Hello Steemians, the 4th of Steemit Crypto Academy has come to an end. The week ran from 00:00 UTC on September 26th to 11:59 pm UTC on October 2nd, 2021. It is my pleasure to be your teacher and I also thank you for that opportunity. I will also like to thank everyone who took part in making this week's lesson a success.

In this week's lesson, we extended our knowledge of technical indicators to understand them properly. Technical indicators are powerful technical analysis tools every trader needs to understand before making a good trading decision. However, having adequate knowledge about the use of technical indicators increases your trading success and also helps you minimize unnecessary losses.

We extended our knowledge to the two types of technical indicators which are leading and lagging indicators. Similarly, we also introduced what a trader looks for while trading with technical indicators. Furthermore, we also studied how to filter false signals while using indicators. Also, we introduced divergence as a good technique to filter out false signals and take advantage of market reversals.

The use of confluence trading was also established. Confluence trading also plays a major role in detecting false signals and also gives a trader confidence in his trading decision.

I believe we have covered every section of technical indicators beginners need to make a good trading decision. There are more than 200 technical indicators a trader can capitalize to take advantage of the market. Though indicators are not 100% guaranteed, having a clear strategy and an indicator that suits your trading style can help to increase the success rate of using technical indicators.

At the end of the lesson, we tested the students' understanding of the topic with some assignments. The assignment was a practical one where the students were required to interact and explore their charts. This will help them understand the topic properly and also help them have an effective knowledge of technical analysis.

The homework task aimed at helping the students in the following ways:

- To understand leading and lagging indicators.

- To understand what to look at while trading with technical indicators.

- To understand how to filter false signals from an indicator using Confluence trading and Divergence.

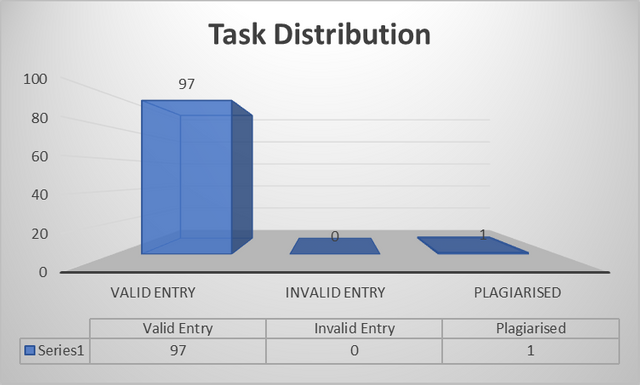

At the end of the week, we had 98 entries. The task distribution is as follows:

- 97 valid entries.

- 0 Invalid entries

- 1 plagiarised/spun contents.

This can be further shown in the chart below.

Grade Statistics

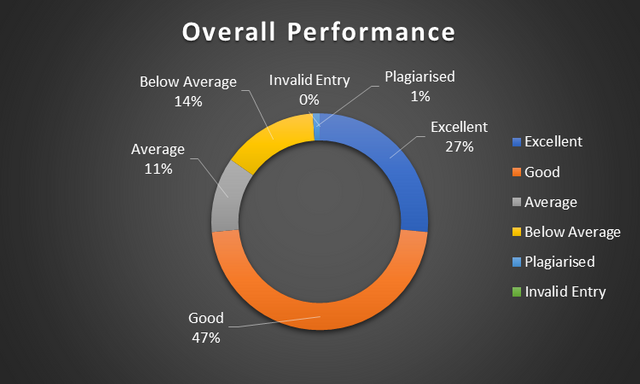

Reference

- Plagiarized content refer to users who copied someone else’s idea without referencing the origin source.

- Below average refer to grades below 5.

- Average refers to grades within 5 and 5.9

- Good refers to grades within 6 and 8.9

- Excellent refer to grades within 9 and 10.

- Invalid is for posts from users who are not eligible to perform the task. Also, late entries are for participants who submitted before the scheduled time which is 11:59 pm UTC, on Saturday, 2nd October 2021.

The chart above shows the overall performance of the students. From the data collected, 47% of the participants scored above grade 9. This result is a great improvement which shows that a good number of the participants clearly understood the lesson before performing the homework task.

Similarly, 27% of the participants scored between grades 6 and 8.9 while 11% scored an average score of 5. Furthermore, 14% of the participants score below average which is not encouraging.

Majority of the participants who performed poorly resulted from the inability to understand the lesson before performing the homework task. Also, most users failed to adhere to the homework guidelines which makes them deviate from the objective of the homework task.

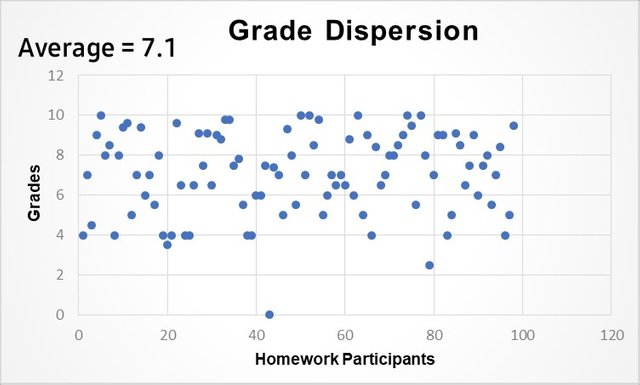

The scatter plot of the grades can be shown below. The average score of this week's assignment is 7.1. This number is quite lower than last week's performance from the students. We encourage everyone to put in more effort to understand the lesson before answering the questions.

Below are the top 3 homework task for this week. I believe they deserve this spot for their outstanding performance in submitting quality content. This was a difficult decision as there was a lot of quality content produced this week.

Top 3 Homework Task

| Username | Homework link |

|---|---|

| @loren0110 | Homework post link |

| @block.kids | Homework post link |

| @cieliss | Homework post link |

Recommendation and Feedback from Homework Task

The general performance on this week's assignment was great. Though the average score was lower than the previous week. 74% of the participants score above 6 which is a good result.

There's a great improvement in writing skills and the use of markdowns compared to the previous weeks. Though some participants are still struggling on that aspect to be better. We encourage them to keep improving their writing skills as this is the criteria for grading the assignments.

There was a lot of confusion from the participants on how to spot divergence on the chart. Only a few numbers of the participants were able to provide a clear chart. I encouraged them to revisit the lesson and get a clear understanding of how to spot divergence as this is a common trading technique to filter false signals while using an indicator.

Majority of the participant failed to adhere to the homework guidelines. The students were instructed not to repeat the same technical indicators used in the lesson. There are more than 200 indicators available for the participants to explore. The reason for this is to help the participants expand their knowledge and not limit their understanding only to the lesson.

All the homework tasks submitted this week met the requirements for the beginners' course and also the rules of the academy. We had only 1 case of plagiarism from participants who copied and gave back the lesson without writing in their own words or referencing the source.

Conclusion

I will like to thank everyone who took part in the lesson. The academy will always aim at educating us on cryptocurrency technology and also how to make a good investment in the crypto market. I recommend the use of stop-loss in trading cryptocurrency due to the highly volatile nature of the market.

The use of indicators and other technical analyses is not enough to guarantee the actual movement of price. Ensure you have proper risk management because anything can happen in the market at any time.

Best regards,

Hello prof @reminiscence01, please you skipped my work and did not grade me. Here is the link.

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit