Hi family here is my presentation for this week and it happens to be the second version of Technical indicators.

made with iMarkup

made with iMarkup

1 a) Explain Leading and Lagging indicators in detail. Also, give examples of each of them. b) With relevant screenshots from your chart, give a technical explanation of the market reaction on any of the examples given in question 1a. Do this for both leading and lagging indicators.

1 (a)

Leading indicators

leading indicators are technical indicators that use previous price data to forecast future price movements in the market. Leading indicators help traders to anticipate future price movements and therefore traders are able to enter into trades potentially at the start of the move.

These types of indicators are suitable for short term traders.

The main aim is to help traders spot price movements in the market before the beginning of the actual price move.

The challenge associated to leading indicators is that, traders anticipate a move before it actually happens and the market could move in the opposite direction which can sometimes lead to loss or market misinterpretation.

These Indicators are vulnerable to price manipulation and fakeouts.

As a result, it is not rare to witness false breakouts or signs of a trend reversal.

It is advisable to complement them with other technical analysis tools in order to get reliable results, since they can be manipulated by the market price.

Some examples of leading indicators include:

Relative Strength Index (RSI)

Stochastic Oscillator

Fibonacci retracements

Donchian channels

Lagging indictors

Lagging indicators, as the name suggests are Indicators that lag behind the market price and they are suitable for long-term trends.

This entails that traders can witness a move before the indicator confirms it which means the trader could lose out on a number of pips at the start of the move.

Lagging indicators also have some challenges associated with them because they let traders enter into the trade when the trend has already began and this probably leads to missing out on some important market moves.

The usage of lagging indicators might make a trader enter into the market when the trend is already weak and there might be a reverse on the trader instead.

These indicators are normally not prone to price manipulation or fakeouts since they confirm the start of the trends before giving out the signals.

Some examples of lagging indicators include:

Moving Average Convergence Divergence (MACD)

Simple Moving Averages (SMA)

Parabolic SAR

Bollinger Band

1 (b)

With relevant screenshots from your chart, give a technical explanation of the market reaction on any of the examples given in question 1a. Do this for both leading and lagging indicators.

Leading Indicator

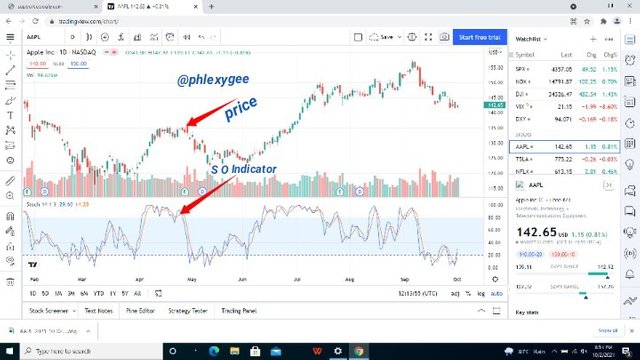

A chart (AAPL) display of Stochastic Oscillator

The above chart is a display of the asset's price matching or going in line with the stochastic oscillator in terms of the overbought and oversold price of the asset.

A stochastic oscillator is known as a popular technical indicator for generating overbought and oversold signals.

Lagging indicator

A chart of display of a Parabolic SAR BTCUSD

The above is a Parabolic SAR Indicator which is lagging behind the market price.The Parabolic SAR is a technical Indicator used to determine the direction that an asset is moving. The indicator is also referred to as a stop and reverse system, which comes with an abbreviation as SAR.

It aims to identify potential reversals in the price movement of traded assets.

2 a) What are the factors to consider when using an indicator? b) Explain confluence in cryptocurrency trading. Pick a cryptocurrency pair of your choice and analyze the crypto pair using a confluence of any technical indicator and other technical analysis tools. (Screenshot of your chart is required ).

2 (a)

Below are some factors to consider when using an indicator.

Understanding of one's Trading Strategy; this is the most essential factor to consider in order to properly utilize the technical indicator. Understanding one's trading strategy helps to choose the best and appropriate indicator that suits one's trading style. This also helps to configure an indicator based on one's trading strategy or style.

Take note of the Market Trend; this is also a crucial factor to consider when using a technical indicator. The market can either be trending or ranging. During the trending market, the trader will consider using the trend-following indicators in order to properly analyze the market whiles during a ranging market, the trader can focus on momentum-based indicators and also volatility-based indicators to capture overbought and oversold regions of price and also swing highs and swing lows. This also help to sell at a high price and buy at a low price as the market ranges.

Properly selection of Indicators; traders need to know or consider if the indicator is a lagging or leading indicator before its application.This helps traders to be very conscious and become aware of the market movements and help them to apply the necessary trading management.

Ensure Confluences; traders need to deploy the usage of other forms of technical analysis tools in order to confirm the signal given by an already applied indicator. As there is no 100% accurate indicator it will then be necessary to combine multiple of them (good ones) in order to obtain same or similar results or information that will yield positive results.

Strong internet connection; the operations of technical Indicators depend on internet connection, so it will therefore be necessary to ensure a stable and effective network connection in order not to lag behind the market trend when not using a lagging Indicator.

2 (b)

Confluence in cryptocurrency trading is simply the instance whereby same results or signals are being obtained after the application of two or more indicators on a chart.

As mentioned earlier, this is one of the crucial factors to consider when choosing an indicator.

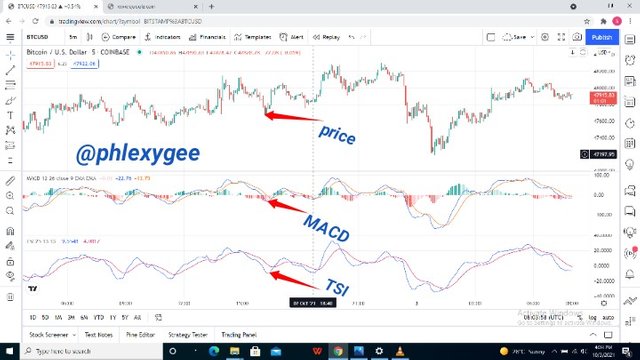

The above BTCUSD pair chart is the combination of TSI (True Strength Index) and MACD (Moving Average Convergence Divergence) of which both have shown same reaction or results with regards to the market price.

3. a) Explain how you can filter false signals from an indicator. b) Explain your understanding of divergences and how they can help in making a good trading decision. c) Using relevant screenshots and an indicator of your choice, explain bullish and bearish divergences on any cryptocurrency pair.

3 (a)

False signal usually takes place when the signal of the indicator and the market price action don't match or are in opposition to each other in the chart, but fortunately there are are some ways in which such false signals can be filtered out.

The most common and effective way to identify a fake signal is to have a look at the price action or market reaction and then compare it to the signal or reaction of the indicator to see if they go in line, if they do then the signal is correct but if they don't then there is a false signal on the part of the indicator.

In simple terms, If the indicator gives a signal and the market reacts towards it, then the signal is correct whiles when the market gives an opposite reaction, then it means the signal is given is fake.

3 (b)

In my understanding divergences are the instances whereby the current price action of assets moves in contrary to the direction of the technical indicators.

Divergences can therefore aid traders to make a good market decisions by helping them to filter out false signals of the indicators and they can also be used to detect prices reversals at an earlier stage.

3 (c)

Bullish Divergence:

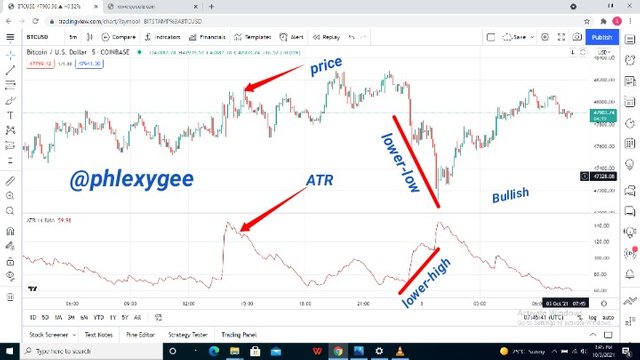

Bullish Divergence happens when the indicator signals lower-high formation (Uptrend) but the price movements shows a lower-low formation (downtrend), this connotes that there is an expected reversal from downtrend to uptrend.

Bullish Divergence usually signifies a reversal of prices movements from downwards movement to upward movement

The bullish divergence simply means the downtrend is coming to an end and a possible reversal to the upside is expected.

A display of BTCUSD chart of which the Average True Range (ATR) indicator has moved in a lower-high direction whiles the price has moved into a lower-low direction.

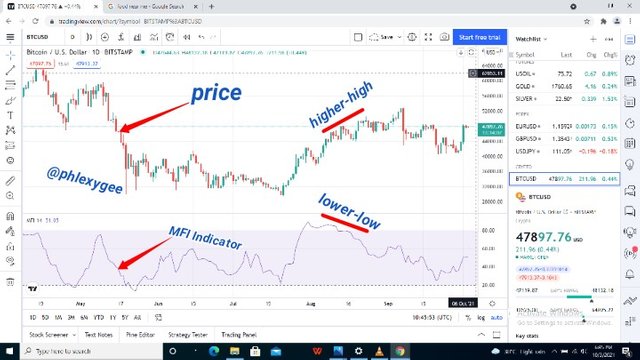

Bearish Divergence:

This is takes place when an indicator signals a lower-low (down trend) formation but the price actions shows a higher high formation. The lower-low formation indicators shows that there is an expected reversal from bullish to bearish trend.

The above is a BTCUSD chart of which the the Money Flow Index (indicator) has shown a downtrend whiles the price has move to the opposite direction (Uptrend)

All the screenshots of the charts were taken from www.tradingview.com

Conclusion

Initially this lesson was kind of complicated to me due to the technical terms but after spending some quality time on it I have been able to grasp all the relevant concepts with regards to this lesson (Technical Indicators II).

Thank you Professor @reminiscence for helping us gain more knowledge in the field of crypto.

Although I am not there (perfect) yet but I know gradually I will definitely become a Pro.

Hola amigo me alegra que después de dedicarle más tiempo pudiste entender felicidades, feliz día.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

gracias

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @phlexygee , I’m glad you participated in the 4th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much Professor.

I appreciate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit