Hey there everyone this is @prakhar9675 here this side. And this post is a homework Post which was given by professor @stream4u.

In this post I will try to answer all the questions asked by professor @stream4u.

So let's get started:-

What Is Crypto Margin Trading?

Crypto Margin Trading is a way by which a trader can trade if he don't have enough money to buy assets.

In this type of trading, a trader borrows money from a third party. This third party may be any lender or the exchange itself where he wants to trade.

Margin trading gives opportunity to Trader with less fund to trade with high buying power.

In this type of trading, initially trader set the percentage for the borrowed money. This money is called as marginal amount.

When this marginal amount is set, then trader can choose from various type of leverage. There are many leverage for example 2:1, 3:1 and this continues upto very high ratio. These leverage are represented by 2x, 3x respectively.

Now let's understand what does 2x, 3x or 2:1, 3:1 mean:-

If a trader choose 2x leverage and he has 100 USD in his account. Then he can trade with 200 USD. That extra money may be borrowed from any third party person or the exchange itself.

This may sound simple but this is quite riskier too. For example you used to trade with 100 usd in account and then you decided to use marginal trading and trade with 200 USD. And for example market price didn't go according to your prediction. Then you will face loss.

Now, if you had trade with 100 USD then you would have suffered less than trade with 200 USD. This makes it quite riskier.

How To Plan For Trading In Crypto Margin Trading

As I have told you, marginal training may sound easy but it's quite hard to do. So while doing this trader must have a full strategy for every aspect.

Some plan that must be considered by any Trader are following:-

Before doing marginal trading, a trader must accept the risk related to this. And for this that trader must think about it calmly. This type of decision should not be made overnight

Before doing marginal trading, a trader must first start trading with low fund and then should observe that his prediction are going correct or not.

Because in marginal trading if your prediction goes wrong then trader has to suffer much.Leverage should be choose very wisely. And choose only those leverage that you consider you can handle even if you fail to make a right prediction.

If you can handle leverage 2x then shouldn't go to more than 3x.A beginner should avoid choosing leverage like 20x 50x because with the leverage increases, the risk also increases.

One should avoid investing one's all life saving because In any case if prediction goes wrong, then he might become bankrupt..

Crypto Exchanges Name That Provide Margin Trading Service and What Margin They Provide?

Now a days popularity of marginal Trading Is increasing day be day. As by using this one trader with high trading knowledge but with less fund can trade by taking risk.

So to attract more and more people to its platform many exchange are providing marginal trading.

Some popular exchange providing marginal trading are given below:-

1. Bitmex:- Bitmex is one of the biggest exchange when it comes to leverage available. It provides upto 100x leverage. This means one person with only 100$ I'm account can trade with 10,000 USD.

Ofcourse this also make is most riskier but one who have knowledge can take this risk and make profit easily.

2. Huobi:- huobi provides leverage upto 3x. This means you can trade with amount thrice than that of into your account.

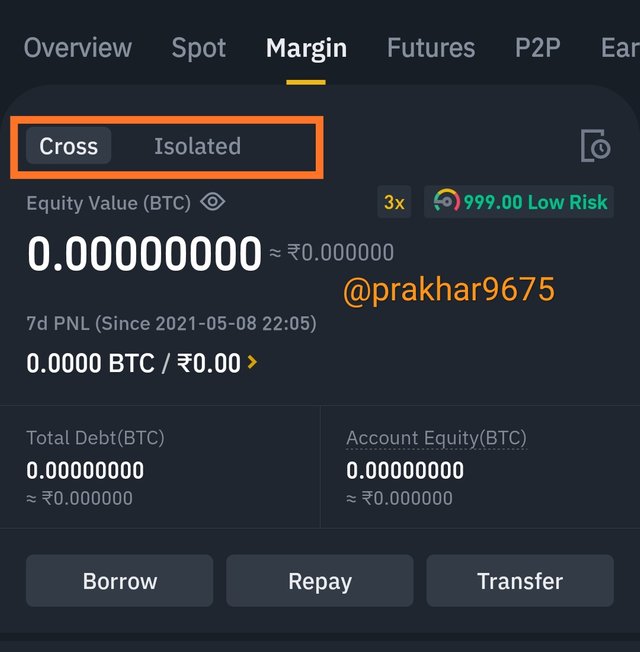

3. Binance:- binance is one of the biggest plateform when it comes to userbase. And it also provides leverage.

But when I checked binance, I found that this has two types of marginal trading

- Cross

- Isolated

The difference between cross and isolated marginal trading is that in cross marginal trading, risk and Reward are calculated by the platform across all postion. But in isolated marginal trading risk and Reward are calculated only on position. This is why it is called isolated because it is independent of other position.

In cross marginal trading, binance provide leverage upto 5x and in isolated it provides upto 10x.

What Is Leveraged Tokens Trading?

Leveraged token are ERC 20 based token and are not real token. They are provided to a trader to earn with less risk. In Leveraged token, there is not much risk of margin, and liquidation. Thus it is less risky.

Leveraged token can't be withdrawn from exchange to your wallet and these are not meant for holding. There are meant for only trading.

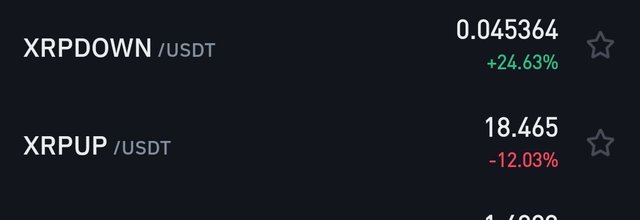

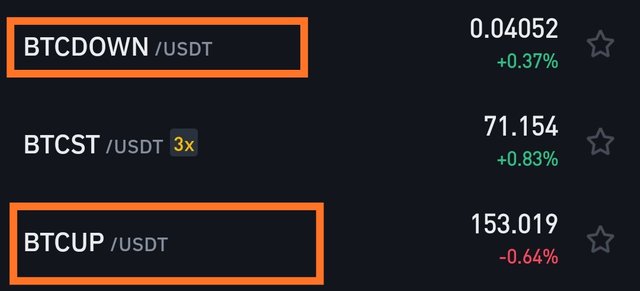

Every exchange has listed its different leverage token like UP or BULL, DOWN OR BEAR.

For example, binance(BNB) has its own leveraged token by the name of BNBUP and BNBDOWN.

Similarly there are leveraged token for Bitcoin (btc) and XRP.

How it works

In this, a trader make assumptions that market will go up or go down.

For example I make a assumption that market will go up and I want to make profit. Then I should buy UP or bull leverage token.

On the other hand if I make a assumption that market will go down then I should buy down or bear.

And these up and down token are linked with the original token. For example BNBUP will have uptrend when BNB will have uptrend and in this situation BNBDOWN will have downtrend.

Similarly, when BNB is having downtrend, in this situation BNBUP will have downtrend and BNBDOWN will have uptrend.

So by using these Leveraged token a trader can make profit even in bearish market as well as in bullish market.

Real time example

As in these photo you can see that BNB was having downtrend (now it's showing green but still there are more red candlestick) and same on BNBUP. Both were having downtrend.

But in the same time, BNBDOWN was having uptrend. (It is showy red signal as it is now decreasing as BNB is having uptrend but still there are more green candlestick).

How To Plan For Trading In Leveraged Tokens?

Similar to marginal trading, a trader should consider many aspects before trading with leveraged token.

A trader must be aware of all the situation that might change the trend of the market.

A trader must know when the market will go up and will go down as this Is the core of this. And without this one can't trade.

A trader must find a exchange that suits him perfectly. Different exchange gives different leverage.

Crypto Exchanges Name That Provide Leveraged Tokens Service and What Margin They Provide In Leveraged Tokens?

Now a days leveraged token is getting popular day by day so many exchange are providing these to attract more and more people to its platform.

Different exchange provides different leverage in leveraged token.

For example :-

Binance provides leverage upto 4x.

Bittrex provides upto 3x

Poloniex provides upto 3x

And there are many other exchange too but mostly all exchange provides leverage upto 3x.

Price Forcast For Crypto Assets XXXXXX

In this section, I will try to forecast the price of steem as this is the only cryto asset I have. So I think I should forecast about it.

This is the candlestick chart of steem/btc with unit time 4 hours. This means every candlestick is representing 4 hours.

And you can see it is having downtrend. And its price is decreasing. But it is not the right time to enter as it's price is not close at support price. Nor it is the right time to exit, why?? I will tell you.

So you can see it's price of decreasing current price is 92.07 INR and it is having a resistance at approximately 103 INR.

As you can see, as the price of the steem is decreasing, the trading volume is also decreasing. This means the price drop is not permanent and it might be temporary. And people are not trading and are waiting for its price to increase. And when this happens, the price of the asset goes up..

So as per my prediction price of the steem will go up in the next few days. And in the next week its price will go again near to its resistance price 103 INR. And it might break the resistance as it is revolving around the same resistance for many weeks.

So that's all from my side. Hopefully I am full understood.

Cc

@steemcurator01

@steemcurator02

@stream4u

@yousafharoonkhan

.png)

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Thank you very much for taking interest in this class

Grade : 7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor @yousafharoonkhan.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit