Greetings all.

Your lesson gave a very clear explanation about CFDs, and am so glad for the lesson. Thanks to that @kouba01

Question 1

What is contract for difference (CFD)

First of all I would like to define cryptocurrency.

Cryptocurrency is a digital currency which is used for trading.

When you decide to trade in CFD, you sign a contract with a broker.

Contract For Difference: is trading method that enables a person to trade and invest in an asset by engaging in a contract with a broker.

CFD is more or less a bet, in a sense that investor predict the price movement of the asset to the broker and if the prediction succeed, the broker pays the investor based on the agreed difference. On the other hand, if the prediction fails, the investor loss money.

CFD involves long position and short position.

Long Position: in this aspect, the trader expect the price of the asset to rise in future so that he can make profit out of it.

Short Position: in this aspect the trader sells the asset because he expects the price to decrease.

Advantages

You only need to deposit some small initial payment to start trading.

You can trade on huge range of financial markets.

Timing for selling and buying depends on you.

Question 2

How do I know if cryptocurrency CFDs are

suitable for my trading strategy.

Before entering into cryptocurrency CFD trading, one must have certain key strategy to enable them meet the requirement needed for the trade. These include:

The ability to deposit an initial payment to open position.This is because you need to posses certain amount of money in your account in order to maintain your position.

Good price forecasting ability which will enable you predict price of the asset in near future in other not to ran loss.

One who can afford to give up on the money he/ she invested, Incas there is loss.

Ability to take risk due to the fact that the price can fall to the extent of losing the amount you deposited. You don't expect profit always due to the market nature.

Question 3.

Are CFDs risky financial products?

My answer is yes. Because in CFDs trading, you only make profit if you have good forecasting ability. But then when your predictions fails you, you start losing. In this case, the more the market goes opposite side of your predictions, the more you continue to loss. You can continue losing until the money you invested got finished, which you would have to redeposite another money Incas you want to start trading again.

It really hurts Incas you can afford to lose money you deposited.

Question 4

Do all brokers offer cryptocurrency CFDs?

Due to the high level of risk, not all brokers offer CFD but most offer cryptocurrency CFD. There are so many options offered by the brokers among which the CFD gaining popularity with many brokers such as eToro, XBT, LMAX and many more.

Question 5.

Explain how you can trade with cryptocurrency CFD on one of the brokers (using demo account).

To trade with cryptocurrency CFD, you first of all have to create an account.

Steps involved

Step 1

• Visit http//www.etoro.com

• from the Pop up page Clic on join now.

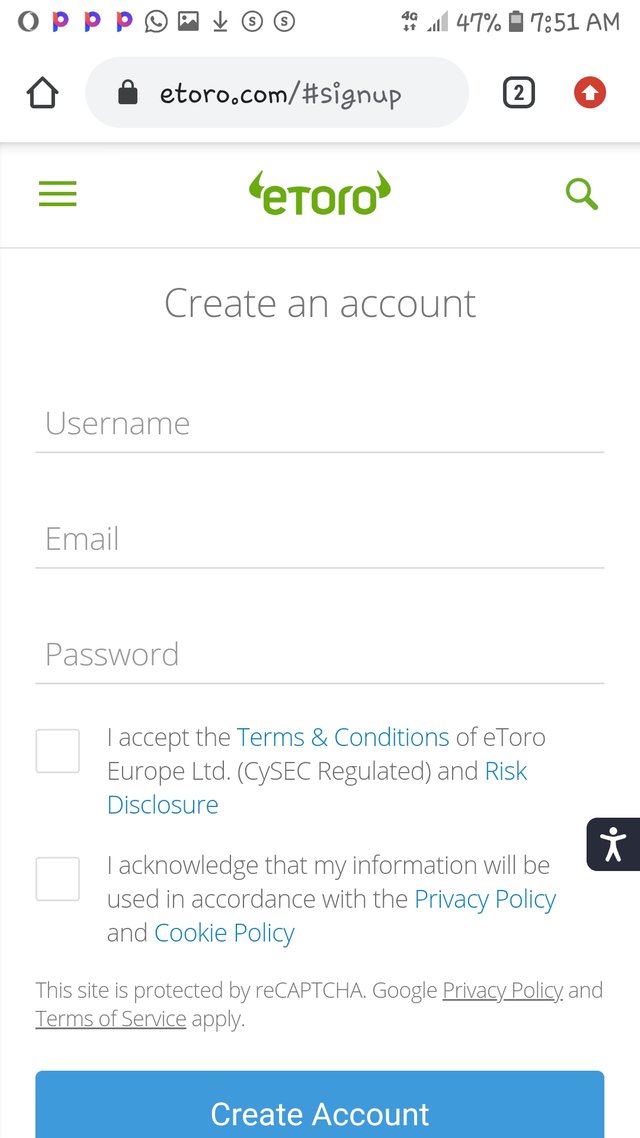

• fill in your username, password and email as required.

• Agree on the terms and conditions to enable you continue.

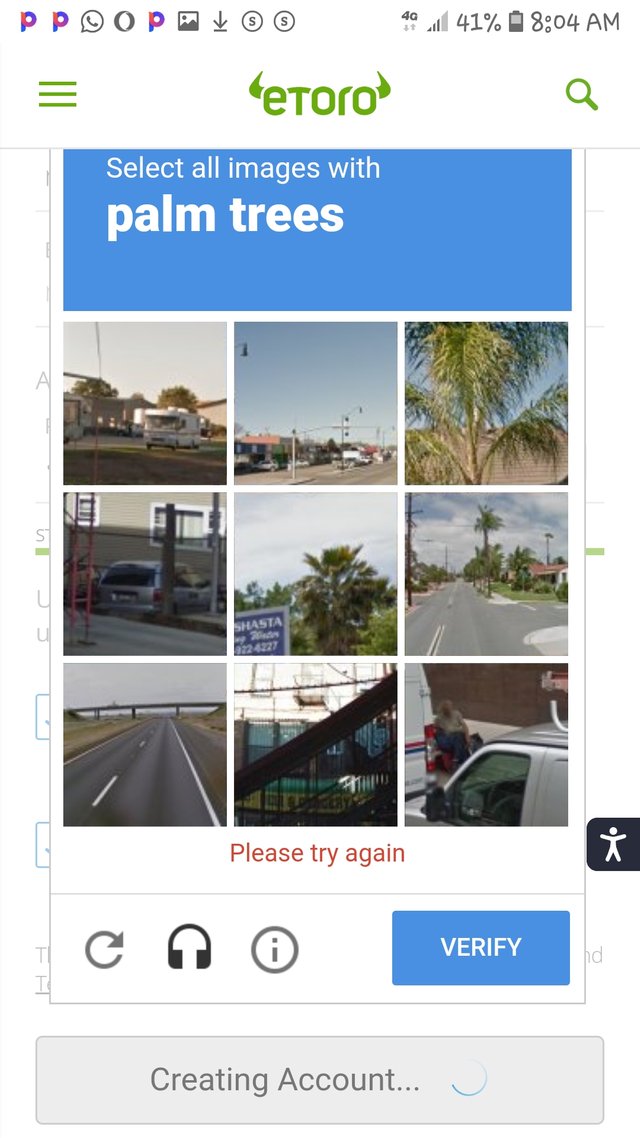

• click on create account and carefully follow the instructions in order to verify your account.

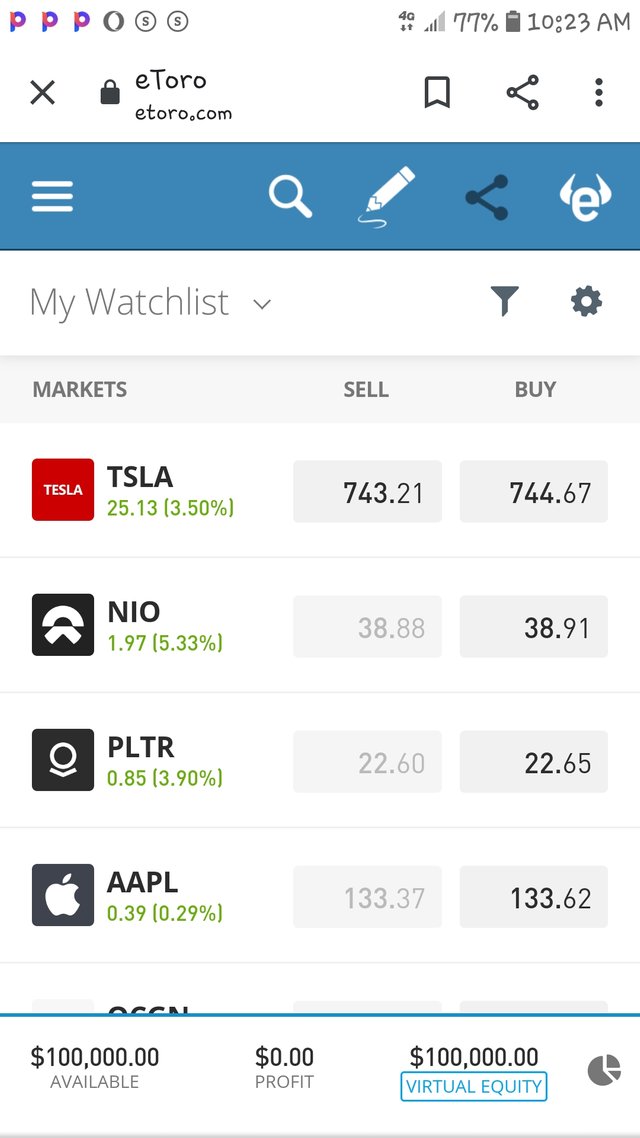

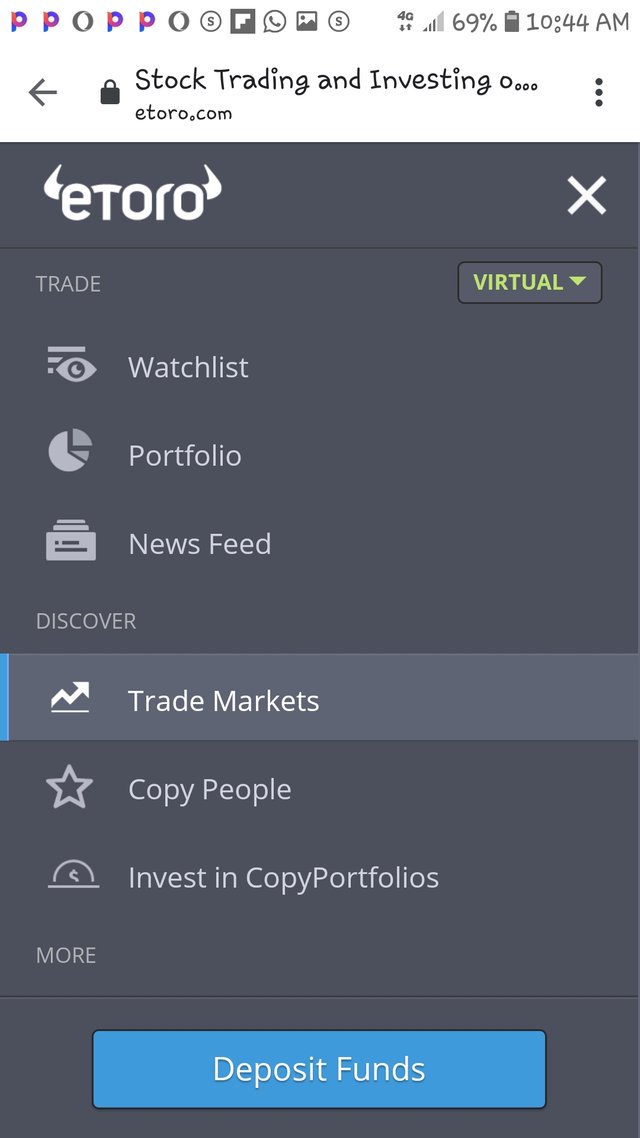

• click on the 3 short lines at the top left corner in order to get to the home page.

• switch your account to Virtua portfolio.

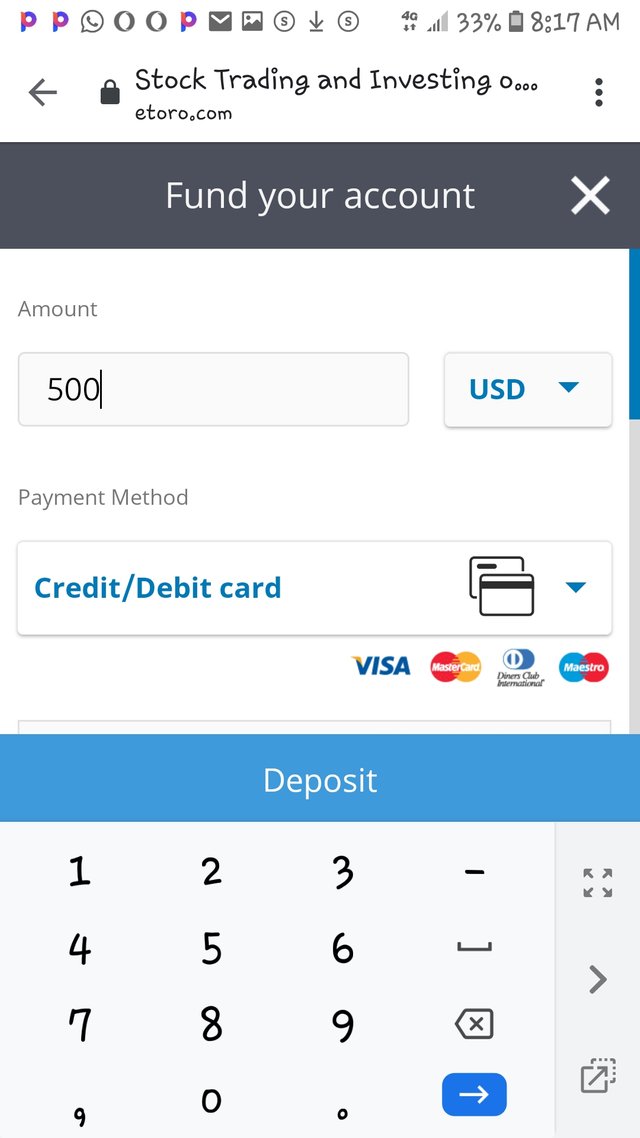

•Click on deposit to enter amount you want to deposit starting from 200 and above

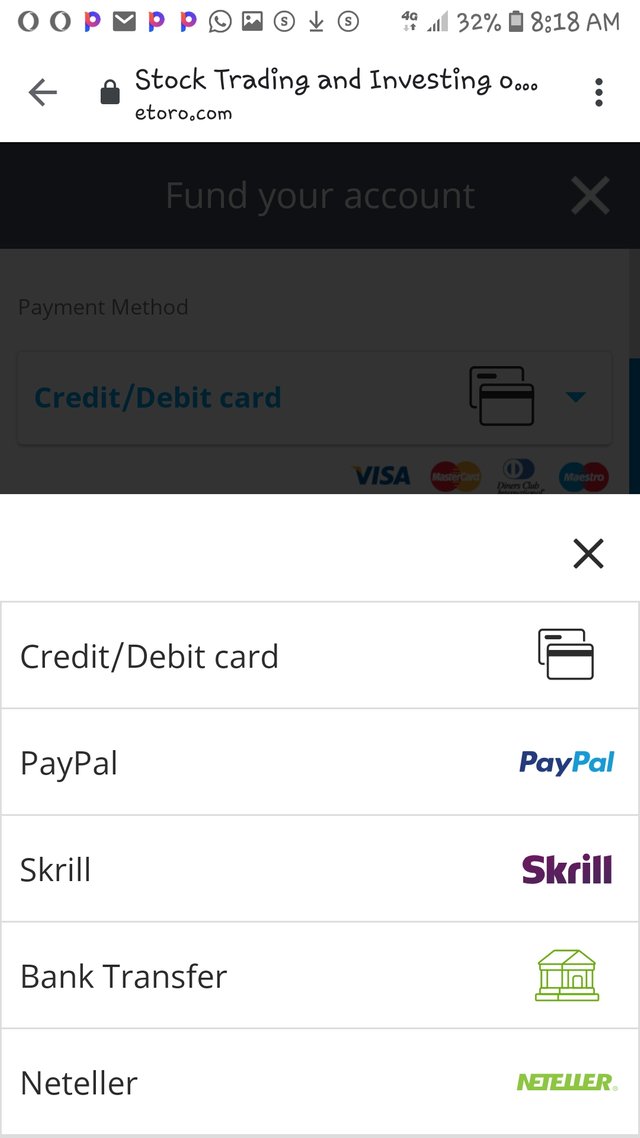

• select your payment method.

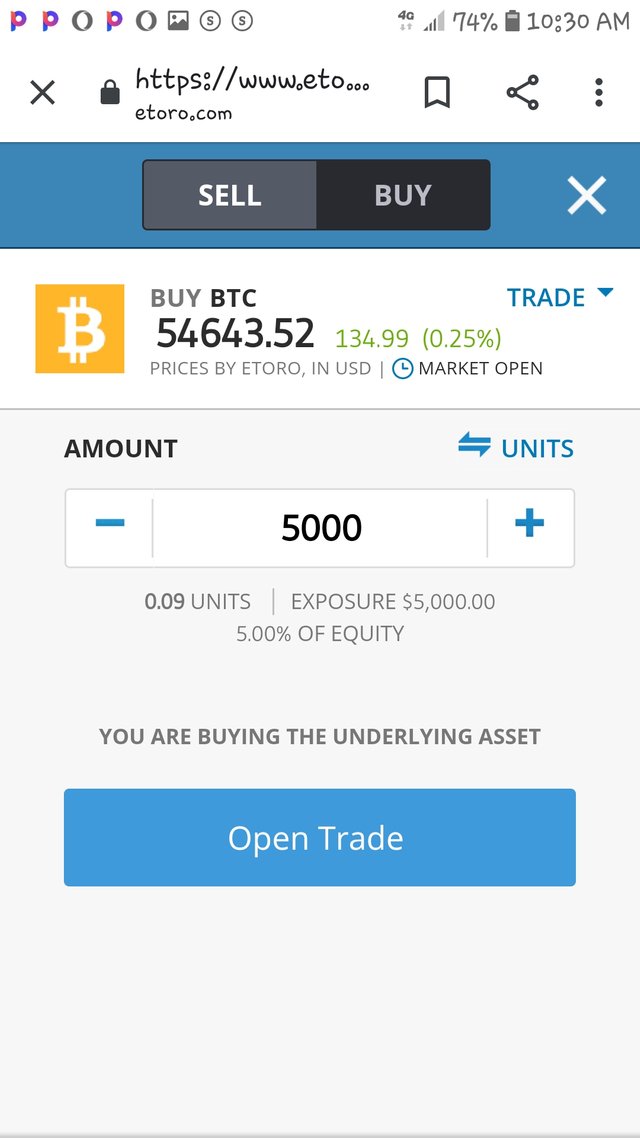

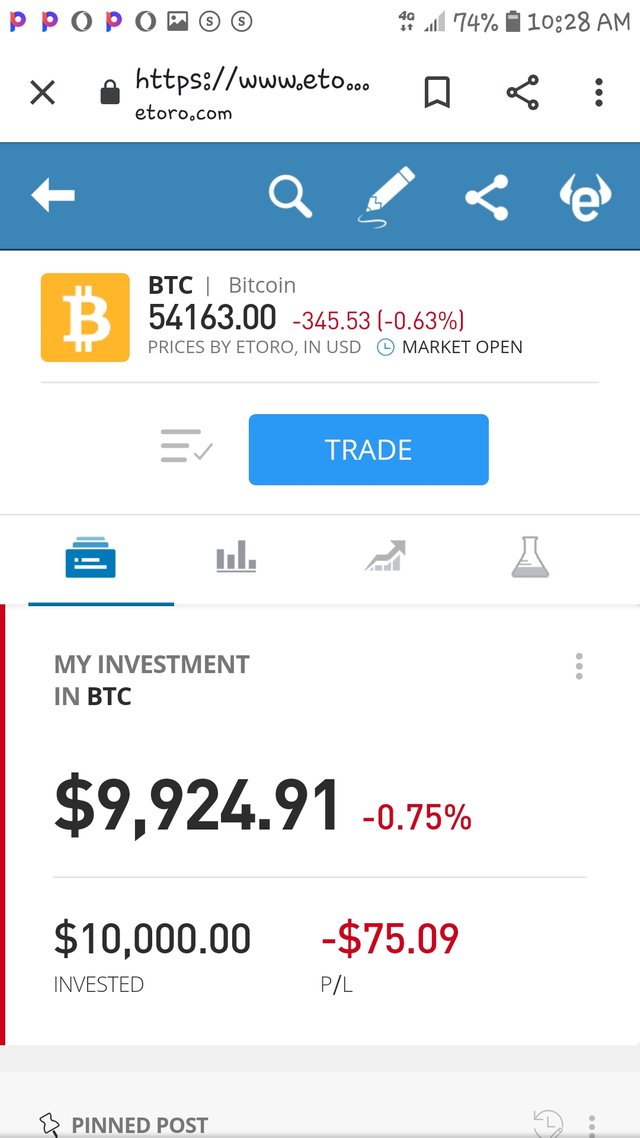

• On the same home page, click on trade markets. When you get to the trade market, there are several assets which I selected BTC.

• Now I am buying BTC at the price of 500

• Click on open trade to start your trade

Thank you.

Hi @rashidfu

Thanks for your participation in the Steemit Crypto Academy

Feedback

You just simply tried. Kindly invest enough time in both your research and in writing your articles.

Homework task

4

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit