Greetings guys,

Introduction

This is the first week of the crypto academy with exciting new courses and I am glad to have the opportunity to b able to learn from professor @reddileep. This time round he has introduced us to the world of leverage trading which I do think every crypto currency trader need to have an idea about. After going through his lecture I will now submit my homework post. Stick with me while I prepare and present my homework task.

1- Introduce Leverage Trading in your own words.

Before we look at what leverage trading is I think we have to first of all know what trading is. Trading is the act of purchasing an item. When we mention the word purchase we mean to buy or to sell an item. In the crypto currency market, we can describe trading as buying an asset to be able to make profit or gain profit on it in the near future. Now every new trader in the market have involved them selves with spot trade before because sometimes in the exchanges there are some assets which can not be bought with money unless they are exchanged with another asset.

spot trade is not risky and it doesn't reward the user as you are only exchanging or what we call purchasing an asset for a price. This is where the other type of trading(leverage trading) comes in. Leverage trade or what we can refer to as margin trading or trading on leverage can be described as a risky but very rewarding type of trading. In this type of trading the trader can gain profits when the market is in an uptrend or the market is in a downtrend. All the trader has to do is to decide the number of times he is willing to bet on the asset and wait for the market to do the rest.

There are different ways of multiplying one's money during a leverage trade, the trader decides the number of times he wants the money to be multiplied when the market goes in his favor and is it does go in his favor he sees the returns being multiplied by either 2X, 3X , 4X etc. If he market does not go in his favor or he doesn't leave the market in time his assets are liquidated in the ,market and his assets can be lost. This is the risky part about leveraging cause a traders money can be lost in a twinkle of an eye if the market goes against you.

There are two types of leverage trading which are the margin and the leveraging.

In margin, the trader is allowed to use his own assets or money to take his positions and when the market goes against him he only has him self to blame and also loose the asset he used. In leveraging, the trader is allowed to borrow assets from the exchange, this very risky because when the market goes against the trader he will have a whole lot of loans to pay off depending on the amount of money he was allowed to borrow.

2- What are the benefits of Leverage Trading?

For every type of trading there are benefits but with leverage trading there are more advantages.

- In Leverage trading a trader can start with a very minimal amount.

Unlike spot trading, you need to have a certain amount of money ( minimum of 10 dollars on binance ) to be able to perform spot trade. On the leverage trading it doesn't matter the amount of funds the trader. The trader can start the leverage trading at a minimal amount of 1 dollar.

- In leverage trading a trader can double or even triple his amount of money in a short while.

When trading margins we are allowed to multiply our money the number of times we want no matter the amount of money that trader has. This makes it possible for the trader to be able to multiply his money 2X,3X , 4X and even up to 10X or more. Unlike in spot trading when the trader converts his assets waiting and hoping that there is an uptrend fro him to take profits.

- In leverage trading, if the trader is able to predict how the market goes correctly the trader will make huge profits depending on the amount of money he put into it and the number of times he opted to multiply the asset.

If the trader is able to predict and the market goes in his or her favor he will be in profits instantly

- In leverage trading, the trader can open the market in two ways.

He can go on a long position when the market is on an uptrend and then go short when the market is in downtrend. This means that either way the trader can still make profit in the leverage trading.

- In the leverage trading, a trader can exit a trade without having to cancel the whole order.

This means if in case the trader took a position and it is going against him he can exit or leave that order before his funds are liquidated and then change a position.

- In leverage trading , as soon as the trader places the trade he is able to see in real time if he is making profits or he is in losses.

This is of importance to the trader because he then decides if he will change his position or he can hold on a little longer. Either way he can take an action before his assets are liquidated.

3- What are the disadvantages of Leverage Trading?

We have been able to look at the advantages of leverage trading in the question above; for every thing that has its benefits there are always disadvantages and we will be looking at the disadvantages of leveraged trading.

- A trader can loose his assets as easily like he makes profits.

We have seen that making profits in leveraged trading is quite easy but the risk that comes with it is very huge. If the market goes against the trader all or part of hos assets will be liquidated.

- In leverage trading, it affects a fee for as long as your position is opened.

Unlike the spot trade where a trader only pays a small fee when he is about converting his asset but after converting the asset it attracts no fee for keeping it in your spot wallet, on the trading on margin the trader has to pay a fee for as longa s he has opened his position.

- In leverage trading, a trader's losses are multiplied.

Just like how a trader's gains are multiplied after making a correct prediction, in the same way the trader's losses are also multiplied in the same way it would have been multiplied if he had make gains

- Leveraged trading is not easy especially for beginners in trading.

Unlike spot trading where a trader only has to convert his asset and hold it, in leverage trading the trader has to do a lot of additions and multiplications and also use complex indicators before opening a position thus a beginner who is trading crypto for not very long will be risking it and wouldn't even understand it.

4- What are the Basic Indicators that we can use for Leverage Trading? (Need brief details for any essential Indicators and their purposes)

We every trading strategy we know or use we have to always have an indicator or a way of confirming our readings before entering or exiting the market; in our case before opening a position.

I will be looking at the following indicators by which a trader can confirm his readings before trading leverage.

- RSI indicator( Relative strength Indicator)

- Parabolic SAR

- EMA( Exponential Moving Average)

RSI Indicator ( Relative Strength indicator)

The first indicator a trader can use for leverage trading the RSI indicator. The RSI indicator is a technical analysis tool that measures the strength if the market. The RSI indictor works by using the numbers from 0 to 100 when added to a chart. The indicator gives a signal to leverage traders when it is the best tike f to open a position in the market. The RSI indicator is able to determine when the market is in an overbought and over sold region. When this happens the trader is able to predict and anticipate when the market is going on a reversal. When the market is in an oversold region it means that the asset is currently undervalued and the price might go up soon.

When the market is in an overbought region it means that the price of the asset might go down soon.

Trading View

When the RSI line is above the 70 mark it means that the market is in an overbought region and the asset is anticipating a drop in price.

When the RSI line is below the 30 mark it means the assets is in an oversold region and its currently undervalued and the price of the asset might go up soon.

Parabolic SAR

The parabolic sar is another indicator which is used by leverage traders. The parabolic sar is a technical analysis tool which is used in determining the direction of an the market. The indicator works by using dots to it advantage. The dots show if the market will go up or down otherwise uptrend or downtrend.

Trading View

The indicator is most sensitive when the market is in an uptrend phase. When the market is in a ranging phase the signal given by the indicator are mostly false signals. The dots of the indicator shifts according to the phase the market is. when the dots of the indicator shifts down to top or vice versa the trader gets his signal to either open or close his position otherwise to make an entry.

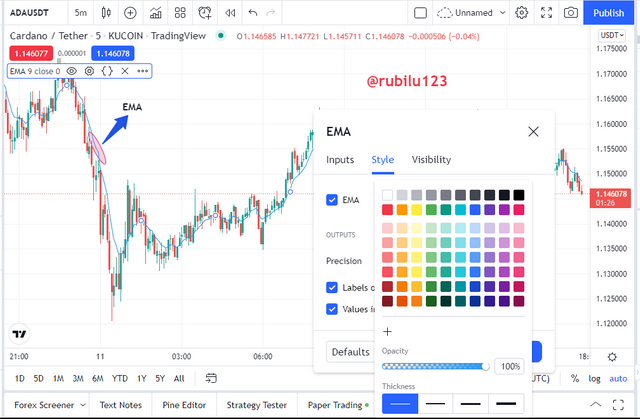

EMA ( Exponential moving Average)

The EMA indicator is another indicator which can be used by leverage traders. The EMA indicator is a technical analysis tool that studies the price of an asset over a period of time. The EMA works by dealing or taking preference in recent prices of an asset.

Trading View

If the price or otherwise known as candle sticks are above the indicator it shows the market is up trending. We are in a downtrend phase if the candle stick or price are below the lines of the indicator.

5- How to perform Leverage Trading using special trading strategies (Trading Practice using relevant indicators and strategies, Screenshots required)

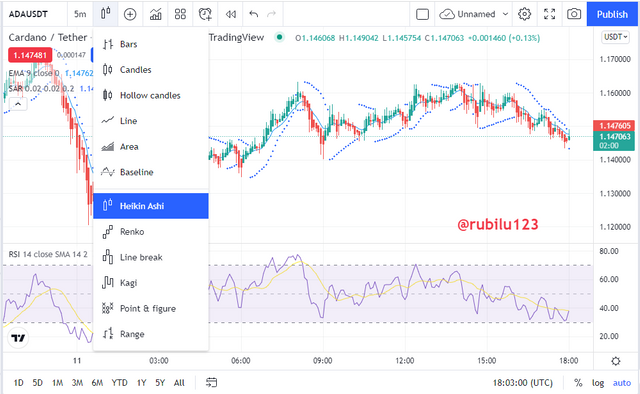

For this aspect of the assignment I have to change my chart pattern which is in the Japanese candle stick to the Heikin Ashi charts. The Heikin Ashi chart helps us to see and identify the trend clearly so that we do not read false signals or entering and trading leverage will cause us to loose your assets.

Trading View

When trading leverage it is better to trade with a shorter time period so I will be changing my time frame to 5 minutes chart.

After changing my chart pattern to Heikin Ashi chart pattern for easy identification of trend and also changing my time frame to a shorter time frame(5 minutes) I will now perform my sell and buy strategies.

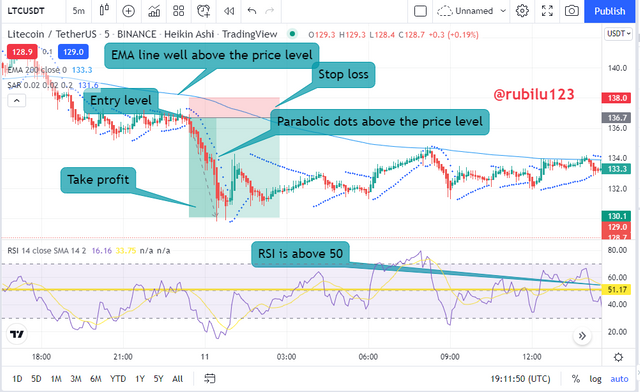

Performing sell short Order

Before I perform my sell short order using these strategies, I have to wait for things to get in to order before I take my trade. I have to wait for the EMA line to be above the price level. After making sure that has happened I will need to further confirm from the RSI line and the RSI line should be above the mark 50 and then the Parabolic SAR should also show its dots well above the price level. After I have confirm these 3 scenarios then I will now make my entry into the market and take my position.

Trading View

In the LTC/USDT chart above I made sure that I waited for the EMA line to be well above the price level. After confirming this I further made sure that my RSI confirmed that my reading was correct and the mark was above the 50 mark after which the parabolic SAR dots was also above the price level. So I placed my entry level just on the parabolic dots and then I placed my stop loss above it. I then exited my position immediately I saw the price level getting above the parabolic dots.

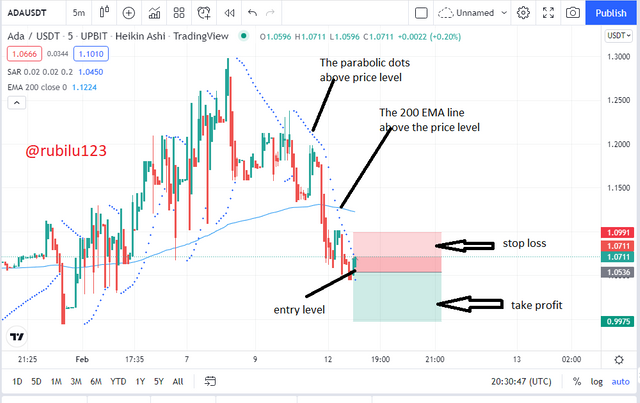

Performing Buy Long position

For the buy long position, I have to wait till I see a suitable entry point. Unlike the sell position some things are quite different here. The EMA line has to be below the price level. The RSI indicator line has to to be below the 50 mark and the Parabolic SAR indicator should show its dots just below the price level.

Trading View

In the LTC/USDT chart above, I set my time frame to 5 minutes and made the following confirmations before taking my buy positions. As you can see from the chart the EMA line is below the price level which shows a bullish confirmation. Then the RSI further confirmed it as it was below the 50 mark and then finally the parabolic dots appeared below the price level telling us that we can now open our buy position.

6- Do a better Technical Analysis considering the above-explained trading strategy and make a real buy long or sell short position at a suitable entry point in any desired exchange platform. Then close that buy or sell position after appearing trend reversal signal from the Parabolic SAR indicator. Here you can also close your Buy or Sell position using any other desired Trading Method in addition to the signal coming from the Parabolic SAR indicator. However, here you must prove that trading method as a reason for closing your position. (Usually, You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines or any other trading pattern. Use at least 2X leverage and no more than 10X )

For this part of the assignment I will be using the trading view platform to make my analysis and then take my real position on the binance exchange site.

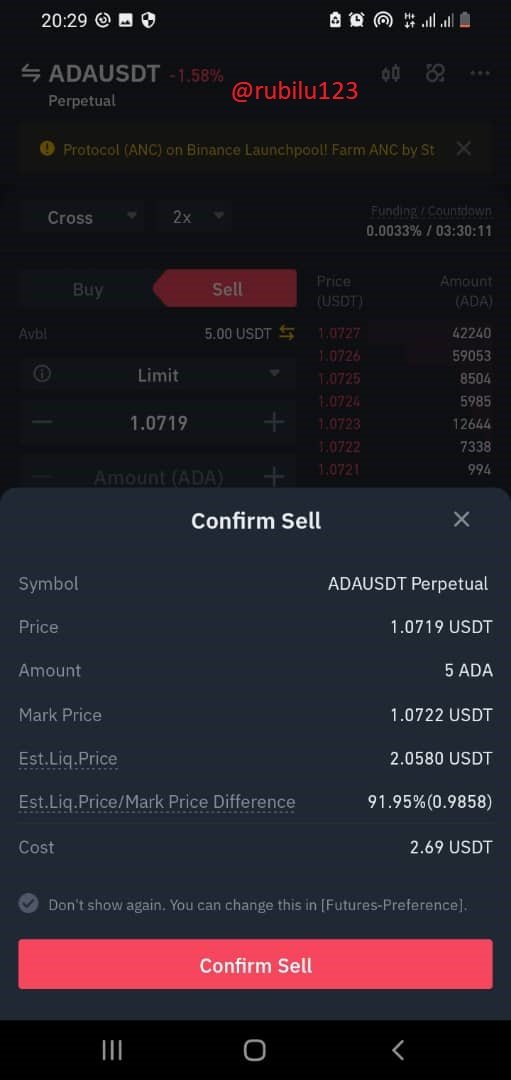

When I observed the ADA/USDT chart carefully I noticed that the market was in a bearish phase which can be confirmed by the two indicators I opted to use. As we can see from the chart the price level is trading below the 200 EMA line which confirms a sell/short position. I executed a sell order at 2X on my binance exchange app. Then I placed my entry trade and waited for a reversal to close my position.

Trading View

The trade was placed at 1.0560 dollars and my stop loss placed at 1.0991 dollars and a take profit at 0.9975 dollars.

Screenshot from binance app

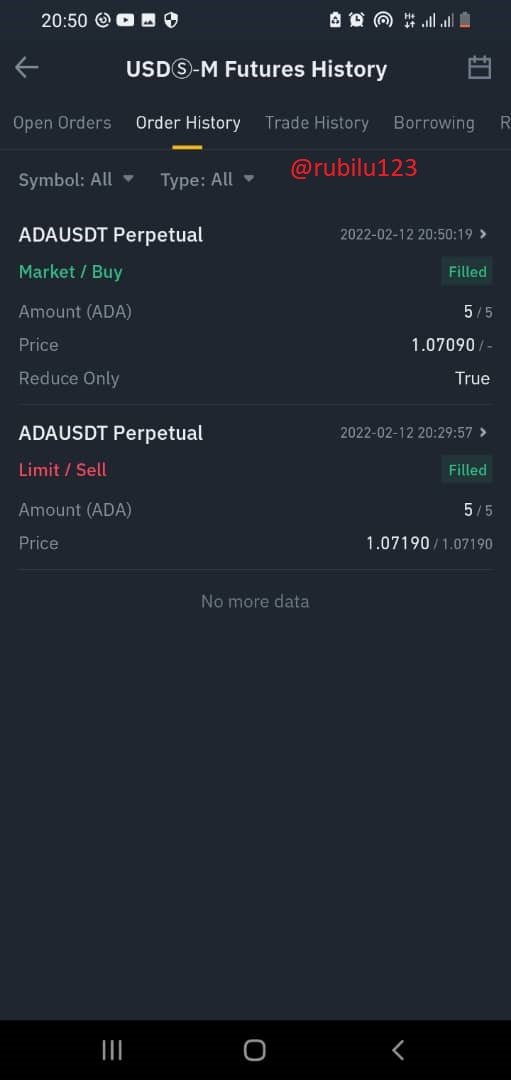

After waiting for sometime to see the movement of the dots to the downside, I didn't see any movement which only goes to confirm how indecisive the market is right now so I had to exit my trade.

Trading View

I exited my sell short order after I saw no movement or the indecisive nature of the market.

Screenshot from binance app

Conclusion

As rewarding and exciting leverage trading might sound Its still a risky type of trade as a trader can loose his assets within minutes of liquidation. But with the right analysis and making sure to open your position at the right spot it is almost impossible for a trader to make loss. There are several ways by which a trader can make leverage, by either 2x, 3x etc and on binance it is up to 125x. A trader can make high earning with this multiplications but it still requires an experienced trader because for a beginner he might not even know what he or she is doing.

Thank you.