In 2017, cryptocurrencies took the world by storm. The price of Bitcoin skyrocketed to almost $ 20,000. The average ICO scored more than 10 times. ICO funding outperformed traditional venture capital funding. Blockchain technology emerged as the new buzzword of choice for executives. Is this all an exaggeration?

We maintain that this is only the beginning. In fact, both Ray and I left our jobs at renowned technology research firm, Gartner, to join the blockchain movement. This is how we believe blockchain technology will shape the world by 2030.

Prediction # 1: government crypto

By 2030, most governments around the world will create or adopt some form of virtual currency.

The government currency of the future is inevitably crypto. Compared to the traditional fiat alternative, cryptocurrency is more efficient, provides reduced settlement times, and offers greater traceability. Cryptocurrency can also be backed by real assets, similar to fiat currency, and its price can be artificially manipulated by numerous controls (eg monetary policy to "print" more tokens).

In the short term, the government-based cryptocurrency will become an area of experimentation and exploration, led mainly by developing nations with unstable economies and weak institutions. Many of these efforts will be carried out in a hasty manner, with a schedule driven by political concerns rather than economic woes or technical progress. Take the Zimbabwe dollar, for example, which has suffered a staggering 500,000,000,000% inflation. Many Zimbabweans have already turned to Bitcoin as a hedge against their national currency, increasing the price of Bitcoin in the local crypto market. The creation of a new cryptocurrency presents a viable solution for the Zimbabwean government to alleviate the sad perception of its country's monetary challenges. In the short term, such efforts could be very successful. Considering that Venezuela's newly minted "petro" cryptocurrency raised over $ 5 billion during the pre-sale event, many other countries will follow suit. However, many of these initial projects will inevitably fail due to the early stage of the technology that has not yet matured and due to a lack of internal knowledge on the part of the respective government in charge.

In many of these cases, such experiments will not be intentional. In other words, governments moving forward with a crypto project may not realize that they are test subjects in their own experiments. Due to the lack of necessary internal expertise, these governments will turn to external consultancies, some of which are newly created and with limited resources. As a result, many governments will end up falling victim to hackers, due to improper or incompletely implemented practices regarding private key management and related processes. This situation is similar to the early days of the Web, where major companies that were successful in commerce (but unfamiliar with e-commerce) made mistakes in initial implementations, resulting in loss of data and funds. .

However, successful cases will emerge in the long run. Next-generation blockchain technology will solve many current limitations such as scalability, privacy controls, toolset maturity, and interoperability. Stable price tokens regulated by monetary policy and backed by collateral will start to gain traction as they become more reliable as a medium of exchange and as a store of value. Governments that have not been able to create a successful cryptocurrency will turn to "stable coins" as their virtual currency of choice.

Sample companies trying to solve this problem today: Tether, BitShares, Maker, Basecoin, Carbon, Stably, Havven, Kowala, TrueUSD, Arccy, Sweetbridge, Augment, Fragments, Petro, and others.

Prediction # 2: Trillion Dollar Protocols

By 2030, there will be more trillion-dollar tokens than trillion-dollar companies.

There is a race between the four most valued companies in the world (according to the valuation of the stock market) as to which will be the first to reach the value of a trillion dollars. Apple, Amazon, Alphabet (Google), and Microsoft are in a race towards the "4 comma club".

All of these companies are representative of the new economy, one that perhaps should be called the economy that is no longer so new. This new economy is built on the decades-long transition to digital business and online connections. It's the internet economy or what blockchain advocates call "Web 2.0" (anticipating the next era, the blockchain era, like "Web 3.0").

The old economy (traditional, pre-Internet) is analog, physical, based on the extraction of oil and resources, on the manufacture of raw materials and the cultivation of food and supplies, and on the transport and sale of these through the traditional physical channels. . Obviously, the real world will not disappear. It is where we live, breathe, eat and roam. But its economic role has diminished in the grand scheme of things.

The new economy is a layer of value on the physical substrate. It has not yet fully spread to all corners of the world and the economic sphere. Its impact will continue to grow, hence the high and growing valuation on the stock markets. It is possible that after the first trillion-dollar company, others will cross that threshold as well, and there may be three or five.

But the next era is emerging, which may follow a different pattern than previous waves of economic transformation. What the old economy and the new economy have in common is that they are both based on the notion of the company. In business, there is a long-standing notion of the theory of the firm, articulated in 1937 by Ronald Coase. The theory of the company seeks to address questions such as: Why do companies exist? Why do they grow? How are they structured? What are the different functions of a company? And so.

In our opinion, looking at a company is similar to looking at a unicellular organism, observing its internal subsystems and the semi-permeable membrane that allows the flow of certain substances through that limit. Coase's theory is that companies exist because the cost of certain transactions or business processes within the membrane is much less than having to cross the border. Other transactions and processes must cross the border (to do business with other entities), but certain functions naturally gravitate within the walls of the organization or body.

Blockchain technology changes the nature of this equation. Dramatically reduces the costs of transactions and information flows. Where there were friction and impedance, these levels are lowered. Doing so erodes the traditional logic of a company, especially a trillion-dollar company. Large companies exist, in part, because there is a great schism between the processes that occur within the walls and those that cross outward. Blockchain technologies change the equation and favor frictionless flows of tokens and other digital assets.

What this means is that, in the future blockchain era, trillion-dollar companies will be replaced by trillion-dollar tokens, tokens that support a decentralized ecosystem of entities that together fulfill the role of the mega. corporation. We are at the dawn of that era, and there will be more trillion-dollar tokens in 10 years than there will be trillion dollar signatures.

Prediction # 3: Blockchain Identity for Everyone.

By 2030, a self-sovereign, blockchain-based, cross-border identity standard will emerge for individuals, as well as for ## physical and virtual assets.

If email turned out to be the "killer app" for the internet, identity solutions will prove to be the "killer app" for blockchain. Identity systems, as we know them today, are highly dysfunctional, silos, and insecure. Blockchain-based identity systems will solve these problems. These systems will provide a single source of verification for people's identities and assets.

Blockchain-based identity decentralizes data collection, verifies collected data through consensus mechanism, and stores this information in a decentralized immutable ledger. It enables you to reduce the risk of security breaches, significantly higher efficiencies, greater reliability, and most importantly, self-sovereignty.

According to various data sources, 1.5 billion people in the developing world lack proof of identity, including more than 65 million refugees. Blockchain-based autonomous identity platforms will provide the underserved population with the tools to obtain and maintain legal documentation. The new identity platform will be more secure and trustworthy as it will be stored on a distributed ledger rather than in the possession of a central authority. Blockchain-based identity platforms will also allow for self-sovereignty, which ultimately means individual privacy. The decision to disclose identity information will be under the control of each individual. With recent Facebook data breach scandals dominating the news, blockchain-based identity creates a viable and important solution to many data privacy problems.

Some use cases for the types of data stored on a blockchain-based identity platform include (but are not limited to):

Government records (for example, date of birth, etc.)

Reputation and trust scores (for example, credit history)

Certificates and attestations (for example, university diploma)

Medical and health records

Tax identification records

Employment records

While a clear end-to-end solution is unlikely to emerge as a clear winner by 2030, a high degree of interoperability between identity platforms will allow for ease of use and global cross-checking.

Additionally, a blockchain-based asset identity platform will collect, store and share data from physical and virtual assets. There are projected to be more than 20 billion IoT devices by 2020. From your smart refrigerator to an airplane engine, these “smart” chips are already ubiquitous. By their nature, IoT devices are continuously connected to the Internet. They collect, store and transport unique data sets. Blockchain will provide a safe, reliable, and efficient mechanism for these devices to transact with each other. Blockchain will keep an immutable record of all interactions and allow for instant payment settlements (for example, two IoT devices transferring assets to each other).

Virtual assets will also have a unique identity on a blockchain. An example of virtual assets would be crypto kittens, fictional cats that exist in a virtual game, and live on the Ethereum blockchain. With the power of blockchain, these virtual objects become tokenized assets that, like physical assets, will have their unique identity. Ultimately, blockchain will enable an automated operating system that seamlessly connects people with assets in both the physical and virtual worlds.

Sample companies currently resolving individual identity: uPort, BlockAuth, Civic, PeerMountain, IDRamp, Sovereign, Sovrin, LifeID, TrustedKey, Ping Identity, SelfKey, TheKey, NuID, ValidatedID, 2way.io, Microsoft, CryptID, ExistenceID, IBM, Blockstack, BlockCerts, Lumeno.us, etc.

Sample companies solving the identity of physical and virtual assets today: WAX, Verses, BlockV, Xage, Guardtime, Filament, Chronicled, Blocksafe, DMarket, etc.

##Prediction n. 4: world trade on a blockchain

By 2030, most of the world's trade will take place leveraging blockchain technology.

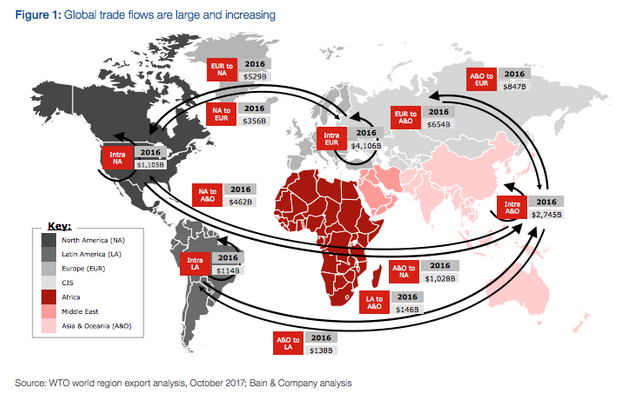

One of the most promising areas where blockchain can provide significant business value is the global supply chain. In its current state, world trade is conducted through a chaotic and fragmented set of business relationships between untrusted parties. This results in inefficiencies, errors, and fraud. This is a set of real-world business problems that are currently unsolved and cannot be fully resolved without using blockchain technology.

Some examples of real-world supply chain problems that need to be solved are:

Counterfeit drugs in the pharmaceutical industry

China's food supply chain (the tragic case of adulterated infant formula)

Fake Louis Vuitton bags and other Asian fashions

Counterfeit Auto Parts in North America

Counterfeit or gray market electronic equipment, including medical devices (the World Health Organization (WHO) estimates that 8% are fake)

Enterprise IT equipment: A major manufacturer of enterprise networking equipment estimates that 10% of the products in its multi-billion-dollar supply chain are gray market

Obviously, problems in global supply chains are significant and, in some cases, life-threatening. According to the WHO, tens of thousands of people die each year from counterfeit drugs. The solution to these problems is difficult because business ecosystems are fragmented, isolated, only partially automated, and lack a trusted central authority with jurisdiction, resources, and credibility to trace provenance and certify authenticity.

Unlike the banking industry example, where there is an existing system (SWIFT) that works correctly and reliably, in the supply chain examples, there is no proven working system. There is no order, only chaos. Therefore, disruption is not an option, because disruption involves disintermediating or dismantling an existing system.

What is required is "anti-disruption," that is, bringing order out of chaos by using blockchain technology as a unifying force: to unify disparate flows of payment, physical goods, and information. This will not be easy and complete solutions will take years to build. In effect, you are building an ERP system for a business ecosystem, which means it will take longer and more difficult than building an ERP system for a single business.

Also, as mentioned above, the technology does not yet have the functional scope, flexibility, performance, efficiency, and maturity. Once it matures, the problems in supply chains are real enough and significant enough that solutions are eventually built, and blockchain will play a critical role in these future solutions.

Sample companies: Skuchain, Provenance, Blockfreight, Blockverify, Caravaggio, Cargo Chain, Chain of Things, Consentino, Everledger, Filament, Fluent, Kioog, Kouvola Innovation, Mojix, Modum, Synechron, Tallysticks, Trade, Wave, Zero.

Prediction # 5: (Blockchain4Good)

By 2030, significant improvements in the world's standard of living will be attributable to the development of blockchain technology.

Poverty and the income gap are possibly the most difficult problems for humanity to tackle. More than 10% of the world's population, more than 750 million people, live on less than $ 2 a day. More than 2 billion people are considered to be unbanked and have no access to financial services. Although the general standard of living is increasing and world GDP is increasing, the rich are getting richer and the poor are getting poorer.

Blockchain technology has the potential to reduce the poverty gap. How? It can be achieved by increasing financial inclusion, reducing corruption, and allowing decentralized access to value-creating assets. Below are three examples.

Financial inclusion is the most obvious benefit of cryptocurrencies like Bitcoin. As is already evident today, Bitcoin and blockchain allow the unbanked population to be banked and therefore paid. You no longer need to depend on a centralized institution, such as the government or a bank, to give you permission to open a bank account. You can buy and sell Bitcoin on an open market (as long as you have access to a crypto exchange) with access to a smartphone. Cryptocurrencies are already accepted by various merchants around the world. By 2030, the cryptocurrency will serve as a de facto standard, similar to how the US dollar is widely accepted today.

Second, blockchain technology reduces corruption by creating transparency in official records. If you are a farmer in a rural area in Latin America or a homeowner in Russia, you will no longer be evicted from your land by corrupt official tampering with the land registry. All assets, including land, will be recorded in a transparent and unaltered distributed ledger open for the public to see.

Solving this problem alone will have huge financial implications for the world economy. According to a prominent economist, Hernando DeSoto, "dead capital" or, in other words, property or asset that is owned but not legally recognized, is estimated at $ 20 trillion. Uncertainty around asset ownership reduces asset prices and tradability potential. Therefore, by creating a transparent and tamper-proof asset and property tracking system, blockchain technology has the potential to increase global wealth.

Lastly, blockchain technology enables large-scale tokenization of value-generating assets that are only available to the wealthy at the moment. Consider buying The Plaza Hotel in New York City or expensive gold mining equipment that produces a steady, recurring income stream over several years. To buy such an asset today, one has to borrow large sums of money from a bank and take an initial risk in the purchase. Blockchain enables large-scale tokenization of assets. This means that even if you are a farmer in rural Africa, you can now become a part-owner of an income-generating asset, such as a gold mine.