Hello Steemians, I welcome you all to the first week of season 6 in the Steemit Crypto Academy. Today, we will be looking at the lesson delivered by professor @pelon53 on Starting Crypto Trading. The lesson covers some important aspect of the crypto market which includes support and resistance level, Japanese candlestick patterns. I will be submitting my homework task in this post.

Fundamental Analysis

The financial market is constantly fluctuating and moving in trends. The price movements are affected by a lot of factors which can be positive or negative for a given asset. For instance, the value of countries currency can be affected by the economic activities, interest rate, GDP, the unemployment rate of the country. Traders however utilize this information to predict the future prices of the currency pair.

There are many ways traders carry out analysis in the market. In this section, I will be discussing the Fundamental analysis as one of the key methods of analysis in the financial market. Fundamental analysis also known as macroeconomic analysis is a type of analysis that focuses on economic events or other important factors that affect the supply and demands of a crypto asset. Fundamental analysis is the most important type of analysis which determines whether an asset will turn out positive or negative.

In the forex, stock market, and the commodity markets, economic events like the interest rate, unemployment rates, GDP, financial news, Central Bank policies, etc, are the fundamental activities that affect the supply and demand of an asset. Traders focus on the fundamental analysis as they majorly cause high buying and selling pressures in the market. For example, a report of a high unemployment rate of a country will lead to selling pressure in the currency pair.

Fundamental analysis in the crypto market is similar to that of the forex and stock market. But there are other fundamental events cryptocurrency traders focus on to predict and make analysis on a crypto asset. These fundamental events play major roles in determining the future prices of crypto assets. These include the following:

- Cryptocurrency partnership with major brands.

- Exchange listings Announcement.

- Burning of coins to reduce its supply.

- Network Upgrades.

Let's take for example the fundamental event that happened this morning in the crypto market. Around 3:22 am today, Binance announced the listing of WOO Network(WOO) on their exchange. This announcement alone spiked a buying pressure in the price of WOO coin to +20%. The chart can be seen in the screenshot below.

Fundamental analysis is very important for a trader especially in a highly volatile market like the crypto market. Traders can focus on fundamental analysis as it plays a major role in the supply and demand of crypto assets. Fundamental analysis helps long-term traders to have an umbrella to rely on the positive outcome of an asset. Even during daily price fluctuations and panic in the market, the fundamental analysis gives traders confidence in the future performance of a crypto asset. One negative thing about fundamental analysis is that it doesn't reveal key price information and traders' psychology in the market.

Technical Analysis

Technical analysis is another type of analysis in the financial market. Unlike fundamental analysis that focuses on financial and economic events on an asset, technical analysts rely on historical price data points of an asset. The idea of technical analysis is that price movement is a result of the emotions and psychology of traders. For this reason, price moves repetitively and being able to analyze past price data will help in predicting the future prices of an asset.

Technical analysis includes the use of charts, volumes, price movements, technical indicators to predict the future price of an asset. These tools help traders to find quick exit and entry opportunities in the market, identify price trends, and also the volatility in the price of an asset.

Looking at the screenshot above, we have a technical Japanese candlestick chart that forms the basis of all technical analysis. Here, traders can predict future prices by analyzing historical price movements. Looking at the chart, we can see support and resistance levels drawn on the chart. These levels represent areas of previous demand and supply on ADA/USD which can be used to predict the reaction of price when it comes back to this area. Also, can analyze the candlestick chart patterns to find entry and exit opportunities in the market.

Technical analysis is helpful to traders as it helps them to find key price information before making any trading decisions. Similarly, technical analysis helps traders in making good trading decisions and also in proper risk management. Traders can find entry opportunities by analyzing the charts and finding areas of stoploss and profit-taking in the market.

Difference between Technical and Fundamentals Analysis

In the previous sections, we have discussed fundamental and technical analysis. Let's look at the key difference between these two types of analysis in the financial market.

- Fundamental analysis focuses on the economic and financial events of an asset. Whereas, technical analysis focuses on historical price data points to determine the present and as well predict future prices.

- Fundamental analysis uses data from economic and financial reports like interest rates, GDP, unemployment rates, CBN policies, etc. Whereas, technical analysis focuses on historical price data points like volumes, chart patterns, indicators, price action, etc.

- Fundamental analysis plays a major role in investment decisions and long-term trading. Whereas, technical analysis is most used by short-term traders who wish to make quick trading decisions by analyzing the charts.

- In fundamental analysis, decisions are made based on the economic and financial information released about an asset. Whereas, in technical analysis, trading decisions are based on the analysis carried out in the chart or trading signals gotten from technical indicators.

- Also, fundamental analysis focuses on the true intrinsic value of an asset which doesn't give investors the right time to purchase an asset. But technical analysis is focused on finding the best time to purchase the underlying asset and also the right time to take profits.

Though these two methods of analysis are different in objectives and mode of data collection. Traders can combine both technical and fundamental analysis to make good trading decisions.

Executing a Sell Order in the Cyprocuurency Market Using Support and Resistance

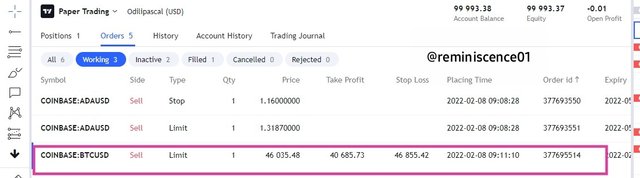

In this section, I will be carrying out a technical analysis on BTC/USD using a 1hour timeframe. This analysis will be carried out on Tradingview.com and a sell position will be executed on paper trading.

BTC/USD Sell Order

Looking at the BTC/USD chart below, I have identified areas of support and resistance where there were major buying and selling pressures. On the chart, I notice that price is almost at a resistance point after breaking a support level at $40685. Normally, price is expected to get rejected at a resistance level. For this reason, I took a sell limit order at the resistance. Stop loss for this trade will be above the resistance and take profit will be the nearest support at $40706. The details of the trade are shown below.

Executing a Buy Order in the Cyprocuurency Market Using Support and Resistance

In this section, I will be carrying out a technical analysis on ADA/USD using a 4hour timeframe. This analysis will be carried out on Tradingview.com and a buy position will be executed on paper trading.

ADA/USD Buy Order

Looking at the ADA/USD chart below, I have identified areas of support and resistance where there are major supply and demands on ADA. From the chart, I noticed that price broke the resistance level at $1.213. Normally, price is expected to get rejected or reversed when it gets to a resistance level. But in a strong buying market, price can break the resistance to continue the bullish movement.

The break of the resistance signals a strong bullish movement in the price of ADA. I took a buy order with a stop loss placed below the broken resistance. Take profit for this trade will be set at the nearest support at $1.321. The transaction detail on paper trading is shown in the screenshot below.

Understnding 'Hanging Man' and 'Leaking Star'

Before I talk about these two candlestick pattern, let me give a brief explanation of candlestick patterns. Candlestick patterns are important technical analysis tools in the market that helps to explain the interaction between buyers and sellers. The formation of the candlesticks is a result of buying and selling pressures on a crypto asset over time. With this information, traders can determine which side of the market is in control of price. Also, the candlestick chart patterns can be used to determine price reversals and continuations in the market.

Hanging Man

The hanging man is one of the most important Japanese candlestick patterns which plays a major role when formed at the top of an uptrend. The hanging is a single candlestick with a long lower shadow and a short body. The hanging man is formed when the open and close of a candlestick is almost at the same price with a long lower shadow.

The psychology behind the formation is that when price opened sellers pushed price down. After some time, buying pressure entered the market to push price back up and finally closes almost at the opening of the candle.

Hanging man signals a bearish reversal during an uptrend. It tells traders that the current trend is weak and a possible reversal might occur anytime. Traders often look for a sell position when the hanging man is formed at the top of the trend. Example of the hanging man on the chart.

Shooting Star

The shooting star is almost the opposite of the hanging man. The shooting star is a single body candlestick with a small body and a long upper shadow. The shooting star is a strong bearish reversal when formed during an uptrend.

The psychology behind the shooting is that the candle opened with a bullish momentum which pushed price up. After some time, selling pressure entered the market to push price down by closing almost at the candle open. This signals a selling pressure which tells traders that a reversal is expected.

An example of a shooting star on the chart is shown below.

Though these candlestick patterns works often in determining price reversals, they work efficiently when combined with other technical analysis tools. For example, the formation of a shooting star at a resistance level is a strong bearish reversal signal.

Conclusion

Trading in the financial market requires some form of expertise and traders make use of any available tools to make good trading decisions in the market. We have discussed fundamental and technical analysis in this study. These two methods of analysis play important roles in evaluating and predicting price movements. Traders can adopt both analysis in their trading strategies for an effective trading experience.

Furthermore, Candlestick patterns are an important aspect of technical analysis which plays a key role in spotting price reversals in the market. However, traders can combine these patterns with other technical analysis tools to boost the efficiency of their trading system.

Note: All images used in this post are my personal charts copied from Tradingview, unless stated otherwise.

Thank you @pelon53 for this amazing lesson.

A beautiful piece boss @reminiscence01.... I'm already missing your teachings and the academy hence I am not eligible to participate😢

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm sorry about that. You are almost close to rep 60 which is the eligibility status to participate in the homework tasks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All the best to your homework tasks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit