Hello steemian ...

This is my new post in the Steemit Crypto Academy community, on this season 5 week 7, I will be working on a homework from professor @lenonmc21 with the theme "Trading Strategy with “Price Action and the Engulfing Candle Pattern””.

we will discuss it through the homework below:

1.) Say in your own words that you understand about the Trading Strategy with “Price Action and the Engulfing Candle Pattern, also describe each step to be able to execute it (Place at least 2 examples in clear cryptographic assets and with your own charts mandatory) ?

A strategy when trading aims to find out the right time to sell or buy, it is done to get a profit when trading. Likewise, with the price action strategy and the engulfing candle pattern, this strategy is also the strategy we use when trading. From the name of the strategy, we can already imagine that this strategy uses a combination of price action strategies and engulfing candle patterns. Although this strategy combines two types of trading strategies, the price action strategy is the core of this strategy because the market must have a clear trend direction which means the price chart must have a very clear direction and also a clean harmonic trend, for example, if the trend is bullish. then the price chart movement will form higher than the previous highest price chart and vice versa.

The price action strategy and the engulfing candle pattern require us to look for a clean trend direction, the trend can be bullish or bearish which will certainly make the difference in future decisions. The net trend is unlikely to continue, for sure there will be a time when the trend goes down. When the price chart drops from the net trend then we wait for the market to break and look for a lot of liquidity to continue the new trend and this is where the engulfing candle pattern is used.

When you want to use the price action strategy and the engulfing candle pattern we use more than one timeframe, for good results it is recommended to use a low timeframe such as 30 minutes, 15 minutes, 50 minutes. To be clear about how to execute the price action strategy and the engulfing candle pattern, I will explain step by step.

Steps to execute the price action strategy and the engulfing candle pattern.

Step 1 (look for a chart with a clear and harmonic trend)

The first step to using the price action strategy and the engulfing candle pattern is to look for a clear and harmonic trend, the trend can be bullish or bearish the goal is to find a clear trend. To identify the trend, it is recommended to use a 15-minute timeframe, here is an example of the net trend.

As we can see in the picture above, the price chart is in a bearish trend with the chart forming a new low that is lower than the previous low.

Step 2 (Strong price movement against the direction of the previous trend)

The next step after identifying a clean trend, then we look for a strong price movement that is opposite to the direction of the previous trend, if the previous trend is bullish then we look for a strong bearish price movement direction and vice versa. This happens because large investors and institutions have started to enter the market and are ready to create price charts to reverse the trend, and we must be able to follow that to gain profits by using the price action strategy and the engulfing candle pattern.

As we can see in the picture, the previous trend was bearish, then there was a strong bullish price movement that was opposite to the previous trend, therefore step 2 has been completed and we continue to step 3.

Step 3 (Look for price breakouts and engulfing candle patterns)

The next step is to identify the engulfing candle pattern. The engulfing candle pattern will follow the direction of the strong price reversal in step 2. As we know that the dominant trend at that time was bearish, then there was a reversal of the trend to bullish. Then we wait for the price reversal to return from the previous strong impulsive movement which is bullish, therefore the price reversal is bearish, then we wait for the bullish engulfing candlestick pattern to form as shown in the image below.

When a bullish engulfing candle pattern is formed, then we make a horizontal line at both ends of the candlestick to look for a price break and also draw a vertical line on the bullish engulfing candle pattern.

Step 4(change the timeframe to 5 minutes)

After step 3 has been completed, the next step is to change the timeframe which was originally 15 minutes to 5 minutes to get a sell entry signal or buy entry. To take an entry when the chart breaks out on the two horizontal lines that we made in step 3.

As can be seen in the picture above, the price chart has a breakout at the top of the horizontal line or it can be called resistance, therefore we can make a buy entry and place a take profit at the top of the buy entry and stop-loss at the bottom of the buy entry.

For the record, when the bearish trend is dominant, as in the example above, our trend will turn bullish, which means we will do a buy entry, if it is a dominant bullish trend, the trend will reverse to bearish which means we will do a sell entry. In addition, when the dominant trend is bearish, we will take an entry to buy action because the trend will be bullish, but when the timeframe changes and the price chart breaks down, then our action is to wait for the chart to return to the horizontal zone and breakout the top of the horizontal line. for entry buys, or we can do entry buys faster when the chart has started to rise.

The above is an example of when the dominant trend is bearish, and here I will give an example when the dominant trend is bullish.

2.) Explain in your own words the interpretation that should be given to a large strong movement in the market. What does the price tell us when it happens?

In the Price Action and the Engulfing Candle Pattern strategy, we initially look for the market direction of the dominant trend, the trend can be bullish or bearish. A bullish trend occurs if the new chart highs are higher than the previous highs and the new lows are higher than the previous lows, it will not last forever, it will stop when the price cannot rise higher than the previous highs but instead, the price moves strongly against the direction of the previous dominant trend, which means there will be a reversal in the direction of the trend which was initially bullish and will turn into bearish.

The above happened because large institutions and large investors had started to enter the market and put a lot of money at that time which caused the price chart to move strongly in the opposite direction to the previous dominant trend. If the current trend is bullish, then a strong movement towards bearish indicates a reversal of the trend to bearish. If the current trend is bearish and then there is a big move towards bullish, it will indicate a change in the direction of the trend to be bullish.

As we know that market price movements are mostly controlled by big investors and big institutions, they can change the direction of the market by entering the market with large funds. When there is a strong price movement that is opposite to the direction of the trend, it indicates a change in trend, and we as ordinary traders who cannot influence the market can only follow the direction of the trend which is made for profit.

3.) Explain the trade entry and exit criteria for the buy and sell positions of the trading strategy with Price Action and Engulfing Candlestick Pattern in any cryptocurrency of your choice (Share your own screenshots taking into account a good ratio of risk and benefit)?

The purpose of using a trading strategy when you want to trade is to find the entry and exit criteria or that of a buy or sell a position to make a profit. Each trading strategy used has different criteria, here are the entry and exit criteria for trades using the Price Action and Engulfing Candlestick Pattern strategy.

First, we have to find a price chart in a very clear and harmonic trend which means the price trend is up and down clearly. When the trend is bullish, it means that the chart will always form a new high that is higher than the previous high and a new low that is higher than the previous low, as well as when the trend is bearish. If it doesn't exist in the market, which means the ups and downs are irregular, then we have to get out of trading and look for other cryptocurrencies.

After we get a very clear and harmonic trend, whether it's a bullish or bearish trend, then we identify a strong price movement that is opposite to the previous trend, if the previous trend is bearish then there is a strong upward price movement. The thing to remember is that there must be 3 to 4 candles with a large body that is pointing against the previous trend. If this is not met then we can exit the trade and look for another cryptocurrency.

Then we look for the engulfing candle, when the two things above have been fulfilled then we wait for the engulfing candle to form, we recommend using a small timeframe such as 15 minutes. When the engulfing candle is formed, we make a horizontal line above and below the engulfing candle and make a vertical line on the engulfing candle. Then we change the timeframe to 5 minutes to get an entry signal. The entry signal is obtained when the price chart breaks the horizontal line during the 5-minute timeframe. When we change the timeframe from 15 minutes to 5 minutes and then the chart has broken the horizontal line, then we are waiting for the price chart to reverse back into the horizontal line.

After the price chart breaks out on the horizontal line, then we can take sell entry or buy entry then place take profit and stop loss. For more details, I will explain the placement of buy entry, sell entry, take profit, and stop-loss using pictures.

Entry Buy

For entry buy, we can get when the initial trend is bearish as shown below.

When the dominant trend is bearish as in the picture above, then there is a strong price movement that is opposite to the direction of the previous trend. When these two things happen, we wait for the engulfing candle to form, because the dominant trend is bearish, the engulfing candle that is formed is a bullish engulfing candlestick. When the bullish engulfing candlestick is formed, then we make a horizontal line at the top and bottom of the bullish engulfing candlestick and also make a vertical line on the bullish engulfing candlestick, after that we change the timeframe to 5 minutes to get an entry signal.

When we have changed the timeframe to 5 minutes, then we wait for the price chart to experience a breakout as shown above. Because the dominant trend is bearish, we will do an entry buy which means we will wait for the chart to break out on the upper horizontal line. When the chart has experienced a breakout, we can enter the market to make an entry buy. Then we put take profit and stop loss in a 2:1 ratio or we can place take profit along with a strong price movement that is contrary to the dominant trend as in the picture above, and also place a stop loss at the last price reversal before the bullish engulfing candlestick is formed. In addition, when the timeframe changes and the price chart has broken the lower horizontal line, we are waiting for the price chart to return to the horizontal line.

Entry sell

We can get sell entries when the initial trend is bullish as shown in the picture below.

When the dominant trend is bullish as in the picture above, then there is a strong price movement that is opposite to the direction of the previous trend. When these two things happen, we wait for the engulfing candle to form, because the dominant trend is bullish, the engulfing candle that is formed is a bearish engulfing candlestick. When the bearish engulfing candlestick is formed, then we make a horizontal line at the top and bottom of the bearish engulfing candlestick and also make a vertical line on the bearish engulfing candlestick, that we change the timeframe to 5 minutes to get an entry signal.

When we have changed the timeframe to 5 minutes, then we wait for the price chart to experience a breakout as shown above. Because the dominant trend is bullish, we will make a sell entry which means we will wait for the chart to break out at the bottom horizontal line. When the chart has experienced a breakout, we can enter the market to make a sell entry. Then we place a take profit and stop loss in a 2:1 ratio or we can place a take profit along with a strong price movement that is contrary to the dominant trend as in the picture above, and also place a stop loss at the last price reversal before the bearish engulfing candlestick is formed. In addition, when the timeframe changes and the price chart has broken through the upper horizontal line, we are waiting for the price chart to return to the horizontal line.

Practice (Remember to use your own images and put your username)

Make 2 entries (One bullish and one bearish), using the “Price Action and Engulfing Candlestick Pattern” trading strategy. These entries must be made in a demo account, keep in mind that it is not enough to just place the images of the execution, you must place additional images to observe the development of these operations to be able to be correctly evaluated and see if they really understood the strategy.

- Entry buy

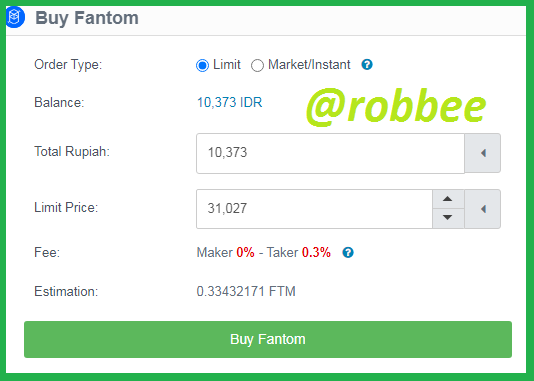

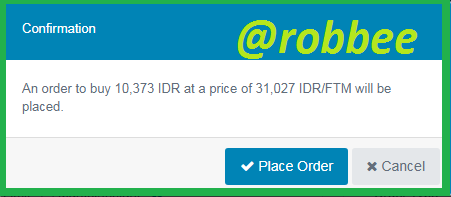

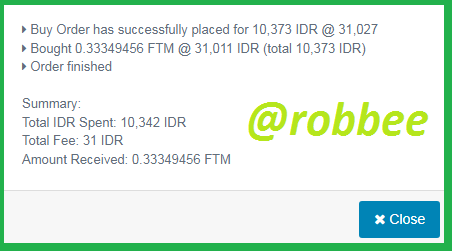

To make an entry buy, the dominant trend that must be identified is bearish, therefore I use the indodax platform to solve this question. Here I use FTM/IDR coins to get an entry buy using the Price Action and Engulfing Candlestick Pattern strategy with a 15-minute timeframe. For more details, see the image below.

As can be seen in the picture above, a bearish trend is formed in the 15-minute timeframe. We can see in the picture above that after the bearish trend was formed, then there was a strong price movement that was opposite to the direction of the previous bearish trend, which means we can continue the Price Action and Engulfing Candlestick Pattern strategy and look for a bullish engulfing candlestick. In the picture above we can see that the bullish engulfing candlestick was formed then I put a horizontal line at the top and bottom of the bullish engulfing candlestick and also put a vertical line on the bullish engulfing candlestick as shown above. Then I changed the timeframe to 5 minutes as shown below.

In the picture above we can see that the chart just broke out on the upper horizontal line which means a buy entry, and I made a buy entry at the price of 31.027 IDR or $2,183 on December 30, 2021, at 16:20 WIB or 09:20 UTC. Then I placed my take profit at the price of 31.376 IDR or $2,204 and placed my stop loss at the price of 30.775 IDR or $2,162.

- Entry sell

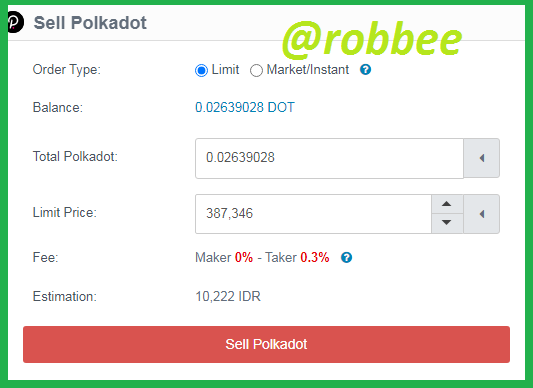

To make a sell entry, the dominant trend that must be identified is bullish, therefore I use the indodax platform to solve this question the same as the previous buy entry. Here I use the DOT/IDR coin to get an entry sell using the Price Action and Engulfing Candlestick Pattern strategy with a 15-minute timeframe. For more details, see the image below.

As can be seen in the picture above, a bullish trend is formed in the 15-minute timeframe. We can see in the picture above that after the bullish trend was formed, then there was a strong price movement that was opposite to the direction of the previous bullish trend, which means we can continue the Price Action and Engulfing Candlestick Pattern strategy and look for bearish engulfing candlesticks. In the picture above we can see that the bearish engulfing candlestick was formed then I put a horizontal line at the top and bottom of the bearish engulfing candlestick and also put a vertical line on the bearish engulfing candlestick as shown above. Then I changed the timeframe to 5 minutes as shown below.

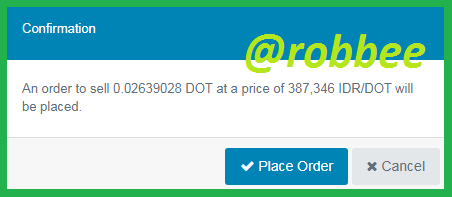

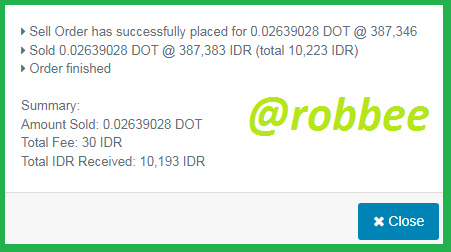

In the picture above we can see that the chart just broke out on the lower horizontal line which means a sell entry, and I made a sell entry at the price of 387.346 IDR or $27,296 on 31 December 2021 at 12:12 WIB or 05:12 UTC. Then I placed my take profit at 381,707 IDR or $26,920 and placed my stop loss at 392.148 IDR or $27,657.

Conclusion

Price Action and Engulfing Candlestick Pattern Strategy is a combination of price action strategy and engulfing candlestick pattern. By using a combination of the two trading strategies, you can generally sell entry and buy entry signals to make a profit. The Price Action and Engulfing Candlestick Pattern Strategy has several steps that must be followed to get an entry signal, if one of the steps is not fulfilled then we cannot continue the next step. To use this strategy, first, we look for a very clear and harmonic trend, then identify a strong price direction but in a different direction from the previous trend, then wait for the engulfing candle to form, and then make horizontal and vertical lines, and finally wait for the chart. breakout on the horizontal line to make an entry, in short, those are the stages of using the Price Action and Engulfing Candlestick Pattern strategy. Here I get new knowledge from this lesson and I want to apply it when trading.

References:

https://www.tradingview.com/chart/ITAaNOcQ/

https://indodax.com/en/

@tipu curate

Happy new year!!! 💥💥

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 4/5) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit