JustLend

JustLend is a Decentralised market protocol build on the Tron ecosystem for lending and borrowing crypto assets to receive interests. There are two players in JustLend, the suppliers and the borrowers. Both these players interact with each other in JustLend to earn a floating interest. Passive income can be earned as Annual Yield Percentage(APY) when you supply crypto assets in JustLend. This APY varies on the crypto assets available in JustLend market.

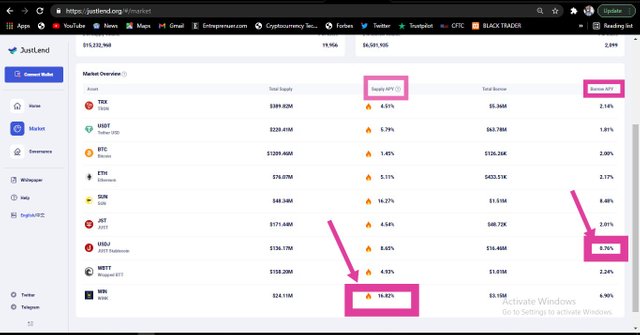

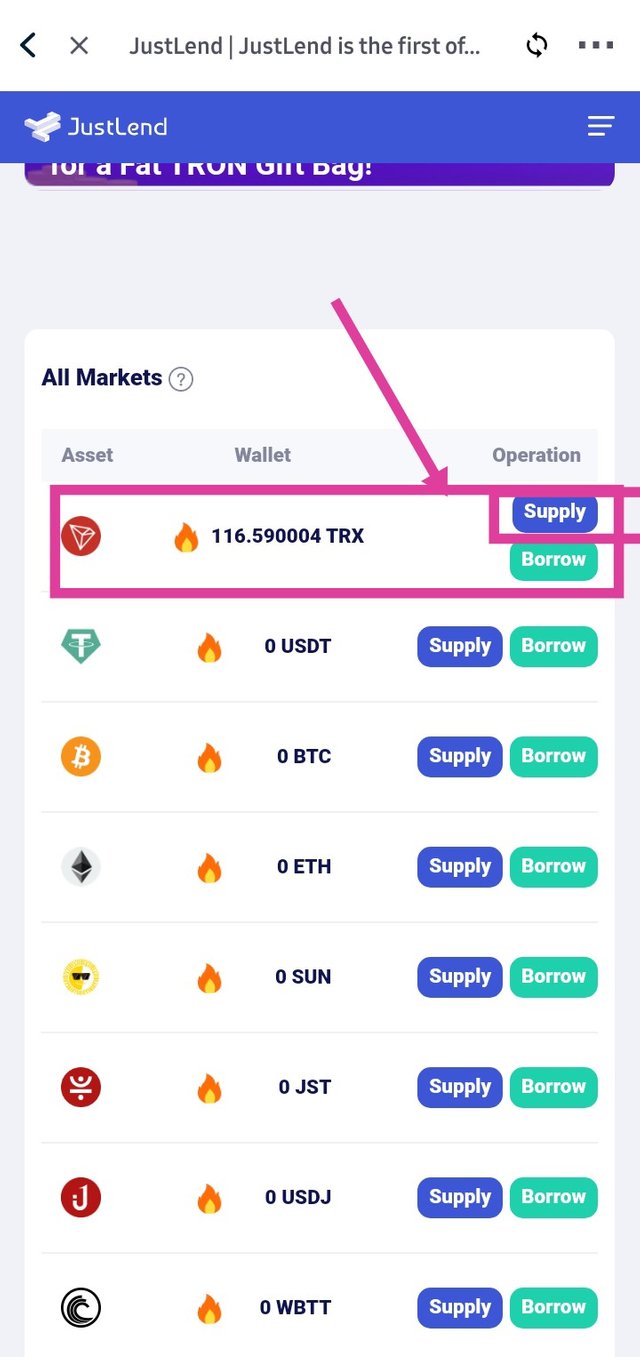

What are the different Markets available in JustLend, which market offers the best Supply APY, and which market offers the lowest borrow APY? (Screenshot needed)

There are different markets available in JustLend and this includes TRON(TRX), Tether USD (USDT), Bitcoin (BTC), Ethereum (ETH), SUN, JUST (JST), USDJ(JUST Stablecoin), Wrapped BTT( WBTT), WINK( WIN).

From the market overview, WINK offers the best supply APY of 16.82%. Similarly, USDJ offers the lowest borrow APY of 0.76%. Screenshots of the market overview are shown below.

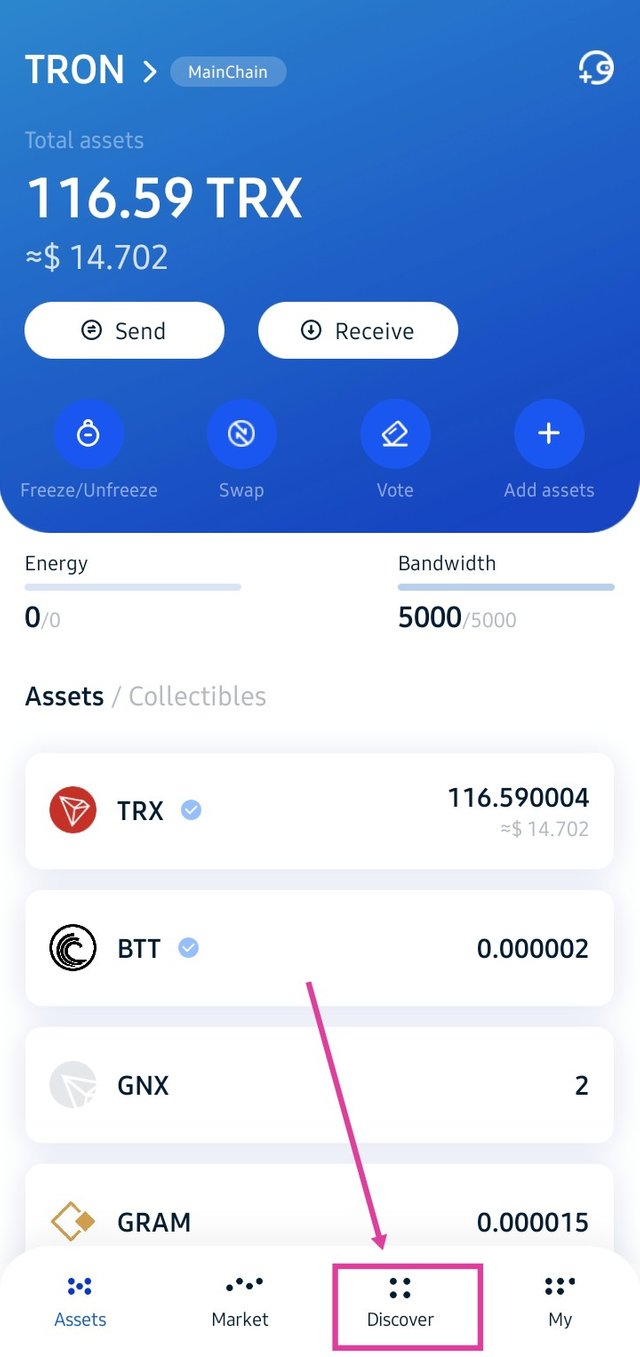

How do you connect TronLink Wallet to JustLend, and How do you supply a token(e.g. TRX, SUN, JST, etc) to earn Supply APY? (Screenshot Needed)

Before you can use JustLend market, you need to connect your TronLink wallet to supply assets on JustLend. This can be done by the following steps:

Step 1:

- Open your TronLink wallet App and click on the Discover icon as shown below.

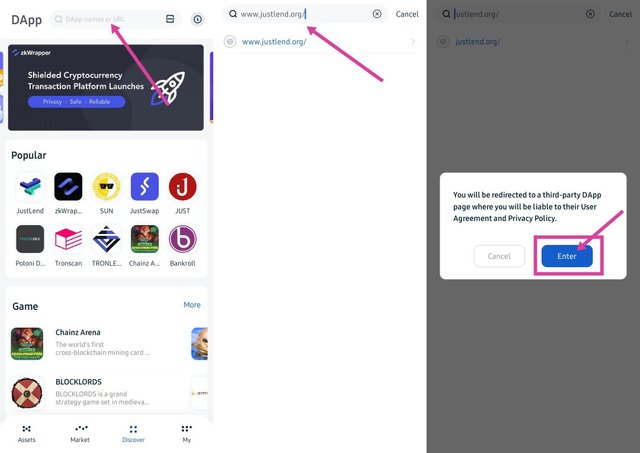

Step 2:

- On the discover interface, use the search bar and type in www.justlend.org and click enter.

- After that, a notice will pop up to redirect you to a third-party Dapp page. Click enter.

- You will be redirected to JustLend homepage after that.

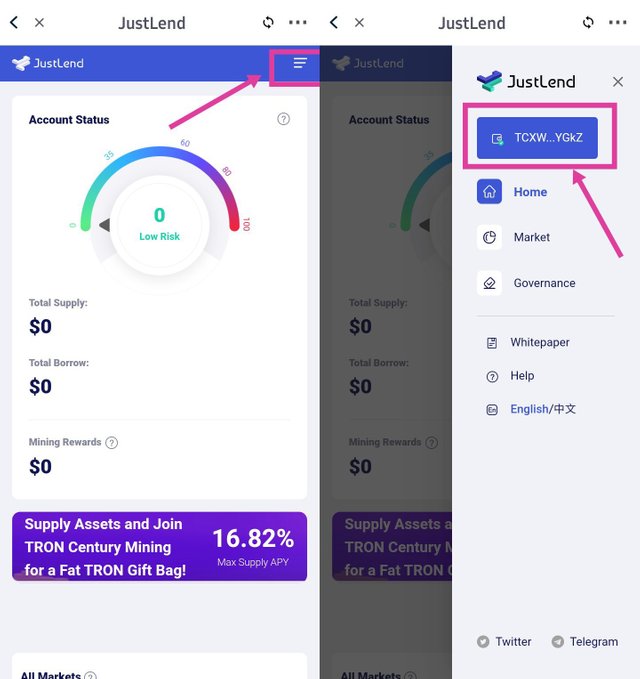

- To connect your wallet, click on the 3 bar at the top right corner.

- After that, click on Connect wallet after the drop menu to connect your wallet as shown in the screenshot below.

How to supply token to earn APY

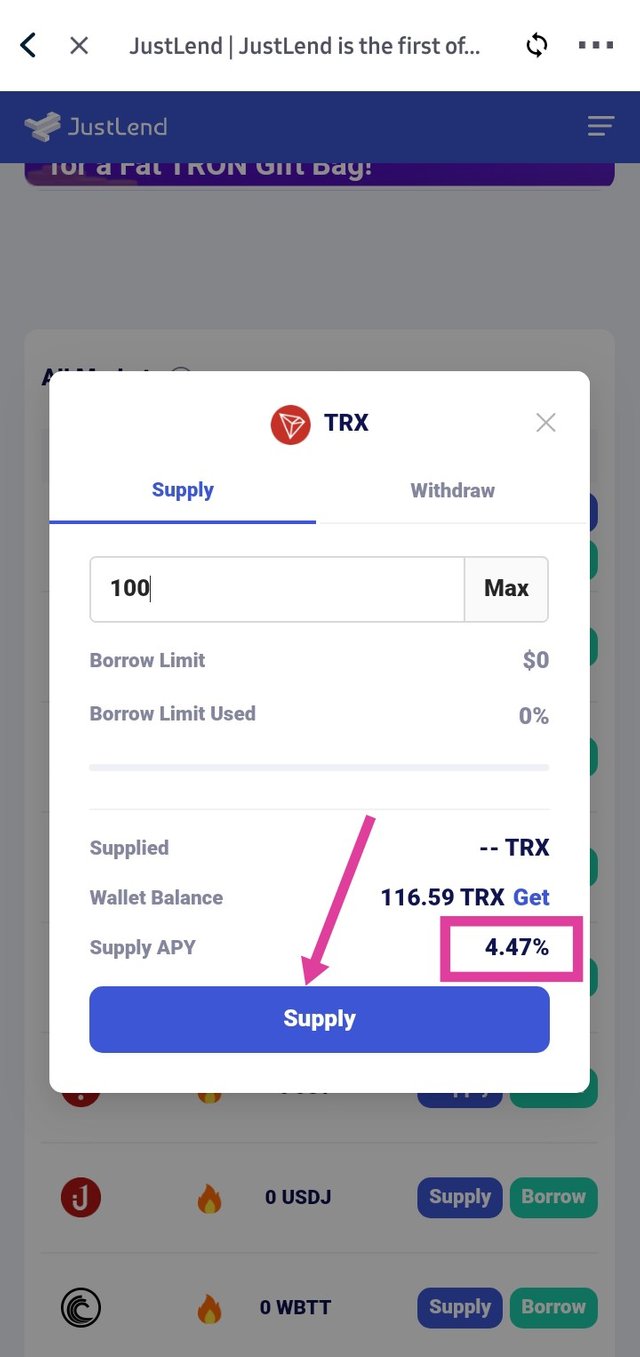

In this guide, I will explain in details how to supply token on JustLend. I will be supplying TRX on JustLend to earn APY. From the market overview, the APY for supplying TRX is 4.47%.

Step 1:

- From JustLend homepage, scroll down to market and select supply on TRX as shown below.

Step 2:

- After clicking supply, a new page pops up to input the amount of TRX you want to supply. Similarly, the APY is shown to be 4.47%. So the amount of interest you will earn depends on how long your supply remains in the pool. Click on supply after inputting the number of TRX you want to supply and click supply. In this case, I will be supplying 100 TRX.

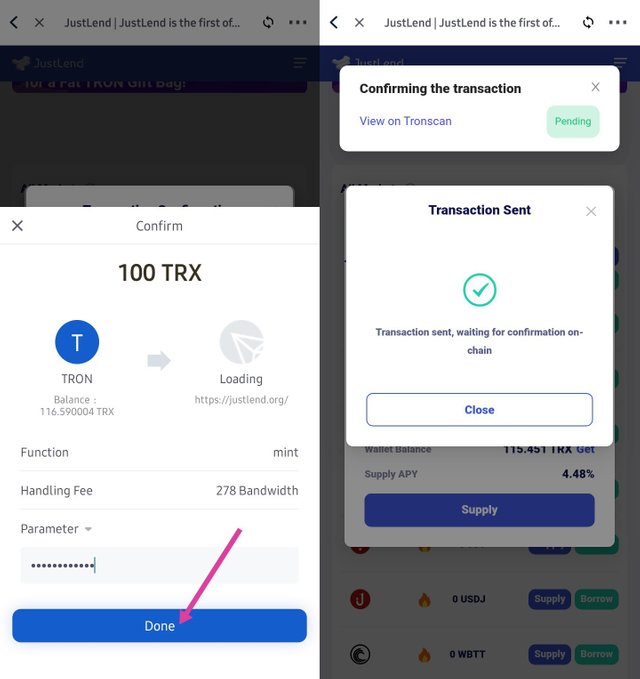

Step 3:

- After clicking Supply, you will be needed to input your password to authorise TronLink to supply TRX to JustLend. Input your password and click Done.

- A new page will show up indicating that the transaction is successful.

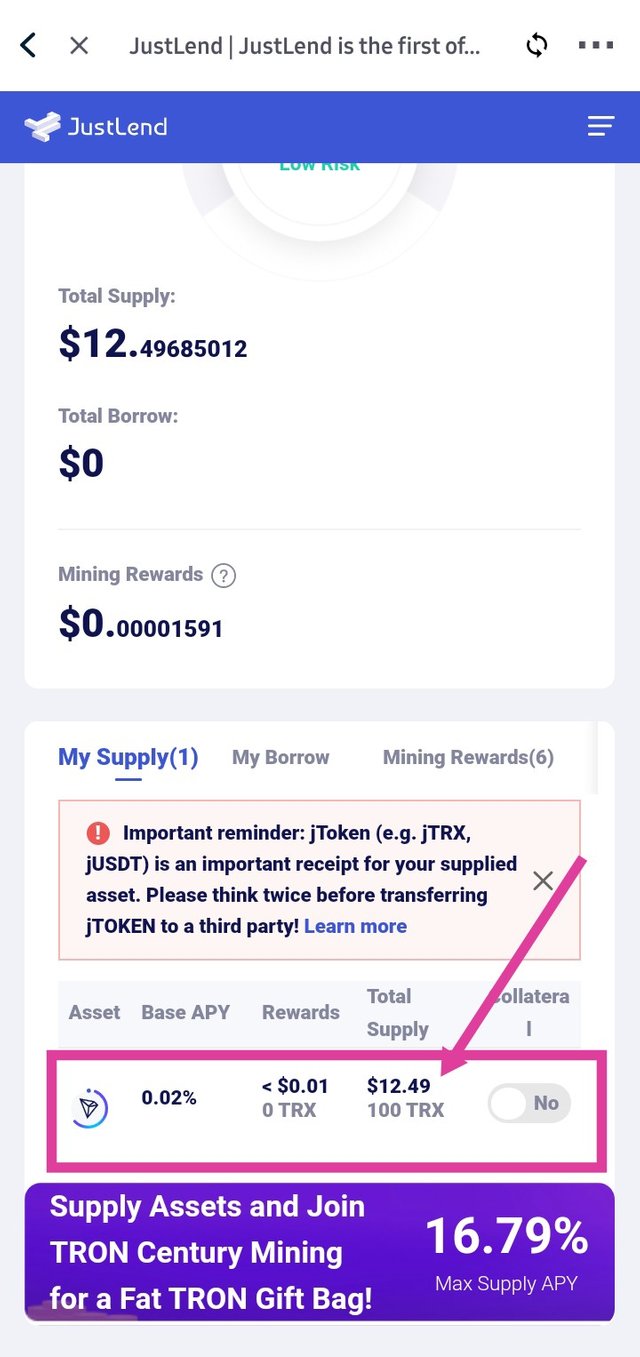

From JustLend homepage, my transaction history is displayed as shown which means that I have successfully supplied 100 TRX. The screenshot can be shown below.

How do you acquire jTokens, after supplying a particular token, check your TronLink Wallet and indicate how much jTokens you have acquired? (Screenshot Needed)

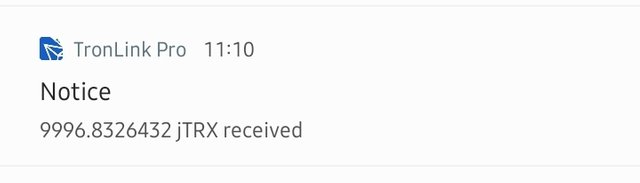

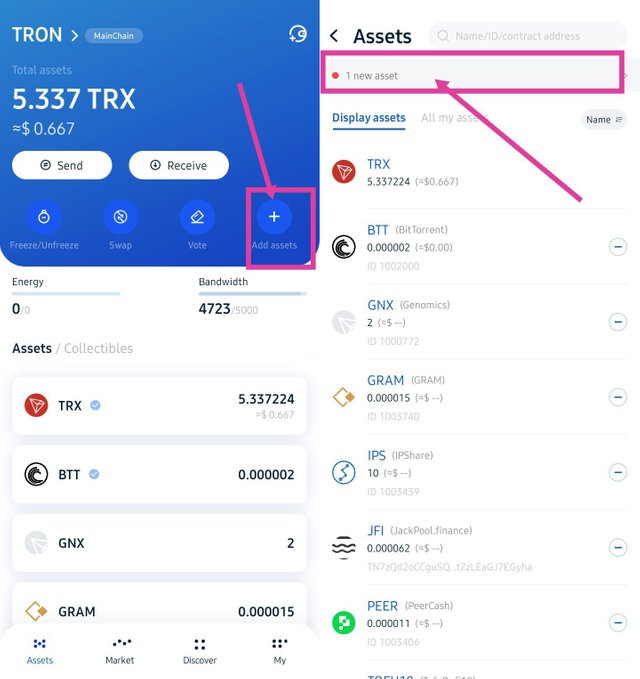

jTokens is acquired by supplying an asset in the JustLend market. Once you have successfully supplied an asset to JustLend market, jTokens will be sent to your connected wallet on the corresponding asset supplied. After supplying 100TRX to JustLend market, I got a notification from TronLink that I have received 9996.832 jTRX as shown in the picture below.

Initially, jTRX didn't reflect in my wallet, but there was a notice that a new asset has been received which I added using the following steps.

- click on add asset as shown in the picture.

- There's a notification that shows 1 new asset, click on it to show the underlying asset received.

- After that, the asset will be shown, click on the add icon to add jTRX to your wallet.

- We can see that jTRX has been successfully added to my assets. I received a 9996.836 for supplying 100TRX to JustLend as shown below.

How do you collateralize jTokens to borrow another asset? Borrow any asset of your choice(e.g. USDT), you can borrow a micro amount(as little as 1 USDT), include the entire process with screenshots?

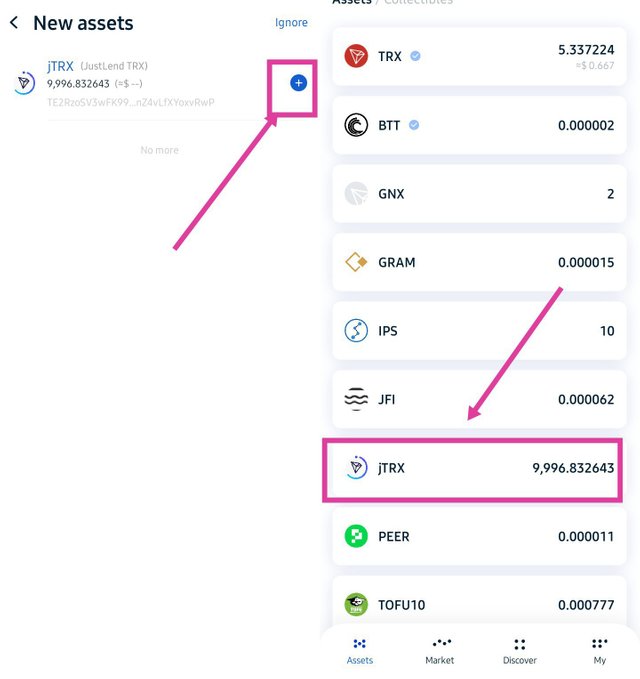

Users acquire jTokens after supplying assets on JustLend. This jTokens will be collateralized to borrow assets on JustLend. The steps involved to collateralized jTokens includes:

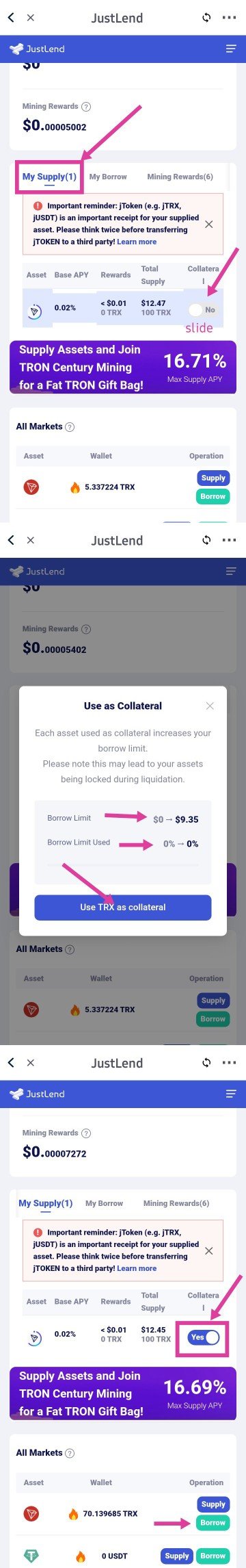

- After I have supplied 100TRX, it was listed under My supply. My supply (jTRX) will be collateralized by sliding the button as shown below.

- After enabling the slide button, a pop-up page appears which contains the borrowing limit to be $0- $9.35 which is usually 75% of TRX supplied. Click on Use Tron as Collateral and sign the transaction using your TronLink password.

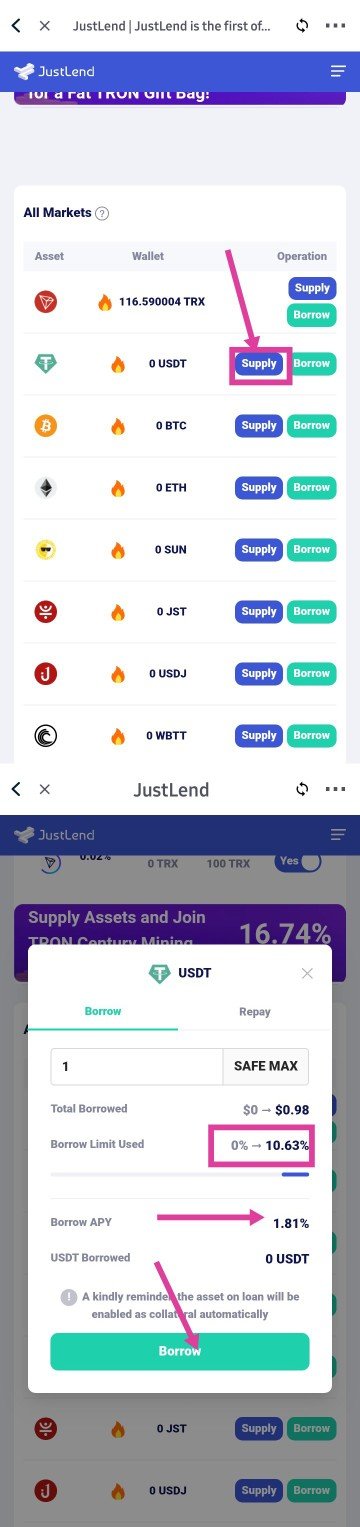

Now we have collateralized jTRX and this will enable us to borrow assets in JustLend. To borrow asset in JustLend, the following steps can be followed. In this case, we will be borrowing 1USDT in JustLend.

- On JustLend homepage, scroll down to markets and click on Borrow for USDT market.

- A pop up appears, input the amount of USDTnyou wish to borrow. In this case, I will input 1USDT. The borrow APY is 1.81% and a borrowing limit of 10.63%.

- click on borrow and sign the transaction using Tronlink password.

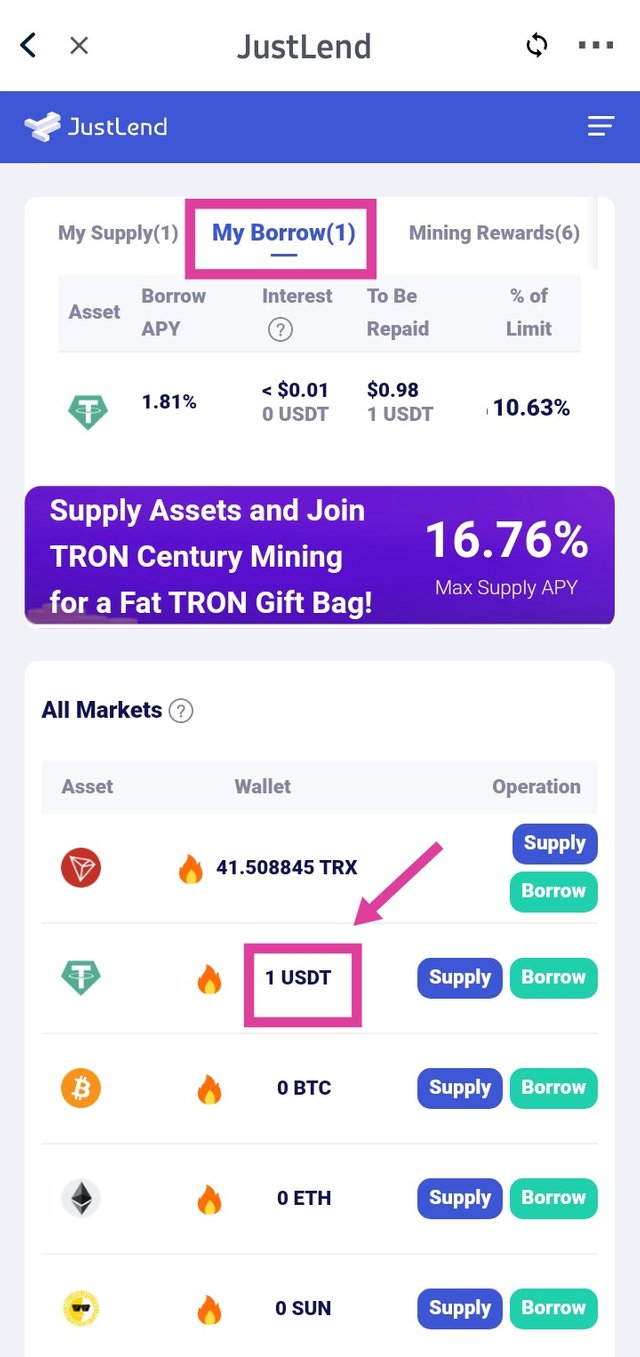

After signing the transaction, the borrowed USDT appears in my wallet and also under My Borrow as shown below:

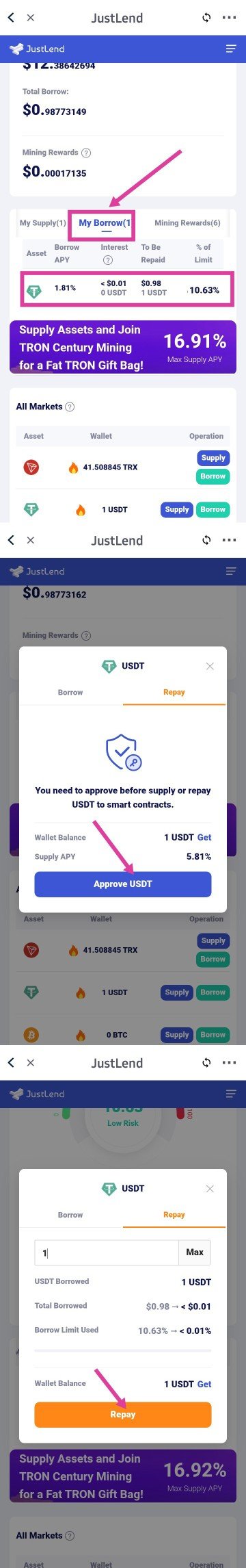

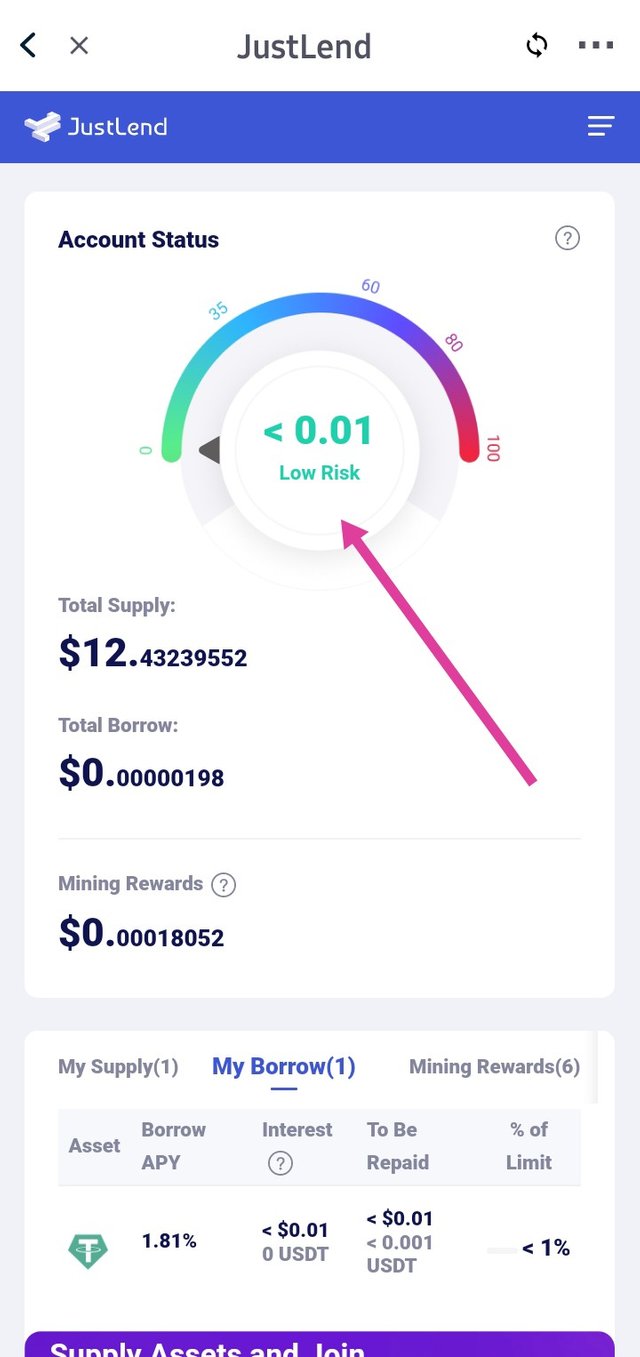

How much interest did you pay, under what condition it will trigger liquidation? What is the net APY in your case? What is the Account Status(Risk Value) in your case? (Screenshot Needed)

The interest I paid for borrowing 1USDT is less than $0.01 and my account will be liquidated when my risk level reaches 100%. Though the risk level can be reduced by adding more collateral, currently, my risk level is 10.63% which is relatively low.

Net APY

The net APY on my account is 4.34%. The APY on my supplied 100 TRX is 4.47%, after which I borrowed 1USDT with an APY of 1.81%. I collateralized 75% of my supply (jTRX) to be able to borrow the USDT. Also, 10.63% of my borrow limit was utilized to borrow the 1USDT.

The risk level of my account is currently 10.63% which is very low and safe for my account to not experience liquidation.

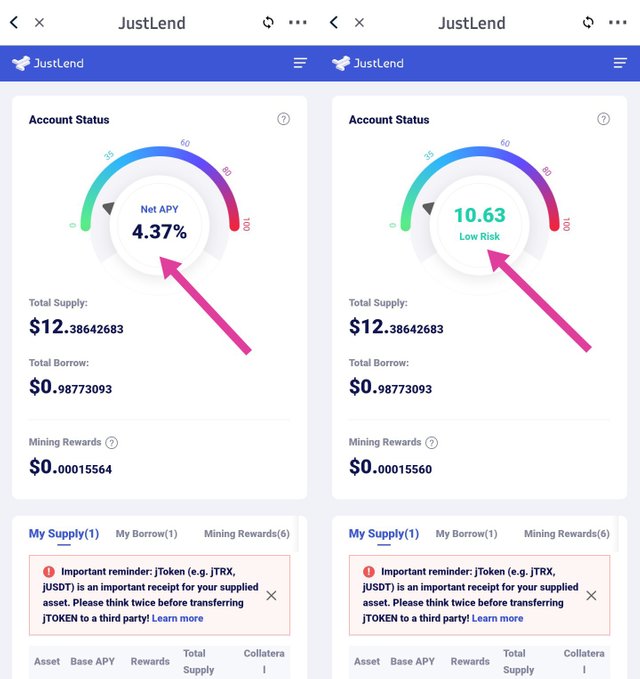

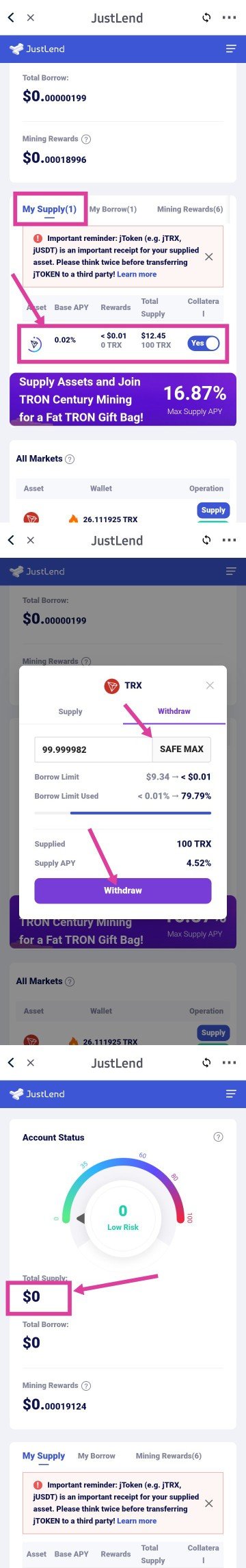

How do you repay & unlock your asset in JustLend?(Screenshot Needed)

To repay a borrowed asset in JustLend, kindly follow the steps as illustrated. In this case, I will repay the borrowed 1USDT.

- On JustLend homepage, switch to My borrow and click on the asset you want to repay. I will select USDT in this case.

- A pop-up page appears to approve USDT repay to smart contracts, click on approve USDT

- After approving USDT repay to smart contracts. A pop-up page appears to input the amount of USDT to be repaid, input the amount of USDT to repay. Select max if you want to repay all the borrowed amount.

- Click Repay and sign the transaction by inputting your Tronlink password.

After successfully repaying the borrowed asset, my risk level reduced to 0 as shown below.

Unlocking an Asset on JustLend

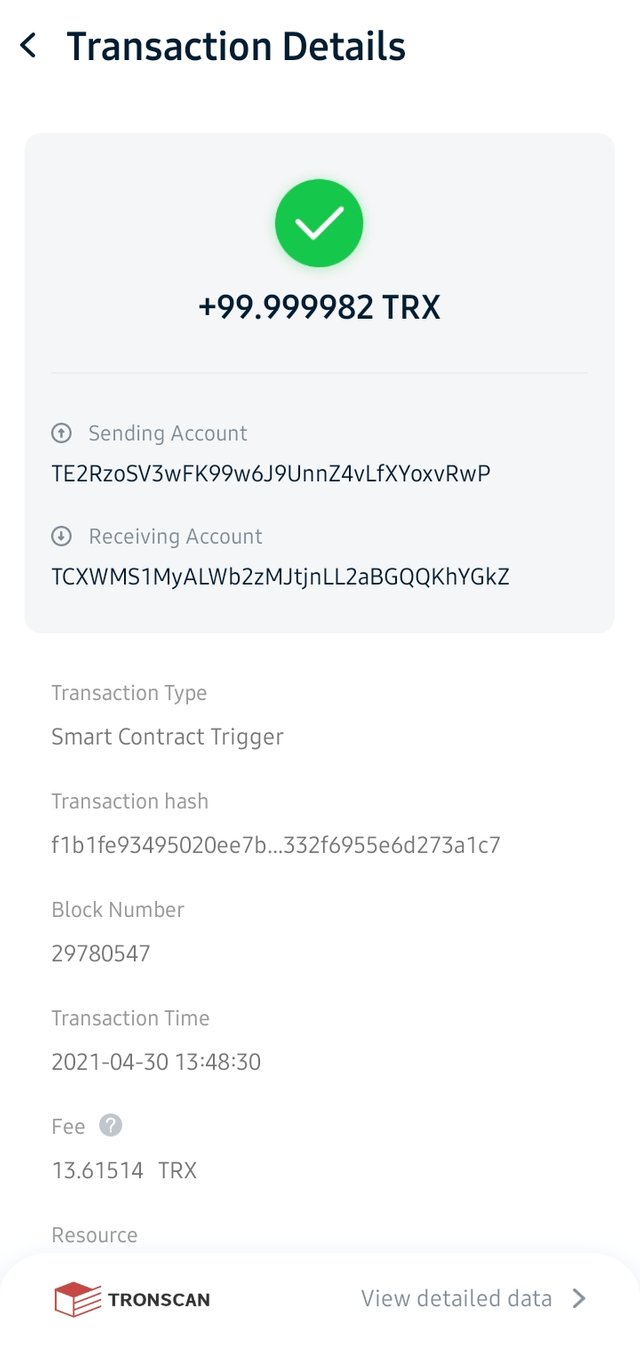

Previously, we supplied 100TRX to JustLend to earn 4.47% APY. Now we are going to unlock the supplied assets by following the illustrations below.

- Under my supply, click the underlying asset to be unlocked. I will select TRX.

- Click Safe max or input manually the amount to withdraw and click Withdraw

- Sign the transaction by inputting your Tronlink password.

The picture below shows TRX receipt successfully withdrawn to my Tronlink wallet.

In conclusion, It is no doubt that the setbacks in our traditional finances are being solved through Decentralized Finance (DeFi). JustLend is a great platform for lending and borrowing services to earn interest. I was able to lend and borrow assets seamlessly without any restrictions or form of verification.

Thank you professor @sapwood for this wonderful lesson. I'm happy to have explored and get to know how to use JustLend to supply and Borrow assets.

.jpeg)

Twitter Promotion

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for attending the lecture in Steemit-Crypto-Academy- Season 2 & doing the homework task-3.

That's correct.

Actually, you mint jTokens by supplying an asset. Further, when you collateralize to borrow an asset, the smart contract actually collateralizes your jTokens.

Feedback/Suggestions:-

Thank you.

Homework Task -3 accomplished.

[9]

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit