Hello Steemians,

Definition of Arbitrage Trading

Arbitrage simply refers to the process or idea of buying and selling financial instruments at exactly the same value but different prices.

In other words, it means taking advantage of price differences on the same thing to make profits with less risks.

For instance, In one part of a town, there's an orange🍊 market, where one orange is sold for $1, and in another town(let's say your town), there's equally a fruit market where one orange is sold for $1.5. Ideally, you would want to sell oranges in a more expensive market where you can get $1.5 per orange, and you would want to buy oranges in a less expensive market where you can get them for $1 per orange. And to accomplish this, you would have to go to the market in the first town and buy oranges (let's say 10 oranges for $10), and then come back to your town and sell them for $15, whereby making a profit of $5 with less risks, that's the idea.

So Arbitrage in Trading refers to the practice of quickly buying and selling foreign currencies in different markets for profit purposes.

There are lots of exchanges in the crypto market, and these exchanges equally have lots of different pairs and assets. In most cases, the prices of assets and pairs differs between exchanges because some exchanges have lower liquidity than others and as such they follow the prices of bigger exchanges. Arbitrage helps traders to buy cryptocurrencies from one exchange and selling it on another immediately.

The different types of Arbitrage includes:

Simple Arbitrage: This simply refers to the buying of assets from one exchange, and selling it on another exchange within a short period of time. It's all about buying a coin on the ask and selling it at the bid on two different exchanges, with the gap being your profit.

Another approach to this type of Arbitrage is that a trader can have currencies on both exchanges, and trade them according to the situation at that point in time. This approach is very important and better because no transaction will be made at the time of the operation, which could have caused any form of delay.

Put Call Parity Arbitrage: It can be referred to as a mistake in the market, where the future value of an asset ends up being more than what it's priced at today, which gives the trader the opportunity to lock-in on a profit.

For Instance, I own a house in a volatile market that you are interested in, but both of us have little or no idea on how the price is going to change (either up or down) in the nearest future, and you seriously need the house, so you come to me and propose that you are interested in my house and if I would be willing to lock-in on a price which would be paid in the future. And we agree to a price which gives you the right to buy my house at a certain price, and at a certain date in the future. The Arbitrage opportunity occurs when the price keeps increasing after the expiry date of the contract we had, and you end up making profits.

Risk Arbitrage: This refers to buying the stock of a company after a merge or acquisition deal is announced, and when the deal goes through you would sell it and make profit from the gap covered between the price of the former company and the new(acquired) company.

For Instance, they are two companies on the market company 1 (bigger) and company 2 (smaller), then suddenly a news comes out that company 1 will be acquiring company 2 very soon. The value of company 2 will increase as a result of the acquisition, and a trader can take the risk of buying the stocks of company 2. And if the information was wrong, it will lead to losses, which is the risk. However, if the information was correct, your investment will result to profits.

Explanation of the Triangular Arbitrage Strategy

Triangular Arbitrage got it's name from it's concept, which is a triangle between 3 different pairs, and 2 out of the 3 pairs must contain a common coin.

Triangular Arbitrage: Refers to buying a coin, after-which you sell it for a different coin, and buy back the original coin all in one exchange, taking advantage of price differences in the order book. It's usually done on one exchange. Below is an illustration of the triangular arbitrage strategy.

As you can see on the screenshot above, I used 3 different pairs which includes:

- USD/UNI

- UNI/ETH

- USD/ETH.

First let's check out the prices for example. - USD/UNI is going to cost $20 per UNI.

- UNI/ETH is going to cost 90 UNI per Eth

- USD/ETH is going to cost $2000 per Eth.

And I started with $1000, and it got me 50 Uniswap token (1000/20 = 50).

And after that, I traded my 50 Uniswap token for ETH at the rate of 90 UNI per Eth, and I got 0.5555 Eth (50/90 =0.555).

And finally, I sold that my available 0.5555 Eth for USD at the rate of $2000 per Eth, and I got $1,111 (0.5555×2000).

Profit Declaration: I started with $1000, and at the end of the Triangular Arbitrage strategy I got $1111.

$1111 - $1000 = $111 is my profit.

Making A Real Purchase of A Coin (TRX) From A Verified Exchange Account, And Selling It At Another Exchange For A Higher Price

The concept and idea of this strategy is to buy it where the price is a bit lower and sell it where the price is higher. Am about to perform this task using my Tron coins, but I need to know how the prices varies in the different exchanges.

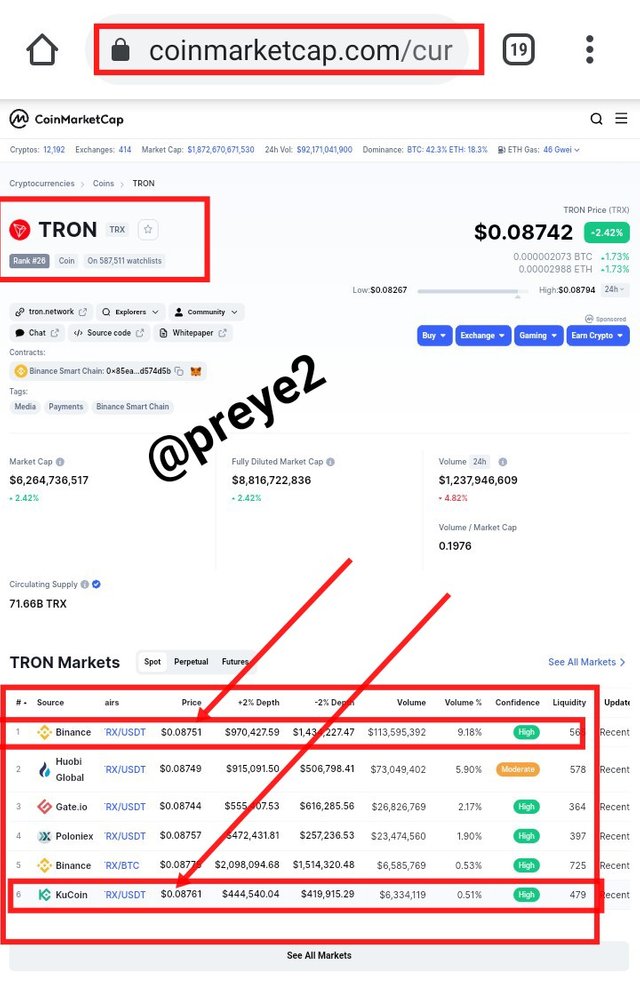

- So I searched the Top 6 Tron Exchanges on Coin Market Cap

- And after checking out the various prices, I decided to work with the first and last exchanges (Binance and KuCoin), because the price in Binance is $0.08751, while KuCoin is 0.08761.

The price on Binance is lower, while that of KuCoin is slightly higher. So I will make a purchase of TRX from Binance, and sell it on KuCoin.

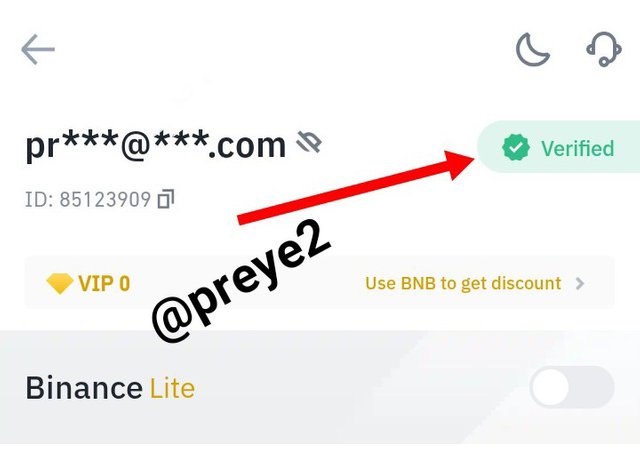

- I logged in to my verify Binance exchange account

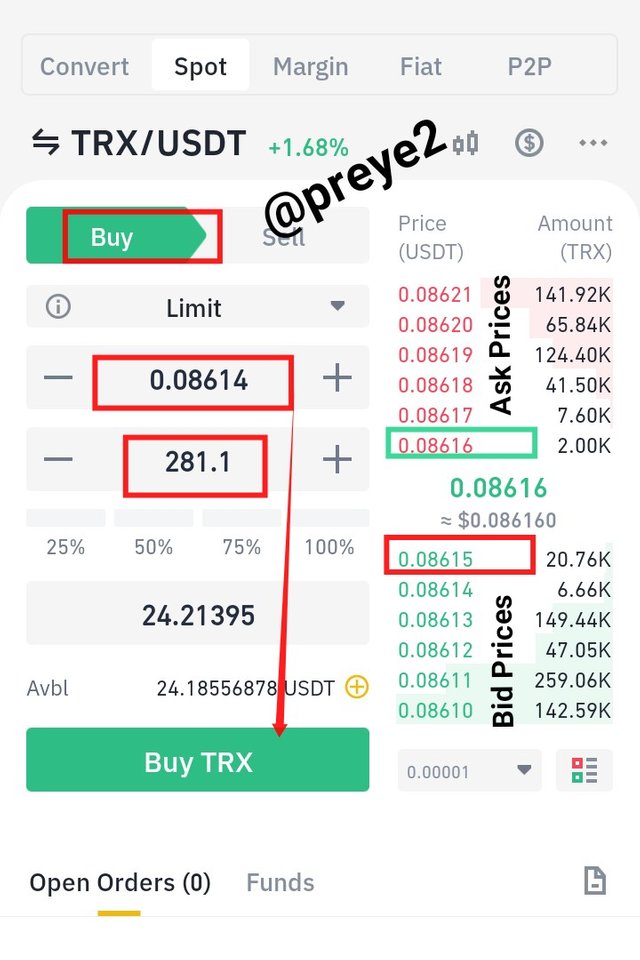

TRX was trading between $0.08616 (Ask Price) and $0.08615 (Bid Price), so I inserted the maximum amount of USDT I have and placed my Buy order at $0.08614.

And I proceeded to buy TRX with my available USDT. So I used 24.21395 USDT to buy 281.1 TRX, at the bid price of 0.08614.

The whole of my available TRX is 281.665989, and it's worth $24.07.

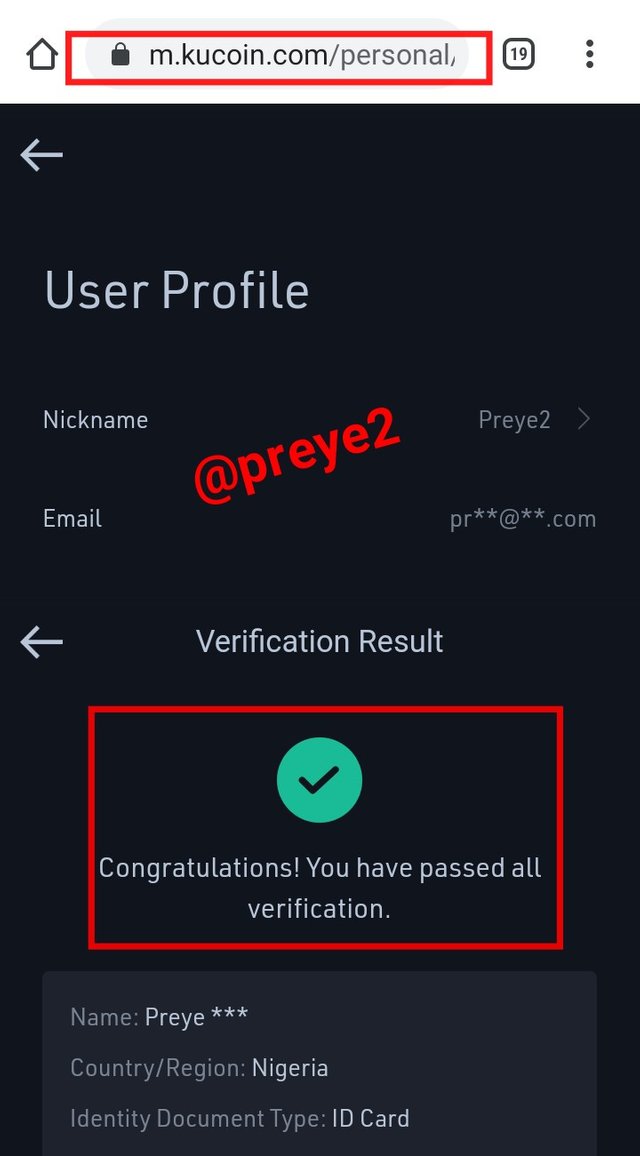

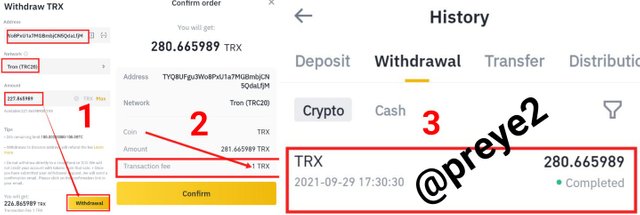

I went to KuCoin website, where I created and verified my KuCoin Account. After filling the KYC requirements, my account was verified.

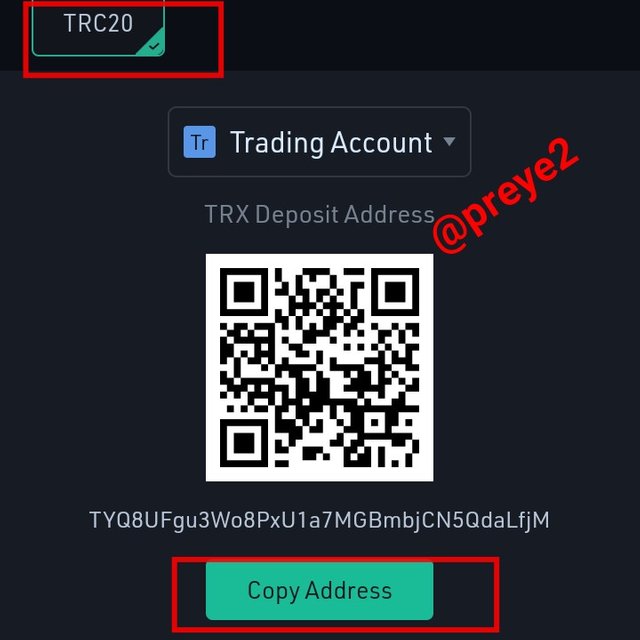

To deposit the TRX to my KuCoin wallet, I copied the TRC20 wallet address, and proceeded to Binance.

On Binance, I clicked on Withdraw, and inserted the wallet address, as well as the amount of TRX(281.665989).

As you can see in the screenshot, 1 TRX was charged as transaction fee.

And the transaction was completed.

On KuCoin, TRX is currently trading between $0.088596 (Ask Price) and $0.088565 (Bid Price), so I inserted the maximum amount of TRX I have and placed my sell order at $0.088597.

- On KuCoin, my USDT is now 24.94 and it worths $24.94.

My Profit after performing this arbitrage strategy:

I bought TRX for a Bid price of $0.08614 on Binance exchange, and Sold it at an Ask Price of $0.088597 on KuCoin exchange.

$0.088597 - $0.08614 = $0.002457

- 0.002457 × 81 = $0.199017.

Performing Cryptocurrency Triangular Arbitrage Strategy on My Verified Binance Exchange Account

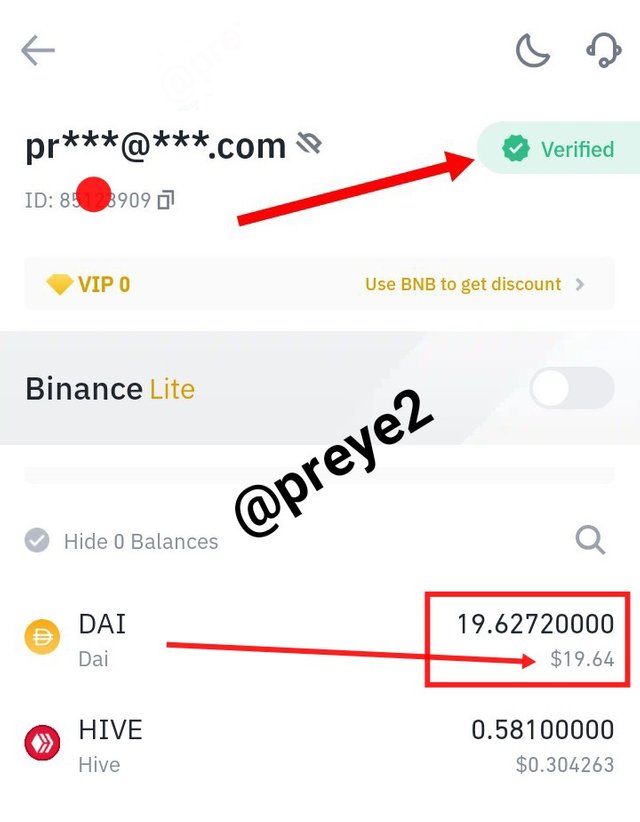

- First things first, I logged in to my verified Binance exchange account and invested 19.6272 DAI coins which was worth $19.64.

Like I said earlier, before performing a Triangular Arbitrage, you should consider the percentage differences, depth and volatility of the various coins you are about to interchange.

I proceed by buying BTC from my DAI coins. I inserted the amount of DAI coin to be bought, which was executed at the latest Bid price(41532.98). And as you can see on the screenshot below, the DAI coin got me 0.00047 BTC.

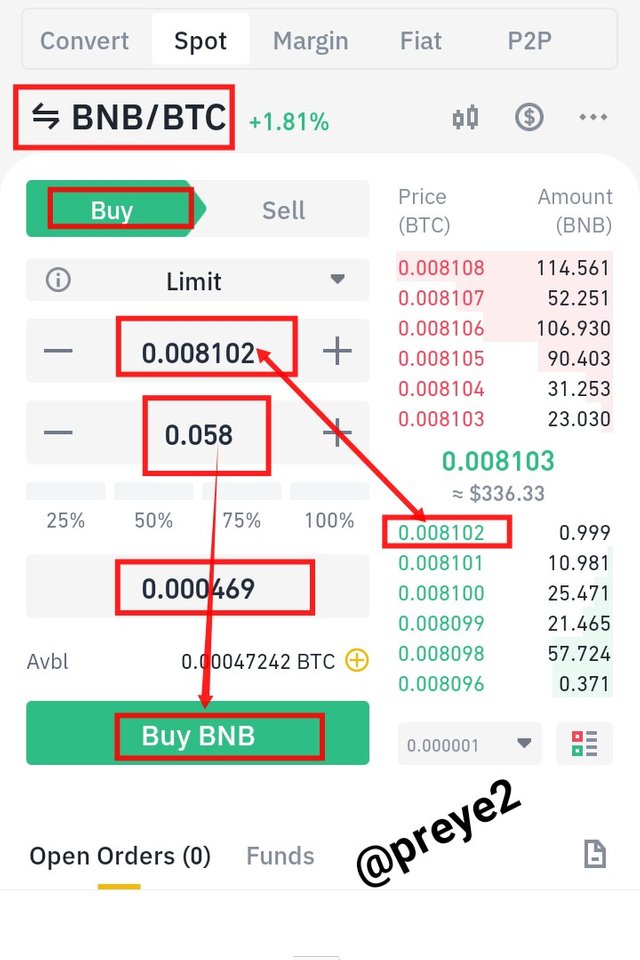

After that, I proceeded to buy BNB coins from my available BTC. I inserted my available BTC(0.000469), and I executed it at the latest Bid price(0.008102). As you can see on the screenshot below, the BTC got me 0.058 BNB, and this is where the main profits are generated.

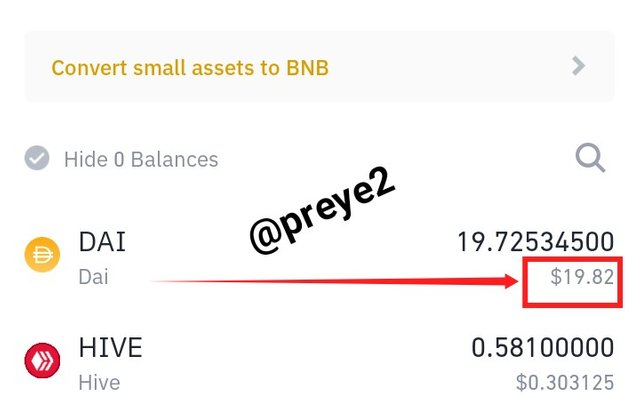

And as you can see on the screenshot below, I am currently making profit, because the worth of my coin has increased to $19.81.

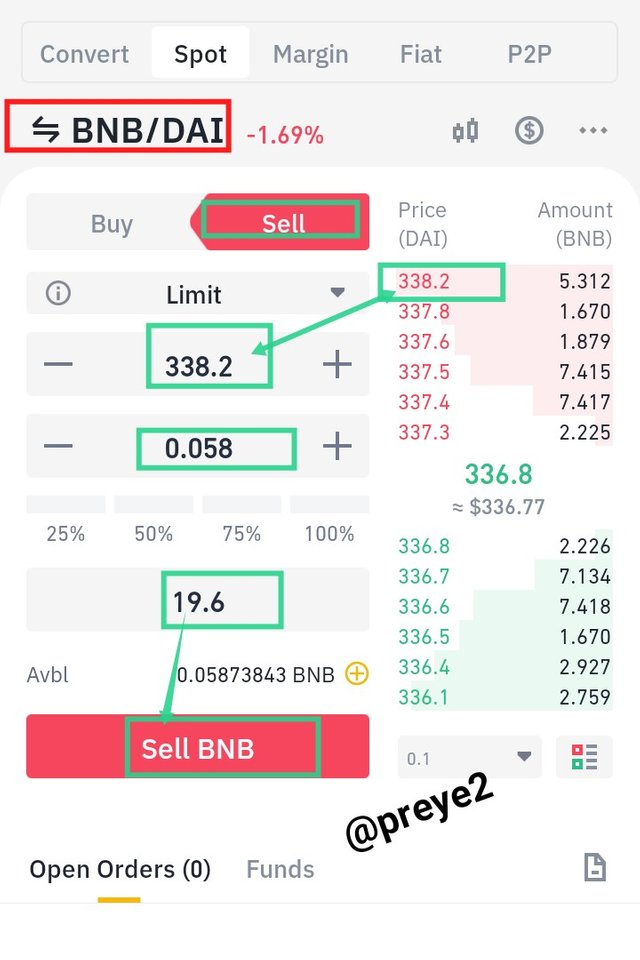

- And finally, I want to get back my DAI coins, from the available BNB coin I have, so that I can detect how much profit I have. So I inserted my available BNB coins(0.058), and I executed it at the first Ask price(338.3). As you can see on the screenshot below, the BNB coins got me 19.6 DAI.

Explanation of how I got my profit after performing the triangular arbitrage strategy, on my DAI coin

For the performance of this task, I used three(3) different pairs, which includes:

- DAI/BTC

- BNB/BTC

- DAI/BNB

I took into consideration the percentage differences, as well as the volatility of the various pairs. And I started the triangular arbitrage strategy with 19.6272 DAI which was worth $19.64, and after the strategy, I realized 19.725345 DAI which was worth $19.82.

$19.82 - $19.64 = $0.18. So after the strategy, I made a profit of $0.18.

Advantage of the Triangular Arbitrage method

It helps traders take advantage of the slight differences in the market to generate Profits.

Generally, the risks associated with the Triangular Arbitrage is low.

In most cases, it takes only a few minutes to generate Profits from a well organized Triangular Arbitrage method.

Disadvantages of the Triangular Arbitrage method

- The triangular arbitrage is a bit harder to find these days, because they are lots of robots constantly looking for these kind of opportunities and using them.

- In some cases, exchanges with this type of Arbitrage opportunity might not be accessible to some traders depending on their country of residence.

- In some cases, if a trader is not fast enough he might loss some of his coins.

Conclusion

To be sincere, this task require some sort of experience and knowledge, because I did the 5th task twice using different coins but I failed to consider the percentage differences, depth, speed and volatility, so I was having some losses. But when I realized my mistakes, I took the percentage differences, depth and volatility into consideration and I got the profit I deserved.

In general, this topic was really educative and I thank Prof. @reddileep for bringing this lecture to us this week.

Note: All screenshots were taken by me on my Binance and KuCoin exchange accounts.

.png)