Hello Everyone,

lets get started...

1-Put your understanding into words about the RSI+ichimoku strategy

The RSI indicator is a momentum oscillator which measures the speed and power of a price movement. This is done by measuring the probability of higher closing price to lower closing price. Prices with higher probability are more stronger than prices with lower probability. Normally, the RSI is based on a 14 day unit which is measure on a scale from 0 to 100. The levels in this indicator is at 70 and 30 to which the trader will use to read the signals.

There are two ways the RSI indicator indicates price movements which are the overbought and oversold. In an instance when the price crosses over 70, it means the price is overbought and also in an instance when the price crosses below 30, it means the price is oversold. Whenever the prices are in this two regions, it means the price might bounce back and make a reverse movement.

The Ichimoku indicator is a trend based indicator to help traders to identify the direction of prices and also sport support and resistance levels. As no indicator is 100% efficient, this indicator lags behind price thus giing signals after price have already moved and revealed.

Now imagine combining this two indicators together to the advantage of the trader. It will give the trader an early signal to trends. Detecting trends early gives the trader the opportunity to make an erly entry or exit into the market to takeout profit. As we know, the RSI indicator most often gives false signals, by using both indicator it helps to clear out those signals to have a clean trade.

2-Explain the flaws of RSI and Ichimoku cloud when worked individually

The Relative Strength Index Indicator most often gives false signals. Its rare to find a true trend reversal on RSI indicators and its difficult to asperate a true signal from false signals. Which is why it is advised to use it with a combination with other indicators like the Ichimoku.

The chart above is an example where the price crossed above 70 and supposed to make a trend reversal but rather it continued in a bullish trend. In this case the indicator will make the trader loose money if in case he make an exit to prevent lose. On the other hand a price might cross below the oversold region which indicates the price will make a trend reversal into bullish but it rather further move downtrend.

Also the RSI indicator remains in overbought and oversold in a long time resulting in missing out some important signals, therefore its not suitable for day trading.

Although, the RSI indicator detect trends but it doesn't tell how long a trend will last or how strong the trend is.

Even though Ichimoku is able to detect support and resistance levels, entry and exit points but its major flaw is that it lags behind price which means it gives signals late. This flaw will make traders to miss out some trading opportunities. In an instance when a trader tends buy low and sell high. Due to the late signal given by the indicator, the trader will rather get into the market after the price is already into bullish. Trader tends to miss out this opportuniy.

Ichimoku uses past historical data price to give signals but as we know past prices sometimes does not repeat itself in current price.

3-Explain trend identification by using this strategy (screenshots are required)

Using both the RSI and Ichimoku Indicators is the best thing a trader can do. The use of both combined indicators filters out false signals and gives accurate and reliable signals. One indicator gives a signal and the other confirms to the trader.

The RSI indicator only signal the trader on the trend of the market but it is not able to tell the volume amount causing the current trend. Now the Ichimoku indicator gives signal of an uptrend when the price is above the ichimoku signal and downtrend when the price is below the Ichimoku signal. Lets take a look at the charts below;

We see that immediately the price went above the ichimoku, the price starts to move in bullish. The size of the cloud was also able to tell us the amount of volume in the market. We can confirm this using the RSI indicator where the price was in the overbought region above the 70 mark, pushing the price to about the 80 mark

From the downtrend chart, we can also see that the price is below the Ichimoku hence signify an uptrend price movement. The size of the cloud also tells us the amount of volume being traded that causes the downtrend movement. Looking at the RSI indicator the price went into the oversold region which confirms the signal from the ichimoku indicator.

4-Explain the usage of MA with this strategy and what lengths can be good regarding this strategy (screenshots required)

Adding the moving average together with both the RSI and Ichimoku indicators increases the efficiency rate of the signals for a better trading opportunities. The moving average is a trend based indicator which identify trends and also trend reversal. MA indicator determines the average price value of a security over a given period of time.

An uptrend occurs in MA when the indicator moves below the price movement similarly when the price moves above the price movement then we have a downtrend movement. I will use a longer period say 100 for this strategy since the Ichimoku already uses a shorter period.

I combined all 100MA(yellow line), RSI and Ichimoku Strategy in the chart above. From the bullish trend the 100MA fell below the price while on the bearish trend of the chart the 100MA crosses above the price movement. The RSI indicated an oversold signal signifying a trend reversal into bullish similarly it indicated an overbought signal indicating a reversal into bearish. The Ichimoku tells us the amount of trading volume in the market that a trend.

5-Explain support and resistancet with this strategy (screenshots required)

Support and resistance are two key items when making technical analysis. They are the key factors when understood will signal the buying and selling pressures in the market. Most indicators have a way of signifying the support and resistance levels but here i will demonstrate how to determine them with RSI + Ichimoku strategy.

With Ichimoku strategy, when the price movement is above the Ichimoku cloud, it serve as the support level. The cloud is mostly green when its below the price movement indicating a support level. The expansion of the cloud tells how strong or weak the support is. The bigger the expansion the stronger the support and vise versa.

similarly when the price movement is below the ichimoku cloud, it serves as the resistance level. The cloud is green here with the size of it indicating how strong or weak the resistance is. The bigger the expansion the stronger the resistance and vise versa.

This is where the RSI indicator comes to play. We will use to it to determine the support and resistance level using the overbought(70) and oversold(30) signal. Lets take a look at the chart below;

6-In your opinion, can this strategy be a good strategy for intraday traders?

The RSI + ICHIMOKU strategy works perfectly for intraday traders and the reason is that, the RSI indicator indicates the overbought and oversold region while the Ichimoku strategy is able to tell us the strength of the trend by indicating the amount of volume in market. We can get support and resistance levels and together with RSI we can detect a good entry and exit points.

As we all know, there is no indicator which is 100% percent efficient, which is the reason more than one indicator should be used. The use of this strategy also depends on the trader experience and how they use the available tools in the indicators to spot entry and exit points in a day trade.

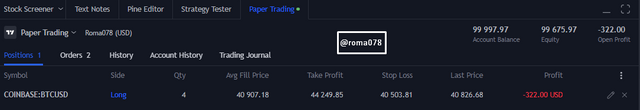

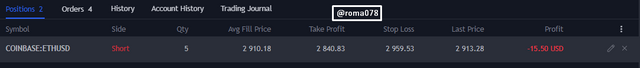

7-Open two demo trades, one of buying and another one of selling, by using this strategy.

From the chart above, the price is in the oversold region reading from the RSI indicator. This means the price will make a trend reversal into bullish. Using the Ichimoku strategy, i noticed the amount of volume in the market was increasing that confirms that the price is about to make a bullish trend. We can see the price has already started a bullish trend

From the chart, the RSI indicator shows an oversold which signal the price will reverse into bullish. Looking at the ichimoku signal, the price was below the cloud indicating price movement is in bearish. I opened sell position with a stop loss around the cloud.

Combining both indicators is something i have learnt and i have seen the benefits and opportunities associated with it. The main reason i love this combination is how the ichimoku could tell the amount of volume in the market since the RSI can only tell the trend.

The flaw of RSI of giving numerous false signals with less true signals, the ichimoku helps to filter them out to be able to detect the true signals.

Decent guide appreciate it https://9blz.com/rsi-indicator-explained/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit