Technical details on Reverse Strategy

The word reversal isn't new to trading. The market is always in a push phase ( bullish or bearish) and after that, there is always a reversal for the price to continue in its original direction. This happens as a result of traders taking profits by closing their positions at the end of the day. Buyers close their position which brings in sellers to the market.

Reverse trading strategy aim at capitalizing on these pullback after the daily close of the asset. This strategy is risky to trade when the 24hours circles of the day as the price of an asset can continue going down or continue going up. It is not advisable to take a sell position when the price of an asset is in a bullish and also not to take a buy trade when the price of an asset is in a bearish phase. A trader is expected to wait for the price to complete the 1-day circle before implementing the reverse strategy. Note that this strategy works best when there is a price change of 20% or more in the price of an asset at the end of the day.

How Reverse Trading Strategy Works

We have established that the trader needs to wait for the 1-day circle of price to complete before implementing reverse strategy. Let's assume the price of an asset in a strong bullish or bearish movement and have a price change of 20% or more before the day ends, traders take profits by closing their positions which causes the price to pull back. This pullback brings in opposing traders in the market who try to reverse the price of the crypto asset in the opposite direction.

Now there are key elements to look at for using reverse trading strategy, this includes:

- Open: This represents the opening price of the new day.

- Close: This represents the closing price at the end of the day.

- High point: This represents the highest price an asset reached within a cycle (1-day circle for this study.

- Low point: This represents the lowest price an asset reached within a cycle (1-day circle for this study).

These key elements are vital to reverse trading strategy. The closing price of a crypto asset and the opening price of the next day is required to take an entry in reverse strategy.

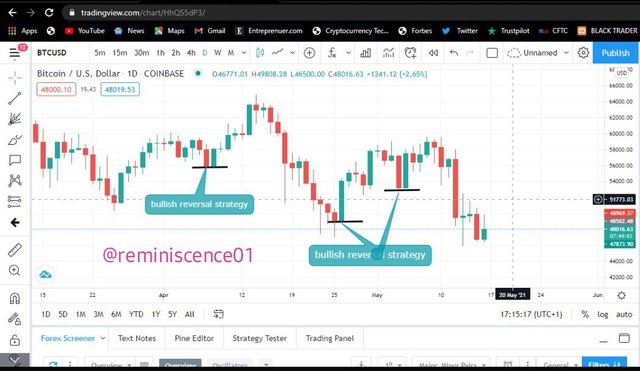

Bullish Reverse Strategy

For a Buy position, if the current opening price is closer/near to the previous closing price, reverse strategy can be implemented to take an immediate buy position. This can be illustrated using the chart below.

From the chart, we can see examples of bullish reversal strategy on BTC/USD. Notice how the opening price of the new candle was very close to the closing price of the previous candle. An impulse buy entry can be taken once this happens in the market.

Bearish Reversal Strategy

For a sell position, the same criteria are met as in buy position. If the opening price of the next candle is close/ near the closing price of the previous candle, a Reverse strategy can be implemented for a sell position. An example can be seen in the chart below.

From the chart above, notice how close the opening price of the next candle is to the closing price of the previous candle. And also, we can see how the price come down to the previous low point of the previous candle.

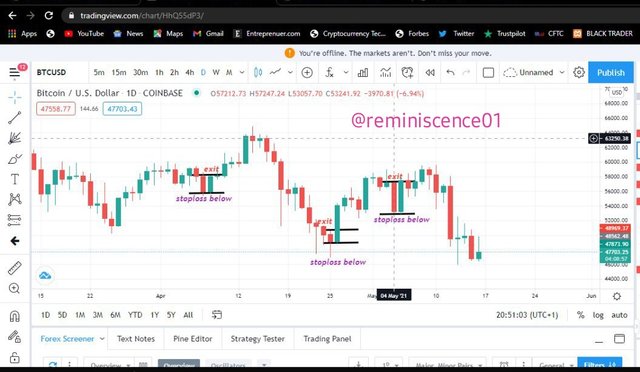

Risk Management Using Reverse Strategy

Every strategy requires an exit strategy. This can be either a stoploss or a profit target. Stoploss is very essential to any trading strategy. The reason is that sometimes our predictions are wrong and price tends to go against our prediction. The use of stoploss protects your account by getting you out of the market on time.

Stoploss for reverse strategy is placed at the low point of the previous candle for a bullish reverse strategy. Similarly, the first profit target should be at the high point of the previous candle. This can be shown in the chart below.

For a bearish reverse strategy, stoploss is placed above the high point of the previous candle and the first profit target is placed below the low point of the previous candle. This can be shown in the chart below.

In conclusion, reverse strategy is a very simple strategy a trader can use to capitalise on price pullback after a long bearish or bullish movement. The strategy works best for a long bullish change of +20% or a long bearish change of -20% at the end of the day. Similarly, the use of stoploss is very necessary for this strategy and it should be placed at the high point of the previous candle for a bearish position and the low point of the previous candle for a bullish position.

Review of Coingecko

What is COINGECKO?

CoinGecko is a Singapore-based company that was founded in 2014 by TM Lee and Bobby Ong. CoinGecko is a cryptocurrency platform where users access valuable information and updates on the performance and progress of cryptocurrencies. CoinGecko provides information like trading volume, price fluctuations, price charts using real-time data feeds.

Cryptocurrencies are ranked based on their market capitalisation on CoinGecko. Similarly, CoinGecko has an amazing feature that enables users to filter the cryptocurrency list and easily find the information they need. Instead of providing cryptocurrency users information about a cryptocurrency based on market capitalization, trading volume and price change, CoinGecko aims at providing in-depth information and performance of a cryptocurrency to help the trader make a good investment decision.

How CoinGecko can be helpful for you in a crypto market?

Just like I have stated, CoinGecko aims at providing in-depth information and analysis about cryptocurrency. CoinGecko is very helpful in terms of obtaining real-time price data of a cryptocurrency. Live cryptocurrencies are well organized and categorise making it easy for a new crypto user to interact with. Similarly, CoinGecko provides portfolio management tools for users to enable them to keep track and monitor the progress of their preferred cryptocurrencies.

Furthermore, apart from providing in-depth analysis of cryptocurrencies, CoinGecko also provides markets statistic and information about the developers and community metrics of a cryptocurrency project. CoinGecko keeps tracking the Github, Gitlab of cryptocurrency projects. Also, CoinGecko track community stats of cryptocurrency projects by tracking the activities on Twitter, Facebook, Reddit, medium and provides information on new post and comments concerning the cryptocurrency. With this information, I can be able to have enough transparent information to make good investment decisions about the cryptocurrency on my portfolio.

CoinGecko Features

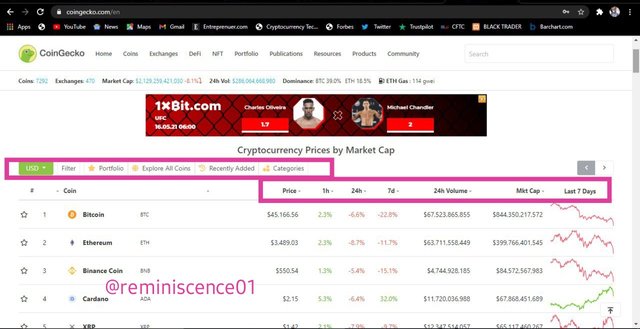

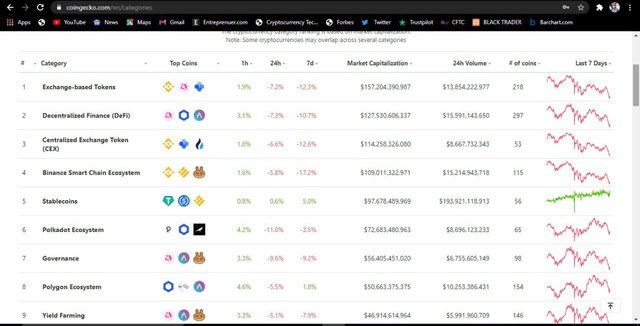

On the landing page of CoingGecko, we have the list of top 100 cryptocurrency categories based on market capitalisation in descending order. This list is accompanied by the current market information about a cryptocurrency. This includes the price of the coin, 1hour, 24 hours, and 7 days change in prices of the cryptocurrencies, 24-hour volume of cryptocurrencies and also the market capitalization of the cryptocurrencies. Similarly, we have a price of cryptocurrency for the past 7 days displayed also.

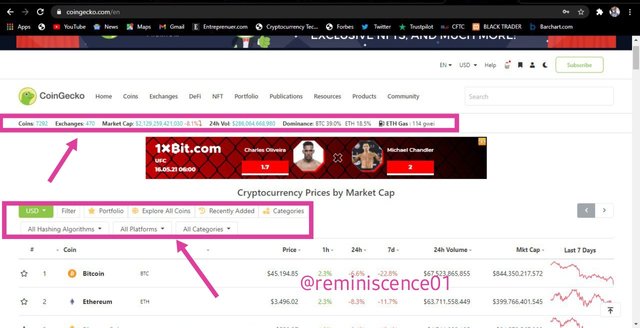

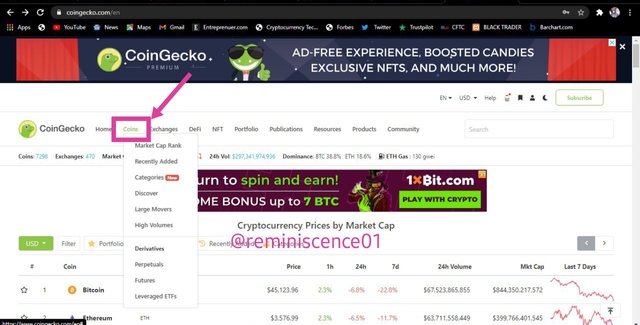

Also, at the top page, we can see the number of coins and exchanges available on CoinGecko. At the time of writing this post, there are 7292 cryptocurrencies and 470 exchanges. Similarly, the market capitalization of the cryptocurrency industry is displayed and also the dominance of BTC and ETH.

From what we can see, there are 7292 cryptocurrencies on CoinGecko, users can search for cryptocurrencies using the search bar. Also, CoinGecko makes it easy for users to filter cryptocurrencies. From the picture above, we can see the several ways a user can filter cryptocurrencies. With these options, users can filter cryptocurrencies like Blockchain ecosystem, exchange-based tokens, Decentralized Finance (DeFi) Decentralised Exchange token (DEX), Centralized Exchange (CEX), Governance, stable coins, Yield farming, Automated Market Maker ( AMM), Non-fungible Tokens(NFT) etc. This can be shown in the picture below.

CoinGecko Market

Under CoinGecko markets, users can filter their views based on 'market cap rank', coins with high pump and highest dump ( Large movers), highest 24 hours volume, recently added cryptocurrencies. Also, the discover section enables users to organize their views based on trending search cryptocurrencies, most visited cryptocurrencies and most voted cryptocurrencies in the market.

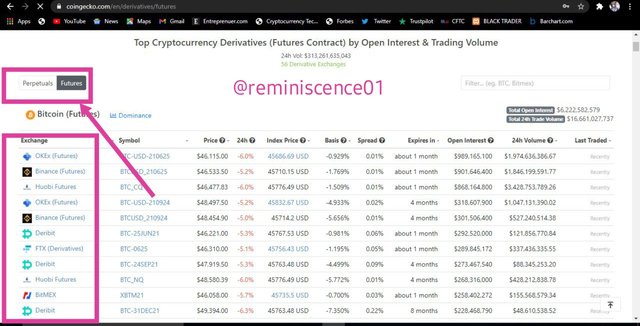

Furthermore, the second section of the CoinGecko market is the Derivative markets*. The derivative market comprises the Perpetuals, Futures and Leveraged ETFs. Users can discover exchanges that trading on Perpetuals, Futures, and **ETFs. Also, currency pairs available for this market can be viewed alongside 24-hour volume, index prices, spreads, open interest can also be viewed under this category.

CoinGecko News

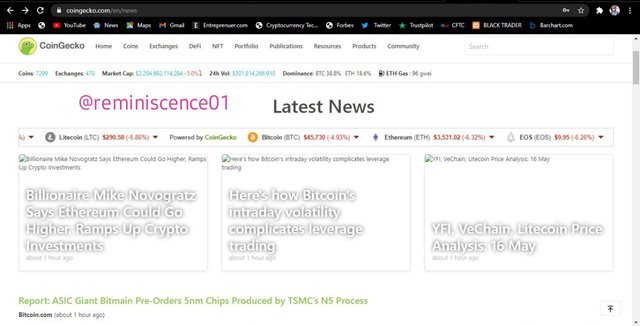

This feature enables users to keep up-to-date with relevant news and information about cryptocurrency. Traders do not only based their analysis on the price of an asset. News and information about a cryptocurrency are necessary as this can create volatility in the market. CoinGecko News provides users news feeds from popular cryptocurrency blog post like Cointelegraph, Coindesk, Dailyhodl, Ambcrypto etc.

CoinGecko Podcast

This is another amazing feature about CoinGecko. The co-founders of CoinGecko host a Podcast and also interview prominent entrepreneur and thought leaders in cryptocurrency. The aim of this podcast is for Blockchain, cryptocurrency and Bitcoin education. The previous podcasts are uploaded and made available for free under CoinGecko Podcast for users to learn more about the cryptocurrency market.

CoinGecko Beam

CoinGecko Beam can be found under the news section. This feature shows published updates on projects, developers, project teams etc. Most cryptocurrency projects share updates about their projects using CoinGecko beam. Users can also filter the beam section based on projects, Events, Exchange listing, Fund movement, New listing, partnership etc.

CoinGecko Buzz

This is another feature of CoinGecko that enable users to learn and get information on the subject that matters to them. This section includes blog post, projects reports and information about cryptocurrencies. Subject matters posted in this question arise due to community interest and raised questions. CoinGecko section is found under the publication tab at the top page.

CoinGecko Books

From the features we have discussed so far, it is no doubt that CoinGecko aims at providing and educating users on valuable information about cryptocurrency. CoinGecko books is another amazing feature on CoinGecko that aim at educating users on Decentralized Finance (DeFi). A well-organized step by step ebook is made available for users who wish to understand and expand their knowledge on Decentralized Finance (DeFi). We all know how the DeFi ecosystem is evolving and users need to have the knowledge of the system to make wise decisions. Similarly, this section also provides ebooks on Bitcoin and cryptocurrency education where users can get their hand on ebooks to learn about cryptocurrency. CoinGecko Books can be found at the publication tab at the top section of the landing page.

CoinGecko Glossary

You can call this section, the cryptocurrency encyclopedia. CoinGecko provides the A-Z meaning of all the terminologies used in the crypto industry. This can include terms like Airdrop, Algorithm, bearish, Altcoins, When moon, pump etc. Users can search for terms they don't understand under this section. CoinGecko Glossary can be found at the bottom section of the publication drop-down menu.

CoinGecko Earn

This feature provides a calculator for users to know the amount of cryptocurrency they will earn by staking their coins on different platforms. With CoinGecko earn, users can calculate the return of investment by putting the amount of coin they want to stake. Different platforms are provided with their APR(%). Also, the security of the platforms is analyzed for users to select the best platform to stake their cryptocurrencies. Coingecko Earn can be found under resources drop-down menu.

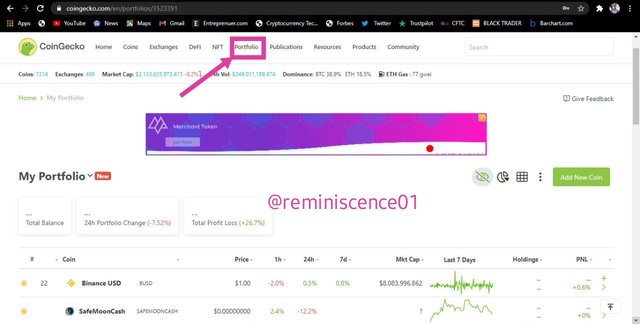

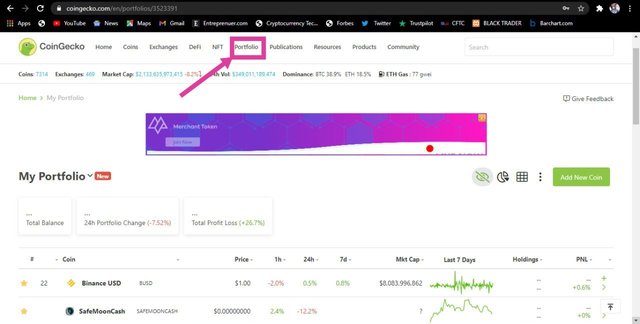

CoinGecko Portfolio

This is a very powerful tool on CoinGecko. This feature provides users with portfolio management tools to keep track of the progress of their investments. Similarly, the portfolio management on CoinGecko provides investment analysis to users by providing the Profit and loss report, 24 hours price change on their portfolio and also the PNL (%) of their investments.

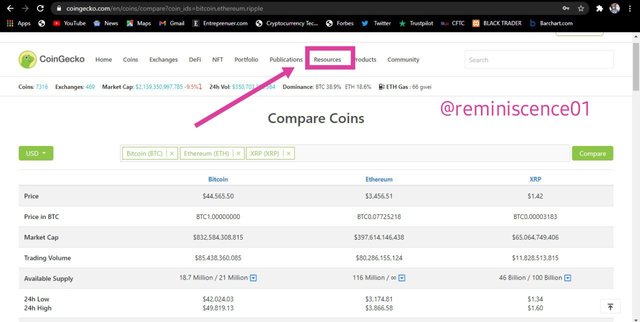

CoinGecko Compare Coins

This feature enables a user to compare two or three cryptocurrencies by providing side by side comparison ranging from price, market cap, trading volume, hashing algorithm, number of trading pairs, number of exchanges, homepage, block explorer etc. This can be found under the resources tab drop-down menu. Then click on Compare coins.

Weekly Price Forecast For Crypto Coin: REEF Finance

About REEF Finance

The DeFi ecosystem has been evolving and constant projects are been developed to better our present day finance. These DeFi platforms offer different financial services which include staking, yield farming, lending and borrowing etc. There are common setbacks among these DeFi platforms which include the inability to interact with other DeFi platforms and liquidity. A user finds who wants to stake and also lend out cryptocurrencies will have to switch in between platforms for these services which leads to high transaction fees. REEF Finance aim at solving these setbacks by developing an ecosystem that will incorporate DApps into a single platform. Here users can be able to interact with several DeFi platforms in one platform where users can access DeFi services like lending, borrowing, staking, yield farming etc in one platform. REEF Finance is built on Polkadot network, and share its cross-chain integration and security that will enable REEF to integrate other DeFi platforms.

Why REEF

The project started in the second half of 2020 and since then, the company is making great efforts and following its roadmap. Similarly, REEF has gotten a lot of attention and has achieved great partner with other DeFi platforms. I believe this project is the future of Decentralized Finance because REEF aim at solving the setbacks encounter in the DeFi ecosystem which includes interoperability, liquidity and high gas fees encountered on Ethereum platforms. Similarly, the platform is highly secured as it shares the PolkaDot security model.

REEF is still developing and has achieved great success within a short of launching it. REEF supports the DeFi protocol on Binance Smart Chain, Ethereum network, Avalanche, Moonbeam, and Plasma. Recently, REEF partnered with Aavegotchi which is one of the creative projects in the NFT space. REEF also partnered with the DEIP network to bring unique DeFi investment opportunities to users on intellectual properties.

REEF has the potential of increasing its market capitalisation as more DeFi platforms adopt the platform. Furthermore, I believe the project value will skyrocket as multiple DeFi users adopt the platform to access a wide variety of other DeFi platforms at ease.

Market Stat of REEF from CoinmarketCap

| Overview | Stats |

|---|---|

| Price at time of writing | $0.038 |

| Rank by market cap | #129 with market cap of $486.24 million |

| Total supply | 15.93 billion |

| Circulating supply | 12.66 billion |

| 24 hour trading volume | $168.76 million |

| Market dominance | 0.02% |

| All-time high | $0.058 |

| All-time low | $0.066 |

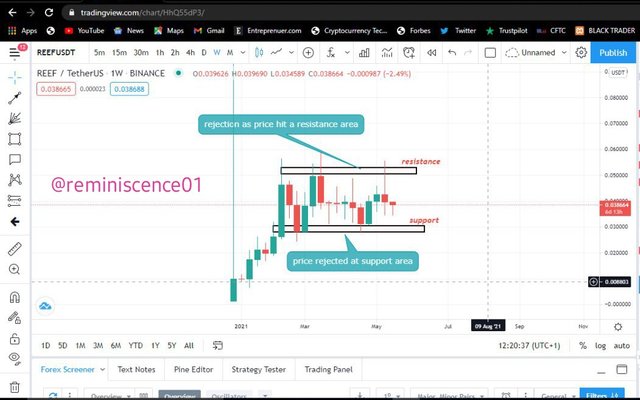

Technical Analysis on REEF

In this section, I will perform technical analysis on REEF using price action, candlestick chart, technical indicator (moving average), Multi-timeframe analysis. This analysis will be carried out on the Tradingview platform.

The chart above shows the weekly chart of REEF/USDT on TradingView. From what we can see, we can see price bouncing off support and resistance levels at $0.053 and $0.03. Price reached an all-time high of $0.053 and came down to form a swing low at $0.03. After that, the price went back up to retest the all-time high which touched $0.058. But we see a resistance at this level as price struggle to go further up. We have been in a range between $0.03 and $0.053 for the past 3 months.

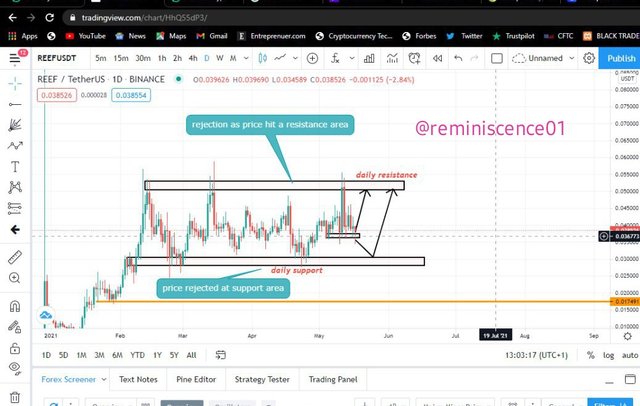

On the Daily chart, we can the range clearly as price have been retesting these strong areas. Currently, the price is approaching the support area at $0.03 and we hope to see a rejection of this area for the price to continue going up. If the current daily candle closes below the open of the previous candle, we will REEF go down further to $0.03 to retest the support.

From the 4 hour chart, we have the price sitting at a support level at $0.036. If this minor H4 support level is broken, that means we will see the price come down to the daily support as stated on the daily chart. But if the price should reject this minor support on H4, we will see the price bounce back up to retest all-time high at $0.054.

Possible Low level for the Next 1 Week

Just like we have analysed on the daily and 4-hour chart, if we price come down and fail to reject the daily support at $0.030, we might see the price of REEF come down further to the $0.017 support area. But if this daily support is rejected, we will have a possible low level at $0.03 before reversal to the upside. I doubt price will break the support as this is a very strong support zone that has been held since 12th February.

Possible High level for the Next 1 week

The possible high level for REEF in the next one week is the all-time high at $0.053. From the H4, the rejection of the minor support will see the price up to retest the resistance at $0.053. For the past 3 months, we have been in a range so I expect the price to retest the previous high level at $0.053 in the next week.

In conclusion, I find reverse strategy as a powerful strategy to take advantage of market reversals after strong price movements. But I think this strategy should be combined with other technical analysis like support ad resistance and candlestick reversal patterns before taking an entry. Also, technical indicators like the RSI can also be used with this strategy to know when the price of an asset is oversold or overbought for potential price reversal.

Furthermore, I recommend CoinGecko platform for users who wish to learn more and obtain information about cryptocurrency projects. CoinGecko provides amazing features which I have explores some of them in this post. This can help users obtain in-depth information on cryptocurrency projects rather than depending on market cap and trading volumes to make trading decisions.

Thank you so much professor @stream4u for this amazing opportunity to learn a new trading strategy.

.jpeg)

.png)

.jpeg)

.jpeg)

Twitter Promotion

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @reminiscence01

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor @stream4u. It is pleasure performing your homework task. I am really making progress in my technical analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice presentation from you.

Reef is one of potential coin. It may durely grow more .

I really like your Technical analysis with Chart explanation. Keep going.

#affable #india

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much. I really appreciate your kind response.

Best regards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit