Hello steemians , I hope you all are doing very well.

In this post , I am here to submit my homework task 3 which I have carried out as required by @besticofinder, crypto professor.

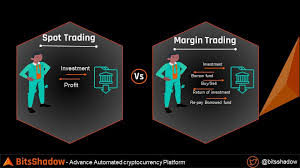

Spot Trading vs. Margin Trading: What Should You Choose?

One of the biggest dilemmas that traders have before starting their journey is deciding between spot trading and margin trading. Indeed, these are two trading options given to traders which you have to decide before embarking on your trading journey. Here’s what you need to know about the two to help you make the choice between spot trading and margin trading.

What Is Spot Trading?

As the name suggests, spot trading takes place in the spot market at the spot (aka current) price. With spot trading, you are essentially executing a trade at the immediately available asking and bidding price that market participants are asking for. And because of the immediate nature of spot trading, you will need to have the available assets to pay for your trade by the date of settlement.

For instance, if you are buying US$1,000 worth of Ethereum with spot trading, you will need US$1,000 balance in your account by the date of settlement (usually T+2 days of the trade). Otherwise, the exchange will not allow you to enter into the Ethereum position.

Why Pick Spot Trading? Or Why Not?

Advantage Of Spot Trading

For starters, spot trading helps you manage your risk. Since you can only trade the balance that you own, you will not end up losing more than what you already have in your account. Spot trading ensures that you only trade based on the assets that you own and avoid over-leveraging.

The advantage of spot trading of managing risk can be a downside in itself in some situations. Because you are only limited to the balance in your account, you cannot take full advantage of good trading opportunities. Thus, even if you have a trade that you have a strong conviction, you can only make as much money as allowed by the capital you own. With only US$1,000, there is only so much you can make with the US$1,000.

What Is Margin Trading?

Margin trading is the concept of borrowing funds from a third party to leverage on your position. Margin trading is unlike spot trading. With margin trading, you do not need to have the entire trade amount to enter into a position. All you need to do is to have a collateral of assets that is at a margin of the position that you are trying to enter..

For example- let’s say you are looking to buy US$1,000 worth of Ethereum. Since trading platforms like Overbit provide you with a leverage of up to 100x on crypto instruments, this means that you only need a mere US$10 in your account to trade US$1,000 worth of Ethereum.

At any point in time, you only need to keep 1% (at 100x leverage) of the contract amount in your account to keep the position open. Depending on how your trade goes, you might even be able to withdraw profits or enter into more positions.

Why Pick Margin Trading? Or Why Not?

Advantage Of Margin Trading

The biggest advantage of opting for margin trading is the opportunity to amplify your profits. Having the leverage element in margin trading lets you trade as much as 100x of your capital on crypto instruments. With margin trading, a good trade at the right moment can yield you a lot of returns.

Depending on your trading style, having margin trading can be a huge advantage for you. Take low frequency traders for example. Low frequency traders only enter into positions that they are really sure of. Margin trading lets them take full advantage of the low frequency but high probability trades that these traders have identified.

Disadvantage Of Margin Trading

There is inherent risk involved in margin trading. As you can imagine, trading up to 100x of your capital makes it possible for you to lose more money than your initial investment. This is unlike spot trading where you can only lose as much as the capital that you have.

When trading on margin, your position may be liquidated if you do not have enough margin to support the losses on time. Thus, another factor to think about is the interest on your position, which is an uncertain amount depending on the direction of your position and the platform you choose.

Which Strategy Is Right For You?

Now, the ultimate question, which one should traders choose?

Ultimately, the choice of strategy comes down to you as a trader. That’s because no one else understands you more than you do. Based on your own understanding of your risk tolerance and your knowledge of investing, you need to decide which strategy is right for you. As the saying goes, “All roads lead to Rome”. So does “All trading strategy leads to success”.

References:

Benefits of Margin Trading

Risk of Margin Trading

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

@besticofinder