Hello Everyone,

Lets get started…

Question 1

Arbitrage trading is an investment strategy where an investor simultaneously buys and sells crypto asset in different market or exchanges to be able to take advantage of the prices differences between the two markets. This strategy requires the investor to be quick in executing the trade before the price difference is corrected and also to minimize risk.

We have a lot of exchanges that exist with soo many crypto assets and pairs. Each exchange has its price of assets which differ from the others due to their liquidity and volume. Some exchanges have higher liquidity and volume than others. One thing which is special about this strategy is that it has low risk, the investor just needs to be quick about it.

Lets assume an investor $500USDT and realized that in bianance exchange, steem is priced at $0.49 but in coinbase exchange it is priced $0.54. The investor quickly buy the asset at lower price in the binance exchange and sell it high on coinbase exchange to him his profit.

Question 2

There are different types of arbitrage trading to which i will try to explain below;

1. Simple Arbitrage

Simple arbitrage involves the buying of a crypto token in one exchange and selling it in another exchange for profit. Most at times a crypto assets have different prices in different exchanges and is due to the difference in liquidity and volume. Before practicing this strategy, the investor need to have the transaction fees in mind to prevent getting into loss after the trade.

2. Triangular Arbitrage

Triangular Arbitrage is the type of arbitrage which deals between three cryptocurrencies. Three selected crypto assets with different USD prices is used. The first crypto asset is sold for the socond one and then the second is sold for the last one and finally the last one is sold back to the first one. The trader needs to make sure the three crypto assets have common pairs to execute this strategy. This strategy require large trading amounts to gain high profit because the differences in prices are always minimal.

3. Statistical Arbitrage

Statistical arbitrage also known as stat arb uses mathematical models to predict the price cryptocurrencies. The crypto assets are traded in pairs base on the similarities between them. As and when the first asset out performs the second asset, the second asset is bought and the entire position is limited by shorting the first asset.

Question 3

As explained earlier, the Triangular Arbitrage is a strategy that involves the trading between three different crypto assets. Investors take advantages of these differences in price for profit. Before selecting the three asset to use, the trader or investor need to check on the difference in prices against the USD. Lets take a look at this illustration below;

For instance a trader spotted a triangular arbitrage between SOL, DOGE and BNB and tried to take advantage of their price differences against dollar. He invest 1SOl and trade it for DOGE and had $723DOGE and also trade Doge for BNB and has $0.42. For the last step he then sells it back to SOL and had $1.10. From the trade he was able to make an amount of $0.10 which is equivalent to $14USD.

Question 4

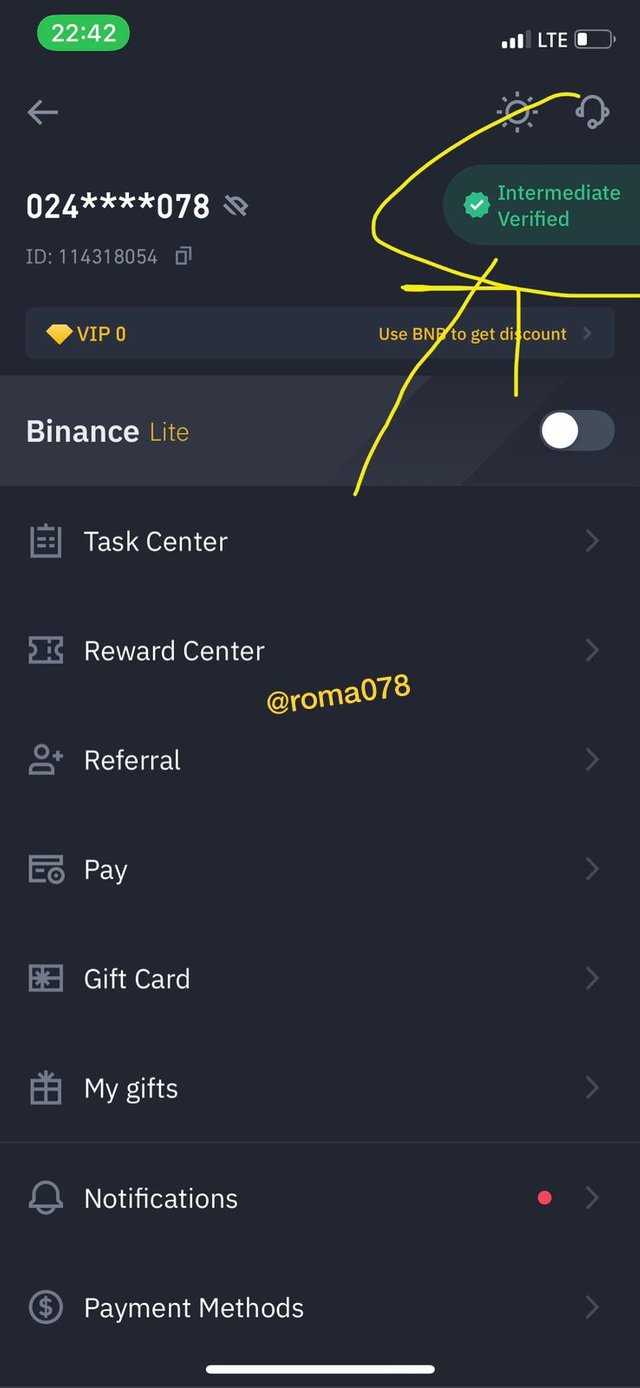

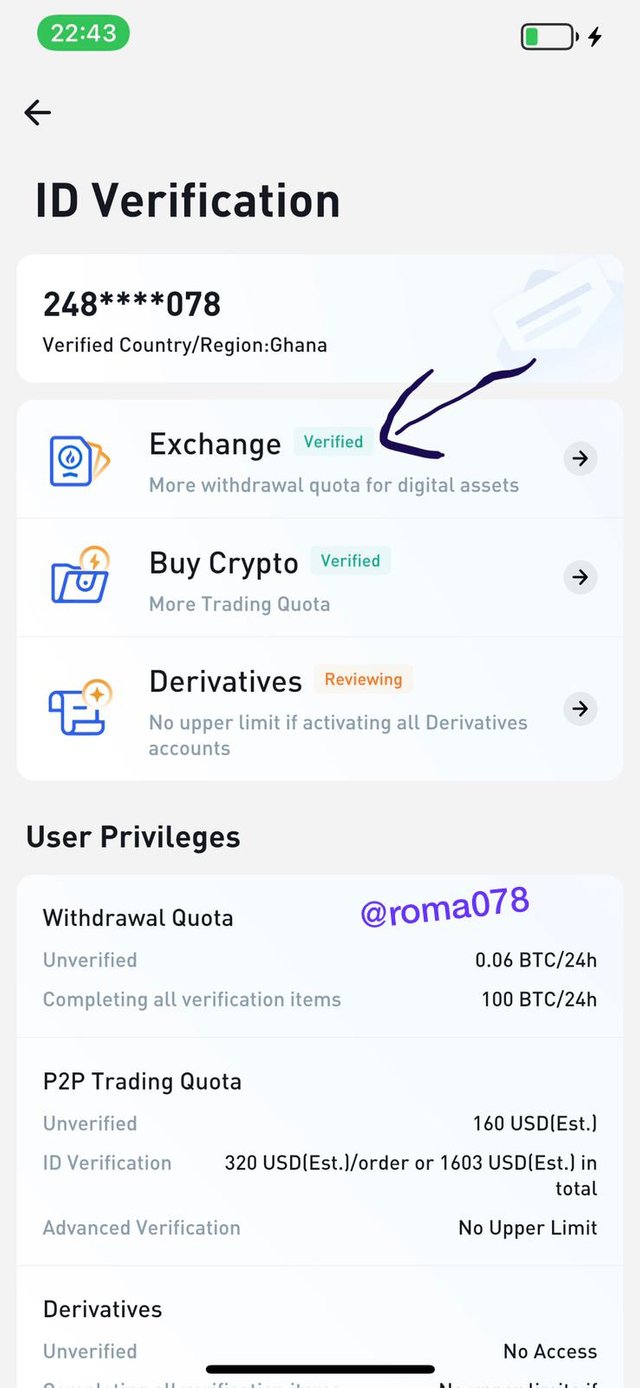

To begin with, here is my verified Binance Exchange and Houbi Exchange which i will be using to demonstrate the illustration.

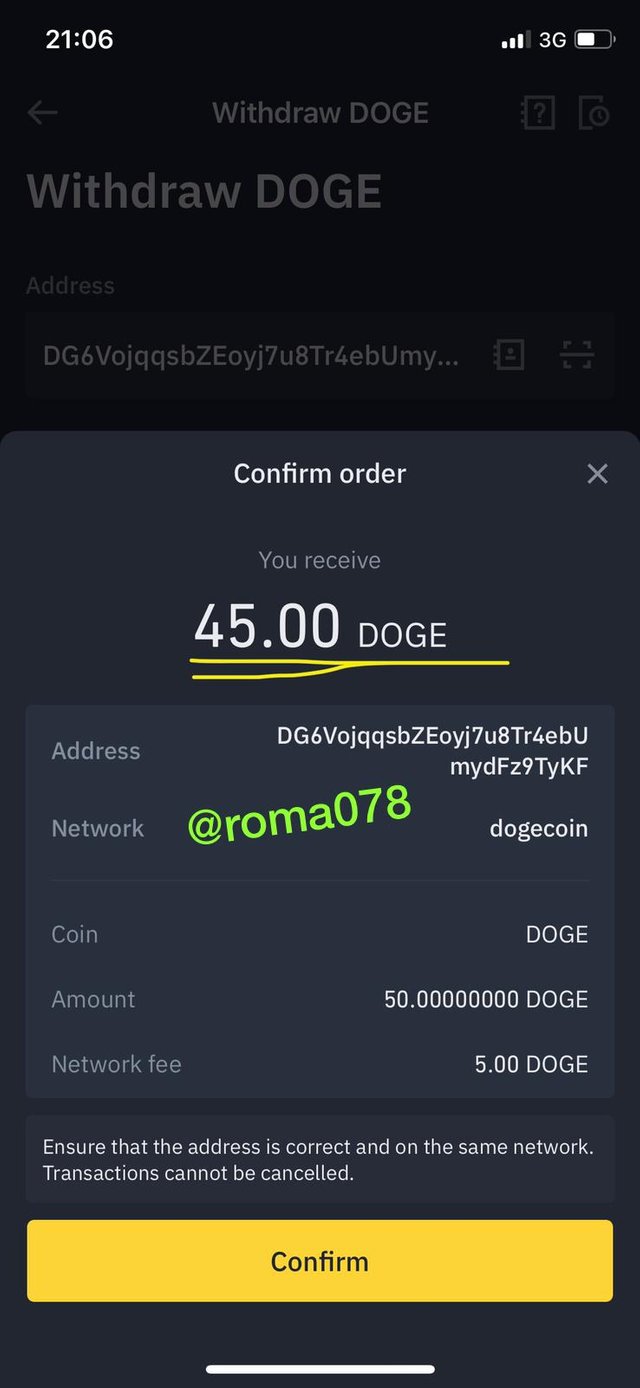

I purchased 50 Doge coin at $10 with the DOGE/USDT pair on binance.

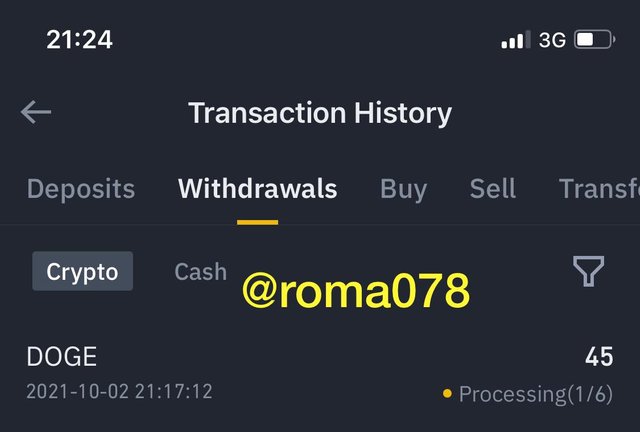

On my binance exchange, i clicked on withdraw and went ahead to my Houbi exchange and click on deposit and selected to Doge coin. i copied the address and paste it on my binance and clicked on withdraw. The transaction fee was 5Doge.

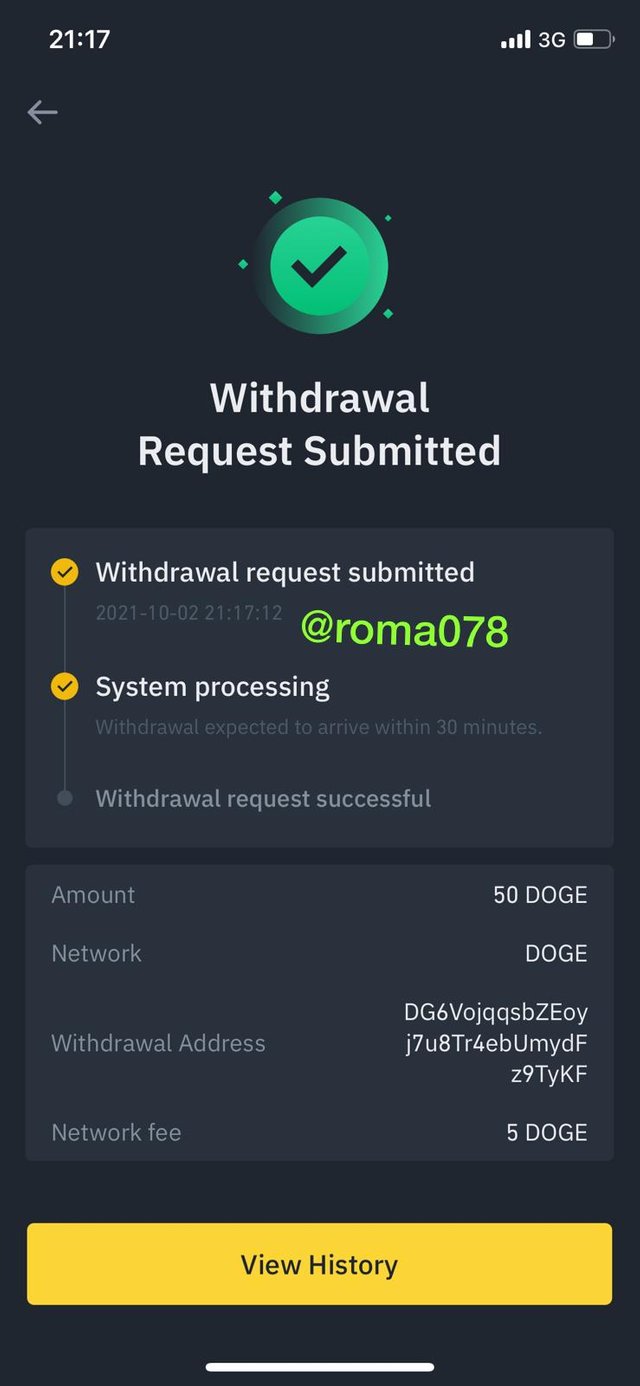

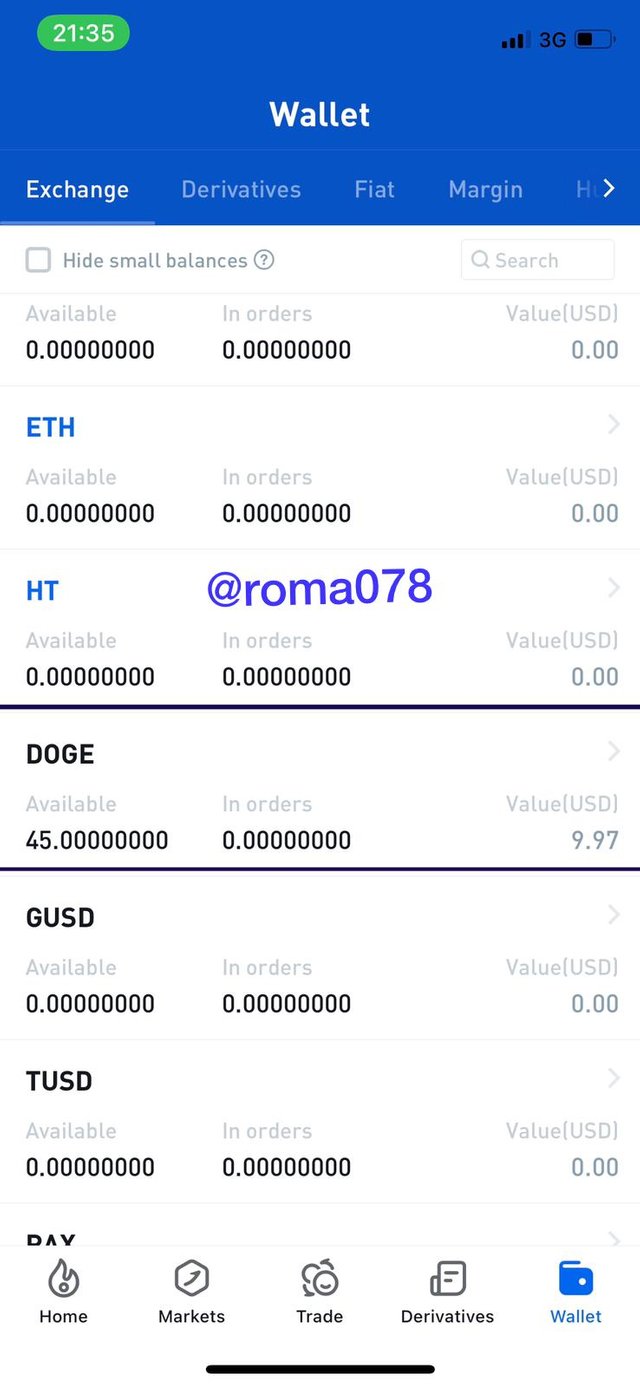

The transaction was successful as seen in the screenshot below

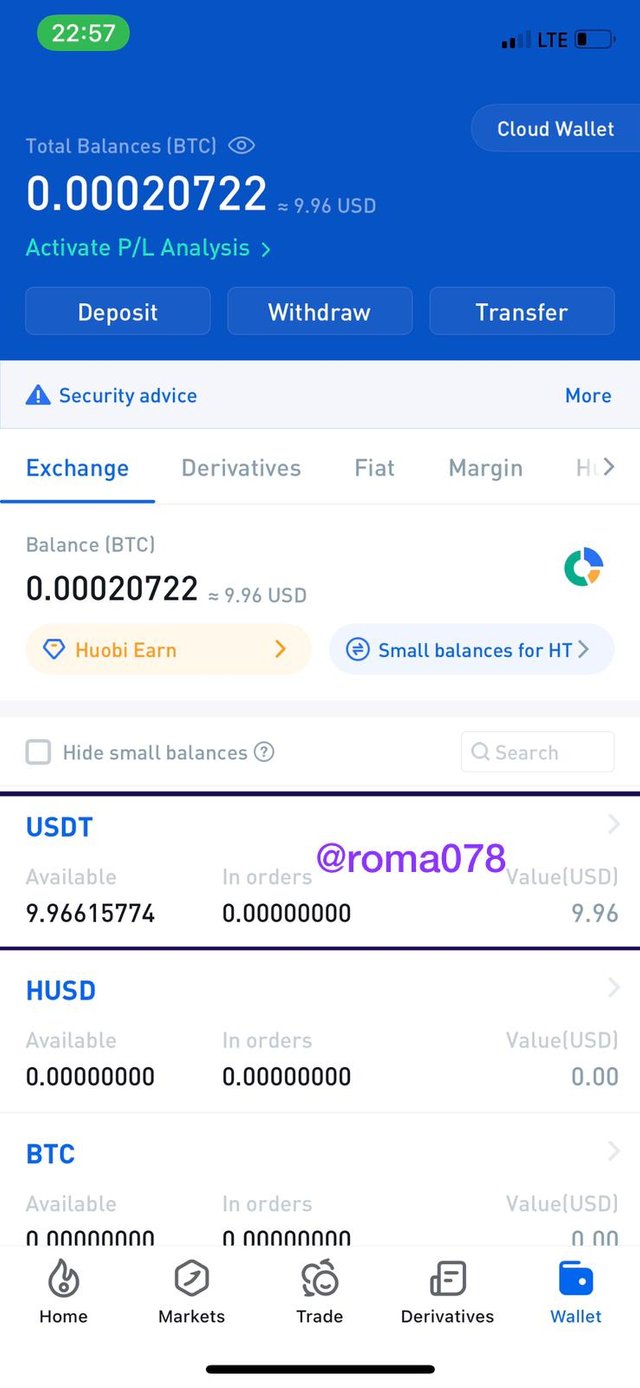

On my Huobi exchange I used the ERP/USDT pair to buy USDT and had $9.96. Comparing with the amount I bought my doge on binance I made a loss of $1.14 which includes transaction fee of 5Doge=$1.11.

The price changed due to the volume and liquidity.

Question 5

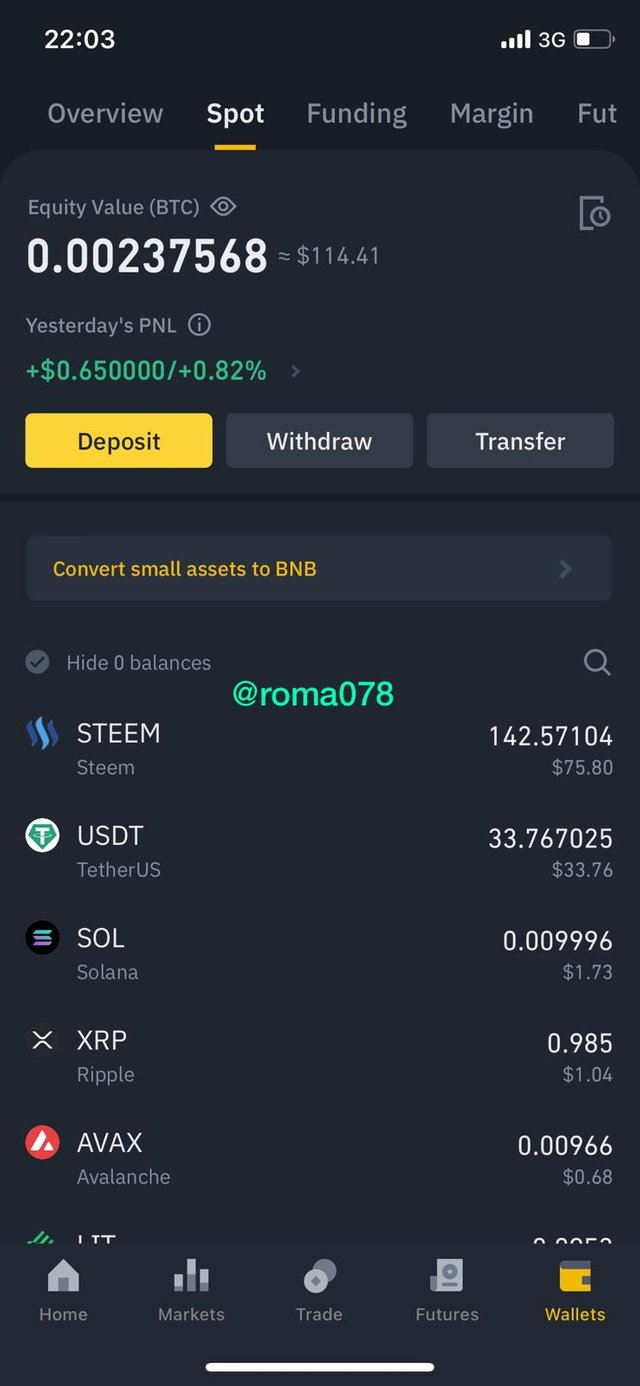

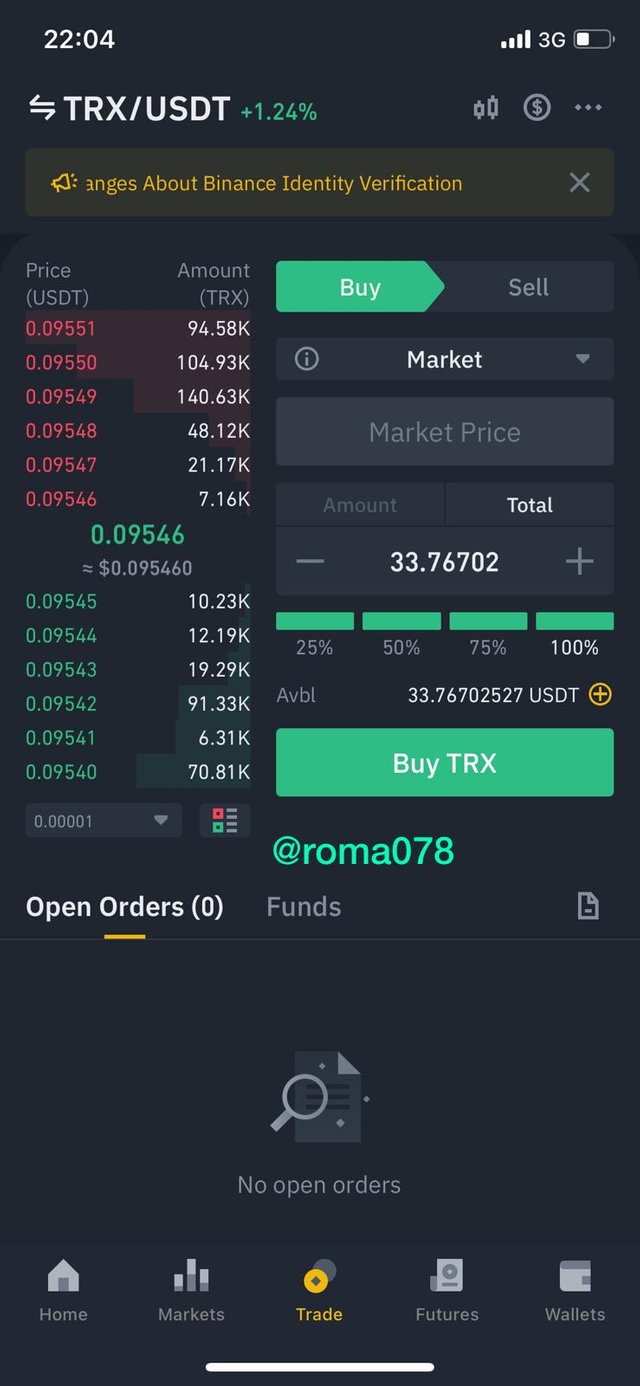

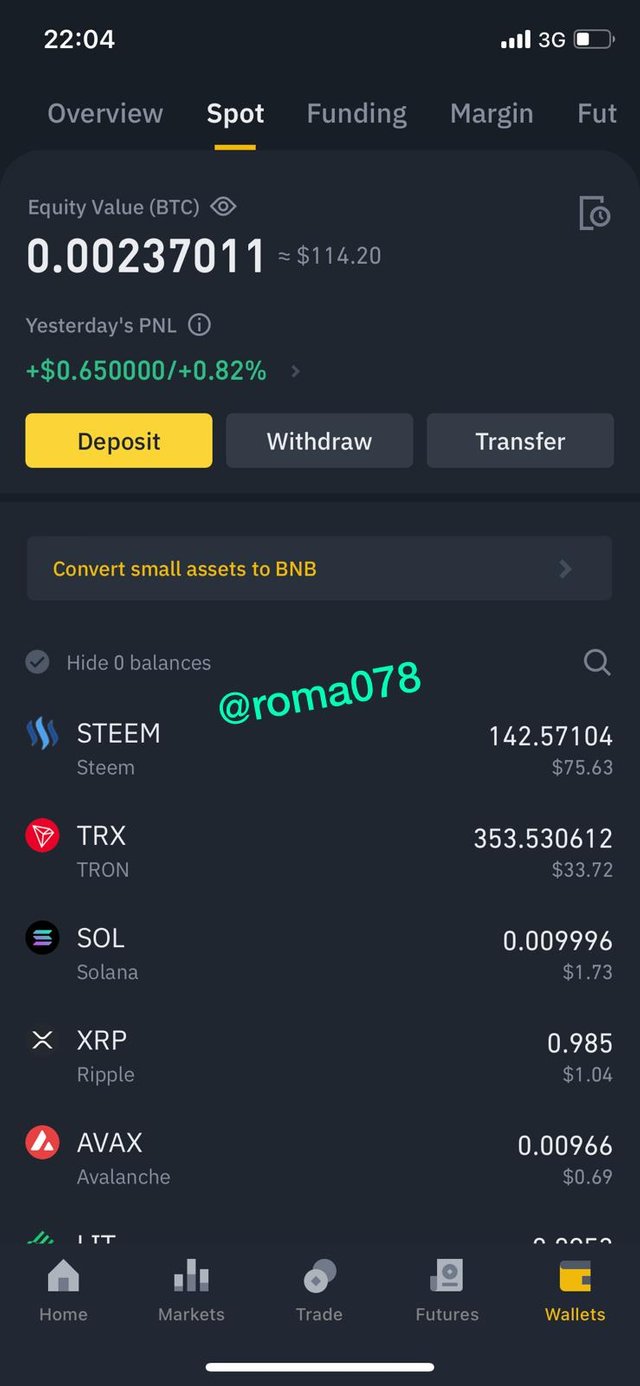

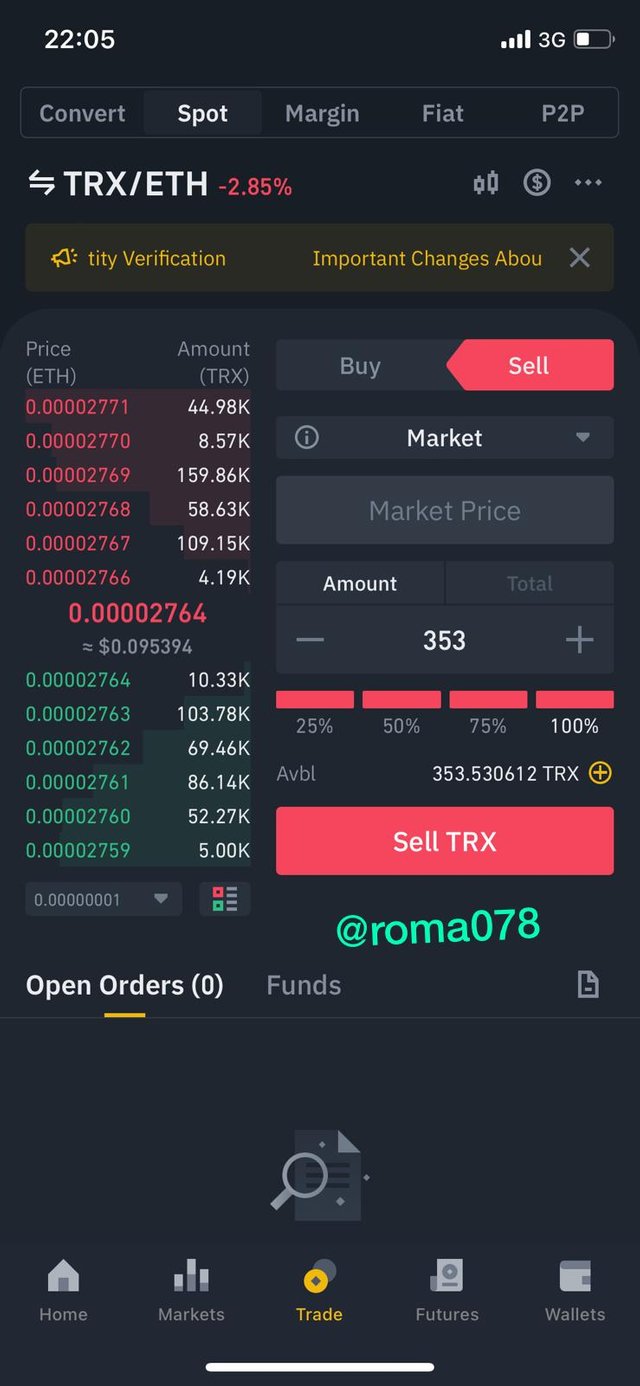

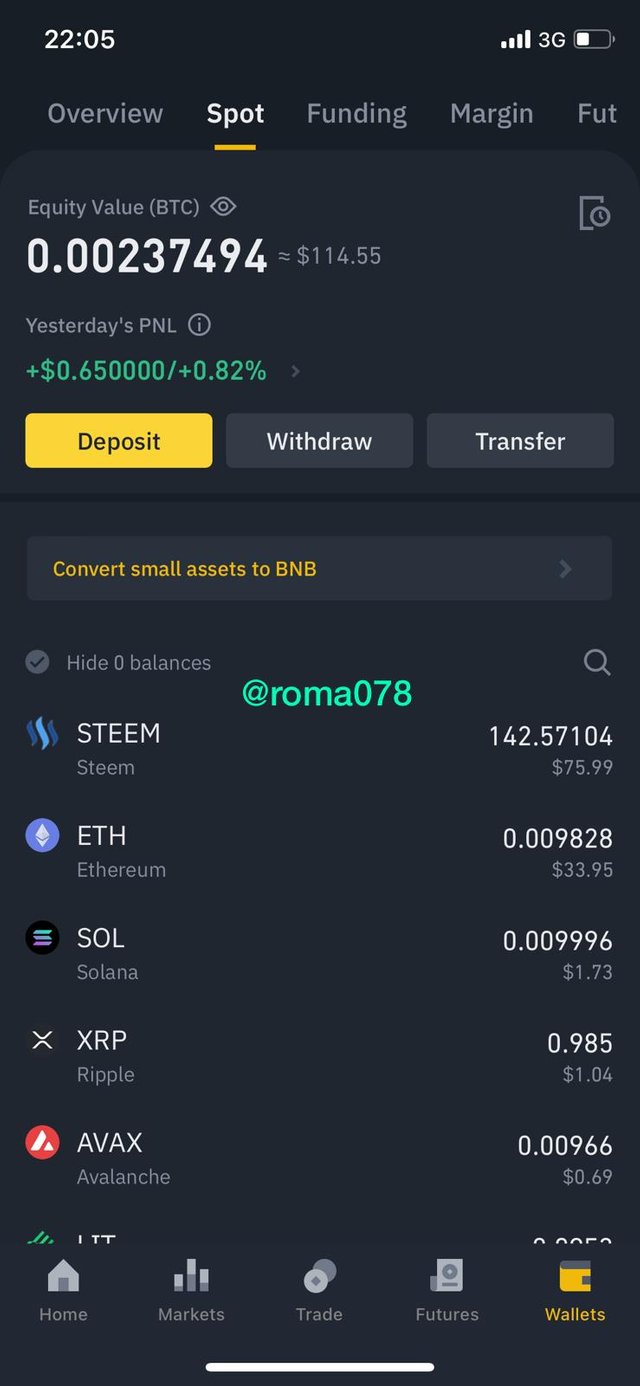

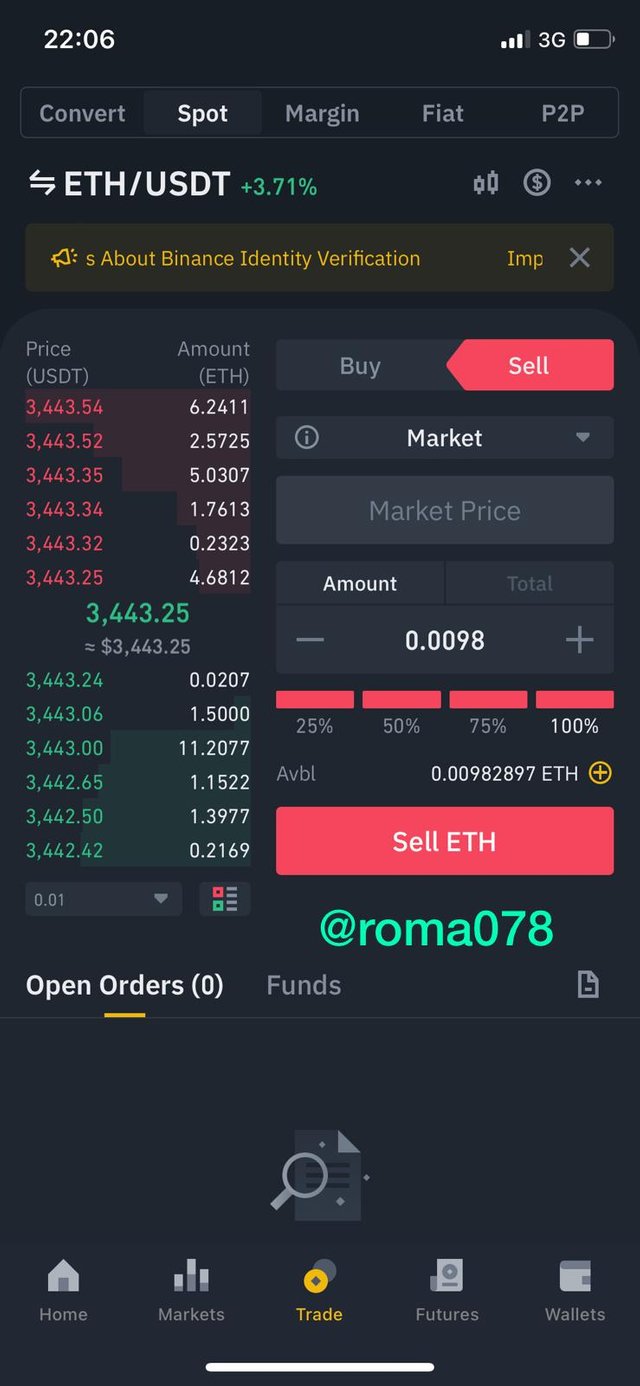

I demonstrate a traiangular Arbitrage with the pairs below;

TRX/USDT

TRX/ETH

ETH/USDT

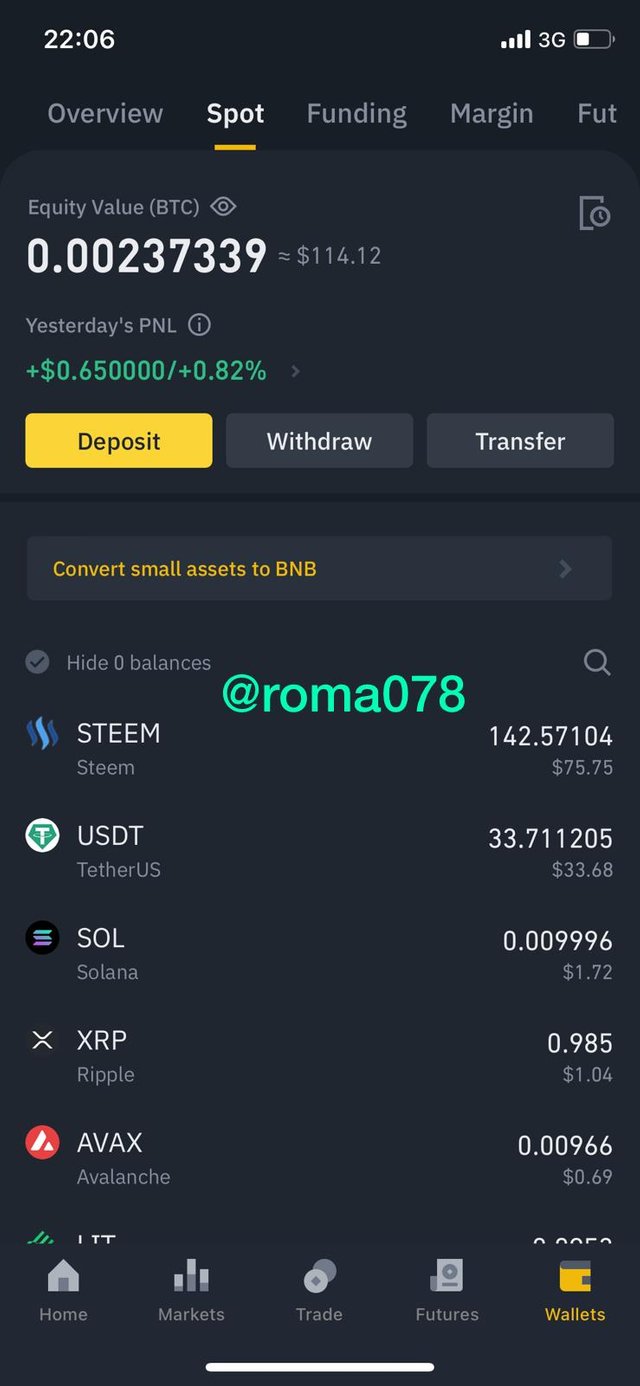

I have $33.76 USDT so i traded my USDT for TRX in the spot market with the pair TRX/USDT and had 353.53 of TRX

I also then bought ETH with the pair TRX/ETH and had 0.009828 of ETH

Finally selling the ETH back to my USDT and had 33.68USDT.

From this trade, i realized i made a loss of $0.08 as a result of the price change which wasn't in favor of me.

Question 6

| Advantages | Disadvantages |

|---|---|

| Quick and easier to make some profit. The trader is required to be snappy when using this strategy to avoid the difference of the price gets corrected. | Require huge sum of money. Due to the small prices differences the trader needs to invest huge sim of money to make a lot of profit. |

| make profit in a short time. The process doesn’t take time and require the trader to be fast | Can loose money in hurry to execute the trades. |

| Low to no risk involved in trading | Trading fee decreases profit and can cause lost. Some coins have high transaction fees which takes a lot of the profit the trader gains. Traders needs to invest with the transaction fees in mind. |

| it Involves three crypto currencies at a time. It’s easier to trade one token to another with the help of the pairs available | Difficulty in finding three suitable assets for this strategy. It’s one of the most challenging thing with this strategy. The prices difference doesn’t occur frequently so traders needs to always have their eyes on the market for the opportunity. |