Hello Steemians, it's a lovely day and a blissful week for us all. Prof @fredquantum looked at another investment strategy in this week's lesson. The study on investment through private and public sales was insightful, and I will be doing the homework task from it.

Question 1: What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

Crypto Investment

Investing is the act of putting resources into an asset to make profits, long or short term. Cryptocurrencies are digital currencies/assets used as a payment system and stores value. Crypto investment is the investment made by investors or traders on crypto assets. There are different crypto investment strategies suitable for different investors as some prefer to invest short term (buy and sell quickly). Others prefer long-term investment (hodling to make a profit).

There are no standard rules to crypto investing, but a few steps are outlined to make the crypto investment safer.

- Research On The Crypto Assets

There is a saying, invest in what you know but that's not always the case. With that being said, it is essential to do research and understand the cryptos the investment is being made on. Investment tools are present to give out important information on the cryptos like use case, ranking, price, market cap, chart analysis, circulating supply, daily trading volume, exchange its listed on, etc. These tools include coingecko, glass nodes, trading views, etc.

- Research Platforms

In crypto investment, an investor needs to research the exchanges they wish to buy and sell cryptos. There are over 500+ CEX and DEX exchanges, and it is paramount to choose the one that best suits your investment strategy needs. Also, there is a great need to know where to store the invested crypto assets as some wallet do not support some crypto, so research on wallets are Important in crypto investment.

- Crypto Assets Diversification

It is always advisable to have a diverse crypto investment portfolio. This is a good investment practice, primarily in the cryptocurrency market that is highly volatile. Diversifying crypto assets mitigates potential loss that can be incurred if an asset investment goes wrong.

- Analysis

An analysis is paramount when making cryptocurrency investments. Technical analysis involves using technical tools to predict the price action of an asset and decide if to invest in it or not. Fundamental analysis is also done as news surrounding an asset has effects on the value of the asset.

Investment Tools

Investment tools are essential when making cryptocurrency investments, and there are a bunch of these investment tools. Outlined below are some of the investment tools that can be utilized when making crypto investments.

- Market Data Tools

Market data tools are investment tools like coinmarketcap, coingecko, etc. These platforms give information on the crypto asset market data like market cap, price, trading volume, circulating supply, etc. In addition, the market data tools also provide an overview of the crypto like dates launched, blockchain, founders, etc. These tools are essential when investing as they give an in-depth understanding of the crypto plus its overall market performance overview.

- Charting Tools

These are tools used for technical analysis, which is vital in cryptocurrency investment. For example, charting tools like tradingview allow investors to make technical analyses using different technical tools and indicators in predicting price actions.

- Trading and Exchanging Platforms

There are trading and exchange platforms like Binance, Uniswap, Kucoin, etc. These platforms are investment tools that allow investors to invest in crypto by making a purchase or an exchange of crypto assets. These are digital platforms with hundreds of assets listed open for investors to trade on.

- Calendar Tools

Events and road-maps of an asset are essential to note when making investments, and calendar tools like coinmarketcal and Coindar are good investment tools. Several events and dates are set in place for assets that trigger a change in value. For example, bitcoin experiences halving, and this brings about an increase in value. Also, there might be a swap, hard fork, airdrop, etc. Calendar tools give investors insights on this event and dates, enabling them to make a more informed investment.

Question 2: Talk extensively about the following. Also, highlight the benefits and risks associated with each.

i. Private Sale in Cryptocurrency.

ii. Pre-sale in Cryptocurrency.

iii. Public Sale in Cryptocurrency.

Private Sale In Cryptocurrency

Private sale is the first phase of an ICO (fundraising). This is the selling of coins privately to investors (usually venture capitalists) by the coin developers or founders without being announced to the general public. The investors are selected or sorted out specifically by the coin owners to fund the development of the coin or project at the early stage in return for the project cryptocurrency.

Investors invest in a project and, in exchange, get the project's cryptocurrency expected to grow in value. The tokens received by the investors are not listed on any exchange yet, and they are given to the investors at a discounted rate, increasing the chance for high profit when the token is made public.

There is usually a set limit to the investment received by the project's founder, and once the limit is reached, the founders stop/close the private sale rounds.

Benefits of Private Sale

- Investors get the coins or tokens at a discounted rate compared to pre-sale and public sale prices.

Investors get to know the founders of this project personally and have the opportunity to buy more tokens compared to pre-sale and public sales.

- Investors are presented with an opportunity to make quick and a possible high return on investments.

Drawbacks of Private Sale

In the case of a poor pre-sale and crowd sale, there will be no rewards

There is no privacy, as founders reach out to the investor and perform a complete detailed KYC (Know your customer).

Some tokens and bonuses might get locked for a set period.

Unable to cash out on the token until it gets listed on an exchange which usually takes months to years from the private sale.

Pre-Sale In Cryptocurrency

Pre-sale is a fundraising activity done before the public sale whereby founders of a coin get investors to invest in the project to help finalize the project's development in exchange for a discounted price of the project cryptocurrency. This sale round is not advertised and made open to the general public compared to the public sale round, but the information about it is not kept private like the private sale round.

Information about the pre-sale is usually on the project's official website and crypto launchpads.

Considered the Second Phase of an ICO, the pre-sale gets investors to commit their funds or assets in exchange for the project token. Project founders do this to raise the necessary funds required to finalize the project and create awareness about the upcoming ICO.

Benefits of Pre-Sale

Investors get the project token at a discounted rate when compared to that of the public sale.

The discounted rate allows pre-sale investors to make quick and huge profits during the project token ICO

Invested funds are used by the project developers to finalize the project development.

Drawbacks of Pre-sale

Investors tend to invest more than crowd sale investors because there is a higher minimum investment level.

Liquidity of token is not possible until ICO

Success of a pre-sale does not guarantee a successful ICO

Public Sale In Cryptocurrency

Also known as the Crowd sale in cryptocurrency, developers or founders of a project called on the general public to invest in their project by buying the token of the project. This is the last phase of the ICO, whereby fundraising is done, and it's bigger than the previous phases of the ICO with respect to investors reached.

The public sale is the general awareness and fundraising event before a coin is listed on exchanges. Considered the most critical aspect of the ICO as it is the coin path to success. Investors, or in this case, the general public, gets to invest in the project just before it gets listed on exchanges at a lesser discounted rate when compared to the private and pre-sale rates. Also, it's a less risky investment because the success of the ICO can be predicted from the result of the previous ICO phases.

There is no minimum limit on the amount to invest, except for the token value.

Benefits of Public Sale

The investment risk involved is lesser as the project is developed and almost ready to be listed on exchanges.

The outcome of the ICO can be predicted from the results of the previous phases. This allows the investor to make a more informed investment decision.

Liquidity is present as trades can happen between investors. Also, the listing of the token on exchanges takes less time.

The KYC process is less rigorous as investors on the public sale round do not need to be accredited.

Drawbacks of Public Sale

Tokens are sold at a lesser discounted rate

Tokens usually get dumped by private sale and pre-sale investors affecting the value of the token and the success of the ICO

Public sales might get canceled if the investment target for the ICO I reached during the pre-sale.

Question 3: What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

Mediums used for Private/Pre/Public Sales

There are platforms used as a medium for cryptocurrency private/pre/public sale outlined below.

Project’s Websites

During the different phases of a project ICO, there is a need for a designated website for ICO. In addition, various information about the ICO and the project purpose and use case is needed.

On the website, investors can exchange their Fiats or other supported cryptos (like BTC, BNB, USDT, ETH, etc.) to get a percentage of the project token with respect to the price of the token issued by the project founders. The phase of the ICO determines the price of the token as well as the investment cap limit.

Crypto Launchpad

These platforms list crypto projects at their early stage before they become mainstream for investors to invest in or participate in their fundraising activities.

Used mainly by crypto exchange platforms to perform Initial Exchange Offering or Initial DEX Offering for new projects. There are several crypto launchpads, and a few of them are listed below.

Binance Launchpad

The Qube Launchpad

The Red Kite Launchpad

TrustSwap Launchpad

Unicrypt Launchpad

For example, Qube Launchpad is a DApp fundraising platform that allows users with a new project to use its features to conduct IDO. Investors can also find new projects at their early stage and invest in them.

Direct Contact

The project's founders meet up with prospective investors (usually during the private sale) and convince them to invest in the project, and in return, get the project crypto at a much-discounted rate. This approach solidifies the strength of an investor's belief in the project as they get to ask questions not available to the public and feel like a part of the process.

Question 4: · Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded).

Mina Protocol Overview

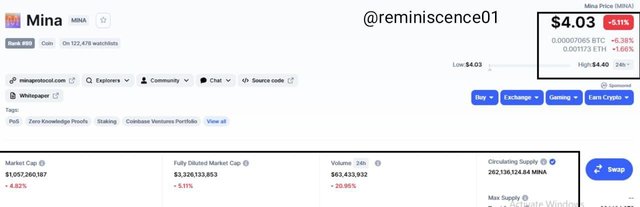

Mina Protocol is a succinct blockchain with a constant size of 22kb no matter the growth in usage, considered the world lightest blockchain. Furthermore, Furthermore, Mina is highly secure and decentralized, built to limit the requirements to develop and run a Dapp.

Initially named Coda Protocol, the blockchain was rebranded to Mina Protocol. Mina protocol aims at achieving an efficient decentralized distributed payment system. Mina Protocol uses a cryptographic function zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge) to verify transactions.

Mina uses a Proof of Stake mechanism called The Ouroboros Samasika explicitly designed for succinct blockchains. Every user on the Mina Protocol is considered a verifier as long as their device can support a 22kb chain, and block producers are stakers who stake their coins for a chance to produce blocks.

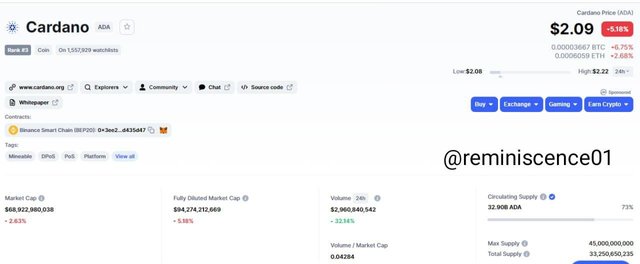

Mina has a native token called MINA currently priced at $4.03, with market capitalization at $1,057,260,187, 24h trading volume at $63,433,932, and circulating supply at 262,136,124.84 MINA

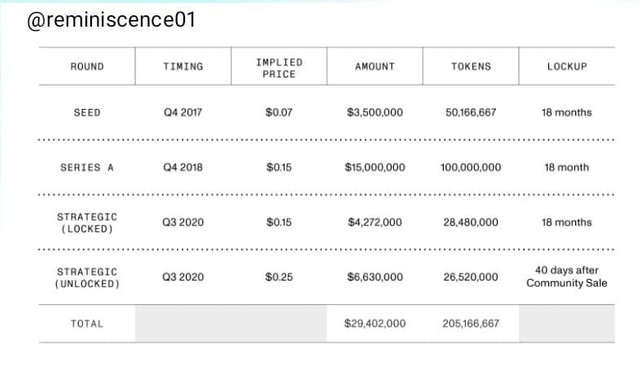

Mina had its ICO on the 13th April 2021 after a series of private sales that span 4 years. Data as shown on the mina protocol blog

Mina had 4 rounds of funding before the ICO spanning 4 years with over 205 million tokens sold on private/pre-sales.

75 million tokens were sold on the day of the initial coin offering representing 28% of the total token with a price placed at $0.25. The Mina ICO had an investment cap of $1000 as shown below.

Question 5: Create an imaginary token. Write about the project, including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1). Note that: You are expected to explain what the funds are intended to be used for, your Private sale should have 3 stages and specify the initial supply available and the price you are issuing the token in each stage. Also, specify the price you are issuing the token at the Public sale phase (including the supply).

Xmarr Token (XMR)

Xmarr is a Dapp game that mimics the Italian Mafia syndicates, where players are rewarded for their game performance and overall engagement on the platform. Game characters, gears, and collectibles are NFTs that can be traded on the game's in-app marketplace.

Built on the Binance Smart Chain contract, Xmarr is an engaging game that doubles as a passive income source for players as they get rewarded for progress made in the game.

Xmarr gameplay will have players join factions and families to reign supreme in their district, with tasks attracting rewards like an upgraded mansion, associates, soldiers, and babes. Xmarr also creates a social network with the chat features subdivided into sections that include but are not limited to personal, faction, city, and worldwide chat.

Xmarr has a governance token called XMR that allows players and holders of the token to vote on the game's development, stake their tokens for rewards, and transact on the platform using the XMR token.

There is a need to optimize the user experience and improve the game's gameplay from lagging by employing expert engineers in blockchain development.

These issues can be solved through funding as there is an estimated investment target of $10 million and a max cap of $15 million

With a Total supply of XMR capped at 205 million XMR (205,000,000 XMR).

First Private Sale Stage

Timing = July 2021

First Private Sale Stage Token Price = $0.035

Allocated Tokens = 50,166,667 XMR

Funds Raised = $1,755,833.345

Second Private Sale Stage

Timing = August 2021

First Private Sale Stage Token Price = $0.075

Allocated Tokens = 100,000,000 XMR

Funds Raised = $7,500,000

Third Private Sale Stage

Timing = September 2021

First Private Sale Stage Token Price = $0.075

Allocated Tokens = 28,480,000 XMR

Funds Raised = $2,136,000

The total funds raised was $11,391,833 above the minimum target but below the max requirements needed. As a result, a total of 178,646,667 XMR tokens was sold during the 3 private sale stages, accounting for 87.14% of the total supply.

A public ICO was held to meet the max targeted funds, putting the remaining 12.86% of the total supply for sale.

Public Sale of Xmarr Token

Timing = 12TH October 2021

First Private Sale Stage Token Price = $0.137

Allocated Tokens = 26,353,333 XMR

Funds Raised = $3,610,406

The Max targeted investment of $15million was actualized. Development has been made, and the Xmarr token XMR is listed on CEX and DEX platforms. For example, Binance, Pancakeswap, Gate.io, etc.

Question 6: What are the criteria required for listing a token on CoinMarketCap. Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

Coinmarketcap Token Listing Requirements

For a Token or crypto asset to be listed on the coinmarketcap platform, they have to meet the following requirements. Informations sourced from the coinmarketcap support page

The crypto-assets must have leveraged cryptography, a consensus mechanism on a blockchain, and/or a smart contract. In addition, the crypto-assets must function as one or all of the following; store of value, medium of exchange, unit of account, and decentralized application.

The crypto-asset must have a functional website and a block explorer to track transactions or see block details.

Must be traded publicly and actively on at least one (1) exchange (with material volume) that has tracked listing status on CoinMarketCap.

Provide a representative or a liaison from the project with whom coinmarketcap can establish open lines of communication for any clarifications.

Projects that do not meet up with the criteria may be placed on the untracked listings. There are also some House rules that needs to be adhered to, and they include;

Submission of forms are to be done online only

Spam requests or repeated request forms are frowned at as they increase the queue of requests to be attended to, creating a delay

Coinmarketcap listing is free, and payment of fees or lobbying is not accepted.

Centralized Exchange (CEX) Token Listing Requirements

There are requirements for a token to be listed on CEX, and each exchange has different criteria. I will be looking at Binance criteria for token listing. Information gotten from binance

Update your project progress to the community and us regularly (i.e., weekly or monthly). This is required even after listing on Binance;

Incorporate BNB/BUSD into your ecosystem and/or raise BNB/BUSD during your fundraising phase;

Support Binance in your community.

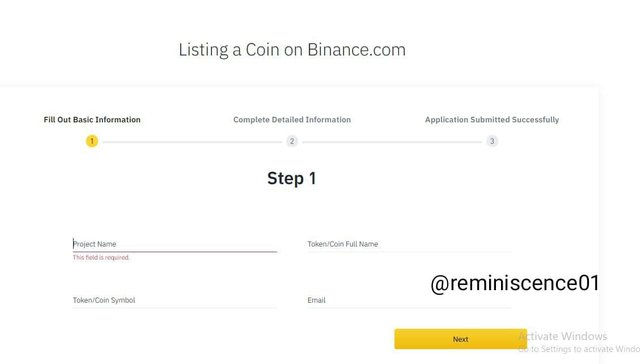

After meeting with the requirements above the founders of the token needs to submit the application form for listing following the given steps below.

Step 1: fill out the basic information about the project and token like, project name, token name, token symbol, and email address.

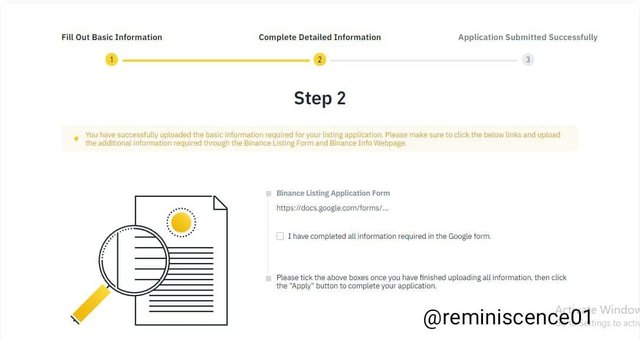

Step 2: Submit the filled binance listing application form and click on the boxes

Step 3: the application is submitted

Conclusion

The ICO stages private/pre/public sale are fundraising stages done by crypto founders or developers to give investors a chance to get in on the crypto assets before it becomes listed on exchanges at a discounted rate.

When investing in cryptocurrency, the investor needs to understand the asset he is investing in through investment tools like coinmarketcap, tradingview, glass node, coindar, etc. Therefore, investment tools are utilized to make better and more informed investment decisions.

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 24 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 5 SBD worth and should receive 31 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePigDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit