.png)

cryptocurrencies are on the rise and in the lecture that professor @yohan2on took last week, we have been reminded of the presence of fraudulent activities and how to dodge these attempts. He highlighted the ways in which scammers work in the crypto-space and has given us some questions to help us further understand the topic, so below is my entry.

What are crypto scams?

Crypto scams are fraudulent and illegal activities that are used to woo prospective investors into losing their money or assets possessed. The fraudsters in the past generation are known to have followed the trend of finance, and they have not changed since then. As the world veers towards decentralized finance and cryptocurrency feasibility, fraudsters have started making their presence evident in the crypto world, as they look into taking advantage of the ignorance and naivety of new investors and newbies in cryptocurrency.

We know how cryptocurrency raised the eyebrows of so many sects of people, this commanded the attention of people looking to invest in new profitable ventures, this is what the scammers use to cash out on. The scammers come up with different formats to strongly drive the newbie investor's will to invest in the scheme. Crypto scams always sound too good to miss out on, because the scammers play with the confidence risk of prospective victims. The increase of scamming activities in cryptocurrency affects a lot in terms of the trust of other investors trying to go into the crypto market and affects the price volatility of crypto assets

Some investors keep in mind that investments could go wrong, and the more profitable an investment is, the riskier it is too, so these fraudulent individuals pry on this basis and bring up juicy proposals or render very good services as bait to lure in these investors before making away with everything. To make it clearer, I will be going through some of these scamming formats that have been used:

Wallet hacks:

Sometimes we have seen scammers just go underneath and hack the online wallets of asset owners, gaining full access to their assets, and making the security of crypto wallets look weak. An example of this is an occurrence of account hackings on the poloneix platform, which forced the poloneix governing body to issue a piece of general advice to all its users to reset their passwords.ICO scamming:

The concept of initial coin offerings has also been exploited by the scamming industry if that is a thing, and they do this by starting up a website and growing a fanbase for a token. This fanbase is the victim in this case as they are forced to make donations for the launch of the token, but the launch never happens because of the scammers who run off with all the donations before the promised launch date.Pump and dump:

A new token is about to launch, but a group of high stake owners is ready to manipulate the price to their desire, reaping every other person that is investing late into the launch. They push up the price and make it look like it is going to be higher, attracting ignorant users who invest and buy these tokens, and then they sell all their shares, dropping the price drastically and causing huge losses for other users.Fake investing sites and platforms:

This particular format is very rampant, especially in my country. The fraudsters create a Return on investments platform, where users are persuaded to deposit coins and receive a percentage return over a period of time. These percentages are usually very attractive, and they make sure to last for several months before finally abruptly closing the platform and taking all the tokens invested.

Make your research on any Cryptocurrency scam. (Attach a few references to the news surrounding that scam crypto project)

Here I will be concentrating on one of the biggest crypto scams ever recorded! There was a token introduced to crypto-mania that was a wolf in sheep clothing and made away with billions of dollars! let's look into some of the features of this scam below.

The Bitconnect scam

.png)

Bitconnect is a company that created a platform for users to exchange Bitcoin for its own token known as the Bitcoin connect coin. Bitconnect launched its Initial Coin offering in late 2016, November 5th to be precise. This ICO had no whitepaper it was based on initially, and still managed to raise a total of 468 bitcoin which was around 400,000 dollars at the time, within a space of one month.

The Bitconnect platform supplied three main services on its platform, they are:

BCC lending services: Here the platform allows users to lend them some of their BCC tokens for a return on investment after a period of time.

BCC trading services:They also provided users the option of trading the BCC token with the hopes of making profits like every other exchange platform.

BCC mining services: on the platform, users could also mine BCC for themself=ves by confirming previous transactions on the platform.

Promises made by Bitconnect's ICO

A giveaway of more than 4.8 million BCC tokens to the Bitconnect community and the cryptocurrency investors that have invested in BCC

Launch of BCC wallet to enable BCC staking and mining by users of the platform.

a yearly %120 return of BCC tokens staked by investors and lastly a proposal for the liquidity of the token, that is the BCC token would be used over different retailers.

The Bitconnect platform then launched its lending services in 2017 and witnessed a large influx of traffic on the platform. They promised the investors a yearly return of %480 and assured them that it was safe as it all resembled a one-way bet, with no ay of losing. All this was to promote the users to stake all their tokens for a long period of time.

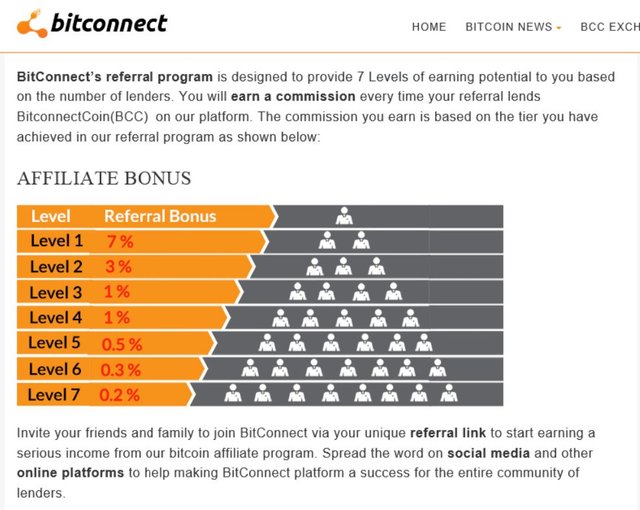

As I have shown above, The platform encouraged affiliate marketing and wanted to see that more people were brought in to lend tokens to the systems. They made rewards available for people who lent and brought others who lent. This is a very big red flag, but back then, as far as 2017, Ponzi schemes were not too well defined, so there was a huge acceptance of the platform and the token.

The Bitconnect platform encouraged users to lend their shares of BCC for a long period, but something could be noticed. The platform made it almost impossible to effectively withdraw lent tokens like they literally wanted to hold it out of reach till they were shut down. This is a huge red flag because legit lending platforms would make it easy to withdraw stakes. It was also noticed that on the platform, there were ridiculous spelling errors and grammatical blunders, but these were overlooked because I mean when you see a platform that could make you a billionaire, would you let some misspellings bother you?😂😂

The price action of the BCC token was also suspicious. It gave off the fact that the platform really was not selling any BCC token for USD or USDT to pay up investors on their lent tokens in case they wanted their money back. let's look at the chart below:

This line chart above shows that there was no selling strength, up till 10th June, and this just seemed like the platform was succeeding, but really this was a bad sign because it entailed that the platform was just hurdling the lent tokens and was not dissipating it to any other ventures.

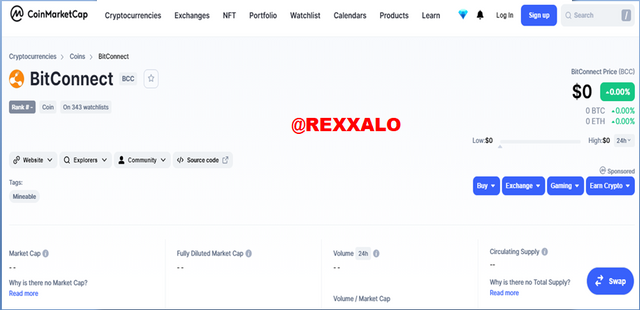

The all-time high of the BCC token got to a whopping $432 for a single token! as of early 2018 and the token was ranking between #23 - #26 on the coinmarketcap list. At some point, its growth for the month was greater than that of ethereum's. Its fame spread through the crypto-mania, attracting a lot of new investors who were interested in lending to the platform too. The next thing that happened was a gravity fall of the price to half of its all-time high in about one week! The manipulation was so evident, as everyone then expected a retracement and put more into the token to try and raise the price, the next three days after this was crazy! the price dropped from about $285 to $25 per token and now can you guess what the price currently is? look below to find out.

Yup, The token, and the platform later got delisted from so every exchange platform in the world over a year after these drastic price drops occurred. An estimate of $1.5 million people was scammed!!!! The known Bitconnect workers are facing lawsuits all over, but the impact has been made, and this is a very historic scam scheme as they mixed in a lot of formats and took several years to pull it off.

To what extent have Crypto scams affected the Crypto space?

To a mid-range extent, crypto scams have affected how things go on in the crypto space. Crypto-mania is now viewed by some as an unsafe place for transactions, as it is over the air, and hackers could access keys or assets could be in jeopardy if sent to the wrong address. Here are some bullet points of the effects of crypto scams;

Crypto space is a zero-trust zone:

The crypto-space has no love! no one trusts each other when it comes to transactions, and this is hilarious to me but also sad in some way. Transactions are very strict between two nodes or peers in the crypto space.Volatility of crypto assets:

crypto scams are known to have affected the price of crypto-assets drastically, like in the case of the popular Bitcoin hacking, it caused a price drop and contributed to the coin's price volatility.no transaction reversals:

The lack of trust in the crypto-space caused by crypto scams has also led to strict policies that hinder the reversal of funds if there was a fill-in of wrong wallet details. This is to ensure the authenticity of actual transaction receipts.Lack of support from Governments all-over:

We all know the unique opinions of the governments of countries like China and even America on crypto development. There is no support for cryptocurrency in these areas because the government also lacks trust in the cryptocurrency system.

There are so many other ways that crypto scams have affected the crypto-space like the fact that new coins are no longer trusted as much because it might just be another pump and dump scheme and so many others, but we just have to hope that cryptocurrency strives through all these challenges.

Will regulations in Crypto add value to the Crypto space?

This question suggests the question: will a decentralized cryptosystem be safer for users than this decentralized system? well in my opinion I would be honest and say yes, it would. If there was a high level of regulation in transactions and everything that happens in it, The crypto-space would be safer definitely, although, in my opinion, I will not promote the decentralization of crypto because if this was to happen, there wouldn't be a difference any longer between it and the old banking type of finance, taking us back to square one.

If the transactions on a blockchain were completely traceable, even to the person that owns the wallet, this would reduce loss of crypto assets to unknown wallet owners, like the notorious @deepcrypto that is steadily feasting off the mistakes made while transferring steem from a user's stem wallet to his Binance wallet.

There are other ways the cryptocurrency system can be improved through new regulations and policies that could and should be implemented, but I would not advise that this be traded for the decentralization of the cryptocurrency system.

CONCLUSION

I am thoroughly glad I got to partake in the class taken by professor @yohan2on and through research, I have managed to relay on this post, how crypto scams occur, and possible features and signals that a crypto scam is around the corner. It just made me realize also that the cryptosystem is also flawed like every other thing in the world, but there could be tweaks in policies that could make the crypto space more secure than it is at the moment. Thank you for reading through, I hope you enjoyed going through my assignment. See you next time!

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your research study on Crypto scams.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your remark

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit