A Little Look At Risk Aversion

With regards to finance and dismal science, risk aversion is the likelihood of people to be in the habit of choosing positive result or consequence with low condition of being uncertain or without conviction, rather than those outcomes with high uncertainty, even if the expected or mean outcome of the second is equivalent to or even higher in value pertaining to money than the more sure outcome. Risk aversion gives explainasions as to the attitude to consent to a condition that is more predictable, but has potentially lesser payoff, rather than another condition that is significantly unpredictable, but has the possibility of giving greater payoff. Evidently, a risk-averse investor possibly can choose to put money into a bank account with a less but guaranteed interest rate, rather than putting it into a stock that could have high expected returns, but also stand a chance of losing value.

Practically speaking, risk aversion is an imperative notion for investors. Meanwhile, investors who tends to extremely risk-averse chooses investments that propose an assured and/or risk-free return. This is preferable to them though the return may be somewhat low compared to higher potential returns accompanied by a higher degree of risk. For instance, government bond would be preferred by extremely risk-averse investors to a higher risk investment like commodities and stocks.

Investors who have a higher risk tolerance or lower levels of risk aversion will consent to take greater levels of risk in exchange for favorable circumstance or occasion in order to gain a higher return on investment.

Which is my risk aversion, the product/s I find the most appealing and why

Having expediently taken a look at risk aversion, who then is risk averse?

A risk averse person (investor) is one who has the idiosyncraticy or trait of preferring to avoid loss over making a profit. This idiosyncrasies is usually broadly joint to investors or market partakers who are in the habit of choosing investments with lower returns and relatively known risks rather than choosing investments that have potentially higher returns accompanied by higher uncertainty and more risk. A risk averse persons is like to avoid investments that have relative higher risk like stocks. They choose to adhere to investments that has a guaranteed return and lower to zero-risk. Such investments may include treasury and government bond. Of a truth, I am a risk averse person.

The Product I Find Appealing

Talking about the product I find appealing, Binance as taught by Professor @fendit, provides us with varieties of investment options that would be suitable irrespective of risk aversion. One of the various investment plan provided by Binance is Staking

Staking is characteristically an alternative to mining that requires a less amount resource. Meaning that staking is less resource-intensive. Staking mostly involves keeping funds in a appropriate wallet and performing various network work like validating transactions in order to get staking rewards. The maintenance of the network's security is incentivized through ownership.

Staking also involves putting up a staking wallet and obviously holding the coins. In most cases, the steps involves annexing or appointing funds to a staking pool. Staking may be a splendid way to increase one's cryptocurrency holdings with Staking can be an excellent way to increase your cryptocurrency holdings with the smallest possible degree of effort. Nevertheless, some staking projects hire strategies that unnaturally inflate the rate projected staking returns. However, it is necessary to carry out investigation on token economics models as they can effectively diminish inspiring staking reward projections.

As seen in the lecture presented by Professor @fendit Binance presents two categories of staking: Fixed savings and Flexible savings of which I will go for Flexible savings

The advantage with Binance flexible savings for which I opt for it is that I can make deposit and redeem my cryptocurrency holdings at anytime regardless of the fact that the interest is low.

Explain in your own words fixed and flexible savings, high risk products and launch pools

Fixed Savings presents a better returns with less suppleness to access funds. What distinguishes it is that one needs to set predetermined duration of time for interest to be accrued funds. Fixed savings offers generally a higher interest/APY rates than Flexible Savings products since the rate of interest and term are both stationary. Fixed Savings products however ranges from 7 to 90 days.

Flexible Savings allows one to earn interest on funds. It’s simple to use, and gives great flexibility. With flexible savings, one can make deposit of funds, earn interest as well as redeem them at any point in time.

High Risk Products are areas of investment that offer relatively high interest/APY with high risk level. High risk products may include: stocks, mutual funds, financial derivatives as well as commodities

Launch Pool It’s a token launch platform where promising projects can get funded by the userbase of Binance through a process called an Initial Exchange Offering (IEO).

How to set investment in Binance.

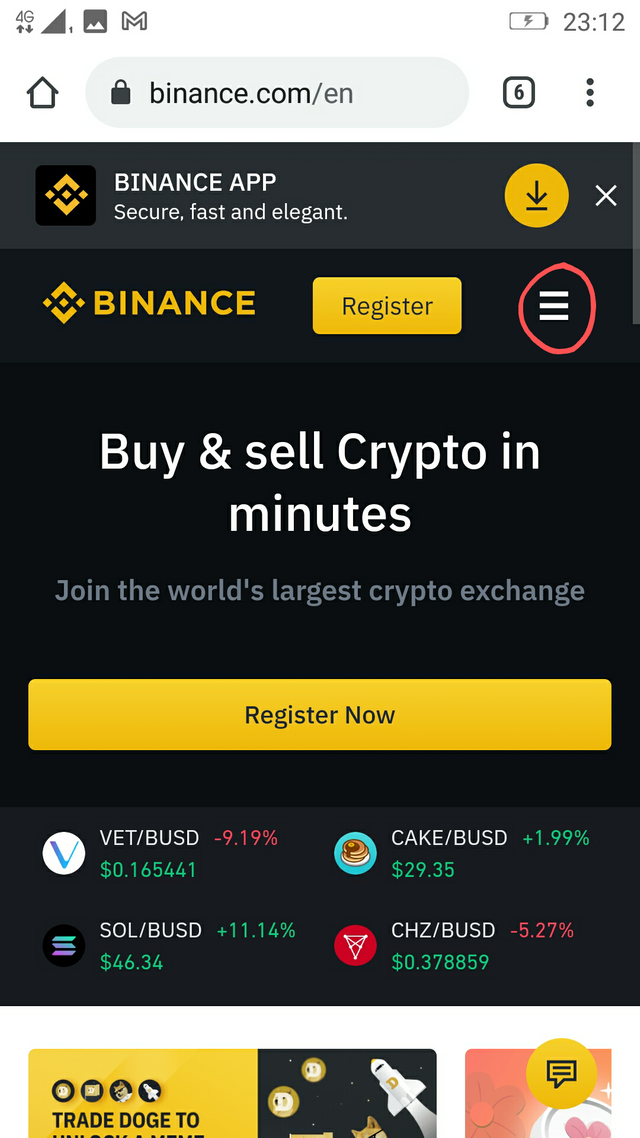

First login or sign up in Binance.com

The circled area when tapped will display a dialogue box from which one can log in if already a Binance user. Once logged in, the same circled area should be tapped to display another dialogue box containing multiple choices from which one would select an option as indicated below

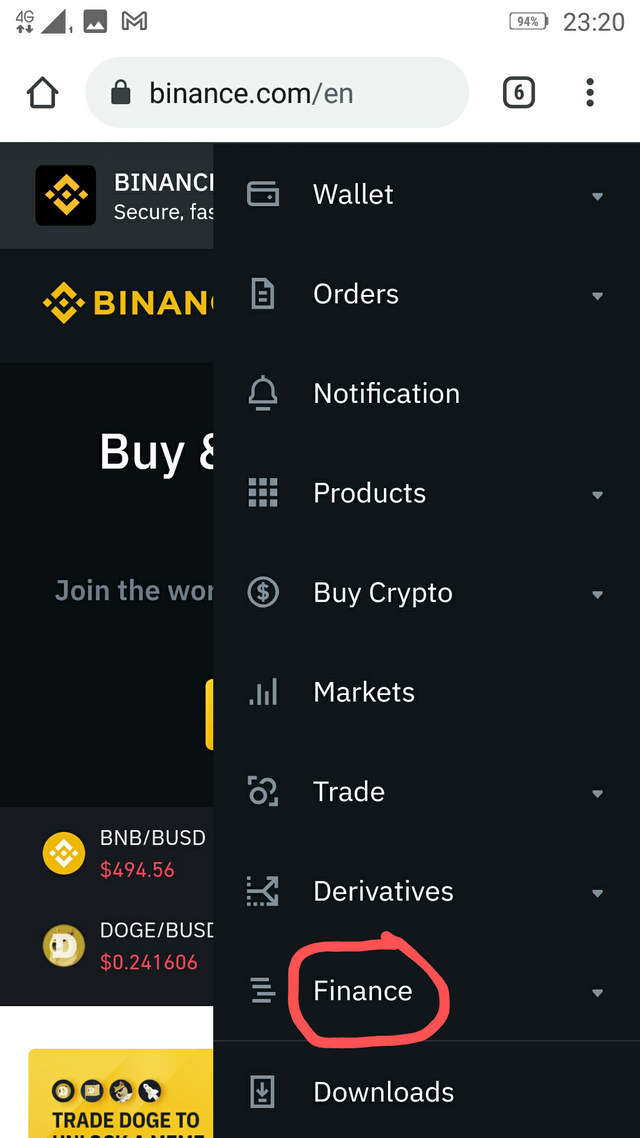

Since it is an investment, finance option should be selected which displays other options as shown below

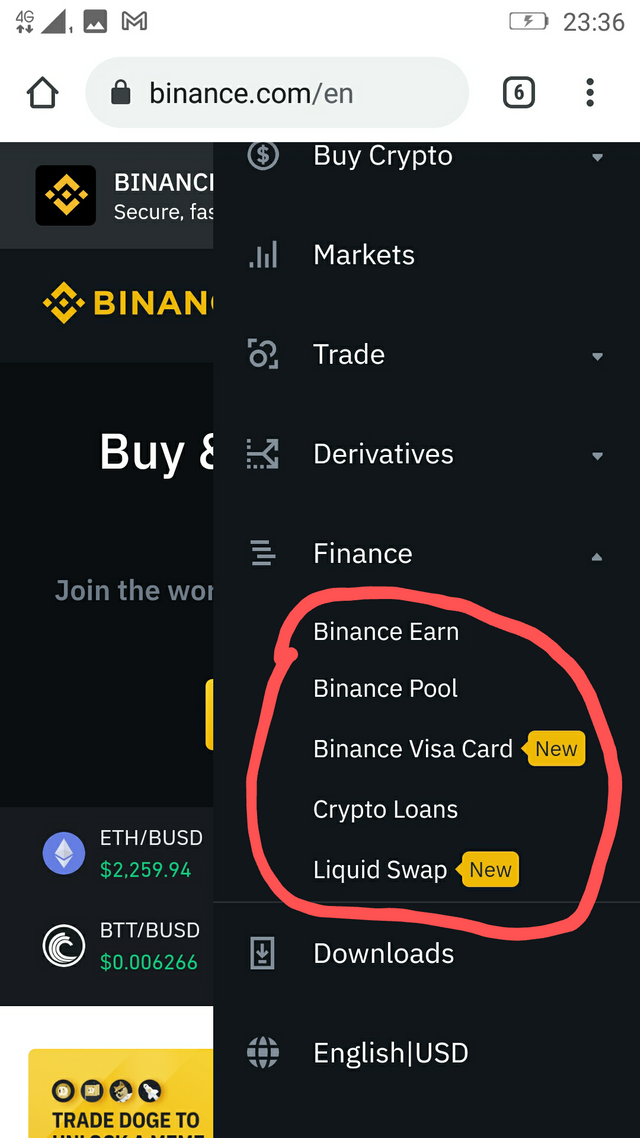

When the finance option is tapped, it displays other options of investment (as shown below) from which one can make a choice

This is my entry Professor @fendit

Thanks for reading

Thank you for being part of my lecture and completing the task!

My comments:

First task was great, it was very into detail and I really liked it!

Still, second and third task could have been a lot better! Explanations were too brief and you could have deepen the description for some products, for insntance dual inversions.

Overall score:

5/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit