Hello steemian ...

This is my new post in the Steemit Crypto Academy community, on this season 4 week 3, I will be working on a homework from professor @awesononso with the theme "The Bid-Ask Spread (Part II)”.

we will discuss it through the homework below:

1.) Define the Order Book and explain its components with Screenshots from Binance.

Every place where we trade, of course, has an order book, which functions to see the price of certain assets, this order book always changes from time to time according to the offer and demand that traders make at any time. In the example below I took the order book on Binance.

In the order book, we can see the bid price and ask price which can help us in placing buy and sell orders. In the order book, there are two parts, the red part, and the green part.

The red part is a sell offer. In the red section, we can see the bids from the lowest to the highest. we can see the price offered, the amount of inventory, and also the total (price x amount).

In the green section are buy orders. In this green section, we can see buy orders from the lowest to the highest. in this buy order, we can see the order price, order amount, and also the total (price x amount).

2.) Who are Market Makers and Market Takers?

Market makers and market takers are two opposite things. A market maker is a trader who buys at the Bid price or buys below the lowest selling price and sells at the ask price or sells above the highest buy price which causes the buy or sells to be delayed and enter the order book until another trader sells or buys at that price. what we want or waiting for the market to touch the price we want. Being a market maker has its advantages, one of which is that you are not subject to discounts or fees when making transactions, and other advantages, you get a high price when you make a sale and get a lower price when you make a purchase.

Market takers are the opposite of market makers. Market takers are traders who buy at the ask price and sell at the bid price which causes our buying and selling to take place immediately without any delay. The advantage of being a market taker is that we don't have to wait a long time to make a transaction, so if we need a quick purchase or sale, becoming a market taker is the best choice.

Market makers and market takers have their advantages and disadvantages. To become market makers and market takers depends on our condition when trading. If we want to get more profit without needing to be quick to get it, we should become market makers and if we want to be quick to make a purchase or sale then we should become market takers.

3.) What is a Market Order and a Limit order?

Market orders and limit orders are features related to market makers and market takers. Market orders are a feature that we use to become market takers, which means we use this feature if we want to buy or sell an asset directly at the selling price or purchase price that has been set in the order book which results in our purchases or sales being processed immediately. without any delay.

Limit orders are a feature that we use to become market makers, which means this feature helps us to set a purchase price below the current purchase price and set a selling price above the current selling price if the purchase price or selling price does not touch or miss the price we set. If you install it using the limit order feature, the transactions that we do will not be processed.

The difference between market orders and limit orders is in terms of execution. If you want to buy or sell on a centralized market, there are two ways that we can use, the first way is to determine the purchase or sale price using a limit order and the second way is to use a market order so that our purchases or sales can be carried out immediately. Both methods certainly have advantages and disadvantages each and we use them as needed.

4.) Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

In the market, of course, there are market makers and market takers. A market maker always makes an order using a limit order which means a market maker is a maker of market liquidity. The more a market maker places orders to buy or sell on a particular asset, the greater the liquidity of the market. Furthermore, a market taker must make a purchase using a market order, which means that market takers will buy or sell the asset at the price previously made by the market makers. Then the needs of both are met because a market maker makes a sale or purchase using a limit order and a market taker buys or sells an asset that is sold or bought by a market maker. In short, liquidity providers are market makers and those who take liquidity are market takers.

5.) Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

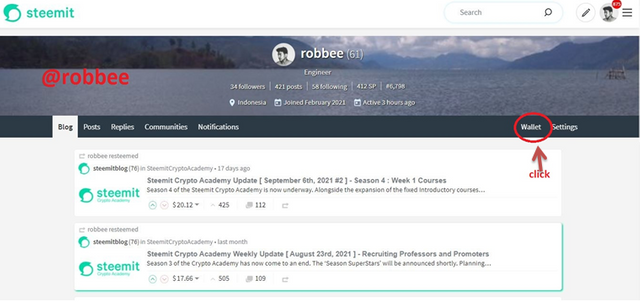

Before accepting and changing the lowest ask, we should first enter the steemit wallet. To enter into the steemit wallet, open the steem profile first. When you are in the steem profile, press the wallet at the end.

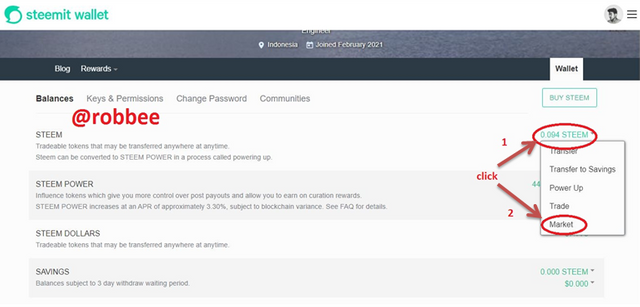

Here we have entered into the steemit wallet. Next, to place an order, we press on the steem section, then press market.

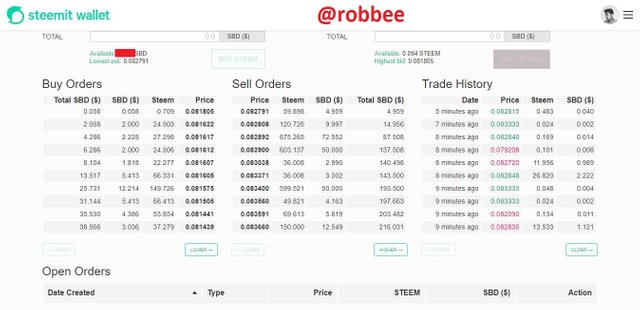

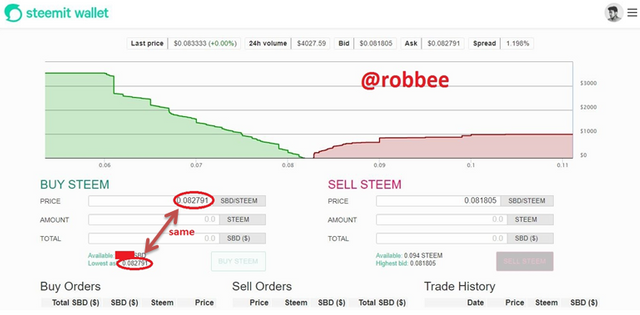

Here you can place an order. If we scroll to the bottom, we can see our order book and open orders.

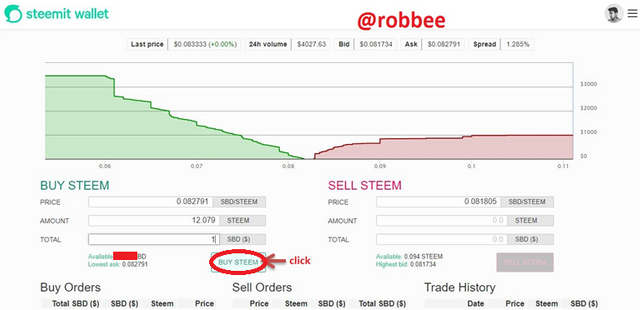

a.) To receive a lower ask, we equate the price with the lower ask at the bottom.

Because here I want to buy 1 SBD, then I fill in the total with the number 1, the amount will automatically be filled.

After the price is the same as the lower ask, the amount, and the total has been filled, then we purchase by pressing buy steem, and the order has been obtained.

If we receive a lower ask, then we get our order immediately because we buy at the lower ask price which is indeed the lowest price sold or the ask price, then as a buyer who buys assets at the ask price or the lowest price that the seller wants to sell the buyer's automatic seller will immediately get the order without delay.

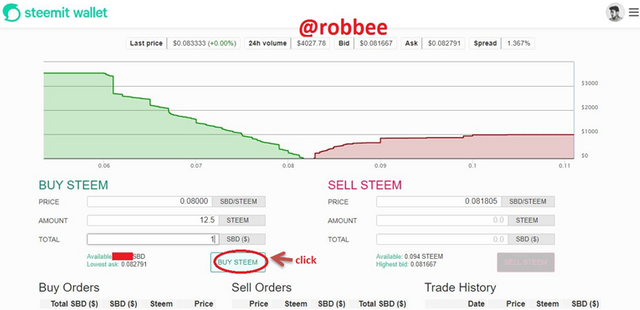

b.) If we want to place an order that is different from the lower ask or below the lower ask price, then in the price section we distinguish it from the lower ask at the bottom.

In the total and amount section, the steps are the same as the steps above wherein the total section we fill in the number 1 and the amount section will automatically be filled.

After everything is filled, we make an order by pressing the steem buy button.

If we order below the lower ask price, our order will not be instant and our order will be delayed until the price drops to the price we ordered.

6.) Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

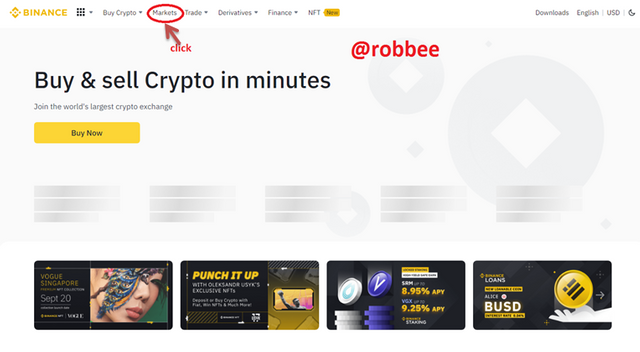

To place an order to buy on Binance, we first open Binance on google search or open the following link www.binance.com. To enter the purchase menu, then press the market at the top.

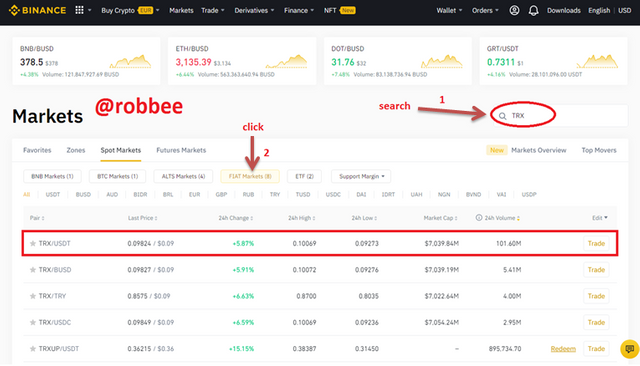

Next, we choose the type of coin we want to buy, in this example, I use the TRX/USDT coin, to find TRX/USDT in the FIAT market.

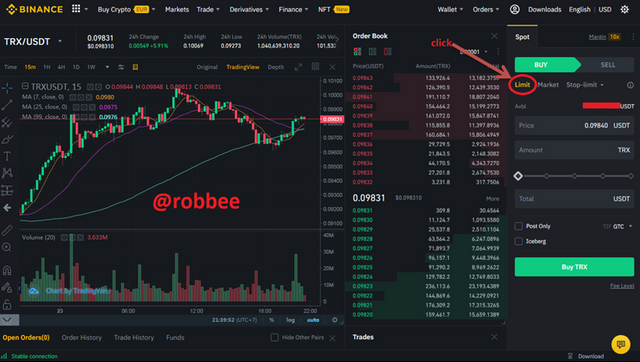

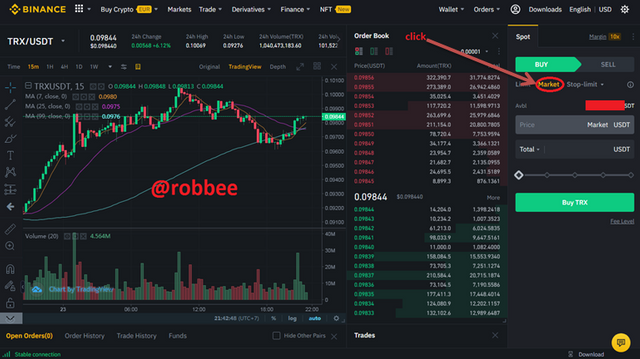

Here is the initial view of Binance when we have finished selecting coins.

To place an order using a limit order, then on the right side as I marked in the picture, press limit on the buy section.

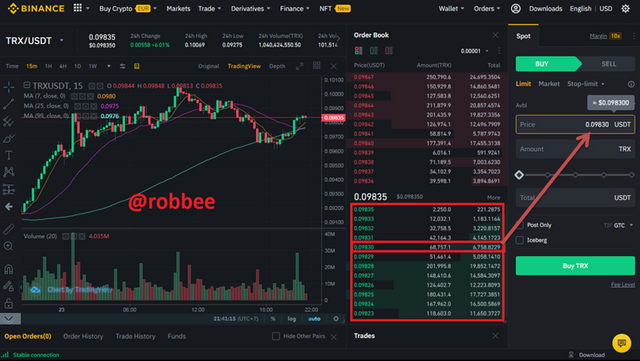

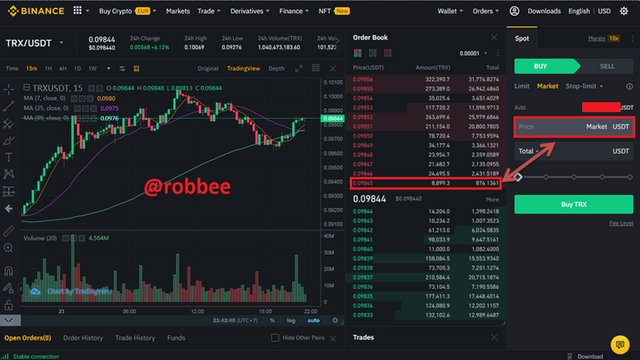

If using a limit order, then we enter the price at the highest bid price or below it as in the example in the image below.

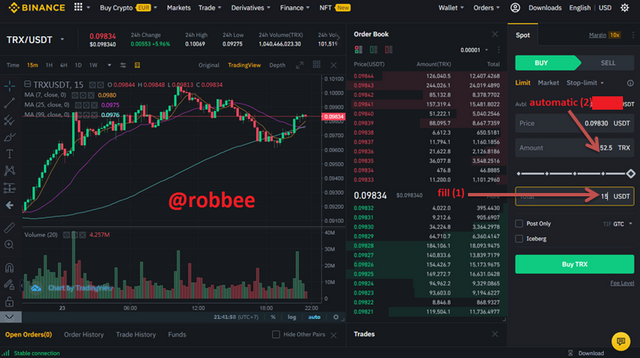

After filling in the price, then we will fill in the amount/total as needed, because if we fill in the amount section, the total will be filled automatically and vice versa. In this example, I fill in the total section of 15$ and the amount automatically fills itself.

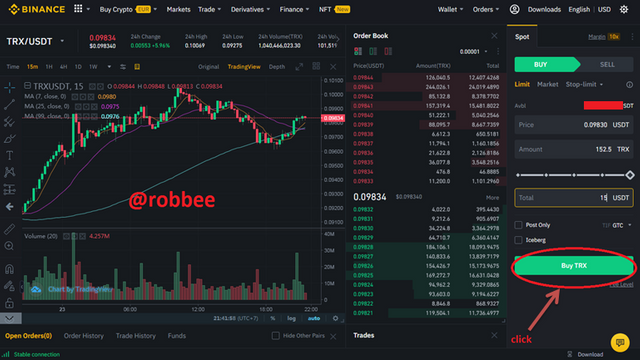

After filling in the price and amount sections, then press buys TRX as shown below.

The impact of buying using the limit order feature, the order we want is delayed until the price drops or someone wants to sell the asset at the price we want.

7.) Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

To buy with the market order feature, the steps are the same as answer no. 6 above. So I immediately explained how to make a purchase.

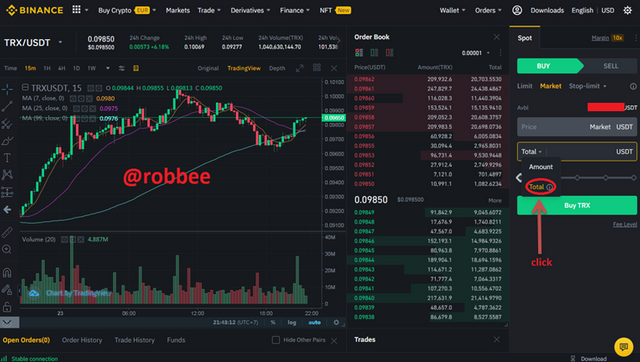

To buy using the market order feature, we select to buy on the right, and then we select the market.

To buy using the market order feature, we don't need to fill in the price section, because this market order feature uses the lowest ask price as in the example below.

Then we only need to fill in the amount/total that we want to buy. Because I want to buy for 15$ I fill in the total part and I fill in 15$ like the example below.

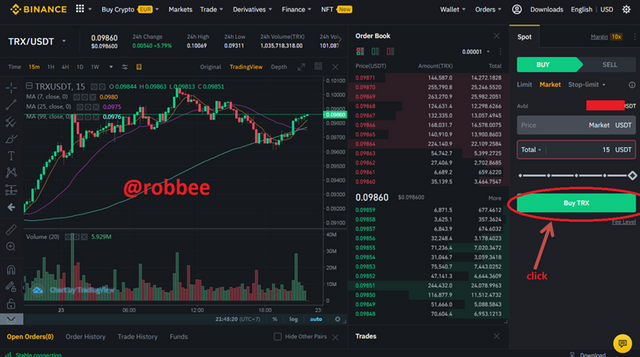

After filling in the total, then press buys TRX to make a purchase using the market order feature.

Because I use the market order feature, my order is automatically bought immediately, because if I use the market order feature, the purchase is made with the lowest ask price.

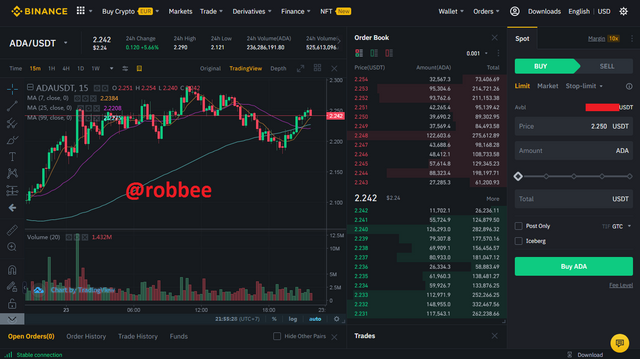

8.) Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

a) To calculate the bid-ask, the formula we use is what we learned earlier, namely:

And for the formula in percentage is:

In the picture above the values that can be taken are:

Bid Price = 2.242$

Ask Price = 2.243$

Then the value of the Bid-Ask Spread is:

Bid-Ask Spread = Ask Price – Bid Price

Bid-Ask Spread = 2.243$ - 2.242$

Bid-Ask Spread = 0.001$

And the percentage is:

% Spread = (Spread/Ask Price) x 100

% Spread = (0.001$/2.243$)x100

% Spread = 0.045 %

b) To find the value of the mid-market price we use the median value of the bid price and ask price. The formula is as below:

Here I take the example in the previous image, and I use the lowest Bid price and the highest Ask price in the image.

Bid price = $ 2.231

Ask price = $ 2.254

Mid-Market Price = (Bid price + Ask Price)/2

Mid-Market Price = ($ 2.231 + $ 2.254)/2

Mid-Market Price = $ 2.243

Conclusion

As a trader, we must be able to place buy and sell correctly. We also have to be able to put ourselves in the market makers or market takers, because they are two opposite things and have their advantages and disadvantages. To become a market maker we have to use the limit order feature while to become a market taker we use the market order feature. The order book is also something we must learn because it can help us in trading.

References:

https://bitocto.com/octopedia/apa-itu-market-maker-market-taker/

https://help.rekeningku.com/pengertian-market-maker-dan-market-taker/

https://blog.pluang.com/cerdascuan/trading/bedanya-limit-order-dan-market-order/

https://www.binance.com/