1a)EXPLAIN LEADING AND LAGGING INDICATORS IN DETAIL. ALSO, GIVE EXAMPLES OF EACH OF THEM

Leading indicators simply put are indicators that give a signal before a trend or reversal actually occurs. They enable investors to get signals in time thereby entering the market early enough which minimizes the size of their stop loss. These indicators which are also called oscillators helps you the trader by predicting what prices will do next. Leading indicators typically work by measuring how a given asset has been overbought or oversold. Generally, trading works with the assumption that if a given asset is overbought then it certainly will bounce back to start selling and if it is oversold it will also bounce back to start buying. The Relative Strength Index, the stochastic, Awesome Oscillator, the Donchian channel and key levels of support and resistance.

are examples of leading indicators.

Lagging indicators on the other hand is simply the reverse. These are indicators that give the signal after the trend has started and this happens most at times some moments late that is a good number of candlesticks after the trend has started. Generally, they move behind the price and tend to be more suitable when used to analyze long term trades. They do not easily suffer fake-outs since they appear when the trend is already active and confirmed. Fake outs are situations where a trader after considering a technical indicator puts on a trading position expecting it to move in a direction and it fails to do so. And as earlier mentioned the disadvantage here is that you as a trader will be a little late in entering a trading position. Common examples of lagging indicators include Moving Averages, Moving average convergence divergence (MACD), Parabolic SARS, Bollinger Bands

b) WITH RELEVANT SCREENSHOTS FROM YOUR CHART, GIVE A TECHNICAL EXPLANATION OF THE MARKET REACTION ON ANY OF THE EXAMPLES GIVEN IN QUESTION 1A. DO THIS FOR BOTH LEADING AND LAGGING INDICATORS.

a. Leading indicator|| Example taken: Stochastic Oscillator.

Source

Let’s take a look at the screenshot above taken from Tradingview.com. This chart is for the SteemDollar/US dollar Currency Pair with the Stochastic Oscillator and from it, the following assumptions can be made

When the stochastic oscillator entered its over sold region we see that the next thing which happens to the chart is that there is a change in its trend. It now turns from a bearish trend to a Bullish trend and this is in accordance with what is generally assumed in the market (“trading works with the assumption that if a given asset is overbought then it certainly will bounce back to start selling and if it is oversold it will also bounce back to start buying.”) So, at the time the indicator shows us that the currency pair is over sold and the market is now ready for the bullish trend just exactly that happened. The trend changes to its bullish direction.

Now let us look at an exceptional case below here

When the indicator entered the over bought level genrally we assume that the trend is about taking the bearish direction. But this seems not to be the case here.

Source

From our picture above, we can clearly see that the stochastic was in its overbought region implying that the market was ready to be taken by the sellers but here the trend rather goes upward indicating a reversal in the indicator. And for this, I strongly suggest that the stochastic oscillator shouldn’t be used alone. I should be used alongside other indicators so that the trend is well predicated and confirmed before a trader goes in to open trading positions.

b. Lagging indicator|| Example Taken: Parabolic SAR.

Below is yet the same market (Steem Dollar/ US dollar) with our Parabolic Sar indicator on. Let us do some analysis on this indicator with respect to this chart.

Source

From our screenshot above, we are working specifically with the area highlighted in the standing rectangle. We see that the Parabolic SAR's dots started appearing under the candles after the market had already been rising for a while. This lagging indicator, starts at a late time after confirming the movement of the price. The trader might not have gained the first few pips, but he has a more confirmed trade to place. He will make enough profits if he starts with this Parabolic SAR after confirming the trade with other indicators.

It is very visible to see where prices fall and where it begins to rise again with the help of the Parabolic SAR indicator. Firstly, on the Bullish side, we see these blue dots appearing above the candle sticks telling the trader that it’s time to sell. Not long from that moment we see the trend changing and now the parabolic SAR dots begin to appear beneath the bullish candles telling the trader that the trend has changed again and it’s not time to buy.

It is recommended that traders should close trades at the appearance of the second dot when the trade being to go against them in the opposite direction. This indicator too is best when used alongside other indicators especially for long term trades.

QUESTION 2.a) WHAT ARE THE FACTORS TO CONSIDER WHEN USING AN INDICATOR?

We now want to look at some factors to consider when using an indicator or a group of indicators. They include you understanding your trading strategy, understanding confluences, understanding market trends, and understanding the type of indicators.

i. You must understand the type of market

It is very much important for every trader to have a clear understanding on what kind of market he is getting into. Primarily, there are two types of markets we have. That is the trending market and the ranging markets which requires different demands to better make profits from that market. Trending markets will always require the trader to select trend-based indicators that will help him analyze the market and help him know what the current market trend is and this in turn helps him to place the right orders. We also have Ranging markets which will demand that the treader uses momentum-based indicators that help indicate when a particular asset is overbought or oversold and when its reversal is expected.

ii. You should have an understanding of your trading strategy

Before a trader decides on the indicator to use for his trades, he must, first of all, know his trading strategy. Understanding your trading strategy helps you as a trader to choose and select that indicator that best suits your trading style and it even helps you configure the indicator in a manner that fits that strategy. Every Scalper for example can not get effective results if he or she gets to use the 50-period Moving Average. He/she will need to use a moving average with a short time span because he operates with short-term trades unlike a trader who rather engages himself with long-term trades then he will need moving averages with a longer time span. So before choosing any indicator, understand what strategy best suits you.

iii. You must have understood the indicator type.

Previously we discussed how technical indicators are divided into leading indicators and lagging indicators and it becomes very important for the trader to know and understand the indicator types before he rushes into a trade.

Leading indicators are indicators that give a signal before a trend or reversal actually occurs. And lagging indicators are those that give their signal after the trend has already started. So there must be that clear understanding of the indicator types for the trader to effectively get into trading.

iv. Finding Confluences

A confluence is a situation where a trader obtains the same signal information from different trading tools. A confluence indicates that the trader is safe and better secured to make the trade. For example, a trader can check at the overbought region in the Stochastic Oscillator and he also confirms the prediction of the fall in the price from the Parabolic SAR dots that may appear above the candles. This confluence indicates that the trader is safe to make the trade. For example, a trader can check at the overbought region in the Stochastic Oscillator and he also confirms the prediction of the fall in the price from the dots of the Parabolic SAR that may appear above the candles. This alone is a confluence that indicates that the trader is safe to enter the market.

b.) EXPLAIN CONFLUENCE IN CRYPTOCURRENCY TRADING. PICK A CRYPTOCURRENCY PAIR OF YOUR CHOICE AND ANALYZE THE CRYPTO PAIR USING A CONFLUENCE OF ANY TECHNICAL INDICATOR AND OTHER TECHNICAL ANALYSIS TOOLS. (SCREENSHOT OF YOUR CHART IS REQUIRED).

A confluence in crypto trading refers to a situation where a trader is able to get the same signal confirmation from the use of different trading tools. It also happens when an indicator comes in to confirm a signal from yet another indicator. Confluences come in to increase our chances of having more accurate signals and this happens when traders are able to use a technical indicator as well as another technical indicator to confirm the movement of price in a given market.

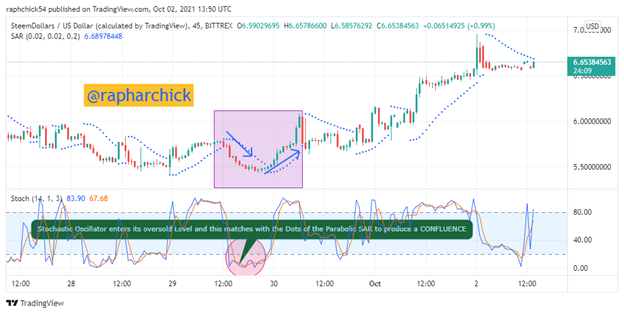

Let us consider the example below. Here, Our chat for SteemDollars/USD uses 2 indicators. The stochastic and the parabolic SAR. The stochastic helps us determine the oversold level in the market and the Parabolic SAR steps in to determine a good trade closing period. There is a confluence here as we see that once the Stochastic hits the over sold region, the Dots of the parabolic Sar begin to appear under the bullish candlesticks confirming a reversal in the market pattern this is called a confluence

Source

From my screenshot above using the steemDollars/USDollars as our currency pair, we have the stochastic Oscillator inserted alongside the Parabolic SAR. At the Encircled point on the stochastic oscillator, it is seen that the stochastic enters its over sold level and generally what is expected is the reversal. The dots of the Parabolic SAR begin to align underneath the candlesticks and from here it is certain that the pairs are about to go long. The best position for any trader to have entered is when the stochastic entered its oversold and then when2 dots appear, he could open more positions level. Here the profits should have been secured from the beginning of the trend.

3. a)EXPLAIN HOW YOU CAN FLTER FALSE SIGNALS FROM AN INDICATOR.

In order for us to easily filter out false signals we just have to make sure that the indicator signal in in a confluence with the price action of the asset. This implies that while the indicator signal is demonstrating an upward movement in the price action, the price action too should be in that same upward direction otherwise nit becomes a false signal and a fake out.

From our screenshot above we see that despite the fact that the Relative strength Index enter its oversold region (Which indicates the beginning of an upward trend), the price movement makes the opposite move as it still goes downwards. So here we can conclude that it was a false signal.

Nevertheless, we can determine how true a signal is if its corresponding price action moves according to the direction of the signal indicator. Let us consider this other chart below

Source

From the screenshot above, it is seen that after the stochastic goes to its oversold level (Meaning the trend is about to take a reversal towards the bullish direction), the corresponding price action experiences a reversal in its trend.

b) EXPLAIN YOUR UNDERSTANDING OF DIVERGENCES AND HOW THEY CAN HELP IN MAKING A GOOD TRADING DECISION.

Divergences refer to scenarios in a currency pair where the indicators signal is quite different from the price action of that said currency. A Divergence can be used to filter out false signals of the indicator and can also be used to predict reversals at a very early stage. A divergence could either be Bullish or A Bearish Divergence. By bullish divergence occurs when the indicator is signaling an uptrend by forming a lower high, Meanwhile, the price action is signaling a downtrend by the formation of a lower-low. By bearish divergence, we mean the indicator is producing a lower low formation and price is forming a higher high formation. This signifies a reversal in the price even though the price is presenting a bullish signal. Divergences can help a trader make a wonderful trading decision because it identifies and filters false signals and also it identifies price reversals at an early stage.

While some traders could see divergences as a fake signal indicator, another trader may see it as potential price reversals.

c) USING RELEVANT SCREENSHOTS AND AN INDICATOR OF YOUR CHOICE, EXPLAIN BULLISH AND BEARISH DIVERGENCES ON ANY CRYPTOCURRENCY PAIR.

In explaining the concept of Bullish and bearish divergences, I will be using the SBD/USD pair which we have used throughout this study.

1. Bearish Divergencies.

This is a scenario where the indicator is experiencing lower lows meanwhile price actions are in a higher high situation. The lower low pattern created by the indicator indicates a possible reverse in price

This implies that price will soon experience a fall and then the higher highs currently form by the price becomes a Diversion. See the screenshot below.

From our screenshot above, we can observe that the higher high formation created by the price action and the Lower low formation Produced by Our relative Strength index Indicator. Since the lower low formed by our RSI alongside the Higher High formed by the price action Means price will take a reversal and as can be seen on the chart the price of SBD/USD began to drop

1. Bullish divergence

A bullish Divergence refers to a scenario where by the price action is presenting lower low formations meanwhile the indicator (RSI) is showing Higher high formations. As soo as something as this happens a price reversal scenario is predicted after which an uptrend begins. A bullish divergence therefore indicates that the upward movement is imminent and will keep spiking upwards so buyers can get readey to take the market

From our screenshotted chart above we can see that after the lower low formation on the price action window and the higher high formation on our RSI indicator, The price of SBD/USD being to rise toward the upward trend. So, we see that the Bullish Divergence of the Higher high indicator to a lower low-price action served us as a trend determinant.

Special thanks to professor @reminiscence01 for the lecture its been wonderful and I learned so many new things. Waiting for the next episode

Hello @rapharchick, I’m glad you participated in the 4th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

This chart is incorrect for divergence.

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the lectures and the review Sir @reminiscence01. I will keep pushing myself to grow better. Thanks again

I don't know what it takes to get labeled but I noticed that I do not yet have a labeling in the #SteemitCryptoAcademy as a beginner

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Labelling is for fixed courses for user who have completed up to achievement 4 in the newcomers community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hAVE COMPLETED RIGHT UP TO ACHIEVEMENT 6

I am a pro- Newcomer in that community. HERE IS THE LINK to my compilation post which was already verified

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit