Understanding Scalping

There are different kind of trading style which Scalping is one of them. This trading style involves taking advantage of small price movements in the market for small profits. Traders who scalp are impatient traders who hold positions in minutes. Cryptocurrency is highly volatile and prices changes are very fast, these traders capitalize on this price movement in the shortest time to make fast and small profits. Due to the nature of the trading style, traders who use this trading use lower time frames like 5 minutes, 10 minutes, 15 minutes, and a maximum of 1hour chart. This trading style can make you a good profit as you can always add up positions in the market. Similarly, it can also result in huge losses when your prediction is wrong. Traders who scalp are always on the screen watching the market.

Finger-trap Scalping Strategy

Finger-trap strategy was developed to help scalpers take advantage of this small price movement in the market. The finger-trap strategy focus on identifying strong short-term trends in the market which a scalper can capitalise on to make trading decisions.

There are two major charts needed in this scalp trading style. This includes the Trend chart and the Entry chart. Just like I explained earlier, it is very important to identify a strong short-term trend. Similarly, it is essential to get the best possible entry when you have identified a strong trend.

Trend Chart

There's this slogan that "the trend is your friend". As a scalper, using lower time-frames can make you miss out on the original trend. Scalping is very sensitive and identifying a strong market trend is important to avoid counter-trend.

Identifying a strong short-term trend using a finger-strap strategy is done on the 1-hour chart. 1hour chart is chosen because we are looking for short information in the market. Then the **8 period EMA and 38 period EMA is used to analyse and find the strongest short-term trends on the 1-hour chart.

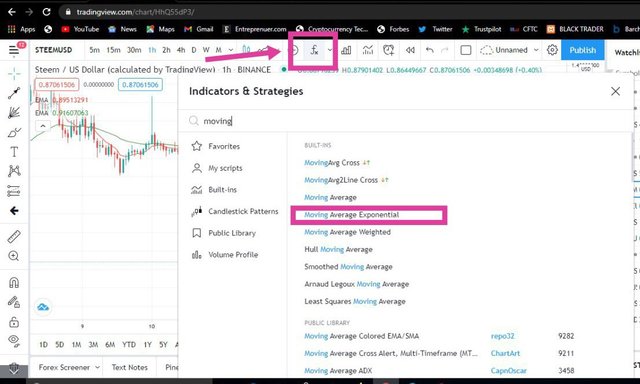

Adding EMA on Tradingview Chart

- Click on the indicator icon on the chart.

- on the landing page, type moving average and select Moving average Exponential. Click on it twice to add two EMA to your chart.

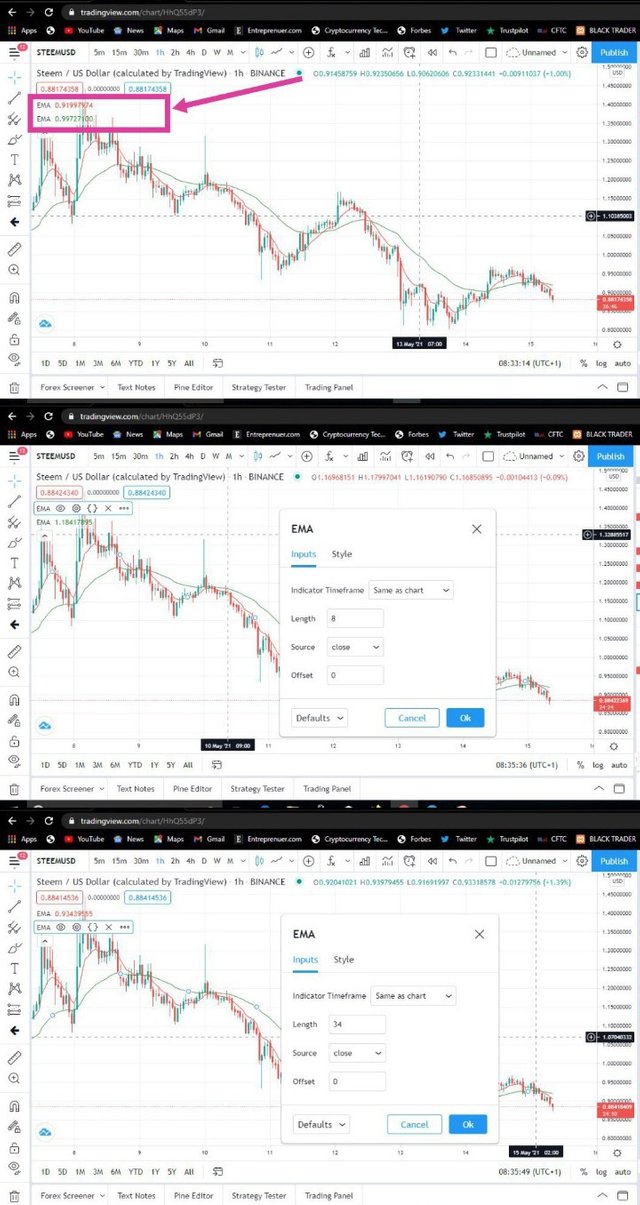

- After that, the EMAs appear on the screen. Click on the indicator panel at the top left corner of the chart. On the EMA, click on the settings icon to configure both EMA to 8 and 34 period EMA.

Adding EMA to chart

The 8 EMA is fast and more reactive to current information on price whereas the 34 EMA is slower. Though these two EMA appear like a cross on the chart, the important thing is to focus on the stronger portion of the trend than the EMA cross. This will be done by taking more of the position of the two EMA. This includes:

- For an uptrend, If the fast moving average(8 EMA) is above the slow moving average (34 EMA), then wait for the price to be trading above both EMA to confirm the trend before looking for an entry.

- For a downtrend, if the fast moving average (8 EMA) is below the slow moving average (34 EMA), wait for the price to be trading above EMA to confirm the trend before looking for an entry.

The Entry Chart

After you have identified the strongest trend of the market using the method discussed above, now it is time to look for entry. The idea for an entry is to buy low and sell high on the 5 minutes chart as the price tends to move against the trend identified on the 1-hour chart. Price moves in a zigzag pattern and we tend to see some pullback in price. On the 5 minutes chart, the entry position will be when the price tends to cross over the 8 EMA on the 5 minutes chart. This can be illustrated in the chart below.

Note: Finding an entry on 5 minutes will be after the trend have been confirmed on the 1-hour chart.

Risk Management in Finger-trap scalping Strategy

Managing in trading is very essential especially in scalping where trades happen in a short time. Your stoploss won't be too tight to give your trade room to move into profit. Also, your stoploss won't be too wide so you can cut your losses on time. I prefer placing my stoploss few pips below the recent swing low for an uptrend and also few pips above the recent swing high for a downtrend. This can be shown in the screenshot below.

Trading Using Finger-trap Scalp trading Strategy

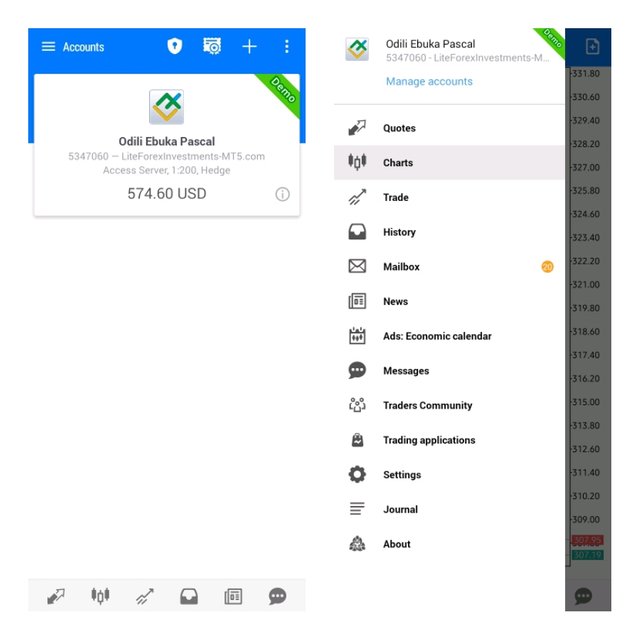

I have explained the Finger-trap scalp trading strategy and also the elements of the trading style. Now I'm going to carry out a trade on two crypto assets using a demo account using the strategy explained.

Note: The chart analysis of this trade will be carried out using Tradingview platform, whereas the trades will be triggered using liteforex demo account on MT5**.

LTC/USD

I will be looking at LTC/USD chart to carry out a trade using Finger-trap scalping strategy explained in this post.

From the chart above, we can see that the 8 EMA is below the 34 EMA and the price is trading below both EMA. This is our trend confirmation as explained previously. Now that we have confirmed the trend on the 1-hour chart, let's go down to our **entry chart which is the 5 minutes chart to look for entry.

This is the current situation on 5 minutes chart, now we will be patient to wait for the price to go against our trend and then come back to cross the 8 EMA before taking a sell trade. This will form a recent swing high where we can place a stoploss above it.

Entry

After some time, I took an entry as price tend to cross the 8 EMA. My stoploss was placed few pips above the recent swing high.

My Entry

Opened position on liteforex MT5 demo account.

Entry price: 309.80

Stoploss: 313.40

Take profit: 304.76

Risk reward ratio: 2:06

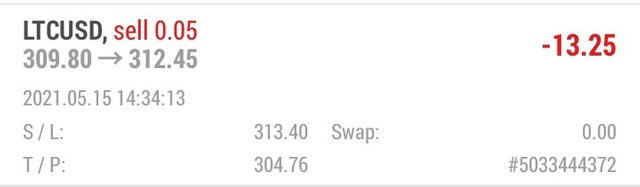

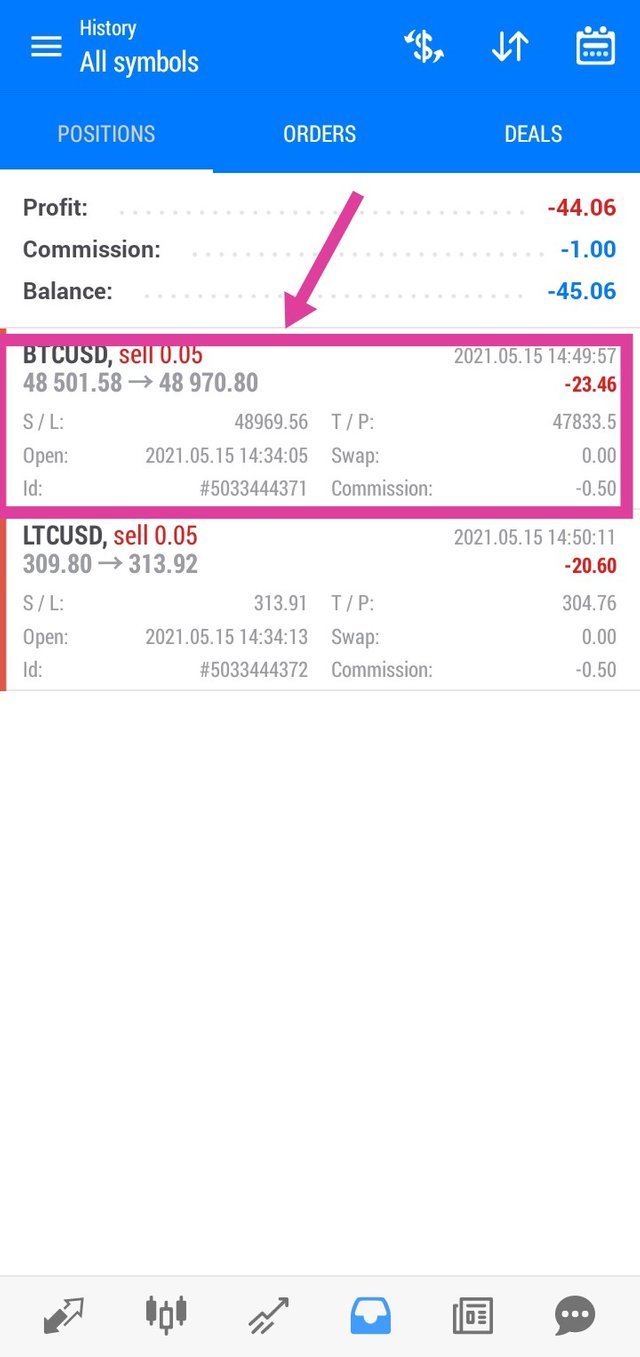

Outcome of trade

After taking an entry based on the entry confirmation as price tends to cross the 8 EMA, stoploss was placed above the recent high formed. After some minutes, the price reversed back to hit my stoploss. The trade resulted in a loss but I was glad that I cut my losses on time as the price continued going up.

Stoploss hit

BTC/USD

I will be looking at LTC/USD chart to carry out a trade using Finger-trap scalping strategy explained in this post.

From the chart above, we can see that the 8 EMA is below the 34 EMA and the price is trading below both EMA. This is our trend confirmation as explained previously. Now that we have confirmed the trend on the 1-hour chart, let's go down to our **entry chart which is the 5 minutes chart to look for entry.

From the 5 minutes chart above, we can see that price has moved against our trend confirmed on 1hour. Now I will be patient and wait for the price to cross the 8 EMA on the 5 minutes chart before taking a sell trade. Stoploss will be placed above the recent swing high.

Entry

After 35 minutes of watching the market waiting for the strategy to play out, I finally took a sell trade as the price tend to cross the 8 EMA on 5 minutes chart. The entry candle is shown below.

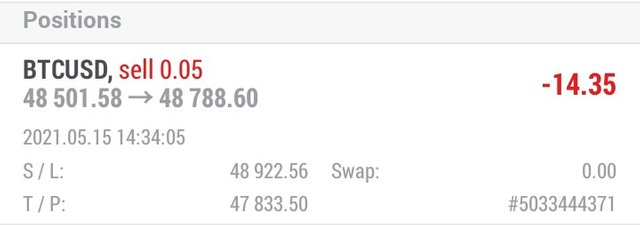

My Entry

Opened position on MT5 demo account.

Entry price: 48501

Stoploss: 48922.56

Take profit: 47833.50

Risk reward ratio: 1:69

Outcome of trade

I took a position as price tends to cross the 8 EMA. This is after I have confirmed the trend on 1-hour chart. My stoploss was placed above the recent swing high formed. After some minutes, the price hit my stoploss and I took a loss.

Stoploss hit

In conclusion, the strategy discussed in this post is very simple to understand and learn. I was able to carry out this research and trade based on my understanding of the strategy. I believe that there's more to this strategy which a trader will need to backtest to understand proper. One thing I observed in this trade I just took is that, despite an entry based on 5 minutes chart after confirmation of trend on 1 hour, the trade resulted in a loss. But looking at the 1hour chart, I still noticed that the trend is still intact as the price is still trading above 8 EMA and 34 EMA. This means that I can also wait for another sell entry if the price reverses back to cross the 8 EMA on 5 minutes chart. I find scalping very stressful because a trader gets to spend so much time on the screen looking at the market. Also, scalping exposes a trader to over trading and entering several positions in a day.

Note: All images used in this post are screenshots taking from my Tradingview account and MT5 account, unless stated otherwise.

Reference:

DialyFx

Thank you Professor @yohan2on for this wonderful opportunity to learn this strategy.

.jpeg)

Twitter Promotion

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @reminiscence01

Thanks for participating in the Steemit Crypto Academy

Feedback

This is excellent work done. Well done with your research and the practical demonstration of the scalp trading style using the finger trap strategy.

Homework task

10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor @yohan2on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit