Hi guys, welcome to my homework post about the Trix indicator. This task is based on answering the questions given by professor @kouba01 at the end of his lesson about the Trix indicator. I will be writing about this indicator based on my knowledge from this class and my additional research.

The Trix indicator is a moving average indicator just like the other moving average indicators. The acronym Trix represents Triple Exponential Average. This is a description of the method of calculation involved in this moving average indicator.

The calculations done for the exponential moving averages are very complex and this is to avoid giving false signals to the trader. Using three exponential moving averages in one will filter noise and avoid any false signal since signals are confirmed from all three exponential moving average lines on the price chart.

We use the Trix indicator to complement information gotten from the price chart as to whether to make entry for a short or long position. This indicator tool might not be used as a direct signal indicator but as a helping hand to perfect a signal gotten from trend indicators. Just like other indicator tools make use of mathematical calculations, the Tric indicator also applies some calculations. These calculations have already been done and embedded in the indicator setting so when we add the indicator to a chart we can just configure it for our use and apply its principles.

Since the Trix indicator is simply a combination of EMAs, the Tric indicator works closely to the functioning of the EMA. The Exponential Moving Average (EMA) indicators are known to make an easy trend identification on the complex chart with candlesticks everywhere. EMA gives a clear view of trends and how or when trends change on the price chart. The candlestick movements upon fluctuations may cause some sort of confusion on the price chart but the EMA clears this out to give precise market direction.

Like I said above, the calculations involved in marking out the exponential moving average are very complex and that’s where the problem with this category lies. This also gives them high precision potential compared to some other moving average indicators such as the Simple Moving Average (SMA) which has a rather easy model of calculation. The high precision provided by the EMA helps to avoid signal lagging as seen from the other moving average indicators. A commonly known issue with the SMA is the fact that they rely on recent data and can be misleading sometimes because each candlestick has influence on the calculation. When we have sudden candlestick movement, the whole trend can be disrupted hence the signal is misleading.

To avoid such misleading information, a more complex calculation was done to bring about the EMA which now avoids much of this misleading information. This makes the chart clearer and also the calculations not solely dependent on each candlestick but dependent on a group of candlesticks such that one candlestick cannot acutely affect the results. Information from the EMA doesn’t lag as compared to the others and doesn’t generate false signals like the SMA.

The Trix is already calculated and installed as a trading tool on trading platforms but it’s good to know how the calculations are actually done mathematically. Before I get into the calculations I would like to make a screenshot showing the graphical representation of a Trix indicator on the BTCUSDT trading pair.

The screenshot above shows the Trix indicator with a length of 20. This indicator is represented by a line oscillating on the price chart such that there’s a zero line to show the negative and positive market movement.

The formula used for calculating the Trix indicator is given below as described in the lesson and I confirmed from other sources.

TRIX = (EMA3 t - EMA3 t-1) / EMA3 t-1

So when we calculate the Triple exponential moving averages based on the closing price of an asset, we can then determine the Trix using the above expression. With such calculations done, the oscillator isn’t easily moved by sudden price changes therefore avoiding false signals in highly volatile price movements.

If we allow the calculations such that the oscillator becomes so sensitive to price movements, we’ll see that there will be a lot of up and down movement which will cause the oscillator to give false signals. Depending on the type of trading activity you are embarking on, you will determine the length of your EMA. Trading on a higher time frame requires that you use a much larger length compared to that of an intraday trader.

We can take keen attention to the EMA period since it is the vital parameter used in this indicator. This period has a strong influence on the value of the Trix indicator. Therefore the higher the EMA is smoothed, the less signals we get in the short term. This will make the Trix indicator to provide mostly long term signals. So we can regulate the analysis criteria based on the smoothing of the EMA. Taking a lower EMA period will give us more results in the short term and complex results over the long term. This means that we have to choose the right smoothing values depending on the term we are working on.

The trend is determined from the crossing of the Trix oscillator to the zero line. Whenever the oscillator crosses the zero line upward, we have a bullish market signal and whenever the oscillator line crosses the zero line and heads below, we have a bearish market signal.

The Trix indicator generates buy/sell signals during its cross at the zero line on both sides. A buy signal is gotten from the Trix indicator when the oscillator line crosses the zero level and heads upward. This type of signal can be used also as information relevant to close an opened short position. The sell signal is gotten when the same oscillator line passes the zero level and heads downward. This also can be used as a signal to close any opened long position. The practical example can be seen on the following BTCUSDT trading pair.

From above graphical examples, we can see how the Trix oscillator crosses the zero line and back, giving way for both positions to be open at different times and closed at the opening of one another. This means that opening a short position is a signal to close a long position and vice versa.

As understood above, the Trix indicator provides very clear signals and makes the chart less complex hence giving the trader a conducive view of the market. In long term applications of the Trix indicator, it will appear rather very good but for the short term there’s a lot of possibility for false signals. We can see a practical example below as this indicator can be true and false sometimes. The screenshot below is that of the BTCUSDT trading pair.

Looking at our screenshot above we see how the Trix indicator can be limited in the short term analysis as it readily gives false signals too.

In part 1 of the above screenshot the Trix buy signal came 28hrs after the uptrend already began its upward move. I’m part 2 of the screenshot we see that the Trix indicator gave a false signal as the beginning says sell and at the end was a buy signal. This means that throughout part 2we are supposed to have a short position in progress but when we look at the chart the price instead rises at this point.

We can see the good signal given by the Trix indicator when we get to pert 3 where we have a buy signal and from there we have the price moving upward to an extreme where we could’ve taken profit. At the end of part 3 we have a sell signal from the Trix indicator leading to a short position throughout part 4 of the screenshot above.

We can conclude that based on our chart above the Trix indicator was true for part 1,3,&4 and wrong for part 2 where the overall signal there was false.

Making trade entries based on the Trix indicator requires that the indicator crosses the zero line to a preferred direction and touches an extreme level. Using a smaller period will enable the signals being filtered such that we work on smaller trading terms such as the intraday trade. On doing this, we can use the 9 period EMA on our Trix indicator which will give us a line signal same as that of a MACD indicator. Now we are going to have two lines on our Trix such that we make entries when these lines cross each other. If the Trix crosses the 9 period EMA heading to the top we open a long position and if it does cross the 9 period EMA heading downward, we open a short position.

I will do an example of a Trix indicator with period of 20 and an EMA of period 9 against a MACD of setting (12,26,9) since both indicators oscillate around a zero line, they should comply in each signal that will be relevant for me.

From the screenshot above we can see how the Trix indicator together with the moving average within shows primary signals and secondary signals. When the Trix crosses the EMA we have a signal already in place telling us that the price change is around the corner and when the Trix successfully crosses the zero line we have a second confirmation of this price change.

Looking at this activity we can see that the Trix indicator has a better and preferable trend regularity compared to the MACD which crosses over several times making the signal confusing to the trader. The Trix indicator appears very smooth compared to the disjunctive MACD lines. This is very clear on the screenshot above which is of the BTCUSDT trading pair.

Just like I started explaining in some sections above, the Trix provides primary and secondary price change confirmation. This is seen from its crossover with the EMA and later it’s crossover with the zero line. The crossover seen from the zero line can be of medium and long term analysis. Depending on the time frame, these calculations can go as long as the trader prefers the time frame to be.

Whenever our Trix crosses the zero line there’s a good significance and a trading opportunity. When the Trux line crosses the zero line heading upward we have a bullish market signal and investors for long term can make entry. The cross of the Trix to the zero line heading towards the bottom also signifies an entry opportunity but in this case it works for the short position.

Using other technical tools to understand or credit these signals is of utmost importance to a trader. For example, confirming such crossover by detecting dynamic or static support and resistance at these points will add a level of confirmation to the trader about the entry and exit criteria.

The momentum indicators are capable of giving good market alerts about strong price movement such as market divergence. The Trix indicator falls within this category and is capable of providing traders with such classic market alerts.

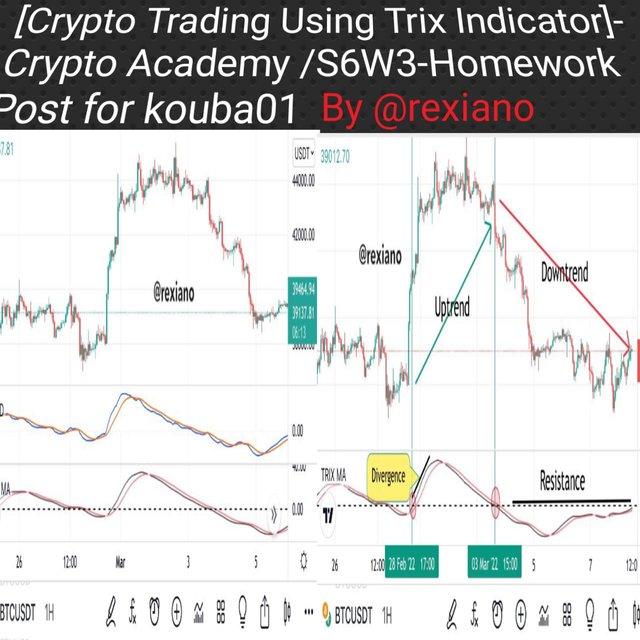

As seen from the screenshot above, market divergence alerts occur when the EMA and the Trix both confirm a certain price change and agree on it.

We can see on that screenshot how the price causes the Trix indicator line to cross the EMA and both are crossing the zero line forming a very strong signal.

The Trix line crosses above the EMA line indicating a bullish signal and later both lines cross the zero line in that order. This is proof of a very strong bullish market move. When such divergence crossing happens for a bearish signal the zero line acts as a resistance zone just like I have indicated on the chart towards the right bottom.

The Trix indicator being a filter indicator itself still requires another filter indicator to confirm it’s entry and exit signals since sometimes the entry signals from the Trix indicator can be late and the exit not even given. In such cases one has to use the information from the other indicator to satisfy these shortcomings.

The Trix indicator is known to best work with the Aroon indicator and in this exercise I will use the Trix-Anoon combination due to their compatibility.

The Aroon indicator on the above screenshot shows us entries and exit points conforming to the Trix indicator and in some cases will provide information where the Trix indicator doesn’t. We can see part 2 on the above chart like we used on the previous section and we can tell how the Aroon indicator was able to give the entry and exit for the part 2 of our chart. Even though we couldn’t get true information from our Trix indicator, the Aroon indicator does it for us.

Over all the parts on the chart above, the Aroon indicator continuously gives entry and exit criteria for all the positions.

If not for the Aroon indicator in part 2, we would’ve left the position open as a long post instead of a short position. Imagine leaving your position open just because an exit signal has not yet been proven to occur by your indicator. This can cause you to lose funds since market volatility is not predictable. Sleeping off a trade can cause such uncertainties. With the help of the Anoon indicator as a filter indicator for the Trux indicator we’ll be able to detect the exit criteria when the Trux lags.

We can conclude here that the Trix indicator completely fails at part 2 of our analysis chart and only the Aroon indicator could bail the trader out in this situation.

Just like other indicators have their advantages and disadvantages, so is the Trix indicator. Following up the previous section we could already detect those pros and cons of this indicator.

The key disadvantages of the Trix indicator are:

1). The fact that it lags a little bit when providing signals. This issue is derived from its formula of calculation which requires the EMA as a basic parameter. Depending on data from the moving average, the Trix indicator will always lag a little.

2). This indicator sometimes may also not give signals and stay dormant such that they require an additional filter indicator to help in such situations.

The advantages of the Trix indicator are that:

1). It filters noise even when working on higher time frames.

2). It also identifies the direction of the main trend of the market with a certain level of accuracy such that it can be confirmed twice.

3).The Trix indicator also has the ability to display divergence signals on the price chart.

The Trix indicator is a very good indicator to use when carrying out long term analysis and short term analysis on trend identification. This indicator is capable of identifying the trend direction and give possible entry points as well as detect extreme levels which can be used as exit criteria for a particular trade. This indicator has proven to be more advantageous to the MACD indicator since it provides signals without disjunctive movements on the indicator itself.

Notwithstanding, the Trix indicator also requires a support indicator such as the Anoon indicator to help filter out noise from the Trix such that lags can be made up for.