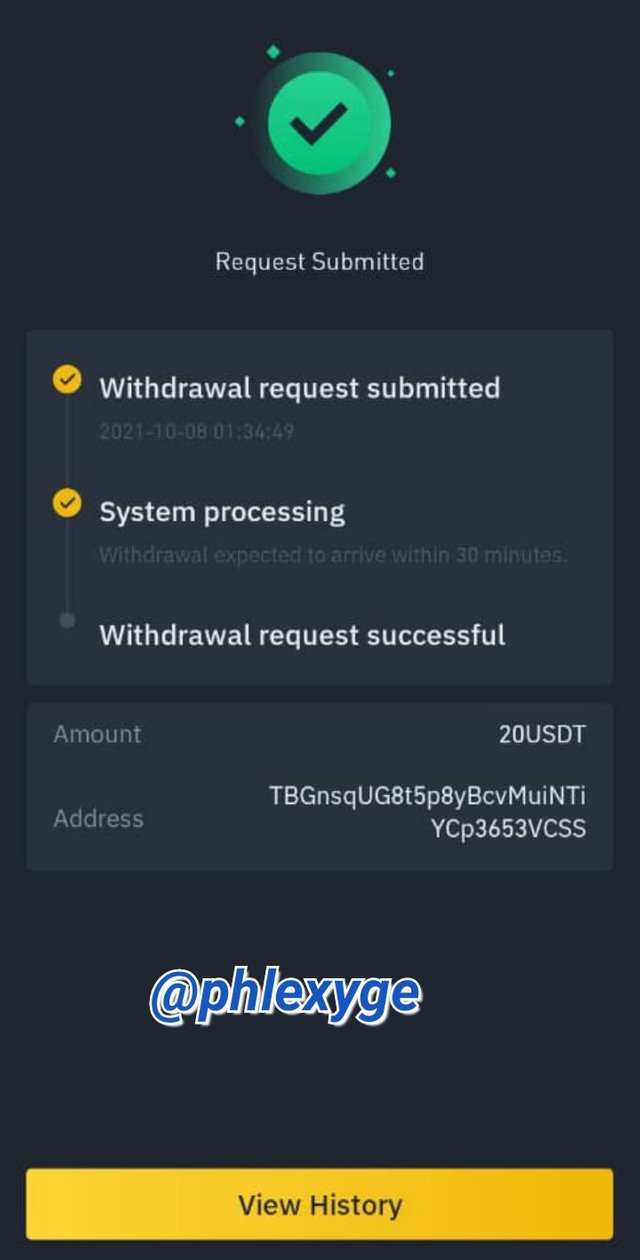

I then clicked on withdraw and went ahead with the confirmation.

Withdrawal

Confirmation

Processing

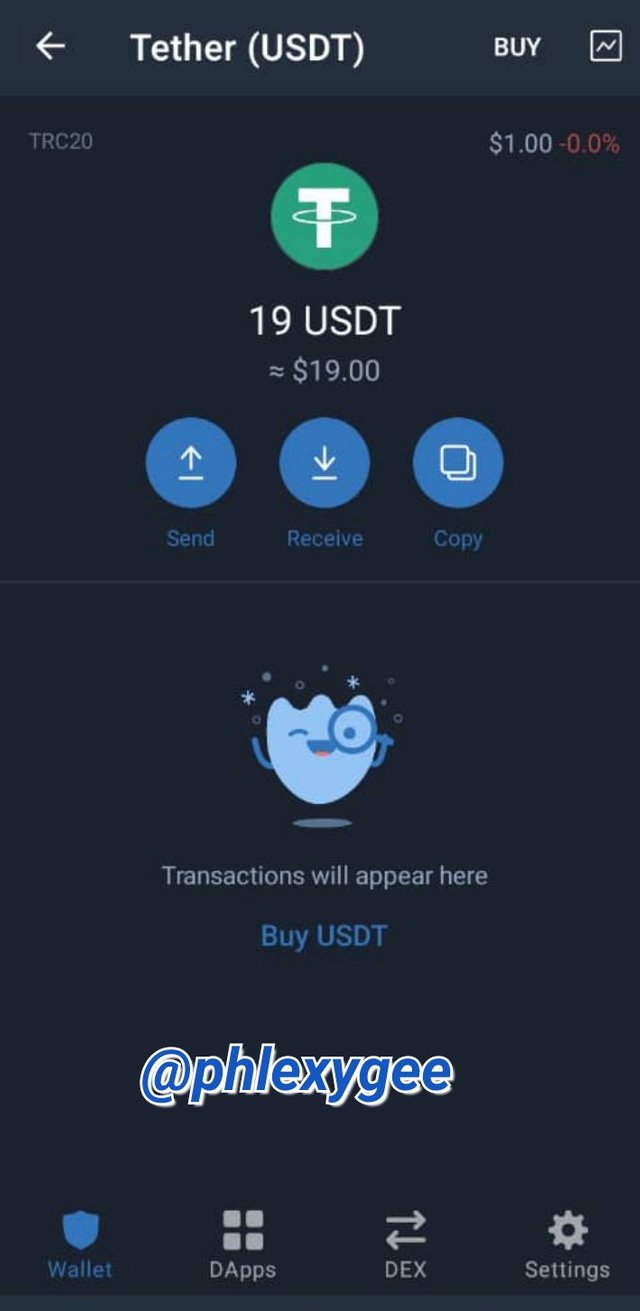

And I received 19 USDT in my Trust wallet because I was charged a fee of 1 USDT.

I noticed some essential things in the withdrawal process and below are some of them.

Pros of Stable coin over Fiat money

I noticed that transaction fees are low as compared to the Fiat money transactions because I was charged only 1 USDT for 20 USDT.

I realized the transactional speed was high as compared to the Fiat money.

I also received both phone and email confirmation code for the withdrawal process which means there is high security.

All the above screenshots were taken from Trust wallet app, Binance app and ampleforth.org

Conclusion

This is an exciting lesson. Until today I didn't know there exist some powerful Rebase tokens which have the ability to resist value change in order to preserve the wallet of the user.

Stability is also good in digital currencies and therefore it should be embraced.

Thank you Prof. @awesononso for such a great topic.

Hello @phlexygee,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

More effort should have been put in question 1.

You can improve on the arrangement.

I noticed some parts that were paraphrased from other sources. Always be as original as possible.

Your explanation and illustration in question 3 need some work.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Okay

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit