Hello Steemians, I hope you all are doing amazing? This week lesson by prof @imagen was centered on yield farming present in Defi platforms. So I will be doing the homework tasks present in this lesson.

Question 1: Describe the differences between Staking and Yield Farming.

Decentralized Finance (Defi) refer to platforms or network built on blockchain technology. The growth of Defi has been astronomical in the past year with mass adoption from different finance sectors. Developers of Defi platforms keep looking for ways to provide passive income with fewer risks than crypto trading and have come up with options like mining, staking, yield farming etc. Staking and yield farming are quite similar with their differences stated below.

Staking

The concept of staking started with the Proof-of-Stake consensus mechanism whereby nodes stake the blockchain native token to validate transactions. The stake assets are locked for some time and can not be accessed. Staking is done to improve the safety of the blockchain, so the higher the stake, the safer the blockchain.

The growth of Defi in the past year has brought about platforms that offer its users the option of staking their asset without having to be a node and go through the process of verifying transactions and earning an Annual Percentage Rate (APR)

Yield Farming

Yield farming is an option for crypto traders to lend their crypto to the Defi platform to add liquidity to the asset for a given percentage return. One of the challenges faced by DEX platforms is low liquidity; hence they rely heavily on investors to lend their assets to add liquidity. The investor who adds to the liquidity gets rewarded. As a result, different liquidity pools have different Annual Percentage Yields.

Difference between Staking and Yield Farming

| Staking | Yield Farming |

|---|---|

| Staking is done to improve the security of the blockchain built on the proof-of-stake algorithm and verify transactions on the blockchain | Yield farming is done to add liquidity to the asset on the platform. Also, yield farming is done to lend crypto assets on platforms that offer lending and borrowing services. |

| Staking rewards are received from the blockchain as a reward for generating blocks | Yield farming rewards are received from the liquidity pool APY |

| Assets staked are locked for a period. | In yield farming, assets can be withdrawn at any time. |

| APR received of the Staked assets is not high, and it usually falls between the 5 - 20% | APY received from yield farming can go as high as 100% depending on the liquidity pool |

Question 2: Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options). Show screenshots

Yearn Finance

Yearn Finance is a Defi platform built on the Ethereum blockchain that offers users the opportunity to lend their crypto assets and earn rewards. The yearn finance platform uses an algorithm that checks for the most profitable lending service such as Aave and Compound and uses the assets deposited and converted to Tokens and lend on those services.

The yearn service also rebalance in other to maximize profit. Launched in 2020 by South African developer Andre Cronje. Yearn Finance launched its governance token in July 2020, and it's listed on coinmarketcap. Yearn Finance is a Defi smart contract that offers automated services and products for platform users to earn passive income.

There are a couple of features on the Yearn Finance, and these features are explored below.

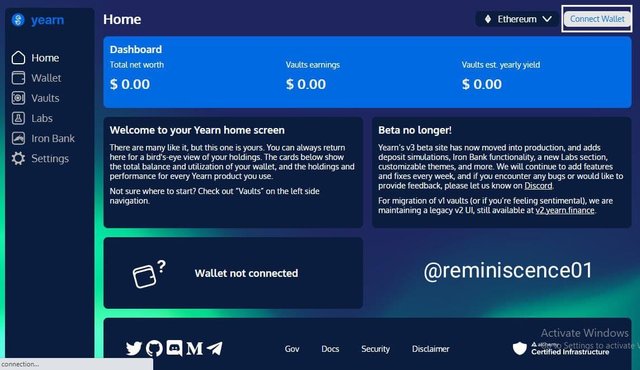

Connect Wallet

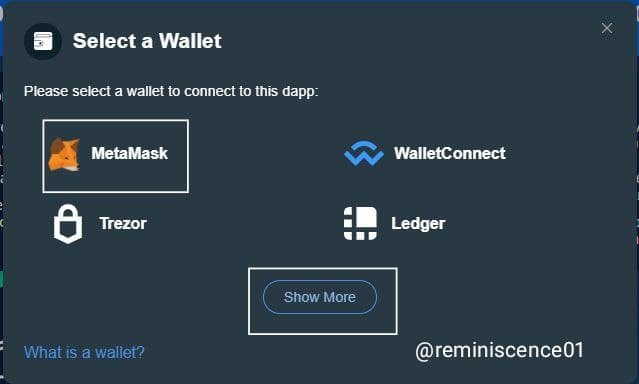

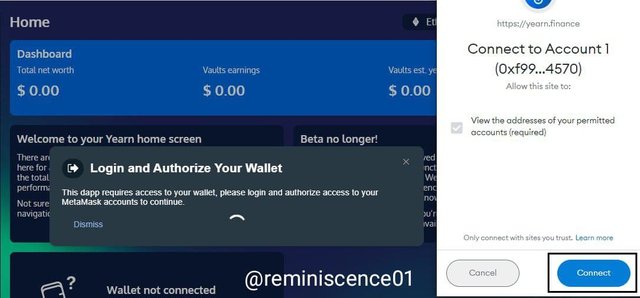

On the Home page of the Yearn Finance platform, click on Connect to Wallet. A pop up with a list of supported wallets will appear. I choose the Meta-mask wallet.

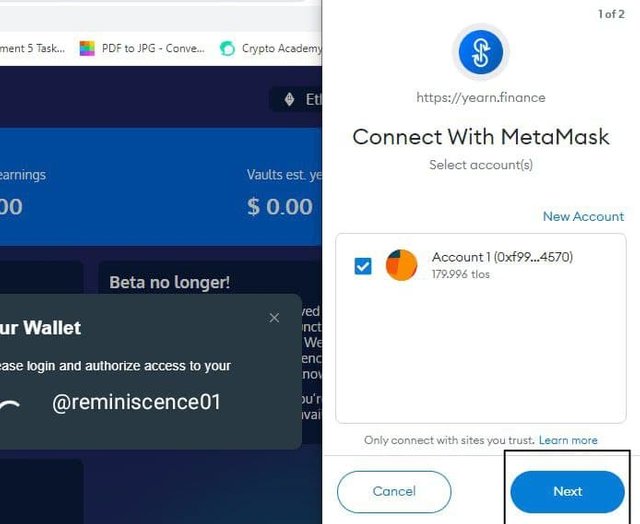

After clicking on MetaMask, my metamask web extension opens to start the connection process. Click on Next

Click on Connect

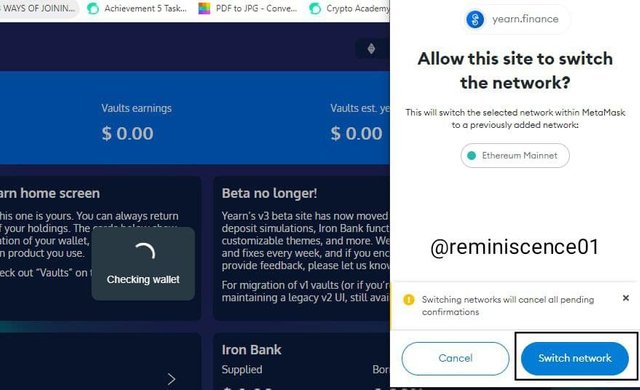

Metamask wallet requested a switch of the network to Ethereum. I click on Switch Network

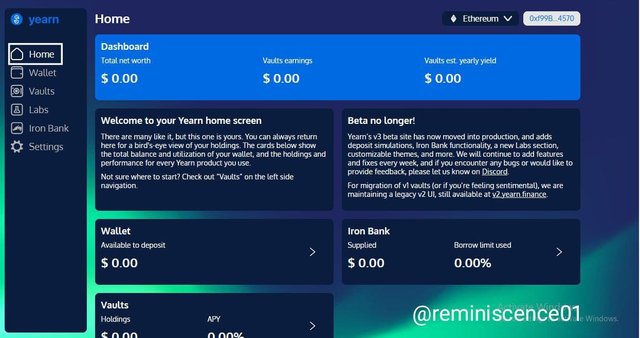

The Metamask wallet is connected to the Yearn Finance Defi platform.

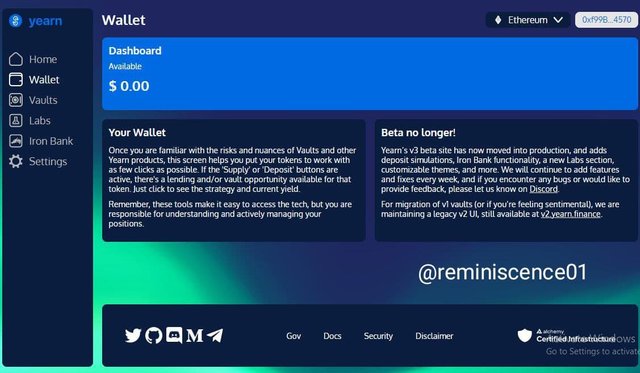

Wallet

The wallet feature shows the available balance in a users wallet, and from the wallet feature, the user can decide to run operations. In addition, there is to be a supply and deposit button that will allow users to lend or vault their tokens.

Vault

The vault feature on the yield finance platform allows its users to take advantage of its new technology. The users deposit their token, and this technology manages their tokens and help maximize the yield by shifting capital, auto-compounding, and rebalancing. The vault feature helps users make passive income by yielding their tokens on different platforms liquidity pools with the highest APY. Using a strategy that best suits each user. The asset can be withdrawn at any time by the user.

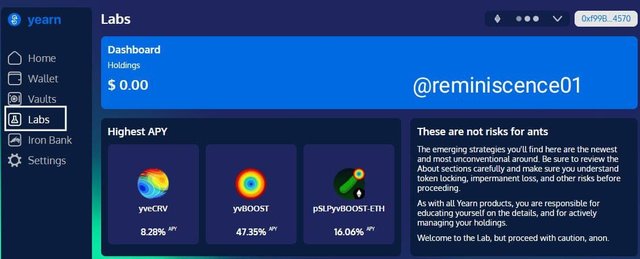

Lab

The lab feature on the Yearning Finance requires a bit of mastery of the strategy as they are unconventional and other factors and risks such as token locking and impermanent loss. Therefore, users are advised to proceed with caution when investing in the lab feature.

Iron Bank

The Iron Bank feature on Yearn Finance has the supply and borrowing option. The supply feature allows investors to supply tokens not present on the vault feature and earn rewards. The borrow options allow users to borrow using their crypto as collateral.

Question 3: What is collateralization in Yield Farming? What is function?

Collateralization In Yield Farming

As in conventional and banking and Finance, borrowing or taking loans comes with a demand for collateral. In Defi yield farming, Collateralization is the demand for collateral from the Defi platform from which one is borrowing from or taking a loan. This collateral acts as insurance for your loan and can be liquidated by the Defi platform if the asset used as collateral value drops below the set threshold.

The collateralization ratio can go as high as 750%, depending on the Defi platform. Most platforms use the concept called over-collateralization, that's for every $100 in asset borrowed, the collateral will have to be worth $750.

The Function of Collateralization is to help keep the platform safe from liquidation or make it liquidation free.

Question 4: At the time of writing your assignment, what is the TVL of the Defi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

The TVL of the Defi Ecosystem

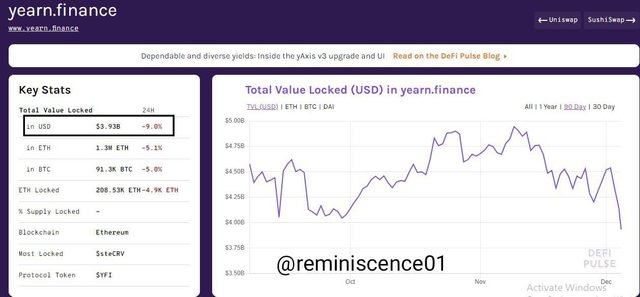

A few platforms update on the Total Value Locked (TVL) of the Defi Ecosystem, as this is a good way to check on the growth and strength of the Defi ecosystem. The platform Defipulse.com will be used to check the TVL of the Defi ecosystem for this task.

From the data got from Defi pulse, the Total Value Locked TVL of the Defi ecosystem is given as $96.23 Billion

The TVL of the YFI Token

The Total Value Locked TVL of Yearn Finance as shown on Defi pulse is given as $3.93 Billion

The Market Cap / TVL ratio of the YFI token

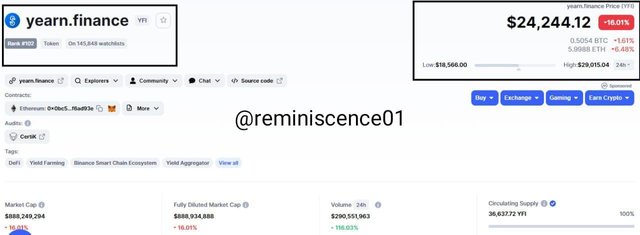

The YFI token has a price of $24,244.12 and Market cap of $897,691,665 as given by coinmarketcap.com.

YFI Market Cap = $$897,691,665

YFI TVL = $6,905,420,547

The Market Cap / TVL Ratio of the Yearn Finance

= $897,691,665 / $6,905,420,547 = 0.129

Question 4.1: The YFI token, is it overvalued or undervalued? State the reasons.

The YFI token is Undervalued

The Market cap / TVL ratio shows if an asset is overvalued or undervalued. For example, if the Market cap / TVL ratio is given to be above 1, then the asset is overvalued, and if the Market cap / TVL ratio is below 1, then the said asset is undervalued.

The Market cap / TVL ratio of the YFI token is given as 0.129, which is way below the threshold of 1, making it undervalued. YFI token has a TVL value of $6,905,420,547 (as of this writing) according to coin market cap with a market cap of $897,691,665, showing a great disparity in the usage of the platform token by active users and the valuation of the token itself. Nevertheless, the YFI Market cap / TVL ratio showing a grossly undervalued asset indicates that it may have good future growth.

Question 5:If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the performance of your investment today? Explain the reasons.

Value of YFI token and Bitcoin On August 1, 2021

To check for the value of the YFI token and Bitcoin, I will be using the coin market cap price charts.

The price of the YFI token on August 1, 2021, was $32,391.07

The price of Bitcoin as of August 1, 2021, was $40,861.75

Current Value of YFI token and Bitcoin

The current price of the YFI token is given as $24,202.01

The current price of Bitcoin is $47,989.45

YFI Token Performance

Price as at Aug 1 2021 = $32,391.07

Current Price = $24,202.01

There was a decrease in value.

Percentage decrease = [($32,391 - $24,202.01) / $32,391.07] x 100

= 25.28%

If an investment of $500 was made on the YFI token on August 1, 2021. the value of the investment today would be

= $500 x 25.28% = $126.4

= $500 - $126.4 = $373.6 will be the present value of investment.

The YFI token experienced a 25.28% decrease in value and, as such as performed poorly.

Bitcoin Performance

Price as at Aug 1 2021 = $40,861.75

Current Price = $47,989.45

There was an increase in value.

Percentage increase = [($47,989.45 - $40,861.75) / $40,861.75] x 100

= 17.44%

If an investment of $500 was made on Bitcoin on August 1, 2021. the value of the investment today would be

= $500 x 17.44% = $87.2

= $500 + $87.2 = $587.2 will be the present value of investment

Bitcoin experienced a 17.44% increase in value and, as such as had a good performance.

Question 6: In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

Risks Of Yield Farming

As much as there is a lot to gain in yield farming, it comes with some risk. One of these risks of yield farming is its complex nature as it is not straightforward, especially the high profiting strategy. It also requires those with expertise and huge capital to venture in to avoid loss. In addition, some terms and strategies require perfect understanding to avoid loss or prepare for the given risk. For example, token locking and impermanent loss are present in yield farming.

Unlike staking that is done on a blockchain and helps secure the blockchain, yield farming is done on smart contracts, and most smart contracts are prone to hacks which might lead to the permanent loss of funds due to the immutable nature of blockchain the smart contract was built on.

Conclusion

Defi is the new rave of cryptocurrency, and with it comes lots of opportunities to make passive income. Yield farming is one of the new ways to earn crypto by lending your crypto assets to add to liquidity pools or deposit it on platforms that offer lending services and earn from the fee charge and interest rate.

Yearn Finance is a Defi platform that helps its users find the most profitable lending platform and maximize their profit while still giving the user full control and responsibility of their assets

Thanks, prof @imagen, for this fantastic lesson.