Describe the differences between Staking and Yield Farming

In respect to the question, I would first of all describe Staking and then proceed to describe Yield Farming. The two concepts are both aimed at increasing our crypto holdings by some percent, but the risks involved in the concepts are both different. So let's individually see what Staking and Yield Farming are all about.

What is Staking?

Staking is mostly used in Proof of Stake consensus mechanism networks, where token-holders put in some amount of token to the blockchain network and get rewarded regularly with little percentage of the staked token.

Node validators of blockchain networks must partake in this staking before getting rewards, this is done in order to ensure that the network is in safe hands, because if the validator perform task contrary to the rules of the blockchain network, his staked coins will be taken away by the network.

In most cases, staking is regarded as delegating or giving out some of your token for weekly or annual percentages in return.

What is Yield Farming?

Yield Farming is basically a way of getting rewards or token by borrowing or giving out your assets to a Decentralized Finance (DeFi) platform.

The users of these DeFi platforms earn rewards from the liquidity pool and fees gotten from the the platform. So Yield famers plays very important role in the DeFi platform by providing liquidity to the platform, and then get rewarded or repaid by the platform.

Having understood the two concepts, let me proceed point out some differences:

| Below are differences between staking and yield farming | |

|---|---|

| Staking | Yield Farming |

| The reward rate gotten from staking is far lower than that of yield farming, so also is the risk rate lower | The reward rate on yield farming is far higher than that of staking, so also is the risk rate higher. |

| In most cases, staking is done with the sole aim of securing a blockchain network from future attacks, and in return you get some rewards | In the cases yield farming, the major aim of the yield farmer is to get as much rewards as possible |

| In staking you get rewarded with the same type of token | but in the case of yield farming, you can get another type of token |

| Examples of staking platforms includes Staked.us, eToro, Lido and so on... | Examples of Yield Farming platforms includes Curve Finance, Uniswap, PancakeSwap and so on... |

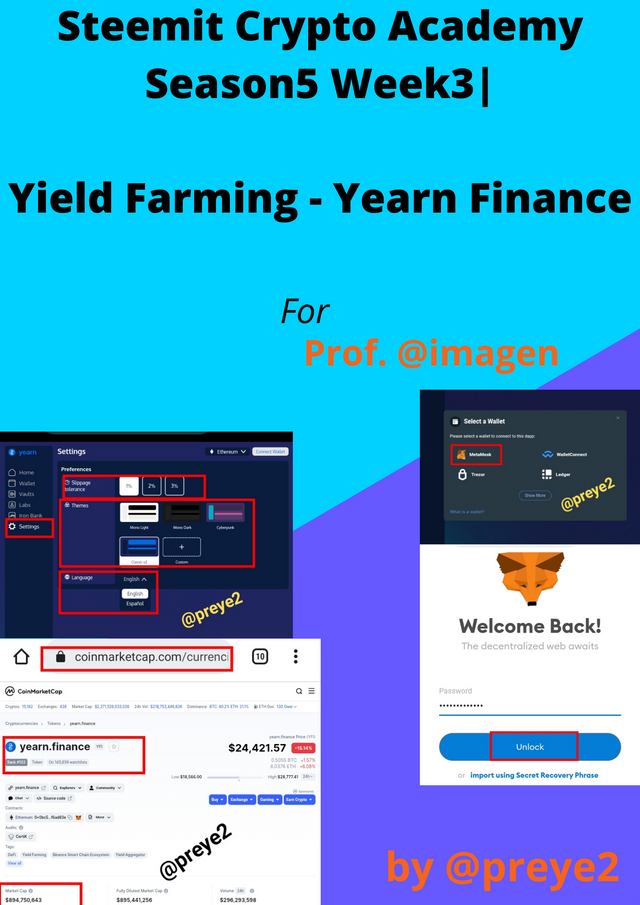

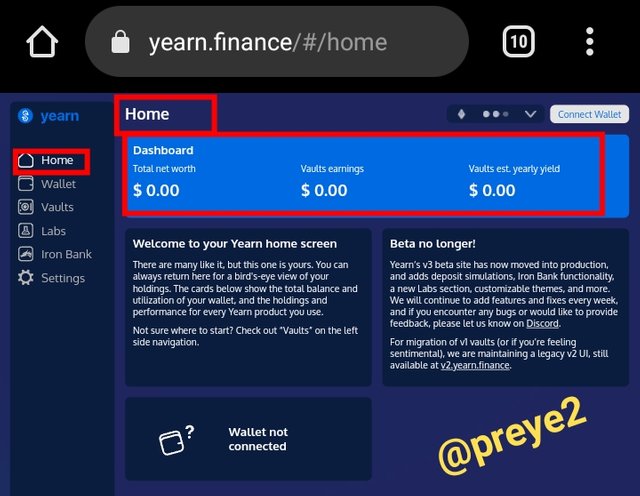

Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options). Show screenshots.

First things first, I logged in to the Yearn Finance Site where I would explore the features and functions of the platform.

- Home Page: This is basically like the welcome page where you can see your dashboard as well as your total net worth and earnings thus far.

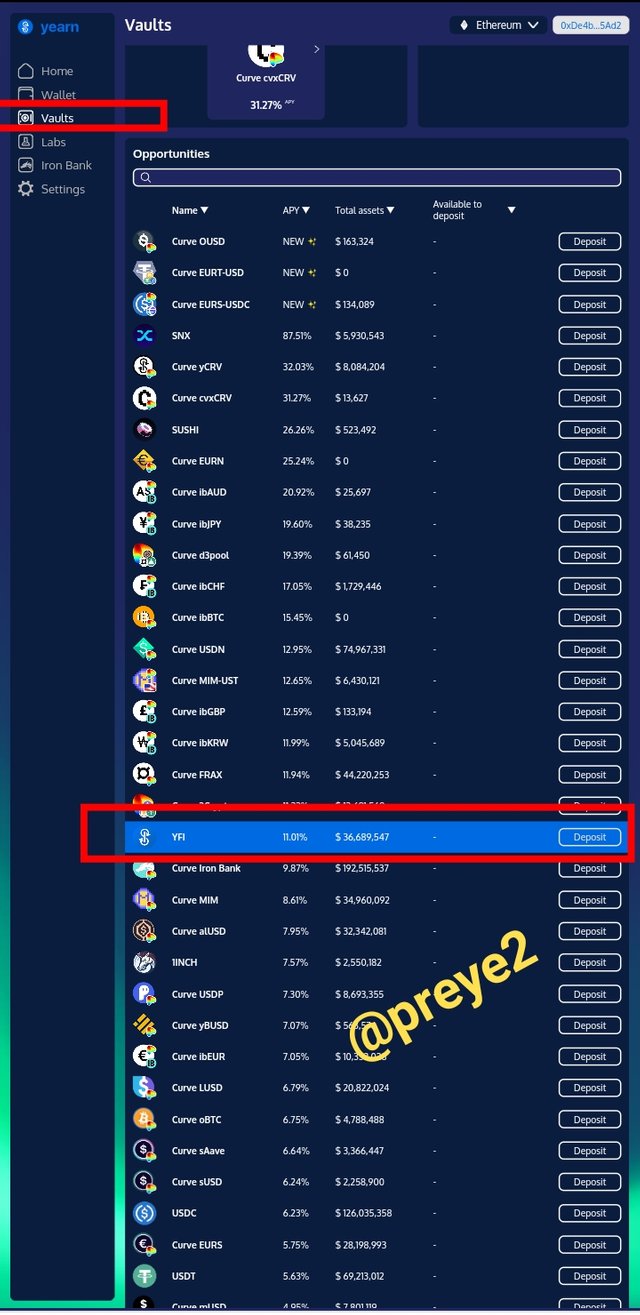

- Vault Section: The vault section can basically be used for access and controlling your balance. When you deposit more tokens to the platform, this vault section will help you compound and balance your earnings.

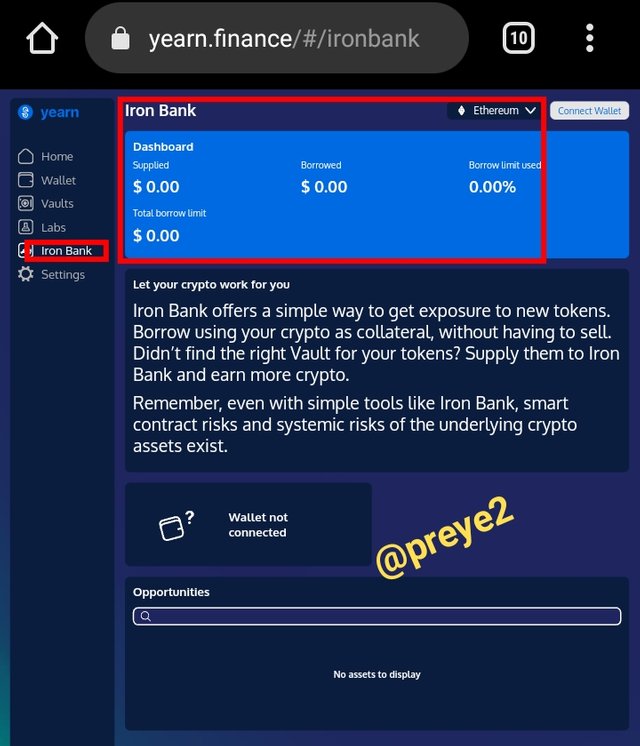

- Iron Bank Section: This section of the platform helps users get access to tokens that are new, and in this case you can simply be loaned some tokens after keeping some tangible amount of crypto aside as collateral.

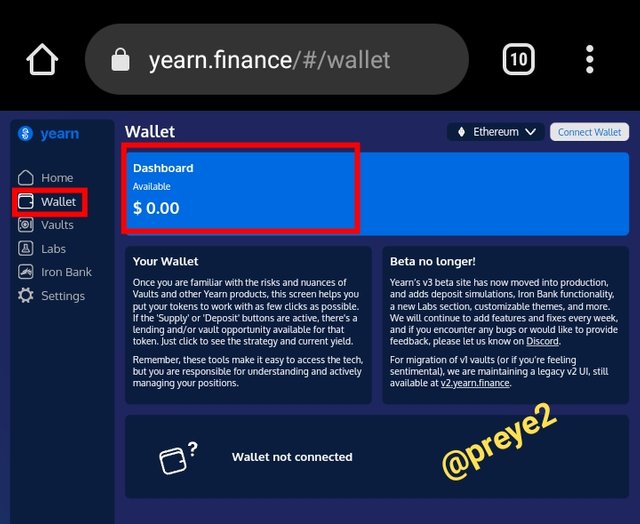

- Wallet Section: Is basically used for depositing and controlling of your funds which would be used for lending purposes. In other words this is basically your monetary section.

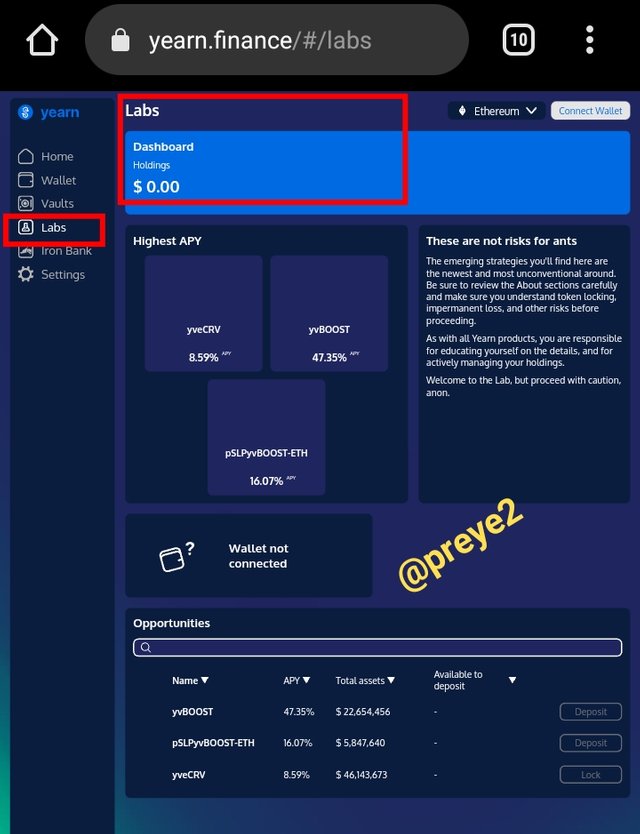

- Lab Section: This section helps users of the platform to know what is currently trending in the platform, because information is very important for the users.

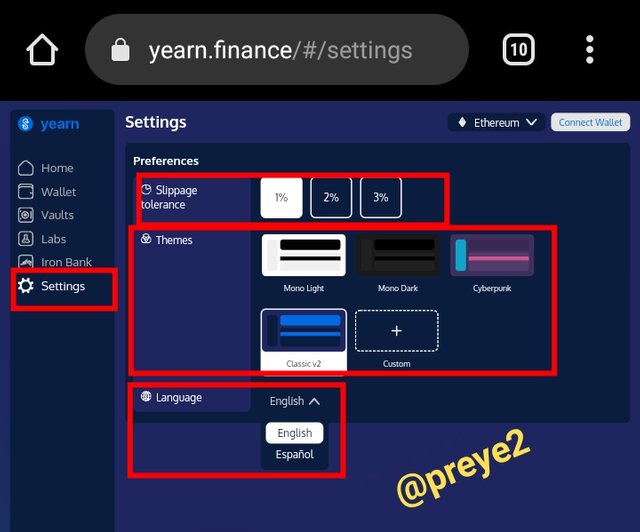

- The Setting Section: The setting section is used to set what ever you prefer in the platform like the language, color, percentage range of the slippage tolerance and so on...

How the connection of wallet is been done on the platform

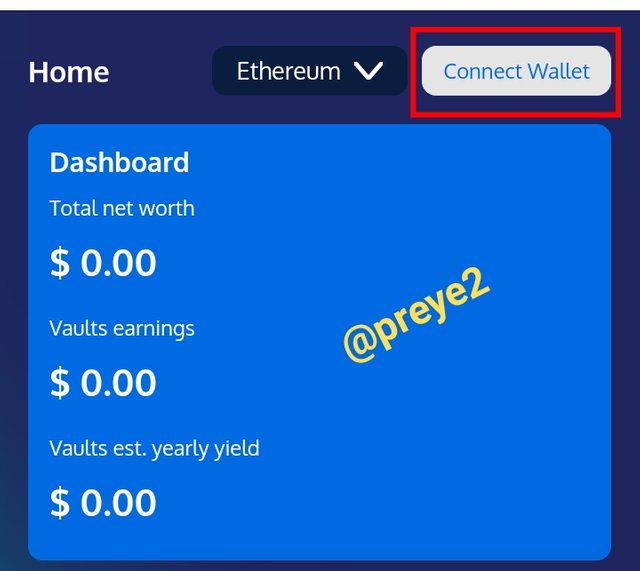

- As you can see on the top right hand side of the platform, they is a tab that states Connect Wallet, which I clicked on

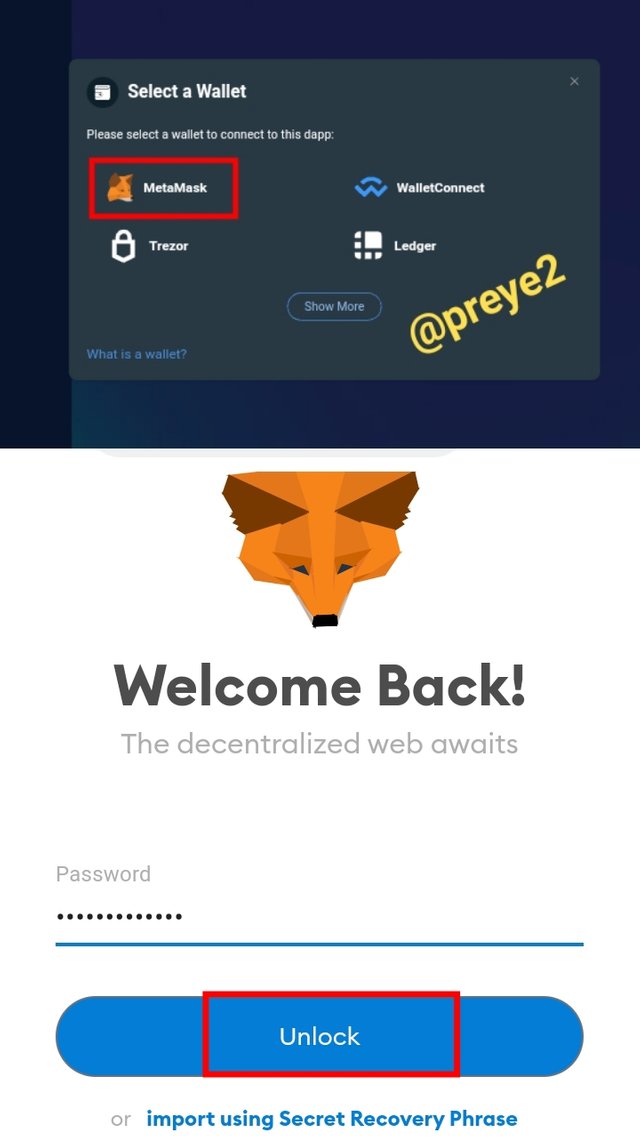

- I selected the dapp which I usually use for such connections (Metamask wallet), which I logged in to

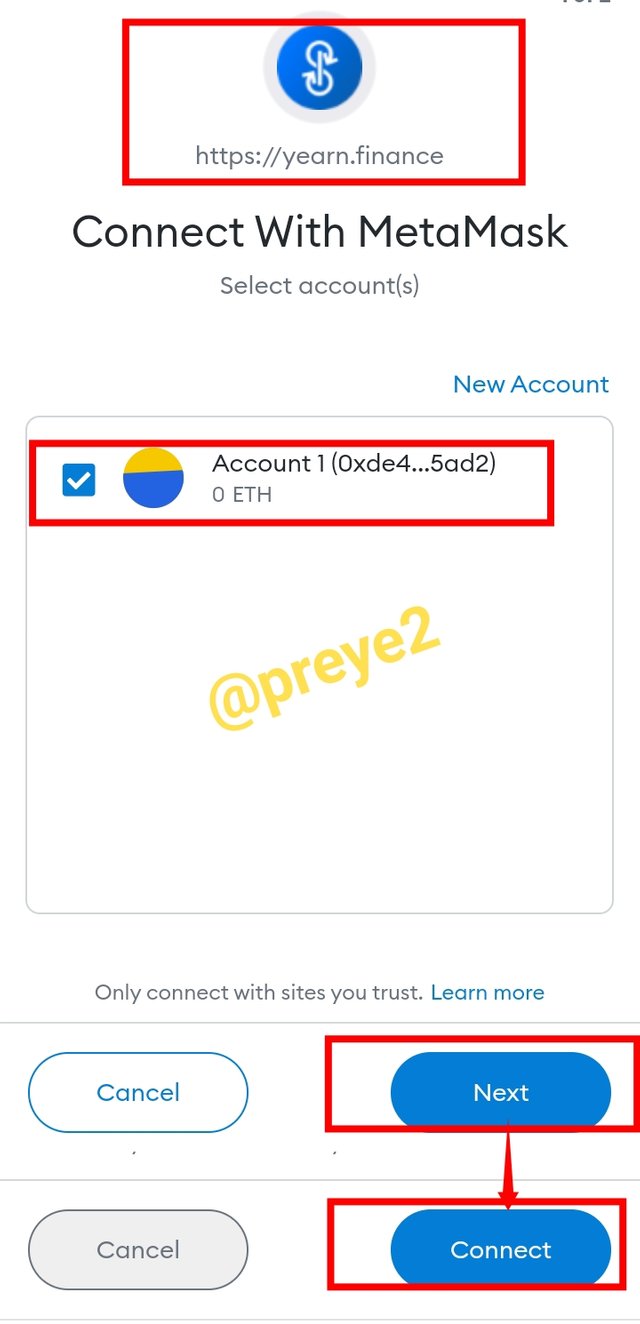

- I selected the account and clicked on Next and then Connect to site.

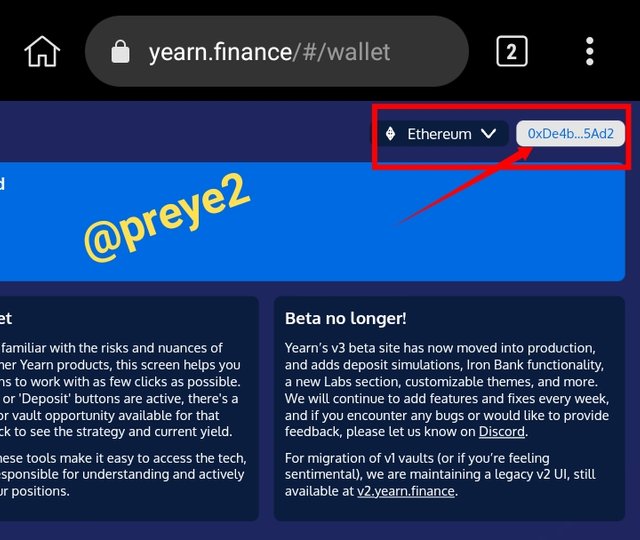

As you can see on the top right hand side of my account, my wallet is now successfully connected to the yearn.finance platform.

How to perform transfers and deposit on the platform

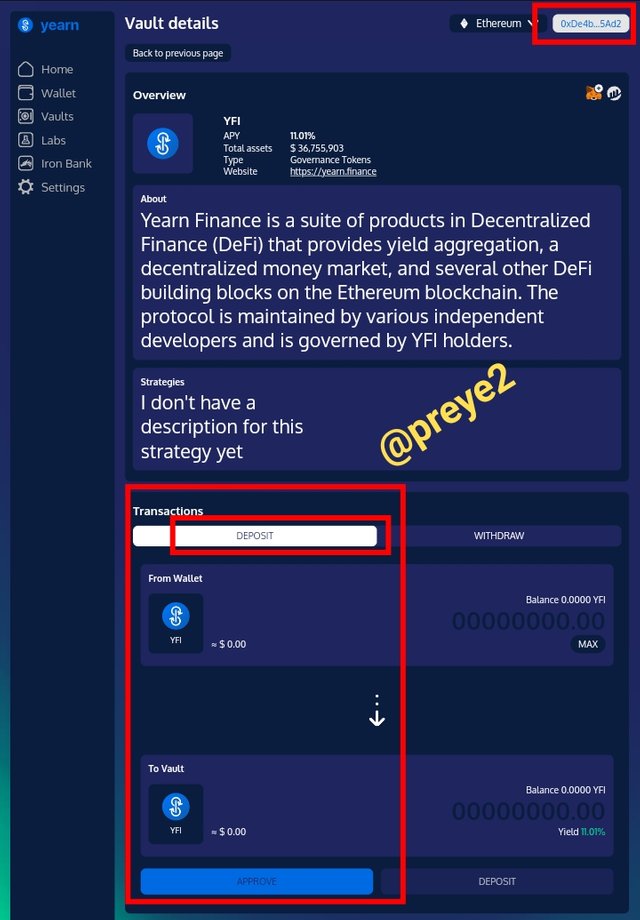

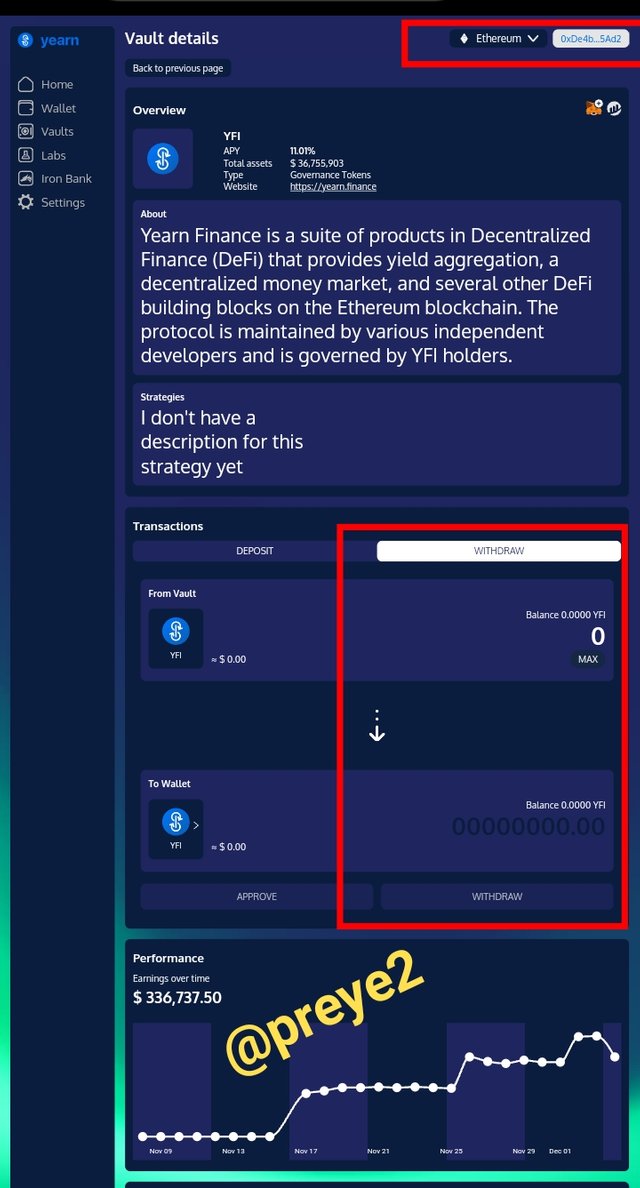

To perform either withdraw or deposit on this platform, the user will first have to go to the vault section and click on the token he wants to perform the transaction on. For this case I selected the Yearn token (YFI).

Deposit Section: on clicking the Yearn token (YFI), I got to the transaction phase. On the left was the deposit section which will allow me to insert and deposit my desired amount of token.

Withdraw Section: On the right hand side was the transfer section which will allow me to insert and transfer my desired amount of token out.

Other Available options Includings:

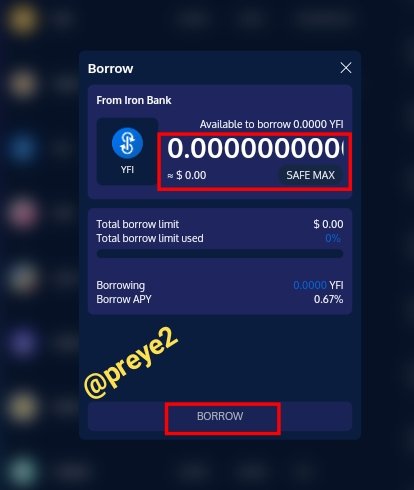

- Supply and Borrow: This can be located in the Iron Bank section of the platform, and using the Yearn Token (YFI) as a case study, I clicked on it.

- If I click on Supply, I would insert my desired amount of token to supply and click on Approve then Supply.

- If I click on Borrow, I would insert the maximum amount of token to borrow and then click on the Borrow button.

What is collateralization in Yield Farming? What is function?

Collateralization: In respect to yield farming, collateralization can be regarded as a situation or setting where the token of the borrowing user is laid aside for security purposes to the lender. This is what the lender will get if the borrowing user refuse to pay back the loan given to him or her, or if something else comes up that would warrant user to delay in the payment. The ratio rate varies between platforms, and the collateral ought to be as huge as possible.

The function of collateralization in yield farming:

The reason for the implementation of a collateral is to control the rate of non-refunding, because some users tend to borrow token but fail to pay back the loan. So with the collateral being a laid aside token of the borrowing user, the lender can easily get back his token.

In most cases, the collateral set by the lender must meet a certain level or amount, so that if the borrowing user refuse to pay the lose will not be huge.

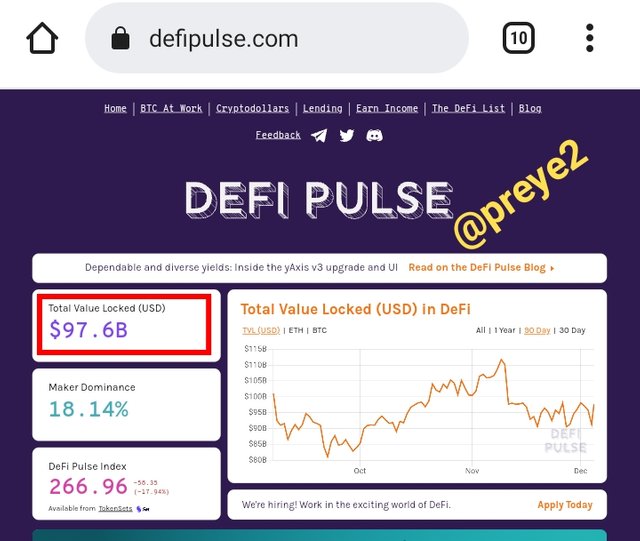

At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

As of the time of writing this article, the Total Value Locked (TVL) of the DeFi ecosystem in USD is $97.6 Billion

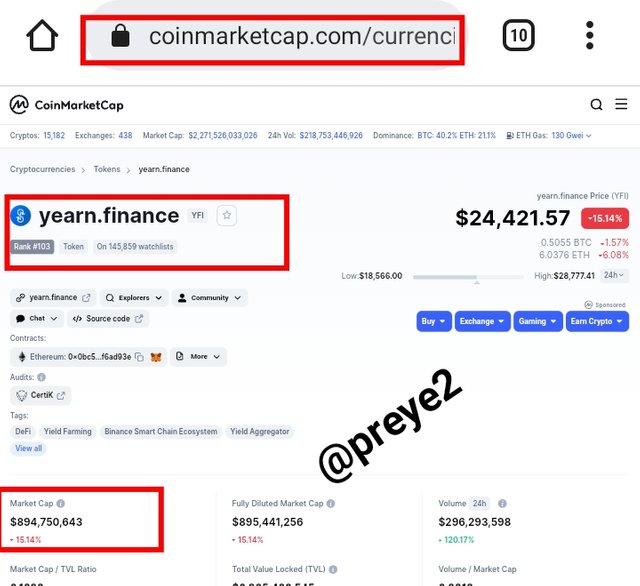

As of the time of writing this article, the Total Value Locked (TVL) of the Yearn Finance Protocol in USD is $3.93 Billion

Below is Market Cap ÷ TVL ratio of the YFI token

$892,501,505 ÷ $3,930,000,000 = 0.227099619592875

The YFI token, is it overvalued or undervalued? State the reasons

Before I proceed to answer this question, I would like to tell us what it means for a token to be overvalued or undervalued.

Overvalued DeFi Token: This refers to a

situation where a token's Market Cap ÷ it's TVL is greater than > 0.99 ≈ 1.Undervalued DeFi Token: This refers to a situation where a token's Market Cap ÷ it's TVL is less than > 0.99 ≈ 1.

So with the explanation above, it is clear that the YFI token is currently Undervalued because it's Market Cap ÷ TVL ratio is at 0.227099619592875 ≈ 0.22.

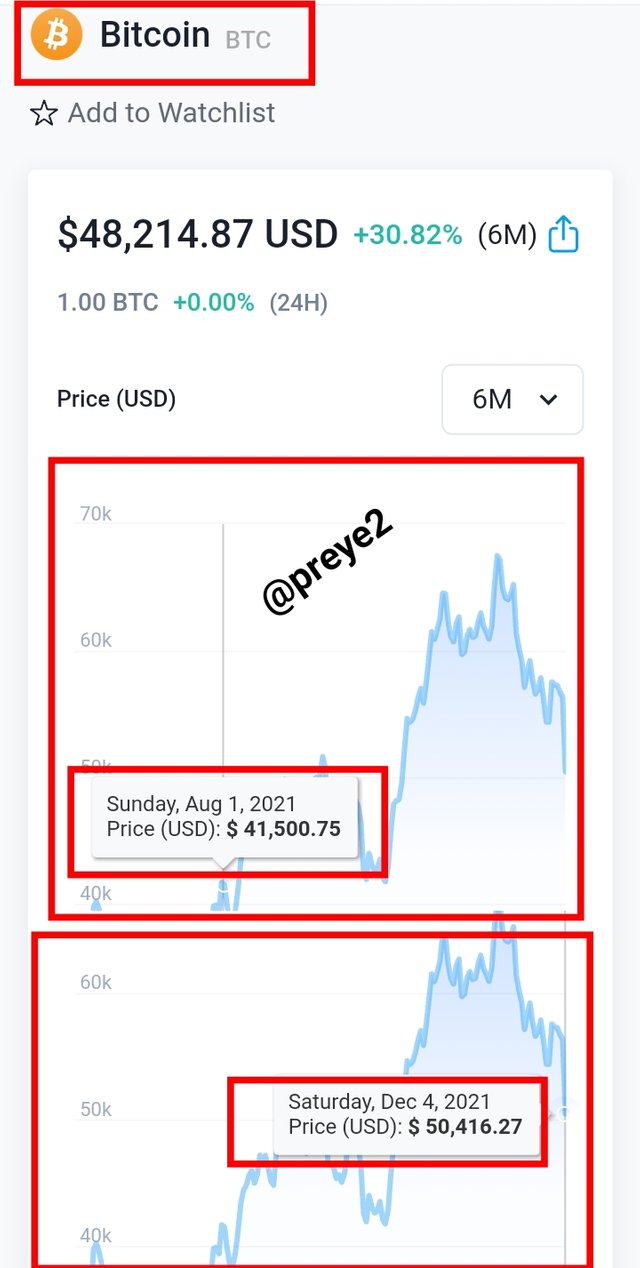

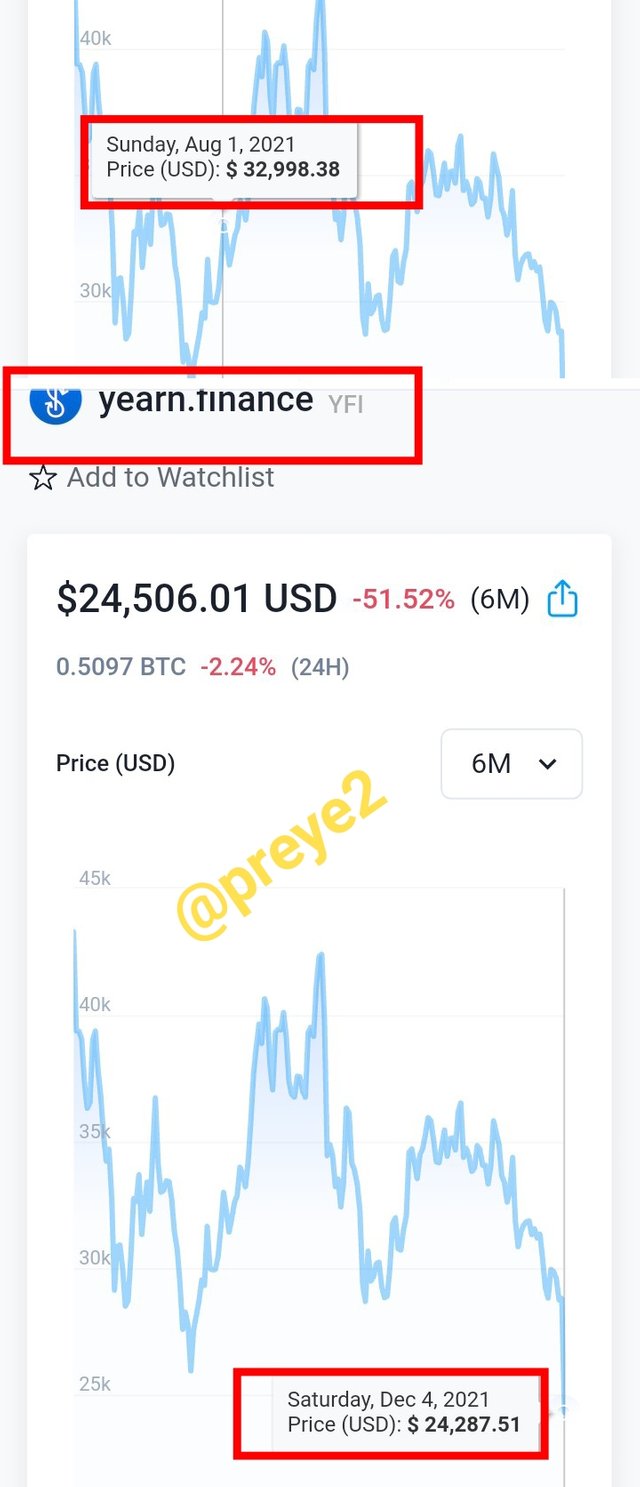

If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

So let's do the calculation. According to crypto.com, the price of Bitcoin as of the 1st day of August 2021 was around $41,500, and as of today being the 4th day of December 2021, the current price of Bitcoin is around $50,416. That's a 21.48% increase in price.

Yearn on the other hand, according to crypto.com was around $32,998 in price as of the 1st day of August 2021, and as of today being the 4th day of December 2021, the current price of Yearn is around $24,287. That's a -26.39% decrease in price.

Now the calculation using the below formula

Total Yield of BTC($500) + (Asset Purchased × increase in %)

= $500 + (500 × 21.48 ÷ 100)

= $500 + (107.4)

= $500 + 107.4

= $607.4

Using the same formula for the Yearn token

= $500 + (500 × -26.39 ÷ 100)

= $500 + (-131.95)

= $500 - 131.95

= $368.05

The total yield as of now for both Bitcoin and YFI token is $975 ($607.4 + $368.05)

The return of the investment for now is - $24 ($975 - $1000).

In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer

In most cases, DeFi platforms are built using smart contracts, which makes it very difficult for assets to get lost because your permission is necessary for every transaction. But in cases where the security of the smart contract is not very safe, a yield farmer stand the risk of losing his holdings. Let me explain it clearer.

The security coding behind some smart contracts might be weak or irresistible to attack due to poor coding, so anyone with a very good knowledge in that field can attack the smart contract.

If a borrowing platform or protocol using a smart contract with weak security coding partake in yield farming, then they would be risk of hackers breaking into the platform and lending money without repaying.

Farming is really very important to the crypto space as it gives investors and crypto holders the opportunity to make passive incomes with just little efforts. So far, alot of money have been gotten by investors who just basically lend their token for interest purposes.

There's no doubt that I have learnt so much from your task Professor @imagen, and I am happy that you brought up this interesting topic to us this week.