The average true range (ATR) indicator depicts how much an asset's price has fluctuated over time. In other words, it reflects the asset's volatility.

It aids traders in predicting how much an asset's price will go in the future, as well as determining how far a stop loss or profit objective should be placed.

The ATR is a form of moving average of an asset's price movement that is calculated over a period of 14 days, although it can be different depending on your approach.

On a chart, the ATR appears as a moving average-like line.

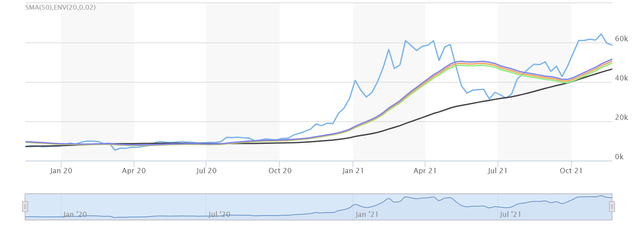

The ATR indicator is typically displayed as a line on a chart. The ATR indicator is commonly displayed on a chart as seen in the image below:

The price volatility is represented by the blue line in the chart.

The real value — in this case, 0.0065 – can be seen in the top left corner. This is the pips range in which the price has changed over the specified time period. Because the preceding chart is a daily chart, the price volatility is an average of 65 pips over the last 14 days.

Traders can expect a 65-pip price swing on any given day if this value is used.

An asset's volatility can grow or decrease.

When the line rises, it indicates that the asset's volatility is rising. When the line falls, it indicates that the volatility is falling. The ATR does not reveal the asset's direction of movement.

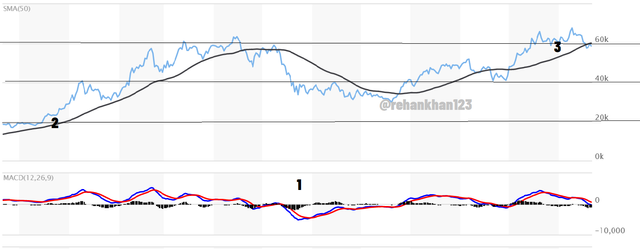

The ATR is used to demonstrate high and low volatility, as shown in the graphic below:

- Volatility is significant, as seen by a higher ATR and a larger daily range.

- Low volatility is demonstrated by a smaller daily range and a lower ATR.

Using the ATR indicator to trade

The ATR is used by traders to estimate how much an asset's price is likely to change on a daily basis. This data can be utilised to figure out how far a profit target/stop loss should be set from the entrance.

For example, if the ATR is 100 pips and the trend you're watching has beyond 100 pips, the trend has a higher chance of ending.

The chart below illustrates how a trader can use the ATR to determine how far a price will likely go.

- The ATR is 125 pips at the time of the highlighted candle, as evidenced by the black line and the value on the right side of the indicator.

- At the start of the day, a long entry is started.

- The profit objective is set at 125 pips using the ATR value.

The ATR was used to calculate the stop loss.

Using the similar technique, you may utilise the ATR to place your stop loss. You may set your stop loss accordingly because the ATR offers you a solid indicator of how far the price will move. You can effectively prevent market "noise" – transient price swings up and down while the price advances in an overall direction – by putting your stop loss away according to the daily range of the asset's price movement.

If the price reaches your stop loss, it signifies the daily price range is widening in the opposite direction of your trade, and you should cut your losses as quickly as possible.

Using the ATR value to establish a stop loss is then ideal because it allows you to place your stop loss as far away from the market as possible while using the shortest stop loss feasible.

The sensitivity of the ATR is affected by changing its settings.

The ATR indicator can be changed to multiple time periods, which affects the indicator's sensitivity.

The ATR's default setting is 14, which means the indicator will calculate price volatility based on the 14 most recent periods of time. As previously said, this usually takes 14 days.

When you use a lower level, the ATR indicator has less samples to work with. This makes it more responsive to recent price movements and results in a speedier reading.

When you use a lower level, the ATR indicator has less samples to work with. This makes it more responsive to recent price movements and results in a speedier reading.

You have learned the following in this lesson:...

- The average true range indicator (ATR) illustrates how volatile an asset's price has been over a period of time and aids traders in predicting future price volatility.

- It works in the same way as the average daily range (ADR) indicator, except it can be applied to any time frame.

- It appears as a moving average line on charts. Traders typically employ larger stop losses when a price's ATR is high and lower stop losses when its ATR is low when using it to create risk management orders.

- It is not more effective in some market conditions than in others.

When the ATR of a price is high, traders normally employ larger stop losses, and when the ATR is low, traders typically use smaller stop losses. - It is not more effective in some market conditions than in others.

- It won't tell you whether a price is trending or trading sideways, or whether it's trending or trading sideways.

- The indicator's sensitivity will be affected if the ATR parameters are changed from the typical 14 periods.

- The indicator will become more sensitive if the setting is lower than 14, resulting in a choppy reading.

- A setting higher than 14 reduces the sensitivity of the indicator, resulting in a smoother reading.

@rehankhan123, You are not eligible to participate in this advanced level of courses which require a minimum reputation of 65 and a balance of 900SP.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit