Made with LogoMaker

Made with LogoMaker

Discuss briefly Centralized exchanges and its Benefits to crypto users.

The roles of exchanges in the live of crypto enthusiasts are of more essence.

There are two types of exchanges which are Centralized and Decentralized exchanges.

These exchanges serve as an avenue for the trading of cryptocurrencies, but for the purpose of this task, I will focus on Centralized exchanges.

A centralized exchange is any crypto trading platform that is being monitored or controlled by a central unit, whiles a decentralized exchange is vice versa.

With centralized exchanges, users don't own or have total control over their private keys, but rather the central authorities have access to them.

Examples of centralized exchanges are Binance, Huobi, Bittrex etc.

Benefits of Centralized Exchanges to Crypto Users.

There are several benefits that users of centralized exchanges enjoy, and some are listed below.

There are more cryptocurrencies listed on centralized exchanges as compared to decentralized exchanges, and this is due to their popularity and reliability. Users have the opportunity to initiate the trading of numerous assets. Huobi for instance make regular daily listing of tokens.

Centralized exchanges offer the trading of/with fiat currencies. Users are able to use real world currencies to comfortably place crypto trades. The combination of fiat and crypto trading make enough room for trading to its users.

They possess customer care teams that operates 24/7 to assist users who need help to tackle some challenges the come across on the platform. The central body takes the responsibility of address issues concerning the exchange.

Scam and fraudulent activities are decrease with the help of the introduction of the KYC (Know Your Client) feature by the exchange. Users personal information are collected for security purposes, therefore decreasing the tendency of fraudulent activities, since one can easily be exposed.

Upon the above listed advantages of centralized exchanges there are some demerits related to them, but I ponder on that later in the article.

What do you look out for when choosing an exchange to trade your crypto assest?

Actually, there some things I consider before trading my assets on an exchange. The under-listed are they:

I consider reliability; for me to trade on an exchange, I do background checks to know the team behind the platform, duration of which the exchange has been operating, the positive and negative history of the platform, as well as the effective operations of the customer care service.

Adequat crypto pairs; I look out for the availability of more crypto pairs which are available for trading on the exchange. Some exchanges lags in terms of listing, therefore I look for the ones with more listed cryptocurrencies in order to get the chance to trade variety of assets.

Effective security; I consider how the exchange deal with it security related issues. In fact, will never trade on an exchange that doesn't support KYC verification.

Liquidity level; I am much interested in exchanges that possess high level of trading liquidity.

Transaction speed level; when choosing a centralized exchange to trade my assets I take in consideration of the transaction speed of the platform, and if the speed turns out to be low, I lose interest and look for the ones with high transaction speed. I just can't spend much of my precious time on waiting on a transaction, therefore the earlier, the better.

Transaction fees; last but not least, I put in consideration of the transaction fees of an exchange. Some have high transaction fees, whiles others don't. I will always go for exchanges that save my funds by charging low transaction fees.

Review your favorite centralized exchange and explain its unique features

Binance happens to be my favorite centralized exchange, and of course it has some unique features.

The platform was created in 2017 by a developer called Changpenh Zhao, and till date it has the largest trading volume.

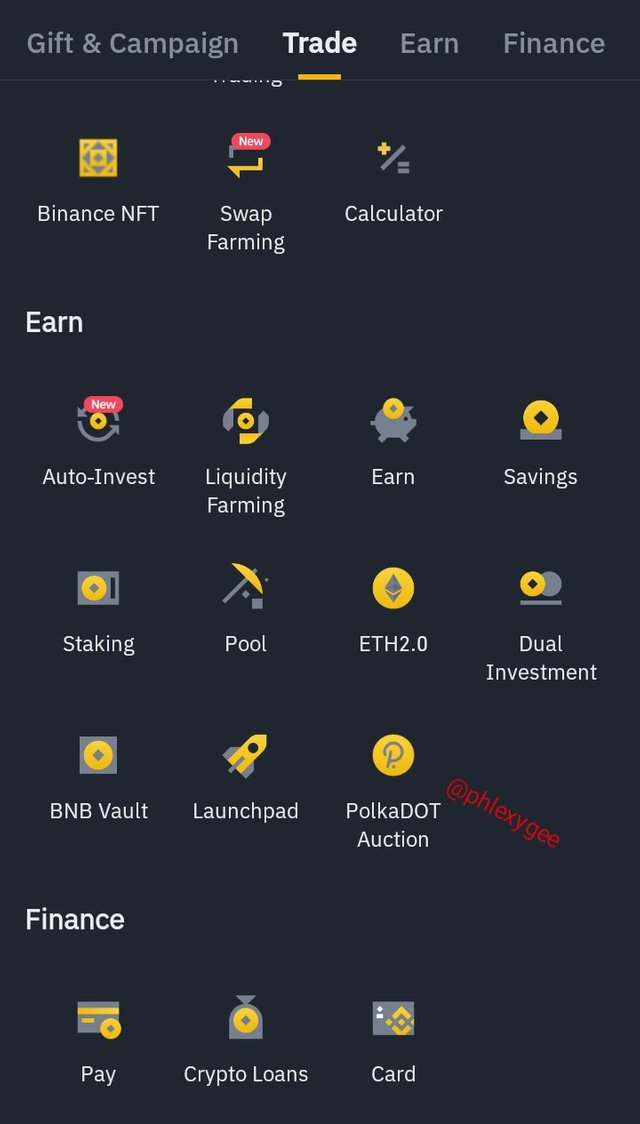

Now let's move to the unique features.

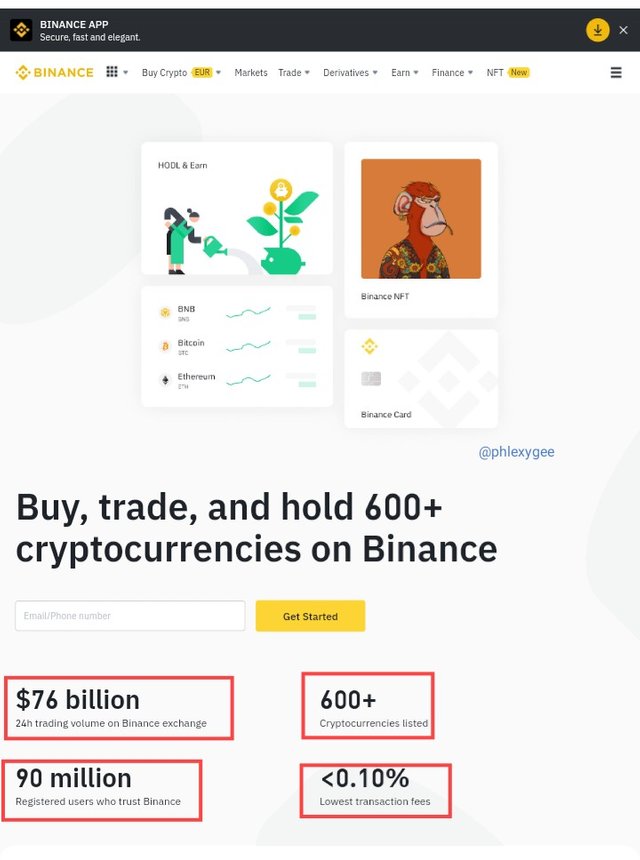

Binance offers the trading of more that 600 cryptocurrencies, therefore enhancing the trading taste of users.

Notably, the exchange has a 24hr trading volume of $76 billion, with 90 million registered users, and these are some of the things that make it more reliable.

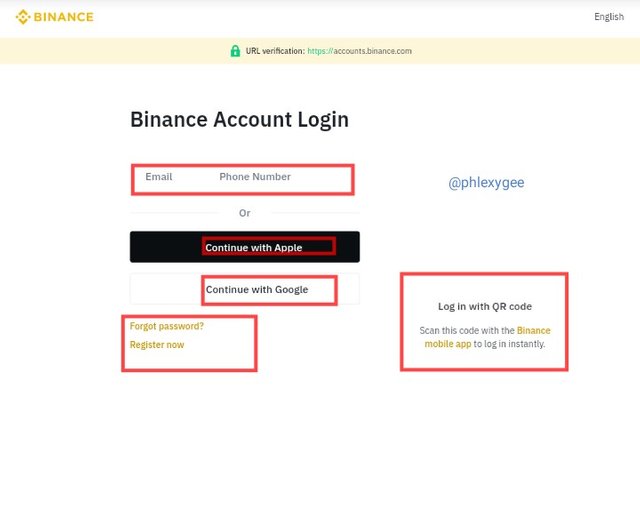

Binance offers variety of logins such as using finger prints on the app, E-mails, Google account, Apple accounts, or Phone numbers, where as users who forget their passwords can easily recover them with just a single click on forget password, and following the necessary procedures.

Users can just log in on their computers by scanning the QR code on the log-in page using the Binance mobile app.

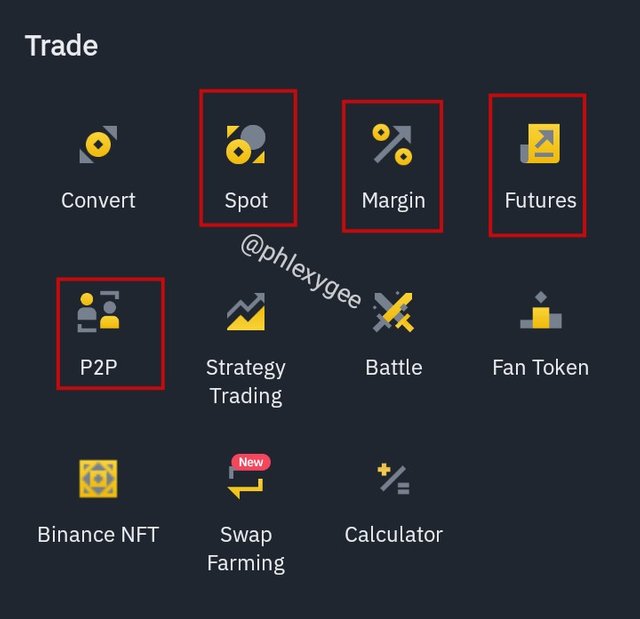

There is P2P trading on Binance which facilitates transactions between users. In case I want withdraw steem to cater for some things, the last process I will use is the P2P (MTN MOMO) since I want the transaction to be quick without involving a third party.

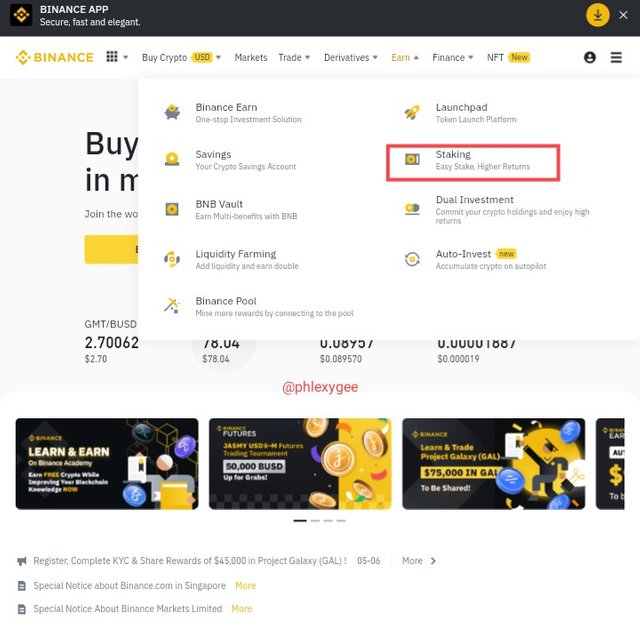

Binance has a staking feature that enable investors to stake their assets and receive some partial income overtime.

Other interesting features of Binance is that it offer educational contents and finacial services like , Binance live, crypto loans, charities, blockchain and cryptocurrency academy, launchpad,chat room, savings and many others.

There is the availability of technical analysis tools such as Moving Average and RSI on the exchange that traders can utilize to set up their trades.

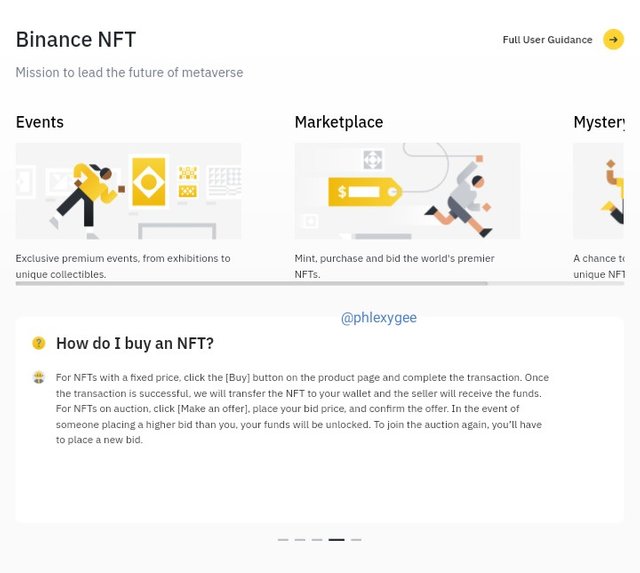

In addition this great platform has an NFT market whereby NFT's are traded, as well as minted.

Last but not least, when it comes to trading, it offers different types of trading such as, P2P, Spot, Futures and Marginal trading.

Is there anything about your favorite exchange you will like to be changed? Discuss.

Sure, there are some things that I will like Binance to work on.

KYC; as mentioned earlier, for security reasons the KYC is necessary, but here is the case that it exhaust a lot of time before finishing with the process. The facial capture together with the uploading of the documents is very frustrating. I spent about 30 minutes on the facial verification before it went through. The verification of my account also took some days, so it will be better if they work on those areas, I think other users may bear in mind with what I am saying.

Transaction fees; personally; I see the transactions fees of Binance to be a bit high. In case of a USDT withdrawal Binance deducts 1$ as a transaction fee, which I think should be 0.5 instead.

Minimum required trading capital; Binance only accepts $10 and above in any trading, which places restrictions on users who's funds are not up to $10. I think a regulation of the $10 to $5 as minimum trading capital will aid Binance to attract more users, as well increase its liquidity level.

What shortcomings do you see on centralized exchanges and how do you think user funds can be protected since we don’t have access to our wallet private keys?

What I know is that, anything that has a positive side also has a negative aspect, and centralized exchanges are of no exceptions.

Some of these centralized exchanges dupe their users by manipulating their system for their personal interest or gains. The tendency to manipulate prices, trading volumes and other aspects is abysmal.

Centralized exchanges are more prone to hackers, due to their centralized nature, which in turn creates fear and panic on the part of the users.

They have high transaction fees as compared to the decentralized, and a practical example is that of Binance and Huobi.

As a result of the KYC users personal information may be leaked, in case of a successful hack attack.

Since users of centralized exchanges don't have total control of their private keys, the security and safety of their assets is weak, therefore to protect their funds and be free from loosing them, users should keep their long term assets in either a decentralized wallet or exchange, leaving only the assets to be used for trading in the decentralized exchange.

Centralized exchanges can freeze or close down one's account based on several circumstances, therefore it is always recommendable to keep assets in a decentralized platform, since they don't have in possession of users private keys, and therefore can't tamper with their assets.

Conclusion

Decentralized exchanges are good trading platforms that enhances trading, but for long term holding, we should always keep our funds in non-custodial wallets or decentralized exchanges, in order to prevent losses and some further restrictions.

This is my opinion on centralized exchanges.

Thank you for glancing through my article.

I will support them on this. Because I think it's only the people who wanted to sell whose accounts are normally blocked. It's good at some point.

By the way great presentation. You did great. Good luck in the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, you have a point, but for security and safety reasons, it is highly recommendable that we keep our funds in non-custodial wallets.

Thanks for passing by.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My pleasure

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Binance was my favorite exchange too, you really made a very good review of it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow, nice. Upon all odds, Binance has a upper hand.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Binance to me is the best exchange because it makes things easier and faster for it's users. Thanks for this your honestly interesting review

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks bro.

I appreciate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have really done a great work bro, I must admit, keep up the good work🥰🥰.

Here's the link to my entry

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit