Hello great Steemians, I welcome you all once again to the new season in the crypto academy, I also welcome y’all to my post for week 1 on the topic; “Basics to trade cryptocurrencies correctly”.

Here's my homework post.......

1. What do you understand by trading? Explain your understanding in your own words.

Trading

Trading basically is the exchange of goods and services (buying and selling) between people which involves compensation been paid to the seller by the buyer. The main aim of trading is to make profit.

In an economy the concept of trading involves two set of people regarded as the producers and consumers. The producers can be classified as the sellers who makes goods available for the buyers while the consumers are the buyers who purchases the goods and services from the sellers.

Trading takes place in the market place which could be an online or offline market place.

In this homework post I'll be concentrating on crypto market trading which is an online market place.

Crypto trading is similar to our day-to-day trading activities but crypto trading is more faster than our normal day-to-day offline trading of goods and services and this is because crypto trading takes place online. Crypto trading takes place in specific crypto market platforms which are known as Exchange, examples of exchange platforms are Binance, Coinbase, Huobi etc; and these exchange platforms allows users to purchase and sell off their assets.

These exchanges also help traders by providing important informations such as liquidity, and technical tools that can be used for technical analysis by traders before entering or exiting the market to avoid losses.

Some important things to do before entering the crypto trading market

Crypto market is volatile in nature and very complex and therefore involves adequate knowledge of crypto which includes the following;

Technical analysis: This is the use of charts to analyze previous market data such as the price movement and volume so as to forecast the future price movement. Traders are able to get accurate signals during technical analysis by using varieties of suitable technical indicators and tools such technical analysis is preferably for short term traders.These short term traders analysis the market using the technical tools and indicator and then buys assets when they're considerably low and then sell them off when the value is high.

Fundamental analysis: Fundamental analysis involves studying of the underlying industry such as the integrity and capability of the developer of an asset, the capacity of the community, market capitalization etc. This analysis is preferably for long term traders inorder to be able to ascertain the future price of a particular asset, because they buy and hold the asset for a longer period of time.

It is also important for one to also be aware of the risk involved with crypto trading before venturing into it knowing that the market is volatile in nature.

2. What are the strong and weak hands in the market? Be graphic and provide a full explanation.

The crypto market is volatile in nature and thats because the two key players (buyers and sellers) are always contending on who will dominate the market. This contention thereby bring the law of demand and supply into the crypto market. The price of assets gets higher when the buying power is very strong and the price drops when the selling power is high. This brings about manipulations in the market.

Strong Hands

The strong hands are referred to the big time investors in the crypto market because they purchase and sell assets in large numbers, they are also regarded as the key players in the market because they dominant and controls the market. A strong hand could be a financial institution or a bank.

These investors that influence the market are known as the Whales. They manipulate the market to their favor and they do this using different strategies such as

Pump and Dump: This strategy involves the artificial inflating of the value of an asset in the market by buying a large number of it thereby luring traders into buying the asset then dumping the asset after getting enough attention.

Stop Hunting: This strategy involves the pushing of an asset price to levels where traders have set their stop loss order then executing many sell orders inorder to move the price down so the stops can be triggered. This will lure traders to buy the asset again.

Whale Wall Spoofing:

It involves placing of huge market orders thereby creating a false sell or buy order books which will lead to the rise or fall in the price of an asset which the whale will then proceed to sell or buy.Most time whales don't even buy or sell assets, all they do is to just make a tweet about an asset and then cause the price of the asset to either increase or fall drastically.

From the chart above we can observe how the strong hands accumulated the assets and then manipulated the market to pump up thereby luring the weak hands to purchase the asset at a high price with the mindset of the asset pumping higher, once the weak hands are done purchasing the price of the asset drops back again.

Weak Hands

The weak hands is used to classify traders and investors who lack resources to buy assets in large quantities, they are referred to as the retail traders or investors. Often times they end up buying at high prices and selling at low prices. The weak hands are the ones that fall victims of the strong hand (whales).

3. Which do you think is the better idea: think like the pack or like a pro?

Humans generally are probe to the pack mentality, tending to conform to the decisions, actions and activities of others, most a times you see people doing something or taking an action because their family member or loved ones is doing that same thing.

This applies when it comes to crypto investment, people most times accept and believe the sentiment of others concerning a particular asset and they proceed to invest in it without making their own analysis especially when the sentiment came through news or tweet of a well known professional in crypto. It is very wrong to invest in crypto based on sentiment because the news that prompted you to invest might be a manipulation. That a particular news came from a professor does not mean it's completely accurate that's the more reason why you need to carry out your own analysis before investing in crypto. “Be your own Professor”.

Let me use myself as an example, I bought TLM at a high rate based on sentiment. A friend of mine came to me telling me about the coin, how appreciating the coin will be in the nearest future. And on hearing that he has bought his, I proceeded to buy mine at a high rate without any form of analysis. Presently I'm losing 3X the amount I bought the coin with. That's sad right? Reason you don't need to invest based on sentiment because if u do you'll end up losing a whole lot.

It is best for us to think, act and operate like the professor making our our trading decisions based on our personal analysis and refusing to be manipulated, by so doing we can buy relatively low and sell at a high price and make profit instead of losses.

4. Demonstrate your understanding of trend trading. (Use cryptocurrency chart screenshots.)

Understanding of trends in the market is very important for trader as it what will determine if one will lose or profit a trade. A Trend is the overall price direction of an asset in the market, for example; if the overall price direction of an asset is upward, the trend is regarded as an uptrend and a downtrend for an overall movement that's downward.

Trends help traders make a trading decision such as an buy or sell position. Traders tends to enter a long position (buy) when the trend of an asset is upward and they enter a short position (sell) when the trend is downward.

Identification of trends help increase the possibility of making good trade decisions and making profit.

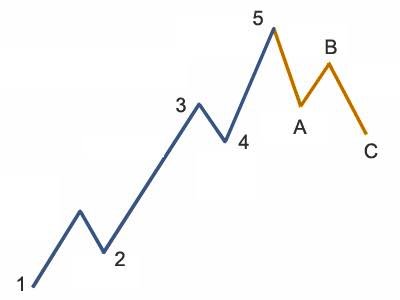

Elliott Wave Theory

Source

Example of a bullish Elliot wave

In demonstration of my understanding of trend trading, I'll be using the Elliot Wave Theory.

The theory is used to identify price movement and it consist of two types of waves; the impulse and correction waves.

- Impulse Waves: The impulse waves often begins the cycle and it consist of 5 sub-waves labelled wave 1 to wave 5. The impulse wave indicates a forward and strong trend in the market

Wave 1 usually starts the cycle, and wave 2 cannot go back to retrace low of 1 and also 4 cannot retrace that of wave 2.

Wave 3 is usually the longest wave, the high of wave 1 must be lower than that of 3, and the high of wave 3 must be lower than the high of wave 5.

- Correction Waves: The correction waves follows immediately after the impulse waves and they are 3 sub-waves labelled wave A, B and C which ends the cycle and a new cycle starts all over. The correction waves moves against the price trend and its presence indicate a price reversal.

The correction waves moves uniformity except for Wave B that moves again wave A and C trend patterns.

Elliot Wave on a chart

5. Show how to identify the first and last impulse waves in a trend, plus explain the importance of this. (Use cryptocurrency chart screenshots)

The first impulse wave in the trend according to the above information can be identified immediately after the correction waves ( A, B and C waves). These correction waves are form due to price reversal after the impulse waves. In a bullish trend during the creation of impulse waves immediately after the impulse waves the price will reverse from a bullish to a bearish trend and afterwards a new trend will be formef thereby starting a new cycle.

The first impulse wave of the trend

The last impulse wave can also be identified by referring back to the Elliot wave theory. The wave cycle begins with the impulse waves ( waves 1-5) and then the cycle ends with the correction waves (waves A, B and C). After the impulse waves the trend reverse forming the correction waves which ends the wave cycle with a new low. Looking at the chart below the last impulse wave can be observed.

The last impulse wave of the trend

6. Show how to identify a good point to set a buy and sell order. (Use cryptocurrency chart screenshots)

The Elliot wave theory as mentioned previously is used to identify price trends and reversal which gives traders insights of a buy or sell position in the market.

A sell or buy position can be identified after the impulse waves depending on the trend that follows whether bullish or bearish.

Sell order

For a sell order the same rules are applied after impulse and correction waves, a sell position is identified if the price movement drops to hit and break the resistance level. Sell order is placed above the resistance level and then stoploss is also placed higher than the high peak of the correction waves, take profit is also set.

A sell order using Elliot waves theory

7. Explain the relationship of Elliott Wave Theory with the explained method. Be graphic when explaining.

The Elliot waves theory provides traders a great insight of trends formations and it also help traders get a deeper understanding of price movement.

The Elliot wave theory can be used on a chart to identify trend formations and which group of traders are in control of the market.

From the explanation above we got to know that strong hands manipulates the market to suit themselves, by purchasing a particular market slowly and steady untill they get to accumulate a great number of the asset. After accumulation they influence the market and make it pump up so weak hands will be lured into the market to purchase their assets, the weak hands in ignorance purchase the asset with the hope that its still on the increase. Once the strong hands accomplish their motive of selling at high price to the weak hands, the price of the asset drops back drastically again.

The relationship the Elliot wave theory has with the above explanation is that the Elliot wave theory exhibit the accumulation distribution pattern of strong hands which can help traders avoid manipulation.

From the above Elliot wave theory chart it can be seen that the first wave is like the accumulation stage when the strong hands begins to gather assets and the accumulation process continues untill the strong hands hits the weak hands at the highest impulse wave (wave 5) which is the distribution stage, and then afterwards the price reverses and begins to drop based on the fact that the strong hands have sold out their assets and this stage is the correction waves of the Elliot waves theory.

Conclusion.

Before going into crypto trading one should get acquainted with market analysis such as the fundamental and technical analysis as it is the basics for every crypto trader.

Crypto market is very volatile and as such it is important for traders to understand risk management such as placing of stop loss and take profit, setting of buy and sell orders etc.

The Elliot waves theory provides great insight of market trend to traders and can help traders understand when the price of an asset is been manipulated which will help them avoid such market.

Thanks Professor @nane15 for the wonderful lecture.

NOTE: All the charts I used in this post are my personal chart from my TradingView account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit