Hello dear students and professor. I am happy to present my homework post on the topic lectured by professor @imagen.

Bitcoin Trajectory by @rosita-nkefor

1.) How many times has Bitcoin been "halved"? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have halved.

Before we go to the main part of the question, I will like us to first understand what Bitcoin is. Bitcoin is the first cryptocurrency that was created. It was created along with its decentralized blockchain by Satoshi Nakamoto on the 03rd of January 2009. That was when the first transaction was made.

This network was special from anything before in that all transactions were peer to peer i.e there is no central server or authority. This network uses the Proof of Work (PoW) consensus mechanism. Block validators on this network are called miners. And when these miners validate transactions, create a new block, and successfully add it to the blockchain, they are given some coins as block rewards.

Now we know what Bitcoin is. What then is Bitcoin halving? From the name itself, we see that something is being divided by two. We also mentioned earlier that miners are given block rewards. Bitcoin halving is an occurrence whereby these block rewards received by miners are divided into two. We can refer to the period whenever this happens as the half-life.

The half-life of Bitcoin is 210,000 blocks. This means that after every 210,000 blocks have been added to the blockchain, the block rewards received by miners will be divided by 2.

To calculate this, we need to know Bitcoin's current block height. This can be gotten from any Bitcoin block explorer.

From the screenshot below, you can see the current block height of Bitcoin is 704188 blocks.

We also know that Bitcoin halves every 210,000 blocks. So we do the calculations.

Current block height = 704,188 blocks

Number of times it has halved = 704188/210000

= 3.35

Rounding down to the least integer part, we have 3.

So Bitcoin has gone through 3 halvings by calculations. This can be confirmed through research. You will see that Bitcoin had first halved in 2012, then it halved for the second time in 2016 and finally, the third halving occurred in 2020.

We know that Bitcoin has already halved three times. This means that the next halving will be the fourth. To know exactly when this fourth halving will occur, we do our calculations.

Current block height = 704188 blocks

Block height at fourth halving = 4 × 210000

= 840000 blocks

So its next halving is going to occur when it has reached a block height of 840000 blocks. If you look at it, this means that we have 135812 blocks to add to the ledger before the next halving will occur. By my estimations, the fourth halving is going to occur in 2024. According to online research, this will occur exactly on the 09th of May 2024 at 11:57 am.

We have said that this halving is by dividing the block rewards of miners. The following table will show how the block rewards changed after each halving.

| Halving | Initial block rewards | Final block rewards |

|---|---|---|

| First | 50 BTC | 25 BTC |

| Second | 25 BTC | 12.5 BTC |

| Third | 12.5 BTC | 6.25 BTC |

So miners now receive 6.25 BTC upon mining as a block reward.

Apart from Bitcoin, other cryptocurrencies have experienced halving. Some of these include the following.

- Litecoin: Litecoin was created in 2011. It has a half-life of 840,000 blocks which is approximately 4 years. This so far, it has been halved twice. Also, the block rewards which were initially 50 LTC, went to 25 LTC after the first halving in 2015 and then 12.5 LTC after the second halving in 2019.

- Bitcoin Cash: Created in 2017, it has a half life of 210,000 blocks which is approximately 4 years. It has undergone one halving in 2020 and it's block rewards now is 6.25 BCH.

2.) What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

We know that blockchains are decentralized in nature meaning that there is no central server or node. Unlike centralized apps which have a central authority in charge of verifying all transactions made on the network, such cannot be done on a blockchain.

Everybody here is a node. So now to find a way to verify these transactions, different users on the blockchain have to verify to say “Yes. This transaction is all good”.

Thus, a consensus mechanism is simply how blockchain users agree. That is, they reach a consensus. This is very necessary to verify all transactions and provide security.

There are many different types of consensus mechanisms adopted by different blockchains. Some examples include:

- Proof of Work (PoW)

- Proof of Stake (PoS)

- Delegated Proof of Stake (DPoS)

- Proof of Capacity (PoC)

- Proof of Burn (PoB)

- Practical Byzantine Fault Tolerant (pBFT)

The two most popular consensus mechanisms, Proof of Work and Proof of Stake differ in the following ways.

- Block validator

In PoW, the block validator is the person who solves complex mathematical puzzles fastest.

But in PoS, the block validator is the person who holds a higher stake.

- Miner selection

In PoW, the selection for miners is very random. So anybody can be able to mine.

With PoS, the selection is done in a very controlled and analyzed manner.

- Energy consumption

With PoW, so much computational energy is needed to solve those complex puzzles. This makes it consume so much energy.

But in PoS, little energy is used, making it energy efficient.

- Scalability

For PoW, there is a limited number of transactions that can be performed at a time.

But with PoS, it is more scalable and can handle so many transactions at a time.

- Transaction verification time

It takes a lot of time to validate a transaction with the PoW consensus mechanism.

But with PoS, the time to verify a single transaction is significantly smaller. This also explains why it has a higher scaling capability.

- Exit protocol

To be a miner in PoW, you need to buy a lot of machines for solving the puzzles. Whenever you feel like selling your machines and discontinue mining, you are free. Nothing is holding you back.

On the other hand, you need to buy and hold a stake with PoS to mine. If you decide that you no longer want to mine, you cannot just sell your stake. This is because it was bought and held and a contract signed. So unless the stated duration is exceeded, you cannot sell your stake.

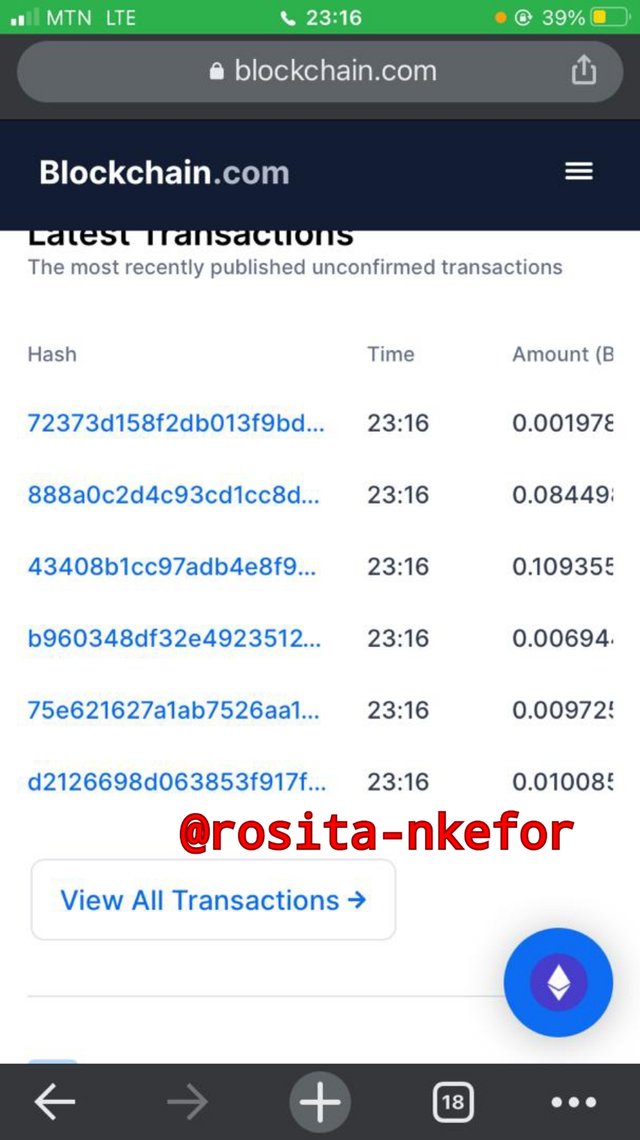

3.) Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

The block explorer I am using is Blockchain.com. Here you can see all the latest transactions.

I clicked on the latest transtransaction and was brought to its summary. You can see the hash as indicated.

Hash: 8f8caf167f792e53c433d65360e22c664d39a3465fe0ab990fb2a74910fa0faf

4.) What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

Before I go further, what are altcoins? Generally, in the crypto world, altcoins refer to any other coin that is not Bitcoin. But some people reiterate that it’s not all coins apart from Bitcoin are altcoins. They argue that altcoins should refer solely to those coins that are not in huge comparison to Bitcoin. Meaning that coins like Ethereum, Dogecoin, etc should not be referred to as altcoins.

I will refer to all the coins except Bitcoin as altcoins for this post for better understanding. This is because the term altcoins came about when other coins were created after Bitcoin, Dogecoin has its hopes of being a better alternative to it in terms of consensus mechanism, transaction speed, block producing speed, data storage, and many more.

It should be noted that these coins were created with a goal in mind and for purpose of a particular project.

With that in mind, what then is altcoin season? In simple terms, altcoin season is simply the period whereby Bitcoin which usually dominates the market, loses part of its dominance to altcoins. That is, during this period, a good majority of altcoins experience tremendous growth while Bitcoin drops in the market.

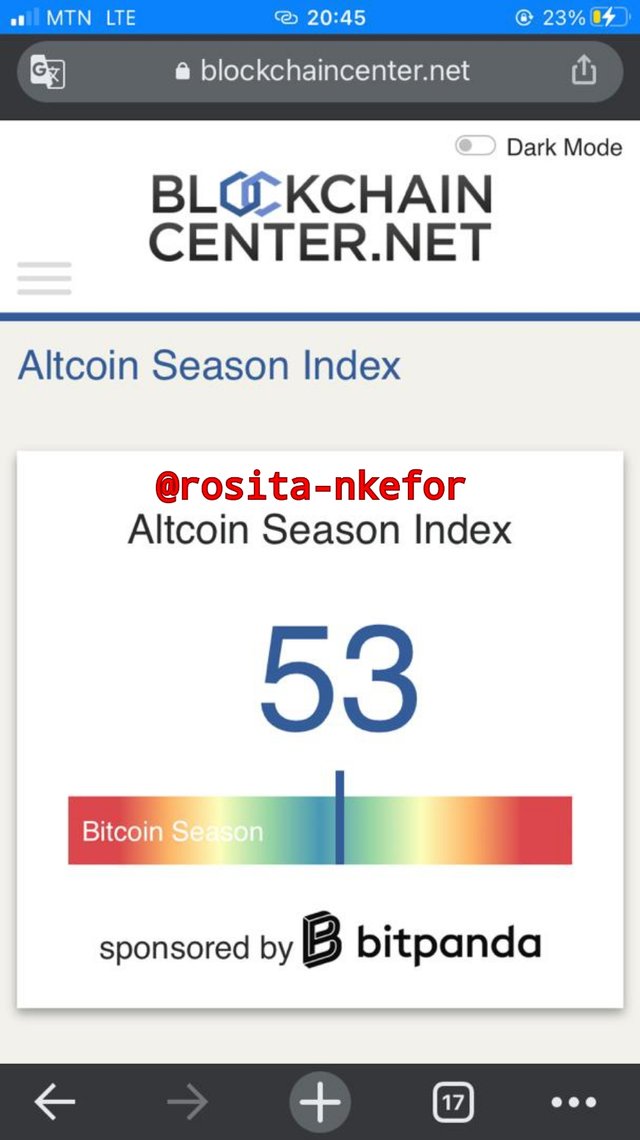

Generally, when so many people are buying altcoins, it is altcoin season. But a group of people made the altcoin season index, some sort of scale to calculate the season be it Bitcoin or Altcoin season.

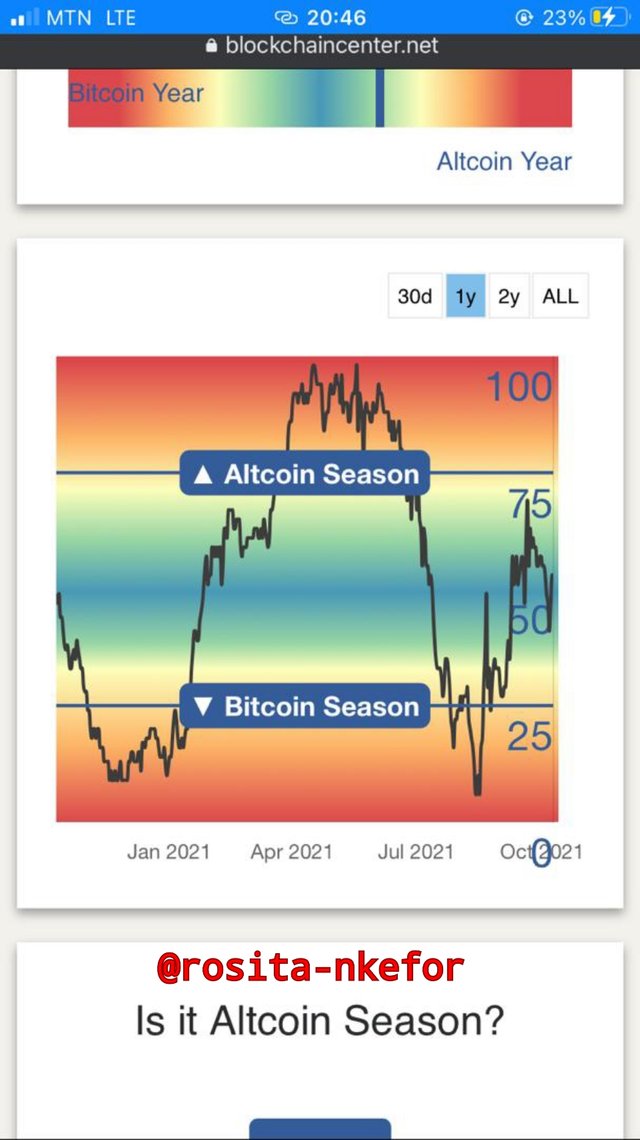

According to Blockchaincenter.net, the altcoin season index is at 53. When you look at the graph carefully you see clearly that we are inching towards Altcoin season but we're not yet there. So no, we are not in altcoin season.

Also, from the above screenshots, we can see that the last altcoin season lasted between April and July 2021. The below image has the list of coins that experienced growth during the last altcoin season.

I shall specify more on FTM and BCHA for this question.

- - Fantom (FTM)

In the last altcoin season, FTM experienced an 846.9% growth. When you take statistics from the coin market app, you can see that the coin is ranked #35, with a current value of $2.15. From its chart for the year, we can see that the coin grew significantly from about $0.031 with an all-time high of $2.45.

- - Bitcoin Cash ABC (BCHA)

It experienced a growth of 615%. It is currently ranked #203 by the CoinMarketCap and has a current value of $192.05. From the chart below, we can see how much the coin free in the last altcoin season, leaving from a value of about $13.3 and hitting an all-time high of $381.95.

5.) Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, Tron, or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders/developers? Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots.

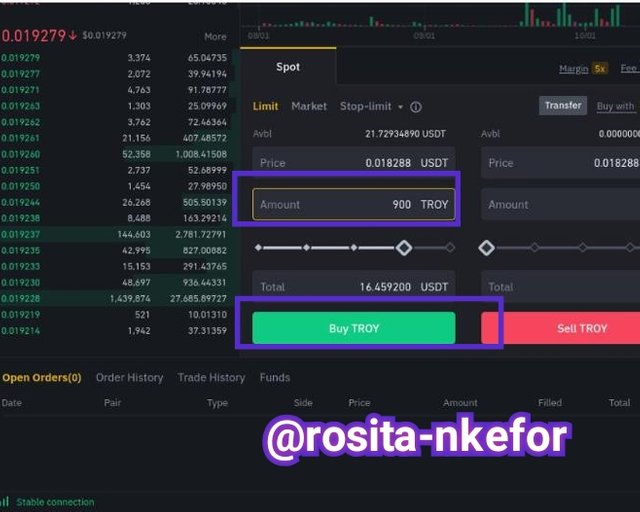

Using Binance, I decided to make a purchase of some TROY coins worth about 16 USDT as you can see in the following screenshots.

Let me start by giving some vital information about the coin. TROY was developed or created in 2017, by Xu Yingkai. It is a utility token and is a member of the ERC-20 family of tokens on the Ethereum blockchain.

This token was created for use on the Troy platform. This Troy platform specializes in brokerage for crypto trading and management of your assets. This token allows you to use certain features on the Troy platform. You can also stake the token to retain a broker-to-broker network.

According to CoinMarketCap, Troy has the following details. It is ranked #305 with a value of $0.01899 at the time of writing. It has a market dominance of 0.01%, trading volume in the last 24 hours of $37,303,931.78 and a market cap of $169,128,540.05.

So why did I choose this coin? From its chart in the last 1 year, you can see that TROY has made a significant increase from $0.0032 and it even hit an all-time high of $0.03874. With its current price of $0.01899, the value of the coin is increasing significantly. So if I buy the coin now, I am expecting to see a huge amount of growth in the next three or five years, almost double to my investment.

One other thing that makes me believe in the token as well, is the fact that the project in which it was made is a very promising one that will gain the attention of crypto traders eventually. And when that happens, more people will get interested in the coun and it's value is going to increase.

6.) Conclusions

Bitcoin introduced the world to decentralization and blockchains as we know it now. Also, being the first, it has managed to gain a very huge dominance over the crypto market. This innovation induced the surge of other coins called altcoins into the market with aim of being better.

Halvings also came about in a way to control inflation in the market and to ensure the coin only gains value as time goes by.

With so many coins in the market, one has to be careful when purchasing coins. Before making any investment in coins, we have to check the found history and data, so that we can determine if it is a profitable risk.

With all these cryptocurrencies, we tend to experience Bitcoin seasons and Altcoin seasons. These periods are not controlled by anybody and we can never be so sure when the next season will be. Also, it is quite risky for an investor to invest solely in Bitcoin or solely in Altcoins.

My advice would be to invest in both Bitcoins and Altcoins so that you enjoy the best of both seasons without making capital losses.

Thank you for reading.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit