Hello steemians how are you? I hope you all are fit and fine in this pandemic time. Today I read about season 3 of the crypto academy and I found it a really interesting and creative way to increase quality content and knowledge.

Today professor @imagen explain a wonderful lecture on staking and DPoS. After complete analysis and reading now i am submitting my homework post to professor.

HOMEWORK BY @rinkisaxena

Staking

Staking is a process to lock funds in a cryptocurrency secured wallet so that users and traders can contribute to the maintenance of a blockchain system based on PoS (Proof of stake). It is similar to cryptocurrency mining but doesn't require heavy hardware equipment. it helps the network to form a consensus and pay back the participating users.

There are two methods of staking which normally used by traders and users for staking :-

- Exchange staking

- Staking-as-a sevice platforms

Exchange Staking :-

Exchange Staking allows investors to keep their PoS guaranteed assets in their trading account wallets and earn "interest" in the form of new tokens. The exchange filters the technical aspects of the process and (usually) charges a small fee for the service. So that exchange and investor both earn a good amount of funds. Which can be considered as profitable staking.

The Exchanges that provide staking are named below :-

Staking-as-a sevice platforms:-

These platforms allow staking by reducing the technical aspects which help trader to stake their stakeable tokens easily. Here the thrid party take care of all the technical aspects during staking process. The main reason of creation of this platform is to open all the doors for users who don't have technical knowledge but want to be part of staking economy. This is also referred as soft staking. The platform charge a normal percentage of fees for development of platforms depends on no. Of coin you stake.

The ServicePlatforms that provide staking are named below :-

QUESTION 1:-

Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable according to your opinion.

Answer :-

Now let us discuss about two platforms one from exchange staking and second from service platforms of staking.

| S.no. | Name | Type of staking provider | Logo |

|---|---|---|---|

| 1. | Figment Networks | Staking as a service |  |

| 2. | KuCoin | Staking Exchange |  |

image source :

https://www.blocksocial.com/top-staking-as-a-service-platforms-to-stake-crypto/

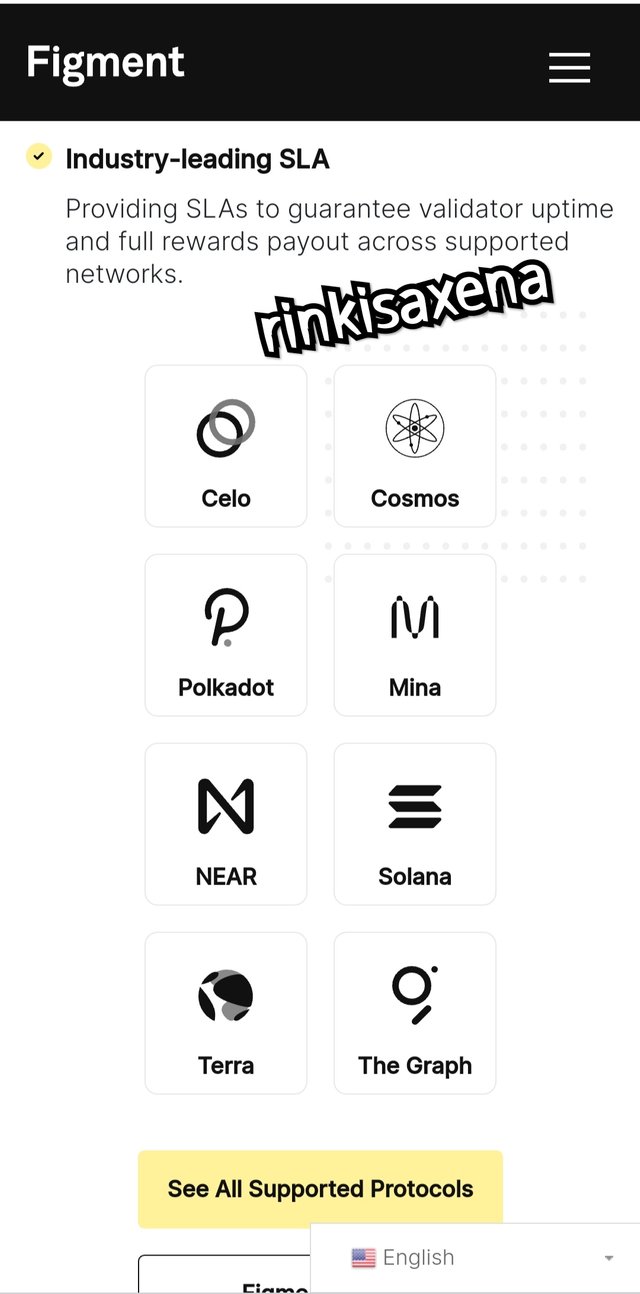

FIGMENT NETWORKS

Figment network is a Canadian staking as a serive provider which was found in 2019 by Co-founders Matt Harrop, Lorien Gabel and Andrew Cronk. This platform not only provide staking but also built a institutional-grade infrastructure, software, and tools for token holders and stake-based blockchains. It provide businesses and individuals to make valuable decisions, track paybacks, manage their staking.

Reward of staking in Figment networks :-

It provide 100% reward after staking the coin and also its staking fees lie in between 0-15% of the total number of coin staked which is less.

Why to choose Figment Networks:-

There are few reasons which allow us to use or may use figment networks for staking coins :-

It provide secure staking infrastructure to the users which promote high staking in between trading community.

Figment network focus on governance and providing better working and staking features to the platform.

It reports in depth staking rewards which help tax pairs to show in their respective books.

It provide user friendly environment and provide 100% staking reward.

It also dont take very high transaction fees after staking.

Coins we can stake on figment networks :-

| Name of the coin |

|---|

| Ethereum |

| Polkadot |

| Tezos |

| Livepeer |

| Chainlink |

| Cosmos |

| Aion |

| Kava |

| Solana |

How to stake in figment network :

- visit the main website of Figment network

- click on stake option ,it will take you to the main option of coins.

- select the coin in which you want to stake the coin.

- Create an account now you are ready to stake the coin.

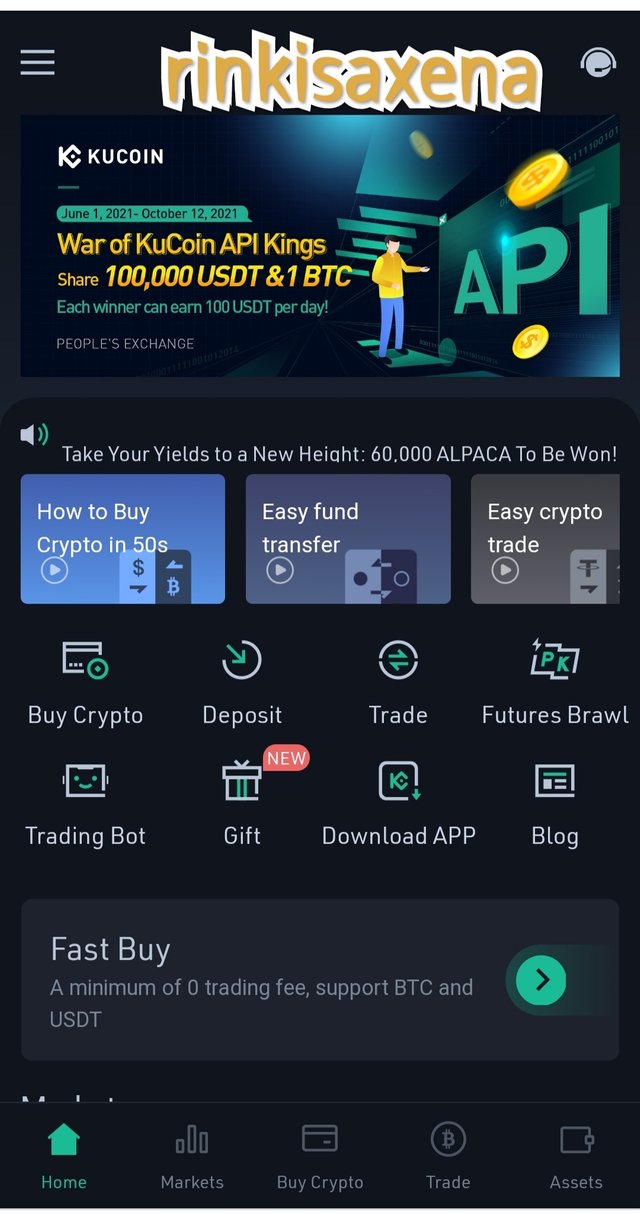

KuCoin

KuCoin Exchange also known as the People exchange is a well-known cryptocurrency exchange that was found in 2013 and was officially licensed and launched in 2017. KuCoin was found by Micheal Gan, Eric Don, Top Lan, Kent Li, Jhon Lee, Jack Zhu and Linda Lin. According to many reports and traders Kucoin is considered to be the safest and responsible exchange in the field of exchanges. And how a days KuCoin provides its services in many countries like India, Turkey, UK, Japan, Canada, Singapore and many more. Its main headquarter Kucoin is in Singapore. kucoin exchange allows its user to stake several assets and coins without locking them using the mechanism of soft staking.

Why to use KuCoin :-

Kucoin exchange have many different features which mKe this exchange more useful and beneficial for use few of them are :-

Low trading and withdrawal fees which help trader to make more money through exchange.

User-friendly exchange which create an environment of excellent trading.

Vast selection of altcoins as it have more than 200 options to select for trading and staking.

24/7 customer support which help trader to clear their doubts related to any altcoin or feature in the exchange.

Ability to buy crypto with fiat. We can buy crypto by our own native currency.

No forced KYC checks, user can do it any time as per their requirements.

Ability to stake and earn crypto yields, also its crypto staking fees is around 5-10% which is quiet affordable.

Coins users can stake in KuCoin.

There are several coins one can stake in KuCoin. A few of them are given below:-

| Name of the coin |

|---|

| Algorand (ALGO) |

| Aion (AION) |

| Cosmos (ATOM) |

| EOS (EOS) |

| Tron (TRX) |

| Internet of Services (IOST) |

| Neblio (NEBL) |

| DeepOnion (ONION) |

| Energi (NRG) |

| NULS (NULS) |

| TomoChain (TOMO) |

| Loom Network (LOOM) |

| Loki (LOKI) |

| V Systems (VSYS) |

| WAN (Wanchain) |

| Tezos (XTZ) |

| PIVX (PIVX) |

How to stake in Kucoin :-

- Download Kucoin app or visit its website.

- create an account and complete your kyc.

- Buy the asset you want to stake.

- Now hold the asset and earn the rewards by staking those coins.

Comparison between Figment networks and KuCoin

| Figment networks | KuCoin |

|---|---|

| Figment network is a Canadian staking as a serive provider which was found in 2019 . | KuCoin well-known cryptocurrency exchange that was found in 2013 and was officially licensed and launched in 2017. |

| It is a staking as a service provider | it is a staking exchange. |

| Its staking fees is 0-15% | its staking fees is 5-10% |

| Ethereum, polkadot, tezos are few coins that one can stake. | V system, Loki, tomochain are few coins one cam stake in Kucoin. |

So these are the two platforms which in my opinion is better to use for staking in terms of Exchange staking, Staking-as-a sevice platforms.

QUESTION 2 :-

What is Impermanent Loss?

Answer :-

Impermanent loss or non permanent is a temporary loss of funds that a liquidity provider face. This loss is faced by provider due to volatility in a trading pair. The price fluctuation increase volatility in the market which may become the reason for temporary loss in the market. The more crucial the price fluctuations is, the greater the impermanent loss can be.

So this is the breif discription about impermanent loss.

Question 3 :-

What is delegated proof of stake?

Answer :-

Delegated proof of stake or DoPS is a new or updated type of consensus algorithm of pos. Both DoPS and PoS are alternatives of PoW. As PoW require strong hardware setup for mining. But DoPs dont require it.

Delegated proof of stake (DPoS) is a blockchain confirmation and consensus mechanism. As a method of analyzing transactions and promoting blockchain organization, it is and alternative of proof of work and proof of stake models to mine more coins. Delegated proof of stake have different projects like Tron, steem etc. The Delegated Proof of Stake (DPoS) consensus algorithm was developed in 2014 by Daniel Larimer.

Working :-

Delegate's duties include guaranteeing that their nodes are always running, collecting transactions and building them into blocks to verify the transactions and re-solving consensus issues that may happen in the network.In most of the DPoS chains, voting for delegates is available to all asset holders in the network, and voting power is directly linked to the number of tokens held by a certain account.More the number of coins more will be the voting power and more will be the block reward.

Conclusion :-

So now its time to conclude our homework post in which we discuss about staking that is the process locking funds in a secure wallet to earn rewards. There are two types of staking:

- Staking as a service provider

- Exchange staking

In these two we discuss about Figment networks and KuCoin. And also comapre them on the basis of origin fees coins etc. After that we discuss about impemanent loss which is a temporary loss of funds due to high flactuation in crypto market. Then we discuss about delegated proof of stake which is a type of consensus algorithm that help to earn reward through voting. Number of coins hold depends on voting power.

So its the end of my homework post. Thank you so much. Have a nice day.

Hola @rinkisaxena

Gracias por participar en la primera semana de la tercera temporada de la Academia Cripto de Steemit.

Me gustó tu portada, la publicación tiene una buena estructura, las tablas que hiciste brindan información de calidad. Muy interesante no conocía FIGMENT NETWORKS

Calificación: 7.65

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much professor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit