Hello fellow Steemians.

Welcome to another one of my posts. Today in this post, we shall talk into detail all we need to know about Market Maker. I must admit, Professor @reddileep's lecture on this topic has really enlightened me on most of the concepts pertaining to Market Making.

Q1. Define The Concept Of Market Making In Your Own Words:

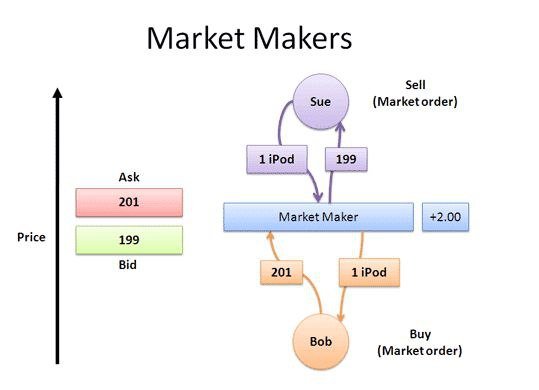

Market making in crypto is one of the many strategies of trading used in the cryptocurrency ecosystem. It basically refers to the processes through which users, known as market makers set prices of assets in the cryptocurrency network for efficient and simple business transactions. Market makers(ie those who ensure market making) refers to an individual or a group of individuals whose basic responsibility is to provide bids of a crypto exchange, as well as provide the liquidity needed to increase market transactions. Market making from its name implies making money in the market by selling or buying as far as cryptocurrencies are concerned.

At every given time, before a transaction should take place, there are always people who are willing to sell and others who are willing to buy simultaneously. The selling and buying of these assets may be done with respect to their current or future prices.

When a market order is given for a sell or buy of a pair at their current prices, the traders involved in this transaction are known as market takers. Simply put, market takers are traders who trade/run transactions of assets at their current prices in the crypto market.

Other times, orders are carried out using future prices of these assets. In this case, the traders involved are referred to as the market makers. As already mentioned above, these market makers are responsible for providing liquidity in the market through buy and sell orders.

When these market makers input a transaction order of any asset, the order will be added to a list of instructions called the "open order". These open orders are just a storehouse where market making orders are arranged in the mean time, since the prices at which they were executed are different from the current prices in the market. Hence, in the near/far future when the actual price values correspond with the open order, the transaction is then carried out.

Hence, market making is the phenomenon where market makers somewhat determine the prices of an asset in the future other than their current market prices. In effect, these market makers are able to control the liquidity as well as approximate the market orders(sell and buy orders) of any cryptocurrency asset.

Q2. Explain The Psychology Behind Market Maker (Screenshot Required):

The liquidity provided by the market makers ensures the smooth and fine movement of transactions in the market prices. As already established, when market makers set sell and buy orders, they automatically add up to the open orders pool, waiting for a period when the order price correspond with the actual prices before execution. When market makers set the limit orders for buy and sell, they indirectly do so inorder to contribute to attaining liquidity in the market. They hold on to defined cryptocurrency assets, which they release(ie sell) when a ask bid is ordered and they also buy assets when a buy Signal is ordered. In a way, this ensures smoothness in the market and ensure that countless transactions and investments are completed in the market. To ensure efficient bid and ask orders in the market, market makers are very resolute as to the volume, time and frequency at which they trade their security exchanges.

The work of market makers is governed by a set of rules/regulations concerning the type of exchange they trade. They receive compensations for the risk they encounter when it comes to bid and ask orders. For example, the prices of assets continuous to change in the market, hence, these assets may depreciate in value before a market maker buys and even sells it to a buyer. When market makers set bid and ask prices for stocks in the market, they do so over a large volume cap within a short spread. In this way they make substantially high profits.

If say a market maker sets the limit buy and sell orders at $100 and $105, these orders shall be added to the order book, until when there are traders who buy and sell within this margin. In effect, there's always traders who are doing transactions between the set prices by the market makers, thus, ensuring constant and liquid market trades.

source

Q3. Explain The Benefits Of Market Maker Concept?

The market making strategy in the cryptocurrency ecosystem has pretty much made market for everyone involved. Some of the benefits of this concept include:

Provides liquidity in the market: When market makers set the limit orders for trade, it helps smoothen transactions among traders, such that, sellers can easily find buyers for their assets and vice versa. This maintains the sufficient flow of sales and buying.

Helps small investors to also make profits:

Understanding the concept of market making is a very huge advantage to the vast small investors/traders. One can easily find good positions for buy and sell orders for their assets in order to make maximum profits.Provides a well structured bid-ask spread in the market:

This helps to increase the number of investors into the market, since buy and sell prices are usually low enough. Thus, traders/investors are offered lower transaction fees.Ensures smoothness in transactions: Since the sell and buy orders are already set for the future, there's always assets available for trade anytime a trader wishes to sell or buy. This also decreases the amount of time a trader has to wait before completing any transaction.

Q4. Explain The Disadvantages Of Market Maker Concept:

Despite the vast benefits of market making, there are some challenges it predisposes into the market.

- Reduction in the level of investment:This can actually happen when market makers decide to get out of the market, thus, activating stop loss. Since market makers have the ability to manipulate the prices of assets, it will make it very difficult for small investors to trade should the spread increase.

- Since they are not completely regulated, the liquidity provided by market makers is not permanent, hence, they can easily choose to withdraw their assets from the market at anytime.

- Loss of funds/assets on the part of small investors: When market makers change their direction of focus of trade, small investors may be found wanting especially if they lack understanding of the concept. As a result, they may end up losing all their funds/assets.

Q5. Explain Any Two Indicators That Are Used In The Market Maker Concept And Explore Them Through Charts(Screenshot Required):

The market making concept in the cryptocurrency network employs the operation of a never of technical analysis indicators including but not limited to Moving Averages (MA), Exponential Moving Averages (EMA), Relative Strength Index(RSI), Stochastic Oscillator, etc.

To explain their operations in the concept, let's consider the RSI and Moving Averages indicators:

RSI:

The RSI indicator is one of the major technical analysis indicators used by traders to identify reliable trends in a market inorder to make well informed decisions for maximum trade profits. This indicator is somewhat sole to interpret even for young investors. It indicates the nature of trends in the market chart, displaying the fluctuations in prices at it proceeds. It has values ranging from 0 to 100.

This range illustrates areas of bullish trends(Uptrend) and bearish trends(downtrend) as well as bullish and bearish divergences.

As seen in the diagram below, when the indicator line lies above the 70 point mark, it depicts an overbought signal, hence, traders can prepare to set a sell order. At this point, the market maker can take profit, when they choose to offertake profit orders and manipulate prices. Contrarily, when the indicator line lies below the 30 point mark, it depicts an oversold signal, thus, traders can prepare to set a buy order as the market proceeds.

tradingview

tradingview

Moving Average (MA):

The moving average Indicator is one other useful technical analysis indicator tools used to identify and analyze trends in market prices. For better and easy analysis, users use two trend lines of the MA indicator. These lines have different lengths. It gives signals for uptrends, downtrends as well as sell and buy order signals. The movement of the lines with respect to each other is key to identifying changes in trends. For example, when the two moving averages cross each other downwards, it predicts a trend reversal from a bullish trend to a bearish trend. On the other hand, when the two indicator lines cross each other opwards, it predicts a possible trend reversal from a bearish trend to a bullish one. Consider the image below.

tradingview

tradingview

The above image is a screenshot of a ETH/USDT chart with a MA indicator applied to it. The blue indicator line is the 20MA while the 55MA is the red line. We can see an upsurge in the prices as it moves in the uptrend. At a later point, we see the 20MA line crossing the 55MA line. This indicates a trend reversal, hence, traders can input a sell order at this point. Just before the crossing of the lines, the market maker manipulates for a selling order for the asset for the a short period of time.

The market making concept is not a simple technique to fully understand especially for newer traders. However, sufficient knowledge of how these market makers go by their activities and the mentality behind their work will go a long way to yielding great profits from a person's transactions. Market makers primarily ensure smoothness of transactions and liquidity providers in the crypto market. They ensure there's sufficient assets for trade(buy and sell) at any given time. This ensures balance in the market as the prices of these assets continue to fluctuate. In essence, there's increase in the market volume order.

This is it guys. Thank you for finding time to read my post. I do hope you enjoyed it. Till I come your way again very soon, I wish you the very best in your endeavors. Peace and Love to you.