INTRODUCTION

There is a very important aspect of trading and business management that tends to be left malnourished, and this causes a short lifespan of traders and businesses. This aspect is the psychological aspect. The psychology behind trading s actually one of the most important building blocks to a successful trading lifestyle, and if one has good psychology while placing trades and dealing with the market, He/she will be more successful than that person that doesn't really try to maintain good psychology. This is why professor @imagen taught extensively on psychology and market cycle, and has given tasks that would help us understand the lesson more through active research.

question 1: Explain in your own words what FOMO is, in what cycle it occurs, and why (cryptographic screenshot explanations are needed).

FOMO (Fear Of Missing Out)

The acronym FOMO means the fear of missing out. It is usually used in very literal contexts like where there is a certain setup for a trade, and then because he doesn't want to miss out on the opportunity to make money so badly, he decides to make wrong trading decisions which we will highlight as we go on.

.png)

Bringing the FOMO context into a perspective of cryptocurrency trading, a typical example can be when the price of a crypto asset shoots up, we might start to think instinctively to ourselves "wow, this coin is really pumping, I should buy now before it goes higher and I miss out on the opportunity to make money" without ever considering if we are buying it at the right time.

FOMO is an emotionally based concept, where the trader acts on impulses and emotions that have been stirred up by seeing the price of an asset go in certain directions and patterns. Imagine saying "oh well I see its coin has a bullish setup, but I'm not going to just jump in to buy it" and so you don't but your friend "john" does. Now imagine that in a matter of hours, that crypto-asset goes a whooping 600% pump. This incident will forever dent your psychology, then now imagine if it happens severally. You would be pushed to look for setups again, without holding back on investing.

FOMO is not just a trading thing, It affects us more often than one might perceive. For example; Have you ever tried something that you are not naturally interested in, just because everyone has tried it and you don't want to be the only one without the experience? That is a typical example of having the Fear Of Missing Out because you don't want to miss out on the experience cause you're probably getting old too😂😂

cycle that FOMO occurs in:

The cycle of FOMO can be summarised as a pathway of wrong buying and selling decisions. It literally is buying when the price is high, and selling when the price is dipping! I know, Right now the summary makes it look absurd, but most of us have been victims, most of us have bought way too late and have sold way too early. This cycle of behaviors is energized by the FOMO concept.

screenshot from tradingview

Let us take a typical example of the recent price actions of Bitcoin. Imagine the beginning of 2020 when the price of Bitcoin was dilly-dallying around $10,000, your friend (let's give him a random name) Jacob tells you "hey, I think I'm going to buy bitcoin, you should too" and you decide for personal reasons that you'd wait till next year and instead invest in something else like real estate.

Then at the end of the year, Jacob comes to you and says 'hello friend I have just withdrawn $10,000 from my Bitcoin deposit, I have about $30,000 remaining, I hope you invested with me". I know, Jacob seems like a show-off right now, but it is these little incidents that drive a trader into making irrational decisions.

so you decide to buy Bitcoin at about $45,000 - $50,000 and then Bitcoin luckily gets to about $57,000 and then starts consolidating at that price, and then you decide to wait it out, but then the price starts heading down this year. You then count your losses and sell all your Bitcoin, deciding that it was a wrong investment, and then the price gets to $27,000 and Jacob comes again and says "I just bought BTC again at an insane price of $27,000, can you believe it?", and then a few months later, the price skyrockets to $40,000 you become interested again, and the cycle continues. this is how the price actions mess up the psychology of investors, making them make the wrongest decisions.

2-Explain in your own words what FUD is, in which cycle it occurs, and why. (Crypto screenshot explanations needed)

FUD (Fear-Uncertainty-Doubt)

FUD stands for Fear, Uncertainty, and Doubt. These three words sound synonymous, and they work hand in hand in this psychological trading disorder. The FUD complex occurs when there is a doubt in the feasibility of a project, and as we may agree, doubt is spread by rumors and wrong notions that might arise from disbelievers of a cause. Till now, there are still people who don't believe in the reality of cryptocurrency.

some Financial whales refer to the crypto world as a temporary financial phase that'd take some time to blow over. This is why some of the time when the price of certain crypto assets happens, there might be an influential person behind all of it, who doesn't believe in the crypto world. This person may cause new investors to fear, be uncertain and doubt the actual feasibility of the crypto idea, due to its volatility.

The FUD occurs mostly on a downtrend, and every crypto asset must have passed through this phase where the investors doubt its ability to yield profit, causing a dip in price because demand reduced drastically and support remained unchanged at that moment.

cycle that FUD occurs in:

The summary of the cycle of the FUD is simple. It happens when a trader hears that a whale is pulling out his investments due to trust issues or "fake disbelief", and then feels anxiety and fear that his investment will end in a loss, so he pulls out but not sharply or swiftly, as he takes some time to do some analysis, this phase where he is uncertain about whether to pull out or not forms the second part of this FUD complex. After observing how the price has drastically reduced in such a short amount of time, he starts to doubt that there will ever be hope for this asset and then decides to pull out whatever he has left.

screenshot from tradingview

Just as he does this, it usually does not take too long for a whale to change his perspective in the investment in that crypto asset, and re-invests, causing the demand of the asset to rise uncontrollably or sometimes slowly. This incident causes the investors who had been affected by the FUD complex to fall into a depressed state, but in all honesty, they are still not certain that this price spike is not temporary, so they wait till it gets to a certain price level, and then the cycle starts all over.

Choose two crypto-assets and using screenshots explain in which emotional phase of the cycle you are and why. They must be in different phases.

Tron (TRX)

The chart of Tron first displayed a pattern that showed that the whale tried to trap the small investors with a FOMO psychology from April till June, that is a 3-month long trap that must have caught enough traders in a hex, where they are scared to keep their investment still on the project.

The uptrend that started in April was initiated when TRON was announced as the first-ever deflationary cryptocurrency in the world, and followed this announcement with a reduction in the circulatory volume of the asset, pushing supply lower demand and increasing the price. Now investors will see that the price of Tron has started to move up, and they might not believe in this uptrend until the price got to about $0.1

screenshot from tradingview

As I have explained before when explaining the F.U.D psychology, some fundamental analysis always comes to play, and the latest phase that TRX is on that I have observed is the FUD. Some news and rumors were spread about the TRX project, which made investors and traders doubt their choice of investment with the platform. Right now the price of Tron has dropped, meaning that more people are selling the token and are at a phase of doubt and uncertainty at whether the project will ever be prosperous.

screenshot from google search

Despite the rumors that are being spread against the TRX blockchain, there is definitely hope for the platform, because of their new developments like the reduction of volume of tokens in circulation, and the partnership with gaming platforms.

Binance Coin (BNB)

The Binance Coin is the official token for the Binance exchange platform and has been having a good run from the beginning of 2021, but had a major bullish push between April and May, that took the price to a high of $680 before starting a very steep fall in price in June this year, that put BNB investors in a state where they were forced to sell their shares and holdings of the token. The prominent and current phase that BNB is on in my opinion is a depressive phase where the price is slowly being taken up by the bulls of the market.

screenshot from tradingview

I depicted this phase because logically there is a strong backing for the coin, and new projects are coming up where the use of the token is going to be vital. As the green arrow in the chart above will depict, there is a brewing uptrend by the corner, just after a bullish engulfing pattern showed up. so all fingers currently point to a new uptrend and price correction.

Based on the analysis carried out in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (required), add screenshots of the operation and the validated account.

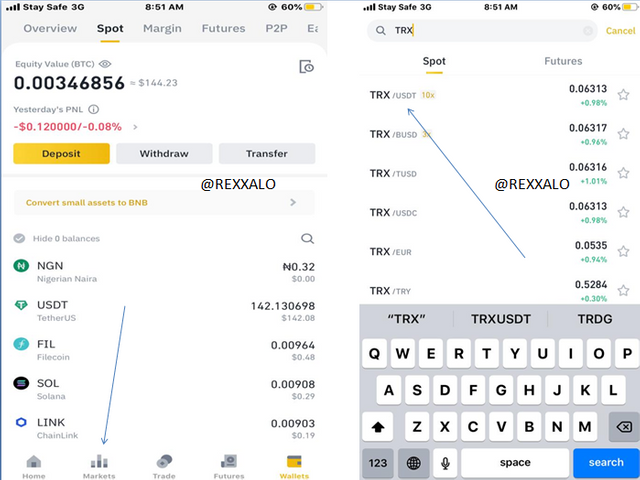

So from the two Cryptocurrencies from the previous question, I have chosen to buy some Tron (TRX)😉 because as I might have portrayed above, it is currently in a depressed phase and it will be wise to accumulate at this stage, and below I will take you to step by step on how I did it.

screenshot from Binance

I opened my wallet to show how much USDT I have to show that I'm a verified user, and I am eligible to buy and trade tokens. Also notice that I have not purchased any Tron here. so to do this, I follow the arrow and click on "market" this brings me to a search interface where I input "TRX" and choose the "TRXUSDT" pair, as I currently have USDT in my wallet. Notice the price of TRX, it currently is at $0.06.

screenshot from Binance

After I did that, it led me to an interface where I am allowed to trade my USDT for TRX so the first thing you have to do is, follow arrow 1, and make sure that it is set at "market" price and not limit price, then input the amount you are willing to buy, I put $20 as you can see above. After this Follow arrow 2 and click on the "buy" button and it will automatically place the order. Now follow arrow 3 and click on the wallet so we can confirm that the transaction has been completed. From the last picture, the arrow shows that I was able to get 316 Tron with about $20

conclusion

A good trader is one who balances psychology with readings and we have just gone through two big psychology phases that traders suffer from very often, and we have also discussed the steps to buy a coin that is looking like it is in a depressed state in order to accumulate. Thanks to @allbert for the informative lecture, I look forward to your reply.

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello, @ Thank you for participating in Steemit Crypto Academy season 3 week 5.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit