Hello Steemians, I welcome you all to another amazing week in the Steemit Crypto Academy. In this lesson, we were introduced to Zethyr Finance which is a DeFinapplication built on the Tron network. The rapid growth of DeFi cannot be overemphasized as new projects keep evolving to fix the pitfalls in the traditional financial system. I have taken the amazing lesson by professor @fredquantum and it is in my interest to participate in the homework task.

Zethyr Finance

The DeFi ecosystem is growing rapidly in the crypto market with over $9.1 billion traded every day across all platforms. Zethyr finance is a DeFi app built on the Tron network to enable users to borrow and lend their crypto assets to earn passive income. Zethyr enables users to borrow and lend Tron assets like TRX, WIN, BTT, USDT. The lending feature is done on the platform through the supply section. Similarly, users can also borrow Tron assets through the borrow feature of Zethyr.

Zethyr finance also features a DEX (decentralized exchange) which enables users to swap Tron assets in the platform at the best rate and also at a zero transaction fee. This is a different feature in other lending platforms as this will save time and fees required to move an asset from one platform to another.

Features of Zethyr Finance. Understanding DEX aggregator

In this section, I will be explaining the features of Zethyr finance platform available to users. These includes:

Lending/borrowing

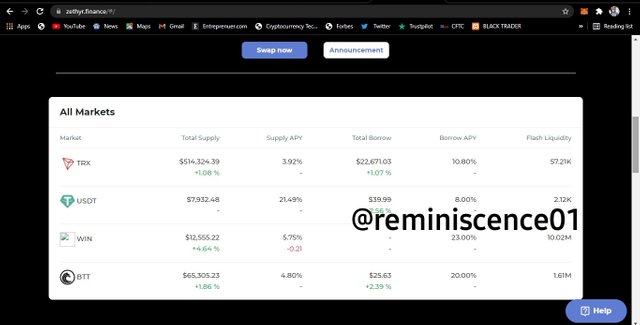

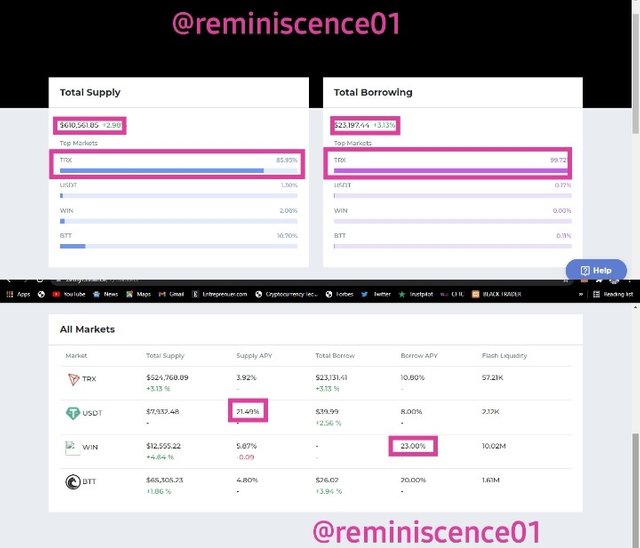

Lending and borrowing are some of the important features of Zethyr finance which allows users to lend out their crypto assets to earn interest in APY instead of leaving their crypto assets in their wallet. Also, users can borrow assets for investments purposes and other urgent needs. The screenshot below is the lending and borrowing market with the different assets available and also the APY attached to lending and borrowing them.

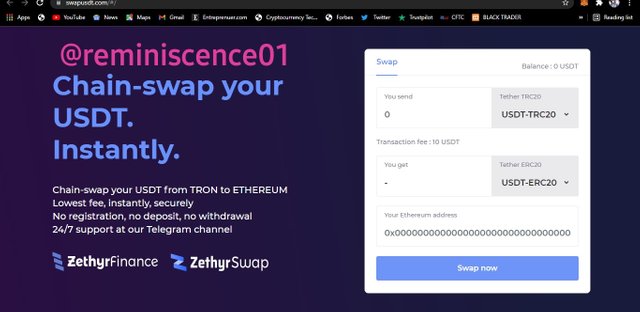

Cross-chain Stable Swap

This is another amazing feature of Zethyr finance which allows cross-chain swap of stable coins between Tron and Ethereum network. Users can be able to swap USDT from Tron to Ethereum network at a low transaction fee. This is beneficial as no form of registration or delay is encountered in the cross-chain stable swap. A screenshot of the Zethyr finance cross-chain swap landing page is shown below.

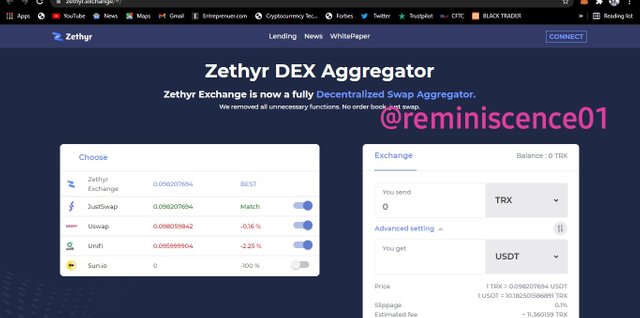

Zethyr Exchange

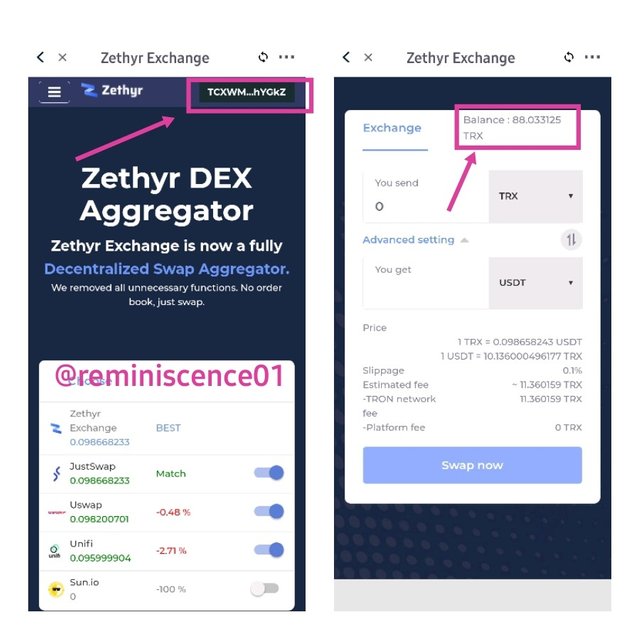

Zethyr finance also offers a DEX feature that allows users to swap Tron assets on the platform. Assets available on Zethyr finance DEX include TRX, USDT, WIN, BTT. The swap feature is a unique feature on Zethyr exchange which is not common in lending and borrowing protocols. Accommodating this feature will also save users the cost of transaction fees and time to move assets from one platform to another.

The Zethyr exchange aggregates liquidity and determines its prices from other exchange platforms. This includes both decentralized and centralized exchanges connected via API. By this aggregation, sell/buy others from Zethyr exchange can be matched with the orders from other platforms at a transaction fee of 0.1%. Zethyr DEX aggregator is a unique feature that plays an important role in maintaining liquidity to exchange Tron assets.

Ztokens

To borrow assets from Zethyr finance, a user is required to deposit an asset for collateral. Ztokens are issued to users when they deposit an asset on Zethyr protocol. An equivalent of 1:1 of the deposited token is minted and sent to the users' wallets. Another amazing thing is that users also get an equivalent ztokens sent to their wallet on any accrued interest on their deposited token. These ztokens are in turn used as collateral to borrow assets on Zethyr finance.

Exploring Zethyr Finance Markets

In this section, we will be exploring Zethyr finance markets. There are a lot of assets viable on Zethyr with their corresponding supply and borrowed APY. Users can expire this section to find the best available market for them.

From the screenshots below, we have the Zethyr market and the assets available for lending and borrowing. The total supplied asset at the time of writing this post is $611,295 and also a total borrowed asset of $23,197. The markets available includes :

- TRX

- USDT

- WIN

- BTT

TRX has the highest supplied and borrowed percentage in the pool. Similarly, on the best asset via APY for both borrowed and supplied assets, USDT has the highest supply APY of 21.49% while TRX has the lowest supply APY of 3.92%. Similarly, WINhas the highest borrow APY of 23%, while USDT has the lowest borrow APY of 8%.

From my observation, it is more profitable to supply and borrow USDT on Zethyr finance.

Steps Involved in Connecting the Tronlink Wallet to Zethyr

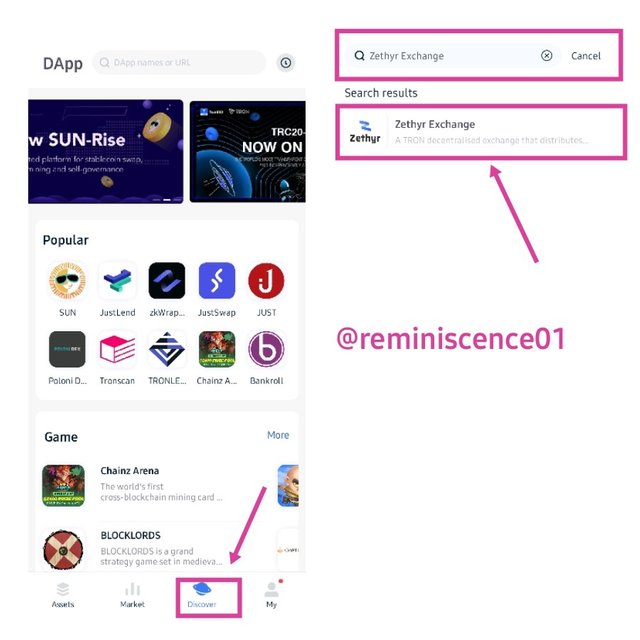

In this section, I will be explaining how to add a Tronlink wallet to Zethyr finance. Tronlink wallet is used because it has a DApp feature that enables users to interact with the web and DApps on the Tron network. The steps include:

On the Tronlink Pro wallet, click on the Discovery icon on the bottom page to access the DApps section.

There are many popular DApps on the Discovery section which Zethyr finance is not one of them. So will use the search bar to access Zethyr finance by typing Zethyr finance in the search bar. We call to see the DApps appear. Click on it to be redirected to Zethyr finance platform. A screenshot is shown below.

- At the landing page of Zethyr finance, we can see that my Tronlink wallet is automatically connected to the platform. This is one of the benefits of interacting with DApps from the Tronlink Pro wallet. We can also see the balance of my wallet on the platform which shows that my wallet is connected to Zethyr finance. A screenshot is shown below.

Ztoken

Every borrower will be required to submit a collateral asset for the lender to have the confidence of recovering his asset. The same is applicable in DeFi lending and borrowing protocols. In Zethyr finance, USDT, WIN, TRX, BTT have accepted collateral assets in the platform. Ztokens are assets minted upon successfully deposited on Zethyr finance platform. These assets are pegged 1:1 to the users' deposited assets. This means that, once a user supplies an asset on Zethyr finance, a corresponding value of ztoken is minted and sent to his wallet.

For example, I supplied 100TRX on Zethyr finance to earn an APY of 3.92%. An equivalent of 100zTRX will be minted and sent to my wallet. This zTRX will serve as collateral to enable me to borrow assets on Zethyr finance.

Furthermore, a user also gets to enjoy the benefits of acquiring ztokens on the interest acquired on his deposited asset. This means that the interest earned at supplying 100TRX, a corresponding value of ztoken of the interest on a supplied asset will be minted and sent to the users' wallet. Similarly, zWIN, zBTT, and ZUSDT are also minted upon successful deposit of WIN, BTT, and USDT.

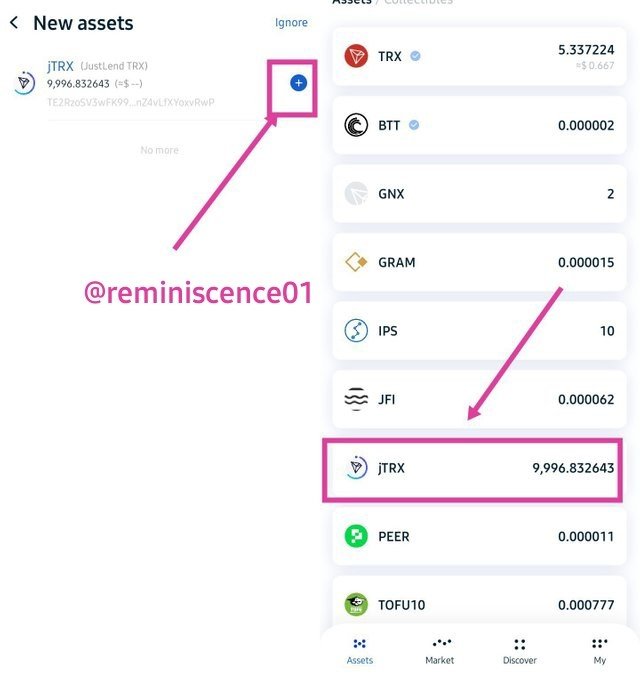

Another Project that Serves the of Ztoken

Another project that serves the purpose of ztokens is jtoken. jtoken are also assets minted on JustLend upon successful deposit of assets on the JustLend platform. Once a user supplies an asset on the JusLend platform, jtoken will be minted and sent to the users' wallet. The jtoken minted is used as collateral to borrow assets on the JustLend platform. In the screenshot below, I received 9996.8 jTRX after successfully depositing 100TRX on the JustLend platform.

Performing a Real Supply Transaction on Zethyr Finance

In this section, I will be explaining the steps involved in supplying an asset to Zethyr finance market. Zethyr finance will be accessed through the Tronlink Pro wallet. The following steps are as followed:

Steps:

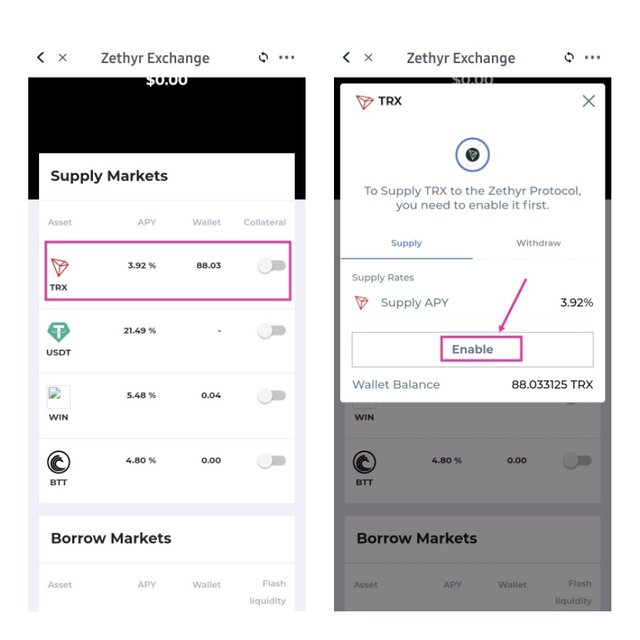

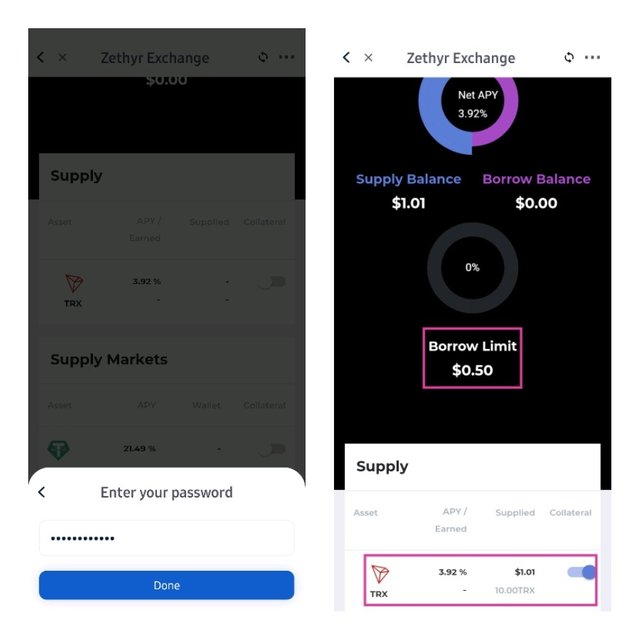

Visiting Zethyr finance landing page from the Tronlink wallet, my wallet is automatically connected as explained in the previous section. Now select any market of your choice and click on Enable as a first-timer.

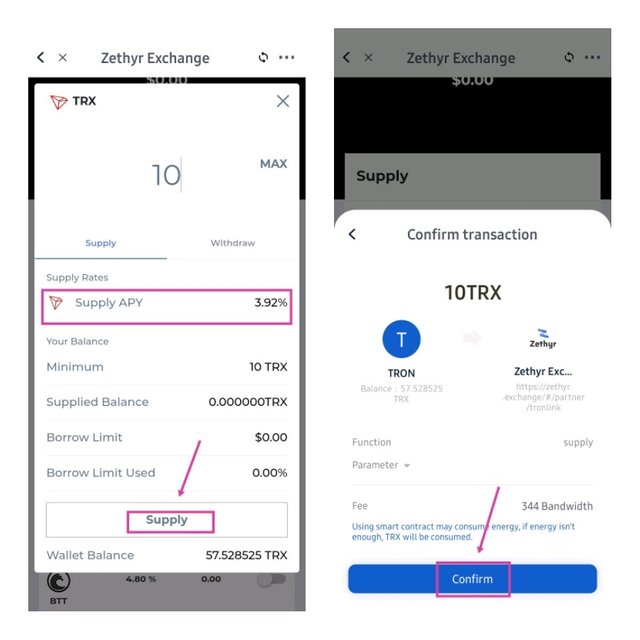

After that, input the amount of TRX to be supplied. In this case, I will be supplying 10 TRX to earn 3.92% APY on Zethyr exchange. A transaction is a smart contract triggered which will require both energy and bandwidth. 20TRX was consumed to cover the energy burned in completing the transaction. After inputting the amount of TRX, I clicked on Supply.

A notice was received on my Tronlink Pro wallet to confirm and sign the transaction using my Tronlink password.

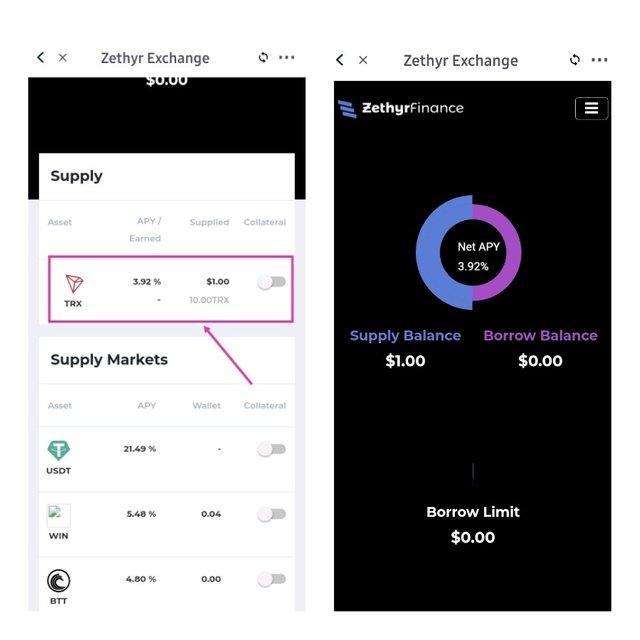

As we can see above, I have illustrated how to successfully supply an asset on Zethyr finance by supplying 10TRX. The transaction details can be found here on Tronscan.

Steps involved in Collacterizing an asset to Borrow on Zethyr Finance and also how to Repay and Withdraw your Supplied Asset

How to Collateralise an asset to Borrow on Zethyr Finance

Just like I explained earlier, before you can borrow an asset on Zethyr, you need to collateralise an asset to access the borrowing feature on Zethyr finance. Here I will explain the steps involved to collateralise an asset on Zethyr finance.

Steps

- From the initial asset supplied on Zethyr finance, activate the button under collateral to access the Zethyr borrowing feature.

- On the interface that popped up, click on Use TRX for Collateral.

- After that, sign the transaction using your Tronlink Pro password. This can further be illustrated using the screenshot below.

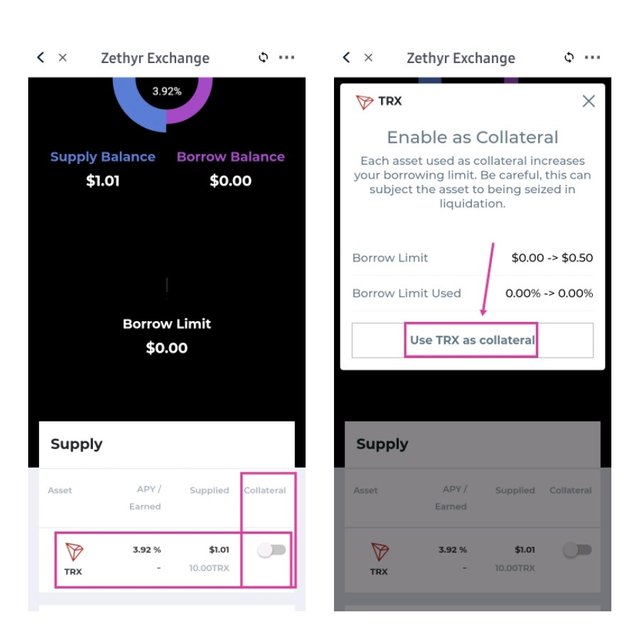

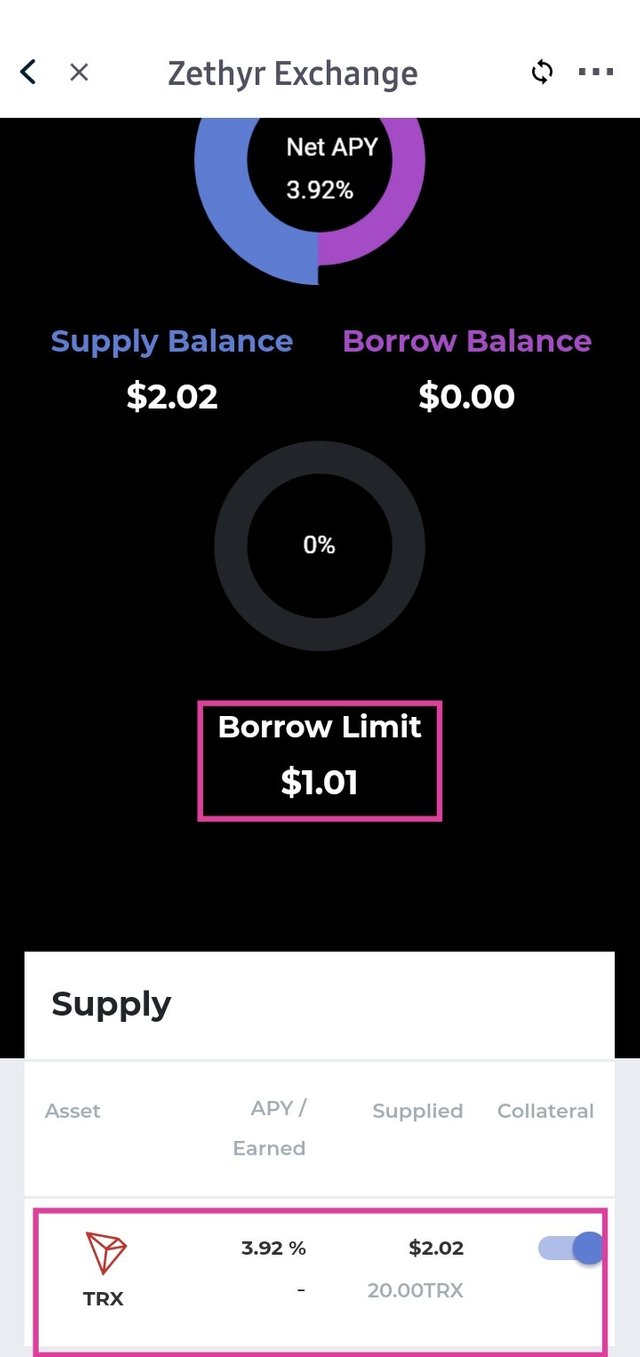

Now that I have collateralized my supplied asset to activate the borrowing feature, I can now go ahead to borrow assets on Zethyr finance. From what we can see in the screenshot above, my borrow limit is $0.5 which is half of my supplied asset. The minimum borrow limit on Zethyr finance is $1. This means that I will need to collateralise more assets to reach this limit.

From the screenshot above, I have increased my borrow limit by supplying more TRX. Now I'm eligible to borrow assets on Zethyr finance.

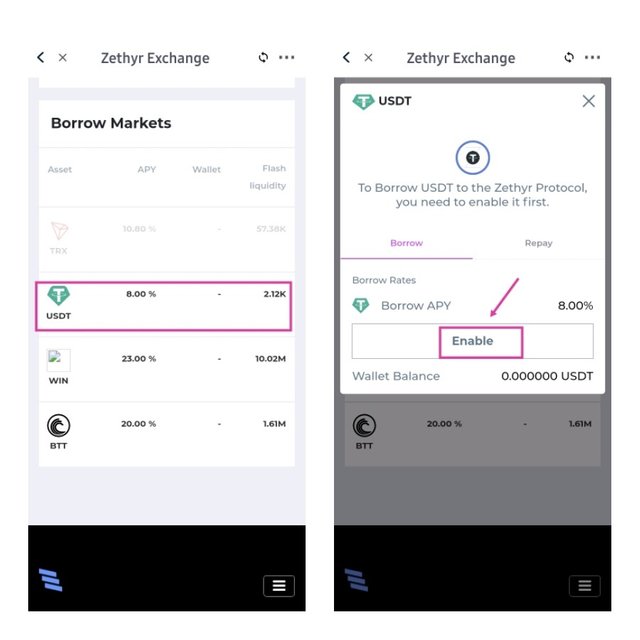

To borrow assets on Zethyr finance, follow the steps below.

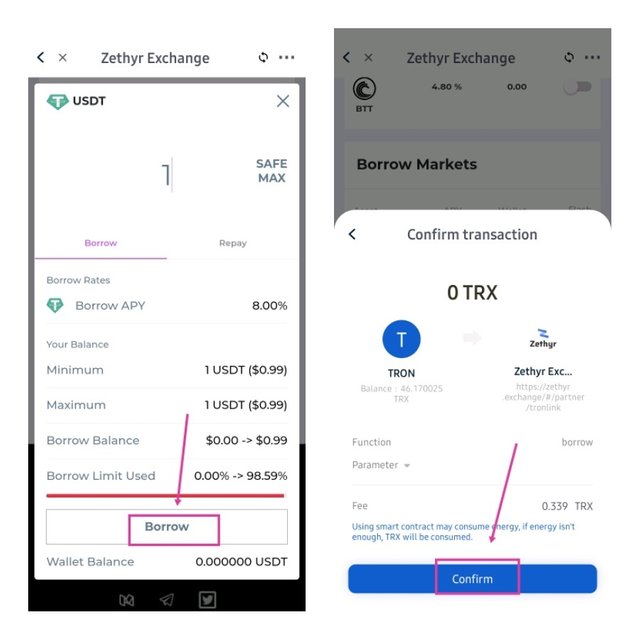

- On the borrowing market, click on the asset you wish to borrow and enable it. I will be borrowing 1USDT with an APY of 8%.

- Input the amount to be borrowed and click on Borrow. Confirm and sign the transaction using your Tronlink wallet.

The transaction was unsuccessful due to technical issues with the Zethyr borrow protocol. The hash of the failed transaction is shown below.

Transaction hash: 6d0713ca143f84fce391f512228ab2c6d58960b312d5095af58579fcf22c4963

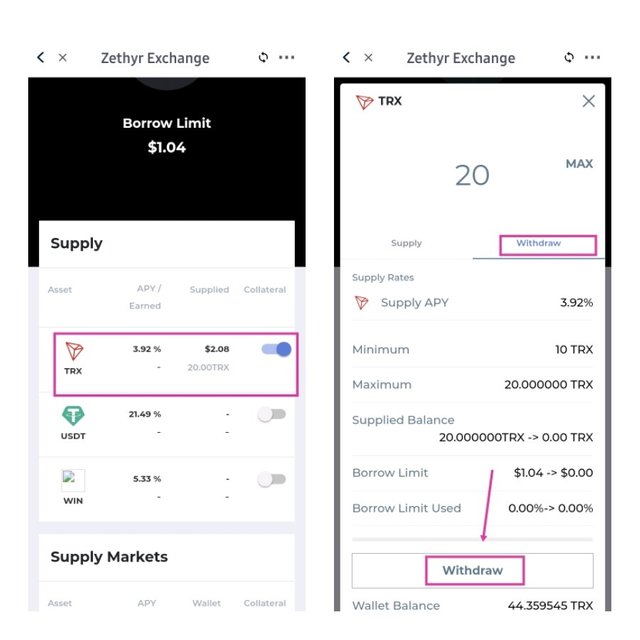

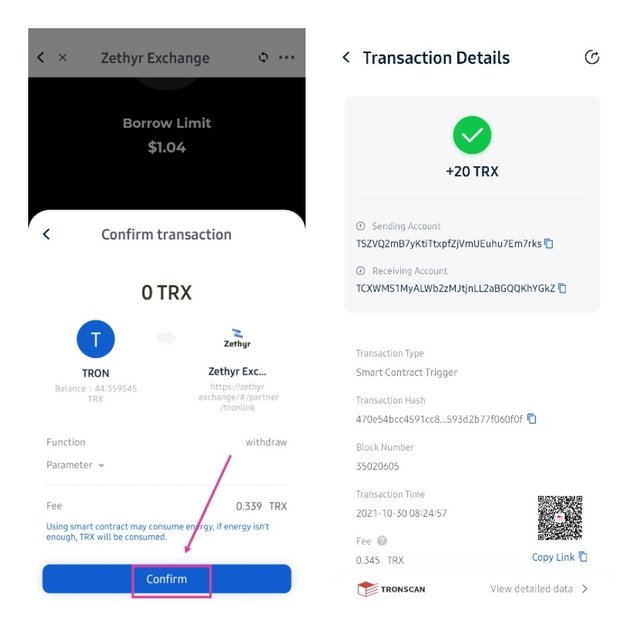

How to Withdraw Supplied Asset on Zethyr Finance

In this section, I will be explaining how to withdraw the asset I supplied to Zethyr finance.

The steps includes:

- On the supplied market, I will click on TRX market to withdraw the TRX I supplied.

- On the landing page, switch to the withdraw section and input the amount to withdraw. You can click Max to withdraw the total supplied asset.

- After that, confirm and sign the transaction using your Tronlink Pro wallet password.

From the screenshot above, we can see that I have successfully withdrawn the TRX I supplied on Zethyr finance. The transaction hash is shown below:

Transaction hash: https://tronscan.io/#/transaction/470e54bcc4591cc824426d0cbb3800be0e23e5577231d5831593d2b77f060f0f?lang=en

My View on Zethyr Finance

Zethyr finance is no doubt an amazing DeFi lending and borrowing protocol that allow for seamless access to financial services. Below are some of the benefits I see in Zethyr finance.

- High-Interest: Zethyr finance offers a high interest rate for users who supply their assets on the platform. This serves as a means of investment and passive income to users while ensuring the maximum security of their assets.

- Aggregated Exchange: Liquidity is guaranteed to users to exchange their assets on Zethyr finance. This is done by connecting the APIs of other exchanges to get the best matching orders across these exchanges. This is a unique feature rarely found in other DeFi applications.

- Two Protocols in One : Apart from the lending and borrowing services offered on Zethyr finance, an exchange protocol is also integrated to allow users to swap their assets. Instead of flipping through separate DeFi apps, users can get both lending, borrowing and exchange features all in one at a reduce fees.

Apart from the benefits listed above, I noticed the high cost of transaction fee associated with Zethyr finance. It cost more than 20 TRX to carry out a transaction which is about $2. I believe the team is still working on the area of improving the platform and the fees associated with.

Conclusion

In this post, I have explained Zethyr finance to my understanding. However, the lending and borrowing protocol has an outstanding features for users to capitalise on. The platform also offers users high yield interest rate for supplying their asset. This serves as an investment and passive income for crypto users.

I believe there's still room for further development as the Devin ecosystem is still improving to eliminate the pitfalls in the traditional financial system.

Thank you @fredquantum for this amazing lesson.

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice work Prof @reminiscence01...

Please I have a little complaint, I participated in #club5050 in the week of your lesson but you gave me 0/1 grade.

Here is the link

I have drafted out the proof in the comment section of my post, you can still check my wallet. Thank you so much, I'm grateful

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit