INTRODUCTION

Hello my fellow steemians and good day to you professor @reminscence01, this is my homework entry for the lecture taken on the introduction to charts, and i am honored to participate in this assignment. It is from the lecture that i will derive the answers to the questions of the homework task.

The questions to be answered

1.Explain the Japanese Candlestick Chart? (Chart screenshot required)

2.Describe any other two types of charts? (Screenshot required)

3.In your own words, explain why the Japanese Candlestick chart is mostly used by traders.

4.Describe a bullish candle and a bearish candle identifying its anatomy? (Screenshot is required)

But before we address the main questions in the article, let us understand the basics of charts, to make answering the questions easier.

Definition of a chart

A chart is usually described as a graphical representation of data relayed over two specific entities, these representation usually has time put in consideration, but this might not always be the case as charts could be used to relay a wide variety of data.

Now looking into charts in the light of cryptocurrencies and crypto trading, a chart can be seen as a graphical layout that is displaying the data of a coin, or a commodity, and sometimes these charts also show data of currency or coin pairs, by showing price change against each other over a period of time.

Now from this chart, a price analyst can now properly analyze the behavior of the price of the entity to a large extent. This will help the analyst to place his/her investment at the right time, or maybe close to the appropriate time, because he is exposed to price behavior over different levels of time frames.

The chart makes the price movement of a coin or a commodity pretty noticeable as it shows the movement of price in a specified direction in various ways, like the candle-stick, lines, bar, volume charts and so on. These various ways of chart representation can also be referred to as price movement charts, because they originate from indigenous ideas of how certain people and groups felt the data was better relayed.

The most used price action chart is the Japanese candlestick and we are about to learn about the japanese candlestick from this post as we go on to the first question!

Question 1: Explain the Japanese Candlestick Chart? (Chart screenshot required)

BACKSTORY OF THE JAPANESE CANDLE STICK

Steve Nison who is a chartered market technician, wrote a book about the japanese candlestick, and published it in early 1991, but it is said to have originally been invented by a rice farmer and trader in japan, who's name was Munehisa Homma in the eighteenth century, so technically, the pattern came into light a century after it's discovery.

DEFINITION AND GENERAL DESCRIPTION AND COMPONENTS OF THE JAPANESE CANDLE STICK CHART

.png)

A japanese candle stick chart is a chart that relays data of a commodity with the use of candle sticks which are placed in the direction of the price movement in relation to a time frame.

The japanese candle stick chart showcases some patterns that allows the market analysts to read the market, and this is called Technical Analysis The analysts use Technical indicators like the fibonnacci retracement indicator together with the candle stick chart as these two are a great pair to read the chart with.

The chart shows the price direction in only two ways as we have talked about previously, either the price is going up or it is going down. When the price is going up, we say it is in an uptrend, or a bullish trend, and when it is goin down, we refer to the direction as a downtrend or a bearish trend.

Later on, we would go on to understand what the candle sticks (which are very essential in the charts) look like and how they work.

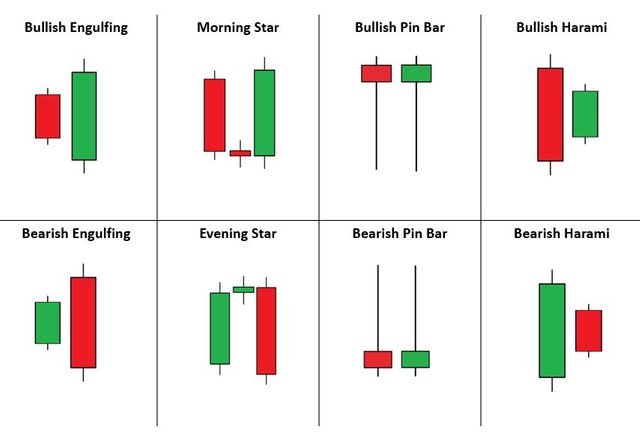

There are some patterns that the candle stick displays on the candle stick chart, that sometimes correctly indicate the future direction of the price the price trend. Here i would like to talk briefly with some pictorial illustrations on few of these patterns, and what they indicate.

BULLISH ENGULFING:

Bullish Engulfing indicates that the buyers of the market are overthrowing the sellers at the moment, and it indicates an uptrend.BEARISH ENGULFING:

Bearish Engulfing indicates that the sellers of the market are overthrowing the buyers at the moment, and it indicates a downtrend.MORNING STAR:

The morning star starts with a bearish candle, and then shows a candle called the "Doji". The Doji is the candle that looks like a plus sign, and signifies indecision of price in the market, but in the morning star scenario, the doji potrayed is usually a sell doji, and it is followed by a long bullish candle, and this pattern indicates a reversal towards a bullish trend.EVENING STAR:

The evening star starts with a bullish candle, and then shows a bullish "Doji" candle which we have said signifies indecision of price in the market, and it is followed by a long bearish candle, and this pattern indicates a reversal towards a bearish or down trend.

Other patterns are the Bullish and Bearish Harami, and Bullish and Bearish Pin bar, and the Hammer pattern.

Question 2: Describe any other two types of charts? (Screenshot required)

To answer this question i will be exploring other charts that tradingview provides, and the two i have chosen are the line chart and the kagi chart

KAGI CHART:

The kagi chart is a very unique chart too, as it consists of a series of vertical lines, connected by short horizontal lines. These vertical lines show the price action of the commodity being analyzed. It also originates from japan, as it was first used to analyze the price behavior of rice in the 19th century.

The Kagi chart is more summarized in comparison to the candlestick in the sense that one vertical line in the kagi chart can represent several numbers of candlesticks in a candle stick chart. Let us look at a picture of a kagi chart of STEEM/BTC below:

.png)

The kagi chart can be analyzed technically by the thickness of the horizontal lines. This is because, not all of the vertical lines are of the same thickness, and this is one of the most important features of the chart.

LINE CHART:

The line chart is a chart that uses a line to show the price movement of an asset or commodity being analyzed over a time frame or period. This chart in my opinion is the simplest and least detailed of all the charts available on the tradingview platform. Below is a picture of the line chart of STEEM/BTC:

.png)

The line chart just summarizes direction of price up until that point, and shows the analyst the opening and closing price of the commodity, but it is very hard to analyze as analysts are given very few information to work with unlike the japanese candlestick chart.

Question 3: In your own words, explain why the Japanese Candlestick chart is mostly used by traders

For this question, we would be addressing the advantages and edges that analyzing with the Japanese candle stick offers a trader who is looking to invest or get a sniper entry for a trade.

Chart colors make it easy to read:

The distinctive candle colors of the Japanese candlestick help traders know from one glance what the trend of the market is, Because if the market is on a bearish trend, there would be more red candles on the chart at that time, but if the price is going on a bullish trend, there would be appearance of more bullish candles on the chart.Little study is needed to carry out technical analysis:

With the japanese candlesticks, one does not need to study too much on how the candles form or how the patterns relate to price changes that happen on the chart.Candles relay so much data unlike in other charts:

The japanese candle sticks show the information about the buyers and the sellers of the market of that commodity, as each candle holds the information of the opening and closing price, and shows the real struggle between the sellers and the buyers at that point, helping the analyst predict where the market might be heading towards.Market reversals are spotted easily:

With the Candle stick patterns like the morning star and the evening star, and like the bullish and bearish engulfing, an analyst of the market is hinted about a price reversal against the formerly established trend. The candles also show clearly the support and resistance levels to help a trader or an analyst to predict and get ready for a reversal in price direction, and sometimes at these points, a pattern or two might show up aiding the course even more.

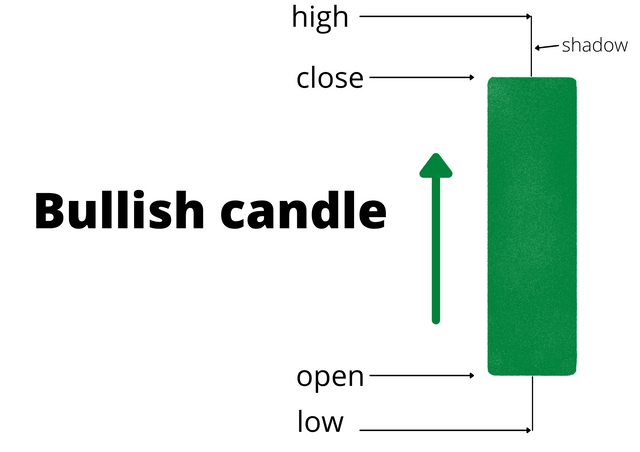

Question 4: Describe a bullish candle and a bearish candle identifying its anatomy? (Screenshot is required)

.png)

There are two main types of Japanese candle sticks and as seen above they are the bearish and bullish candle sticks. a single candle stick consists of components that make it look like a candle and it is structured in a way that it shows the opening and the closing of the market at the time the candle was made.

BULLISH CANDLE STICK

A bullish candle is generally represented with the green color it opens from the bottom and closes at the top, this is useful because it shows a market analyst what side is truly winning the bid whether it be the selling or the buying side. The bullish candle grows up, and represents that the buyers on the market are having a stronger hand. let's look at the chart to see when a bullish candle or bullish candles make up a trend.

.png)

The chart above shows how the uptrend was characterized by long bullish candles on the chart, and soon we would look at the anatomy of the Bullish candle.

COMPONENTS OF BULLISH CANDLE:

The Body:

The body of the candle is the space between the open point and the close point, it is usually rectangular and does not vary in size, that is, it has a fixed width but not a fixed length, as the length of the bullish candle varies with the price movement and the time frame.The high:

The High point of the candle is the end of the wick that shows the highest price that the price reached at the time frame specified.The low:

The Low point of the candle is the end of the wick that shows the lowest price that the price started from at the time frame specified.The shadow:

The shadow of a candle refers to the distance between the high of the candle and the close price, or the low of the candle and the open price.

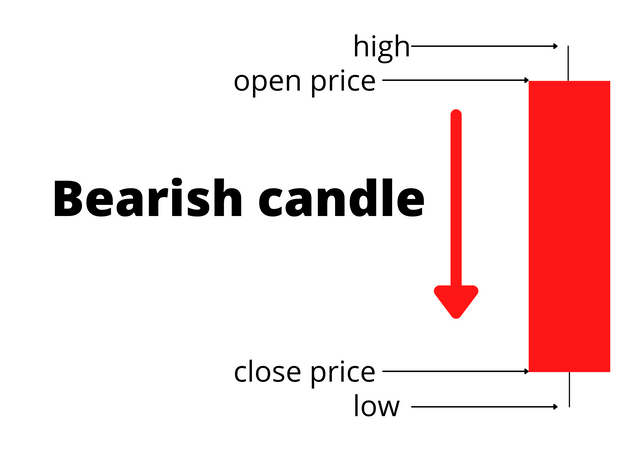

BEARISH CANDLE STICK

A bearish candle on the other hand is generally represented with the red color it usually shows an opening from the top of the candle and closes at the bottom of the candle, this indicates that the high of the bearish candle is under the structure of the candle itself and vice versa. The appearance of a bearish candle or a red candle on a chart shows that the sellers won the price battle. let us look at a chart with a bearish movement caused by a series of bearish candles, before we go into the anatomy of the bearish candle.

.png)

As seen from the chart above, the downtrend consisted 99% of bearish candles because the main direction of these candles are downwards.

COMPONENTS OF A BEARISH CANDLE:

- The body: This is the main part of the candle that relays the data of the direction that price moved at that period according to the timeframe used. The body of the bearish candle moves in one direction, and is bordered by the opening and closing price.

The high:

The High point of the bearish candle is the end of the wick that shows the highest price that the price started from at the time frame specified.The low:

The Low point of the bearish candle is the end of the wick that shows the lowest price that the price ends in at the time frame specified.The shadow:

The shadow of a candle refers to the distance between the high of the candle and the open price, or the low of the candle and the close price.

CONCLUSION

The japanese candle stick chart is the trader's go to chart for technical analysis for reasons that i have stated above, i hope this article was informative and i have answered these questions to the most of my power. special thanks to professor @reminiscence01 for the informative lectur, see you next time!

Hello @rexxalo, I’m glad you participated in the 2nd week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for submitting your homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit