(2) What Is Cryptocurrency and How Would You Like To See Cryptocurrency In The Future?

What Is Cryptocurrency

A cryptocurrency is a unique digitally signed currency that is created by cryptographic protocols to be stored and traded on the virtual space as a means of exchange.

Digital currencies are simply currencies that are electronically generated. That is they are created by computers and have no physical presence. Hashcash, B-money, Bit-Gold, and Blinded cash are all examples of digital currencies that existed before the development of Bitcoin.

Cryptocurrencies are digital currencies but are not limited to the defining parameters of a digital currency, hence the name crypto. Crypto simply means secret, covert or coded. This points to cryptocurrency as being highly secure. Cryptocurrency owes this feature to cryptography.

Cryptography is a networking security protocol derived by mathematical computations; it is not peculiar to cryptocurrency as it has long been applied in the fields of computer networking and cloud computation. However, cryptography only became more popular since its incorporation into the bitcoin project.

Two cryptographic protocols are mostly applied to cryptocurrency blockchains - Asymmetric encryption and Hashing. Both have similar features but are not the same:

Asymmetric encryption uses a private and a public key to encrypt and decrypt data from a sender to a receiver.

Public key: A public key is the encryption key. It functions like a case or variable that holds while disguising information or data. It is the key that can be visible to others without the risk of compromise because only an intended receiver has the private key that can decrypt the content of the public key.

Private Key: A private key is the decryption key. It decrypts the data contained in the public key. This key is kept private because exposure may compromise transaction security.

Put simply, the public key is like a physical lock while the private key is like the key used to open the lock. Every lock has a peculiar key that opens it and that's how it is with asymmetric encryption cryptography in cryptocurrency.

The second cryptographic technique I mentioned earlier is called hashing.

Hashing is used by miners to ensure that every block in the cryptocurrency blockchain is correctly verified and linked. Every block has data (several transactions) and these transactions cannot be added to a blockchain except the block in which they are cased is hashed and verified. The hash is a combination of alphanumeric characters that are derived by complex mathematical computations. They are the only means of identifying a block. Here is the hash of bitcoin genesis block.

000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f

In cryptocurrency, asymmetric cryptography is peculiar to crypto coins while Hashing is peculiar to block formation and verification.

Cryptography primarily eliminates the eventuality of spending a coin twice. Cryptography protocol in cryptocurrency bears the burden that would otherwise be borne by a central authority. In terms of authority, I can say cryptography is an automated authority of the crypto blockchain. Cryptography and consensus algorithm work hand in hand to create anonymity and a trustless system for cryptocurrency,

Blockchain is to cryptocurrency what skeleton is to the body: it is the underlying technology behind the operation of cryptocurrencies. In a crypto blockchain, transactions are not isolated but exist in cases called blocks. A block contains several digitally-signed transactions that occur within a particular time frame, validated by a miner and confirmed by the network.

The number of transactions that are put in a block is determined by the number designated by the network to fit a particular time frame. For instance, Bitcoin can comfortably process 4.6 transactions per second. It also takes Bitcoin about ten minutes to add a block. If this is the case, then:

4.6 x 60 seconds = 276 transactions in a minute

276 x 10 = 2,760 transactions in 10 minutes.

This means that the average no of transactions that can be added to form a block in the bitcoin blockchain is 2,760 transactions.

Every block in a blockchain lays reference to the preceding block. All blocks in a blockchain are linked by a common ancestry - The Genesis Block. The genesis block is the first block of every blockchain that defines the hashing procedure that would be followed by subsequent blocks.

A major feature of blockchain is decentralization.

Decentralization entails that there is no central authority or middle man that processes and controls the activities of cryptocurrency blockchains. The nature of blockchain automated programs and cryptocurrency consensus algorithms make it (centralization) somewhat unnecessary.

Decentralization means that communication is peer-to-peer in cryptocurrency blockchain. This means that users of a cryptocurrency blockchain can communicate directly with each other. It widens the network coverage of a user.

Record keeping in blockchain technology is contrary to what is obtainable in centralized chains where information is stored in a central server or database. Here information is evenly distributed across the different nodes present in a network: transactions are distributed evenly across cryptocurrency blockchains with no one particular node having a veto-proof. This is called a distributed ledger and is the reason why blockchains are deemed immutable.

Types of cryptocurrencies

Depending on developers and regulations, cryptocurrencies can be seen as assets, securities, commodities, utility tokens, property, and currency. Cryptocurrencies, however, are majorly classified into Bitcoin and Altcoins. For clarification, they are sometimes classified into bitcoin, altcoins, stablecoins, memecoins, shitcoins, and forkcoins.

- Bitcoin

Bitcoin is the first cryptocurrency that was developed by Satoshi Nacomoto in 2009. It was created to ensure secure transactions and eliminate centralization in finance. Bitcoin is driven by a Proof-of-work mechanism where miners are charged with the responsibility of solving complex mathematical problems and are rewarded some BTC in return, thus ensuring BTC circulation and continuity. Bitcoin rewards halves after every 210 blocks are created and would eventually be fizzled out when the number of BTC in circulation caps 21 million.

Bitcoin is the most traded cryptocurrency in the world with a market capitalization that surpasses that of Ethereum (the second most traded cryptocurrency) by about 1600%.

- Altcoins

Every other cryptocurrency that is not bitcoin is referred to as Altcoins. They all have different purposes for their creation though they carry the major features introduced in bitcoin such as cryptography, decentralization, blockchain, and consensus mechanism e.t.c.

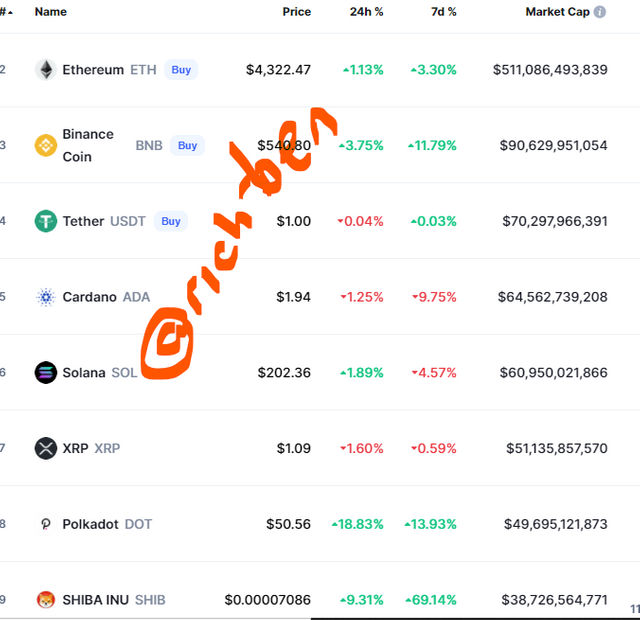

There are thousands of altcoins currently in existence today with the most popular being the Ethereum. Ethereum is the first altcoin that was developed by Vitalik Buterin in July 2015. Others are Cardano (ADA), Binance coin (BNB), Solana, Polkadot, XRP e.t.c. Below are some altcoins by market cap.

- Stable coins

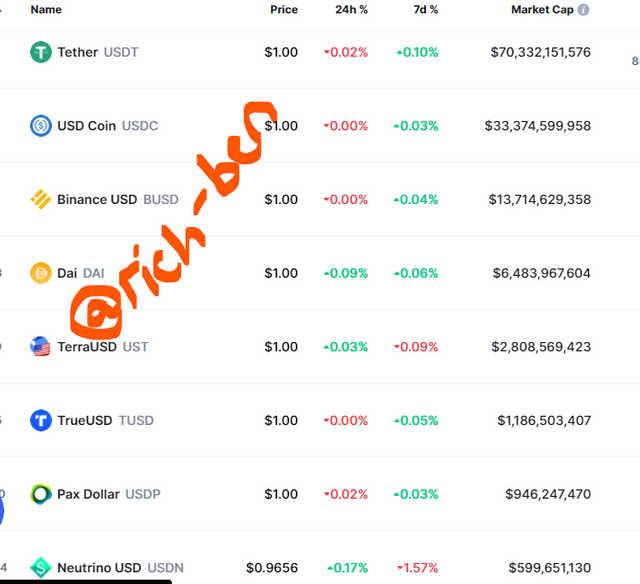

They are the crypto version of a fiat currency so to say. They are coins which values are attributed to the value of a fiat currency. USDT, for example, is the stable coin of the US dollar: 1 USDT always equals 1 USD. Stablecoins are used as intermediaries to exchange cryptocurrencies that cannot be readily exchanged. For example, a user may want to buy bitcoin with their steem but may not be able to do so because the exchange does not support such pairs. What the user can do is buy USDT with their steem and then use the USDT to buy bitcoin.

Stablecoins are better options for investors who are uncomfortable with the volatility inherent in the crypto market but are willing to invest in it. Below are some stable coins by marketcap.

- Shit coins:

AS the name implies, shitcoins are coins that have no value. They usually give the impression that they are useful but their operation across time in the market exposes how valueless these coins really are. They serve no specific purpose and are usually characterized by low market cap and low price.

Sometimes, the valueless nature of shitcoins is exposed in their whitepapers. It could be that the eventual operation of the coin in the market does not reflect the publication in its whitepaper or the whitepaper is altogether erroneous: it could be vague or plagiarized content or both.

- Meme coins

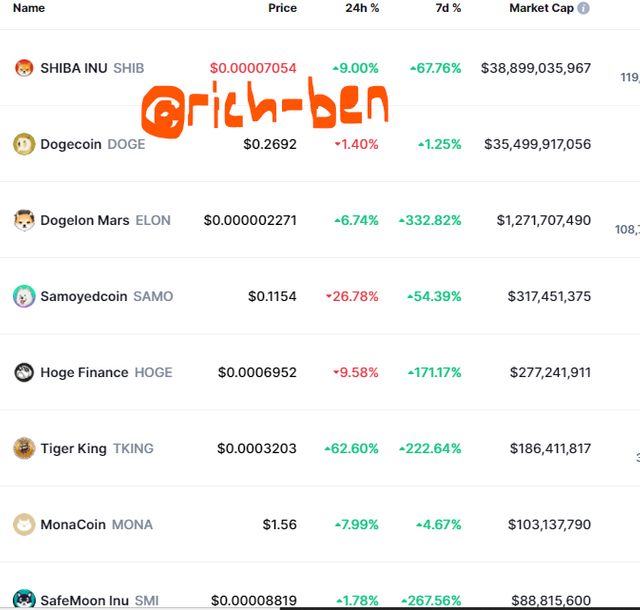

These are alternative coins that are inspired by memes. Dogecoin is a notable example of a memecoin: it is inspired by a dog meme. Others include SHIBA INU, Samoyedcoin, Tiger king, SafeMoon Inu, and Hoge e.t.c. Below are some meme coins by market cap.

- Fork coins

Fork coins aka split coins are coins that are formed as a result of alteration in the software protocol of mining activities. They are developed from an already existing cryptocurrency blockchain. The process of creating a forkcoin is termed forking.

There is the soft fork and the hard fork. Soft fork does not necessarily create a new cryptocurrency but makes slight changes in the software protocol of the cryptocurrency.

Hard fork is the total change in direction of a software protocol by miners. This entails that the change in software protocol is adapted to form a new chain of blocks in the blockchain, thus denying reference to the genesis block of the original chain. And it is likely manned by a new team of developers. Some examples of bitcoin forks include Bitgold, Bitcash, Bithereum, Bitcoin Oil, Bitcoin Gold, Bitcoin Core, Bitcoinx, Bitcoin Faith and Bitvote e.t.c. There are so many bitcoin forks out there.

How would you like to see cryptocurrencies in the future?

Cryptocurrencies, I believe have come to stay and would yet be developed and incorporated into greater technologies. And here are some of my opinions on what cryptocurrencies should be and not be in the coming future.

- Cryptocurrency Education

First of all, I would like to see more financial training being conducted on the usage, importance, and risks associated with cryptocurrencies (wallets and exchanges inclusive).

Financial institutions and other related institutions can incorporate the study of cryptocurrencies into their curriculum. This is necessary because people find it difficult to understand the intricacies associated with cryptocurrency usage.

- Regulation

Secondly, cryptocurrencies must be regulated to ensure that cryptocurrency is not a hood for criminal activities. Regulation, though necessary, shouldn't undermine completely the underlying technology and protocols behind the operation of cryptocurrency.

- Means of Payment

Thirdly, it would be nice if more global and local corporations accept less volatile cryptocurrencies as a means of payment. PayPal seemed to have worked this out for USA citizens. This would go a long way to reduce the cost that is incurred when making payments through middlemen like banks and Western Union.

This would also foster faster transactions and eliminate the eventuality of high conversion rates when exchanging one fiat currency for another.

- Better Scalability

Also, I would like to see enhanced scalability with cryptocurrency blockchains. Scalability seems to be an issue with virtual decentralized setups like cryptocurrency blockchains. However, I hope that with continuous development and upgrade, more cryptocurrency blockchains would be able to compete with virtual centralized setups or even be better in terms of the number of transactions they can process per second. It is good that some cryptocurrency blockchain like Solana is making real progress in solving this issue.

- Curb Proliferation of cryptocurrencies

In addition to the above points, I think it would be important to limit the number of cryptocurrency projects that should ever be allowed to exist. If a lid is not put on cryptocurrency development, the geometric progression of cryptocurrency may see cryptocurrency projects grow to even outnumber the number of people in a continent. That wouldn't be nice!

Some of the outcomes would be confusion in investment choice and loss of investors' money. It would then be justified when cryptocurrency is referred to as a "Superfluous Bubble".

- Possible Retrieval of lost keys

The idea of irretrievable loss with cryptocurrency keys is quite scary. Someone invests a huge amount of money, loses his keys and that's it. Wow! That’s enough to deter someone from investing in cryptocurrency. If lost keys can become retrievable without altering or destroying the underlying technology behind cryptocurrency, that would be a lot better!

- Acceptance as a legal tender

Finally, I would like to see less volatile cryptocurrencies like Bitcoin become legal tender in countries of the world. Volatility, which has been one of the major deterring factors to this idea, can be eliminated by pegging Bitcoin to an asset like gold or petroleum or to a fiat currency (this may prove very difficult to achieve).

I do not believe that volatility is a problem with cryptocurrencies as some may argue. It is the major attraction for short-term traders and even long-term traders depend on volatility for profit. It remains that you invest what you are willing to lose (This sounds funny though as I don’t know anyone willing to lose money). Traders profit and lose from volatility.

However, as I pointed out earlier at the beginning of this point, the more popular and less volatile cryptocurrencies like bitcoin can be pegged to an asset or fiat currency so that it can be used as a legal tender without having to go up and down the streams of volatility.

Cryptocurrency is a forward leap on the achievement of a cashless economy which I believe has been the aspiration of many developed governments of the world.

Surprisingly, the governments didn't make cryptocurrency happen, Satoshi Nacomoto did. Bitcoin opened the way for the influx of other cryptocurrencies and here we are exploring the new technology.

Despite all of its benefits, cryptocurrency remains a relatively novel project and therefore is prone to investigations on important issues such as security and regulations.

The future of cryptocurrency is quite certain, though regulations are hitting hard on it, it seems to be resilient enough to stand the test of time.

Thank you for reading.

Courtesy: Prof @stream4u

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit