Welcome to my trading task of the day. Today I will be trading the BakerySwap governance token against ISDT tether. I will do some fundamentals about this projects and then carry out technical analysis to make entry where necessary.

This project was launched by 09/202” and the native token BAKE is used as the governance token of BakerySwap ecosystem. The BAKE token can be used to pay rewards to liquidity providers on BakerySwap liquidity pools. This token is also used to pay trading fees on BakerySwap as well as being used to vote in the ecosystem. The BakerySwap ecosystem is a decentralized automated protocol built on Binance Smart Chain and therefore the BAKE token falls among the BEP20 tokens.

Just like Bitcoin, the developer team behind the creation of the BAKE project have stayed anonymous.

The Bake token is available in different exchange platforms for trading. The platforms includes Binance, Hotcoin Global, CoinTiger, Mandala Exchange, Gate.io, Pancakeswap, and Bingx. Oke can trade the BakeryToken on these platforms with different cryptocurrency pairs that are available in the respective categories.

For about 11 days now BAKEUSDT has been in an uptrend after the halt of a drastic bearish market. This certain uptrend switch can be as a result of a pullback that takes place in days and up to weeks and as an intraday trader it’s a great opportunity to make entries after identifying strategic positions to take a long position so long as the bullish pullback is in place.

The above screenshot is that of the BAKEUSDT trading pair fr tradingview. We can see that for a couple of days this cryptocurrency pair has been in an uptrend and it’s a good time to make long position entries for an intraday trader.

I prefer using one trading strategy for as long as I can master it and most of my readings will be done using the same strategy but just adding credibility to it when certain patterns occur in the market.

I will use the two TEMA indicator strategy adding to it the RSI indicator as my filter indicator for this analysis. Working on the 1D timeframe to understand strong support and resistance and also using the 15 minutes and 5 minutes timeframe to make my entry. When the smaller period TEMA crosses the higher TEMA period line I will make a long entry as this is a bullish signal. Confirming from the 5 minutes timeframe in order to be early for the entry since the 15 minutes timeframe will be late. The RSI should be in the oversold region moving to the overbought in order to confirm my entry.

From the above screenshot we can see how the RSI confirms the cross fr the smaller period TEMA to the higher period TEMA. All three indicators proof to be bullish and so I made an entry.

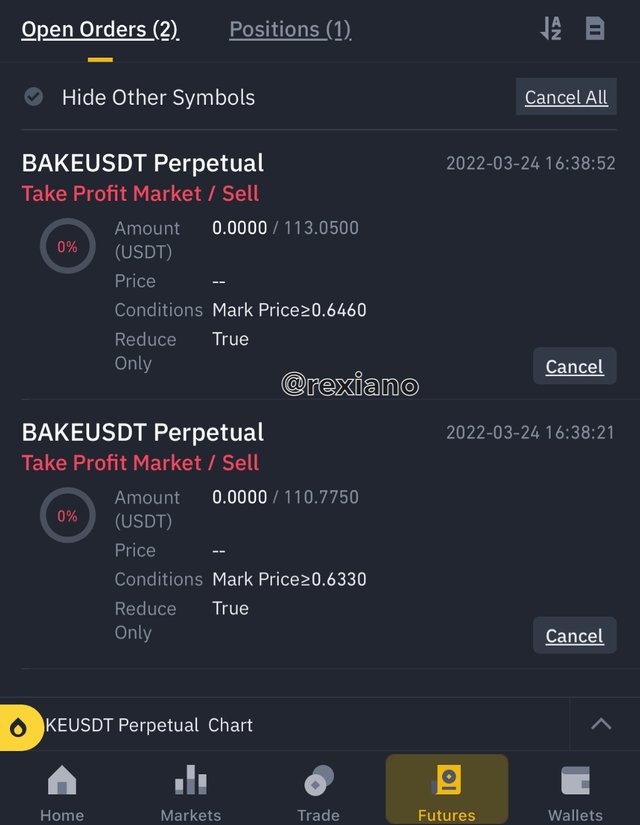

The exit criteria is done such that the first Take Profit (TP1) is at the immediate resistance (high) and the second Take Profit (TP2) is just below the immediate highest high. I made this in a 50%/50% take profit from my staking amount.

The screenshot above shows our trade progress on the Binance platform where I placed the trade. At some point the price went almost hitting the TP1 but retraced below the entry.

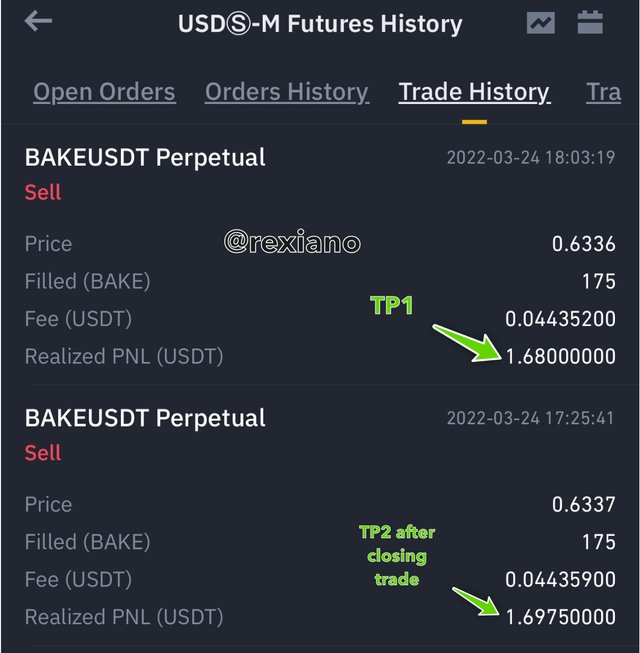

At this point of writing, my first take profit point was hit already with a small profit of $1.6975. The second target trade is still in progress. The small profit size came from the small position size I made because I don’t want to lose funds and I’m trying to manage my portfolio as well as I can. The screenshot below shows the profits from my first target.

When the price trades above the TP1 I realized that there’s a strong resistance just above the 1TP and it is likely that the price will not break this resistance following the move of the RSI into the overbought region I had to close the trade at this point making a second profit of $1.68 which when added to the first profit will yield $3.377 for the overall trade. It’s better out with little profits than out with loses.

This is a futures intraday trade that I only intend to keep going until my SL or TP points are met. I do not intend to hold this token for any period of time but trade it just for few minutes to hours provided my trade goes north or south.

We can all see that BAKE is in an uptrend and one can wait for a slow down and make entry in the trend continuation until the major resistance is met. I advice traders of interest to the BAKE project to take a look at it and make their analysis before doing any long or short entry for an intraday trade.

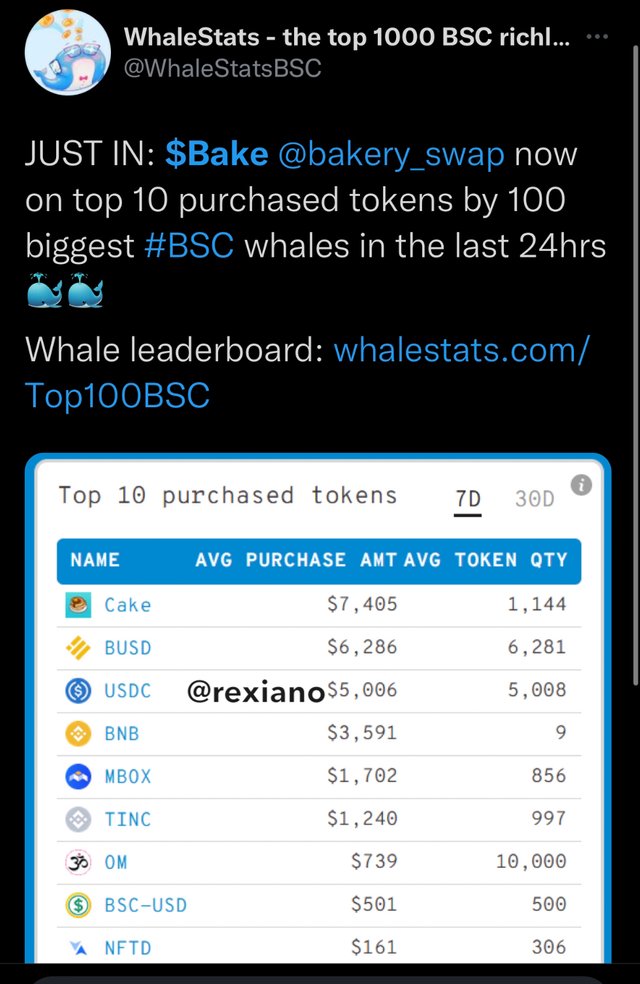

When you type $bake on Twitter you’ll realize that the token has been receiveing interest for the past days when the reversal began to show green light and everyone who bought as early as 7 days ago is in good profits for the short term. An example is the following Twitter page whose screenshot is below.

Futures trading is very risky but with enough analytical satisfaction it is worth trying as it readily brings great profit opportunities to a trader. The BAKE project has a good use case and high liquidity available. Oke can stake this token and earn rewards. Trading bake for an intraday trader requires good technical analysis. From what I have done you can take it as a head start to do yours for the cake token at any point in time.

Thanks for reading and I hope for a successful trading journey throughout the week just like this one has been successful.