Hi everyone, few days ago we were taught on the steemit crypto academy about yet another useful indicator called the vortex indicator. We were taught by professor @asaj and I was glad I attended, now let us go into answering the take we were given shall we?

QUESTION 1: In your own words explain the vortex indicator and how it is calculated

Technical analysis has proven to be a very reliable method of analyzing price action in the market. In technical analysis, a trader or analyst makes use of tools known as indicators to depict and predict price changes and price actions. Indicators have proven over the years to be highly reliable, and there are so many variants of market indicators available for use on data sites like trading view, but today we are concentrating on the Vortex Indicators.

vortex indicator (VI) is an indicator made up of two lines heading in two different directions, these lines are nicknamed by their directions. The uptrend line is called the VI+ while the downtrend line is known as the VI-. Like so many other indicators, the two lines also differ in color.

The uptrend line (VI+) is usually depicted with a green or blue color, while the downtrend (VI-) is usually depicted with a red color or light pink. The Vortex Indicator is used to confirm the current trend the market is on, and predict a trend reversal also. Etienne Botes and Douglas Siepman developed and introduced the vortex indicator idea in 2009 in a publishment. The distance between the current high and previous low is known to depict positive trend movement, while the distance between the current low and the prior high is known to depict a negative trend movement.

When the trend lines of the vortex indicator meet and cross, there is usually a sell or buy move in price, depending on how the lines crossed. to explain further, when the green or blue line that depicts the uptrend crosses the red line to go above it, it usually means the buyers are gaining strength against the sellers and an uptrend is brewing because there is a higher need to buy the asset in question, this means that the demand becomes higher than the supply. In contrast, the opposite happens to price if the red line crosses the blue line to move above it.

Calculation of vortex indicator

There are three parts of the vortex indicator calculations: the True range, The uptrend and downtrend calculation, and the Parameter length or period. Below are the formulas to calculate these:

True Range:

To calculate the true range, we have to select the highest value of the following values:

current High (CH) - Current low (CL)

Current low (CL) - Previous Close (PC)

Current High (CH) - Previous Close (PC)Uptrend And Downtrend Calculation:

We can calculate the uptrend (VM+) and the downtrend (VM-) with the values of the current highs (CH) and current lows (CL) and the previous highs (PH) and previous lows (PL) using this formula:

VM+ = CH - PL and VM- = CL - PHparameter length or period:

according to the Welles wilder theory, the number 14 is one that would most likely yield more accurate readings, be it in minutes, hours, days, months, and years even. The period choice of the trader is important because it affects the calculation of the highs and lows of the different trend movements, sometimes a trader might need to double the length of the period from 14 to 28 in order to analyze the chart in his own unique way using the vortex indicator.

QUESTION 2: Reliability of the vortex indicator strategy

first of all, I would like to state the fact that no indicator would be put to use in expert trading platforms if it wasn't already tested and trusted to have a high accuracy of prediction. In my opinion, the reliability of an indicator strategy is mostly subjective.

Not every trader would be able to make a profit from the vortex indicator strategy because of the difference in trading habits. If a trader who has no sense of risk management tries to use this indicator, it might not be effective for him, because he lacks some basic information and trading skills needed to handle the market and indicator strategies like the vortex indicator.

Now expatiating more on the efficiency and reliability of the vortex indicator strategy. Nothing in this world is perfect, and that applies to the vortex indicator strategy too. I hope you weren't expecting to hear that it is the only indicator with 100% accuracy because if you were, I wouldn't be sorry to disappoint😂 The vortex indicator strategy is reliable enough, and though it might not be correct once in a while, it is said to be as reliable as the moving average's death and golden crosses.

QUESTION 3: How is the vortex indicator added to a chart and what are the recommended parameters? (Screenshot required)

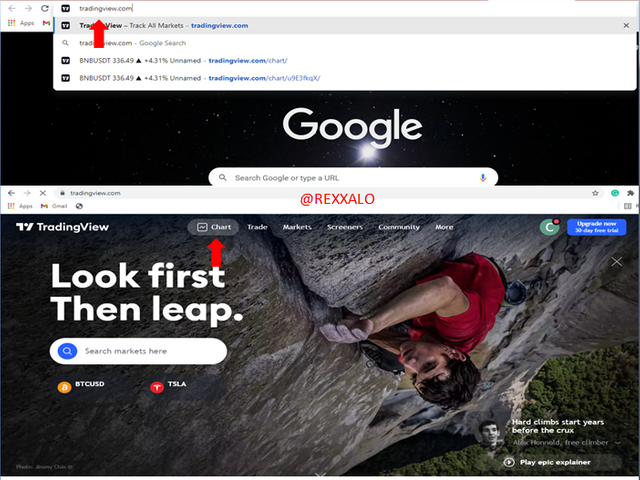

For this task, we would be making use of a trusted database site known as tradingview

STEP 1:

so firstly what we have to do is type in "tradingview.com" as I have shown below, when you do this, the trading view home page will load, and then we navigate to the option that says "chart" to laud op the charts of cryptocurrency pairs.

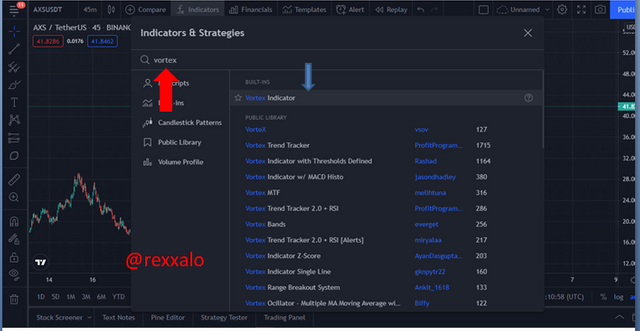

STEP 2:

The next thing we want to do after a chart has been loaded (as you can see below, I am currently looking at the AXS/USDT chart) we navigate to the top left of the chart and look for "Indicators" and you click on it as I have shown below.

STEP 3:

when you click "Indicators" a dialogue box appears where we can search for the indicators we wish to use, so we go on to search for "vortex" and then select the vortex indicator from the result as I have shown with the blue arrow.

STEP 4:

Below, we can see that the indicator has been implemented just below the chart. This is to ensure space for proper analysis between the chart and the indicator.

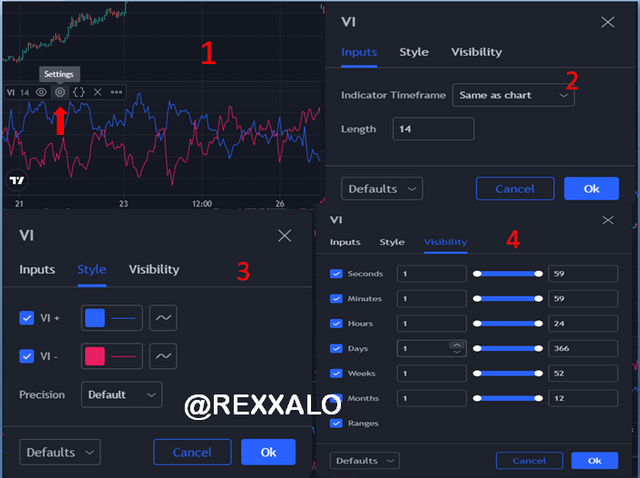

To conserve space and to shorten the post to make it easier to read, I have made a collage on how to customize the indicator to the user's preference. From picture 1, it shows that to get to the settings of the indicator, we go to the fart top left and look for the indicator toolbox and click settings. picture 2 shows that when this is done, we then see a small box that has three customization categories, the input, the style, and the visibility. Picture 2 also shows that in the input section, the trader can change the time frame and period length of the vortex indicator. The default period length used in the trading view is also 14.

moving on to the style section, here we can modify how the indicator looks. We can change the colors of the two trend lines, and we can also edit the precision of the indicator. Finally, picture 4 is the visibility section, where we can edit the visibility of the trendlines according to time frames. Now we've gone through the customization, but I did not change anything because it was all fine from the start.

Recommended Parameters.

There are three important parameters of the vortex indicator strategy and I have already mentioned two above, but let me outline them here:

The color of the indicator lines:

As I have mentioned before, the indicator lines differ in color, depending on the trend they are representing. The uptrend line is usually a green or blue color while the downtrend indicator line is usually red or dark pink. This color differentiation is necessary so that we can clearly ascertain the crosses between the two lines, and to be easily seen on the chart.The parameter length or period:

As I have shown above The preferred period postulated by Welles wilder is 14. This period has been found authentic over time, but we still get the chance to edit it in case it does not support our trading style, to in a case where the market prices are ranging. In this case, it is advised to increase the parameter length to even double of 14.Timeframe:

To properly make use of the vortex indicator strategy, a trader will need to use a larger timeframe to eliminate the excesses or noise that could come about from too much price movement. These excesses could be misleading and can make traders see a different prediction than what it really is saying. A 1hour and above time frame will be suitable, but the timeframe shouldn't be too huge either.

QUESTION 4: Explain in your own words the concept of vortex indicator divergence with examples. (Screenshot required)

There are two types of divergence of vortex indicator and they are:

- Bullish divergence

- Bearish divergence

Bullish divergence

The bullish divergence is a scenario where the trend on the chart forms lower lows while the VI+ line on the chart forms higher lows. This indicates that the buyers are gaining strength and the sellers are being exhausted, meaning that there is going to be a shoot up in price.

As I have shown above using the BTC/USDT pair on a 1-hour time frame after the bullish divergence comes an uptrend. I have properly connected the lower lows of the chart and the higher lows of the VI+ line using a trend line, and I have pointed out the time it took this divergence to occur which is from the 20th of June to the 22nd of June, so roughly two days. We can clearly notice how both trend lines are heading towards separate directions, but after this, they both corrected and found their directions upwards together.

Bearish divergence

The bullish divergence is a scenario where the trend on the chart forms higher highs while the VI+ line on the chart forms lower highs. We can then notice that it is the direct opposite of the bullish divergence. This indicates that the sellers are gaining strength and the buyers are being exhausted, meaning that there is going to be a push-down in price.

As I have shown above using the BTC/USDT pair on a 1-hour time frame after the bearish divergence comes a strong downtrend. I have properly connected the higher highs of the chart and the lower highs of the VI+ line using a trend line, and I have pointed out the time it took this divergence to occur which is from the 27th of June to the 29th of June, so also roughly two days. We can clearly notice how both trend lines are heading towards separate directions, but after this, they both corrected and found their directions downwards together.

QUESTION 5: Use the signals of VI to buy and sell any two cryptocurrencies. (Screenshot required)

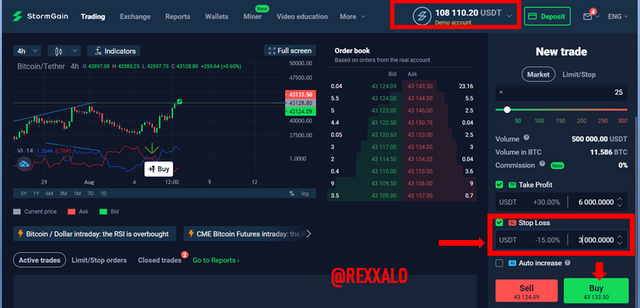

BTC/USDT analysis

To complete this task, I will be making use of the stormgain platform. let us use the Vortex Indicator to analyze the chart of BTC/USDT. Notice that my time frame is at 4 hours. Now the first thing I noticed was a bearish divergence. This bearish divergence caused a downtrend that wasn't too strong. Then I noticed that there was a cross of the VI+ line over the VI- and as we have established, this means that there will be a new uptrend, but one thing I realized was that BTC had already broken past the imaginary resistance line, and was looking for new highs, hence my decision to buy.

Now to place the trade, I navigate out of the chart, mind you, this is a demo account. Knowing that the BTC/USDT price action can be very fierce, I cut down on my leverage to 25%, only risking about 15% of my account, and then I hit the buy button.

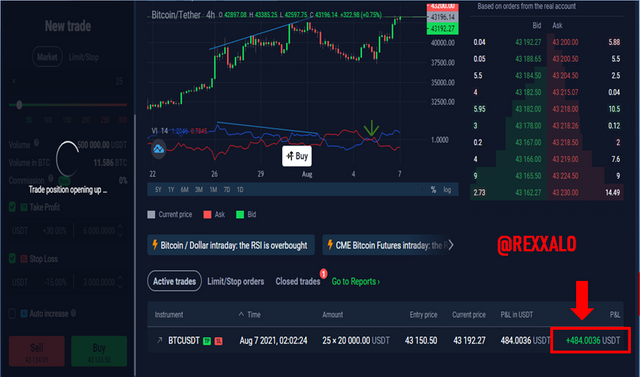

It didn't take too long for the trade to get to about $800 in profit, observe the screenshot below.

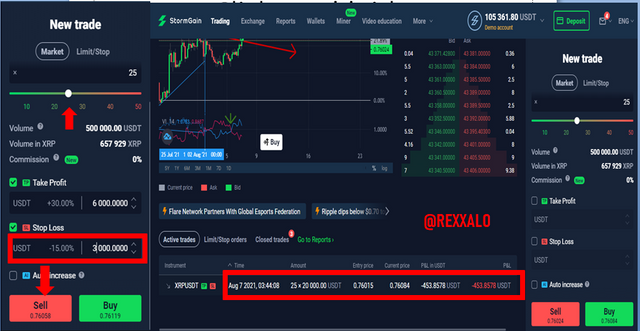

XRP/USDT analysis

let us use the Vortex Indicator to analyze the chart of XRP/USDT chart. Notice that my time frame is at 4 hours. Now the first thing I noticed was a bearish divergence. This bearish divergence caused a downtrend that wasn't strong at all, and from the looks of it, the downtrend was just starting. I noticed that there was a cross of the VI+ line over the VI- and as we have established, this means that there will be an uptrend. The uptrend happened, but at the point of making this article, the price was being pushed down by resistance strongly, so it just looked like a formation for lower highs on the chart itself

Now to place the trade, I navigate out of the chart, Knowing that the XRP/USDT price action is also volatile enough, I cut down on my leverage to 25%, only risking about 15% of my account, and then I hit the sell button. The trade was in a loss, but here is the confirmation that I sold it below:

CONCLUSION

The vortex indicator is pretty simple to understand, and also very easy to use, it has its own unique ways of telling the trade the current trend, and the price action predictions. one of these ways is the bearish and bullish divergence. It can also be used with different indicators like trend lines to bring up better assertions. I really enjoyed the class from professor @asaj, and I am happy I have learned about this strategy. thank you all for reading through, see you all next time.

Good job @rexxalo!

Thanks for performing the above task in the sixth week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 6.5 out of 10. Here are the details:

Remarks

You displayed a good understanding of the topic. However, task 4 could use a bit of more originality. Bitcoin isn't the only existing cryptocurrency. Quite a majority of participants have already used Bitcoin in their examples.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow... i really believe this score is low for the amount of work i put in... please reconsider @asaj

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit