Introduction

This week professor @sapwood has delivered his lecture. A detailed and comprehensive lecture on sun.io. After going through his lecture, I will now like to present my homework task.

1. Discuss the various features of Sun.io, a comprehensive DeFi facility of Tron family?

Sun.io is one of the areas of branches of the defi family which has been introduced into the tron ecosystem. The sun.io which was previously known as justswap is a platform that supports stablecoin swap, staking, mining, has its own governance and also liquidity pool.

Justswap as I mentioned was its previous name up until 20th of October 2021 when it was acquired by sun.io. Since its big announcement sun.io allows its users to also swap sun tokens on the platform. More to it, the fees charged on the exchange has its percentage uses. Part of the fees goes to users who are holding or have locked up their tokens and part of the fees are used to buy back and burn sun tokens. This helps in the continuous supply of the sun tokens on the platform and also helps in the running of the platform.

Users on this platform are allowed to lock up their tokens for a period of time and by doing this they can earn on what they have locked up depending on the amount of tokens they supplied.

Now I will explore its features

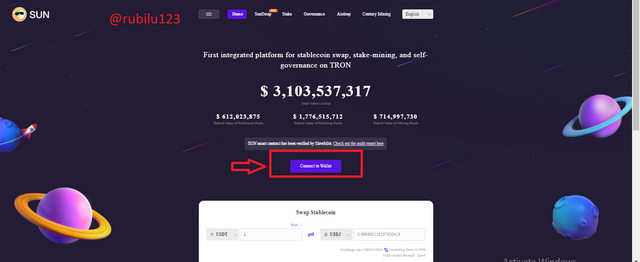

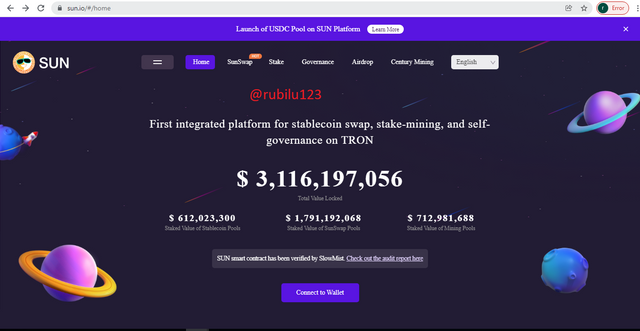

First of all visit sun.io on your Web browser.

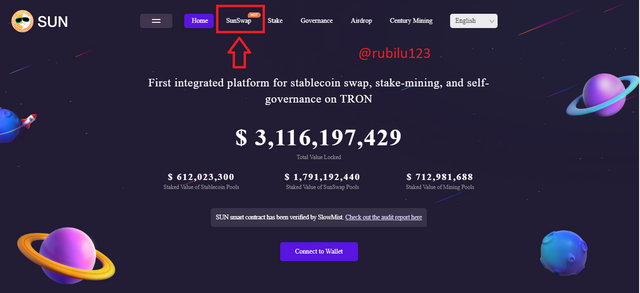

Upon opening this is the homepage of the platform.

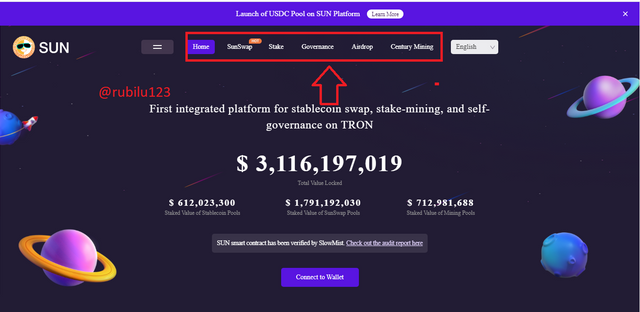

On the homepage you will see the following features which are

- Home

- Sunswap

- Stake

- Governance

- Airdrop

- Century mining

Now I will explore each of the features listed above

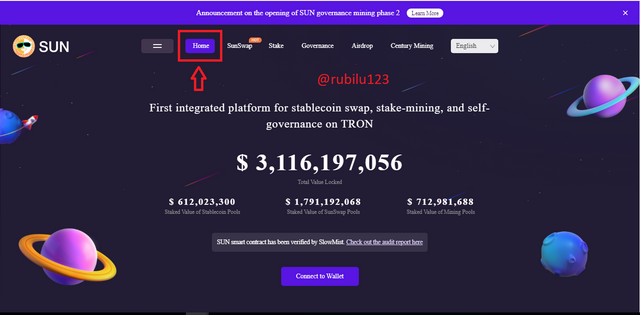

Home

When a user opens the link of Sun.io on Google the first place is the homepage of the site which is the place we are currently at.

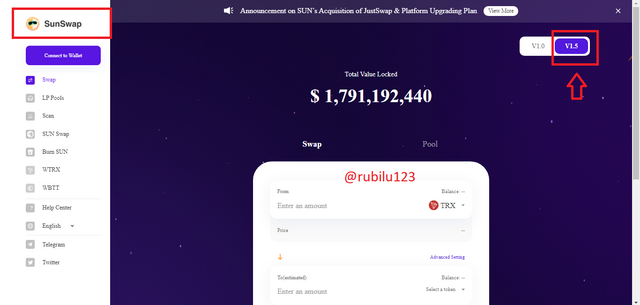

SunSwap

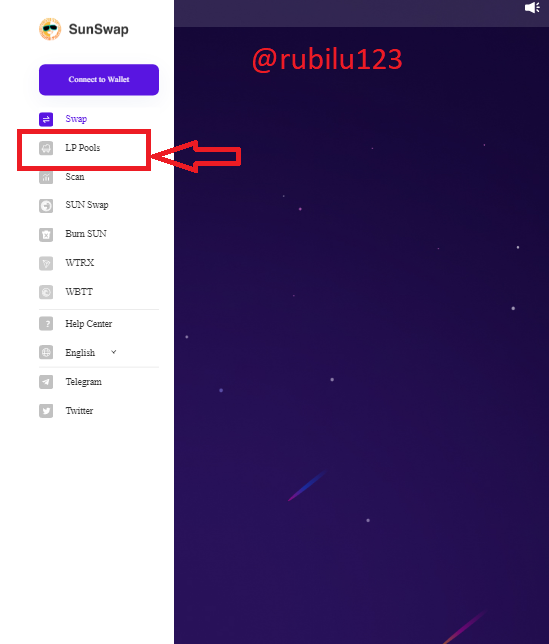

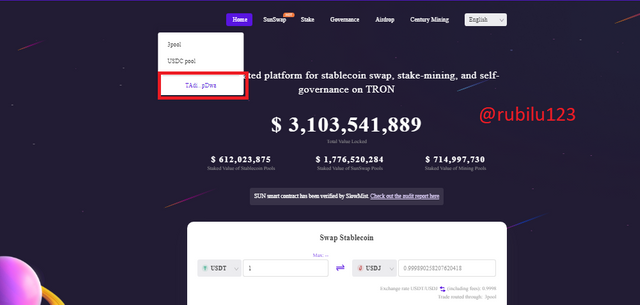

The Sunswap feature when clicked opens a new page with various options. A few of the options are swap, lp pools, scan sun swap and a whole lot of features which cam be seen in the screenshot above. It is important to note that it is running on its new version; V1.5 which can be seen at the top right of the page. On the Sunswap page is where the swapping of tokens occur.

Now let's explore the sub-festures of Sunswap.

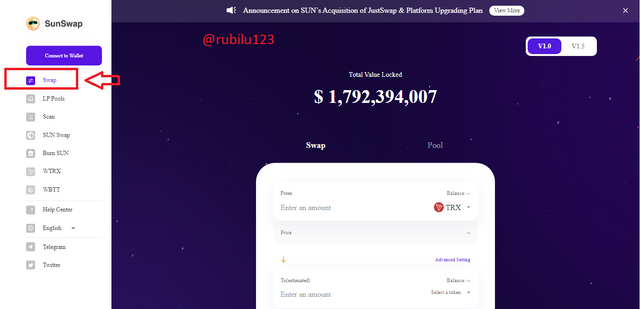

swap

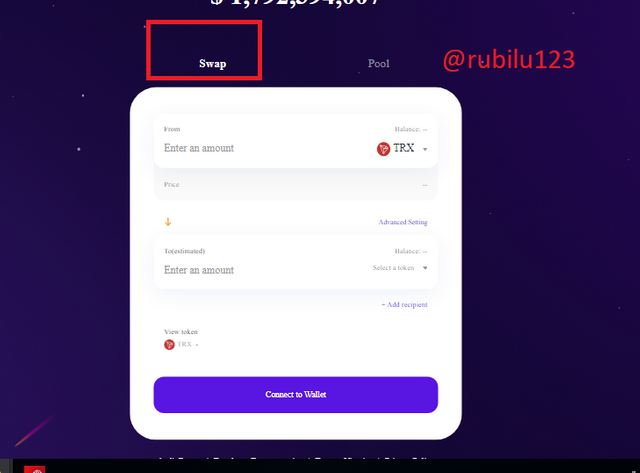

The swap features is where a user can stake tokens and also swap tokens for other tokens. Here a user can also provide liquidity.The total value of locked assets as I was doing my assignment is $1,792,394,007.

The page where a user can swap his tokens for other tokens

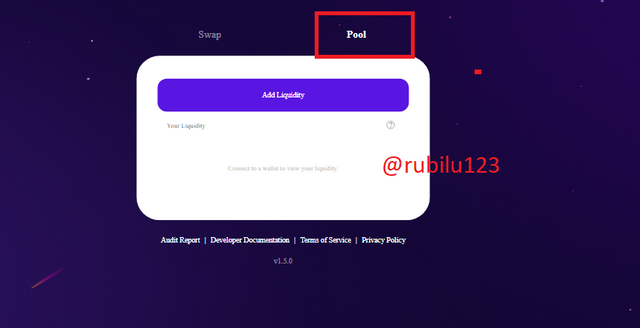

On the same page a user can also provide liquidity by clicking on the pool option as seen below.

Lp pools

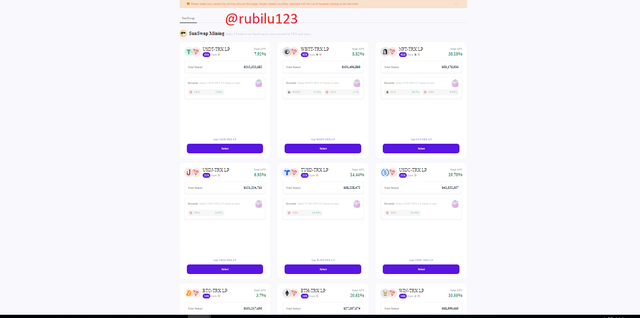

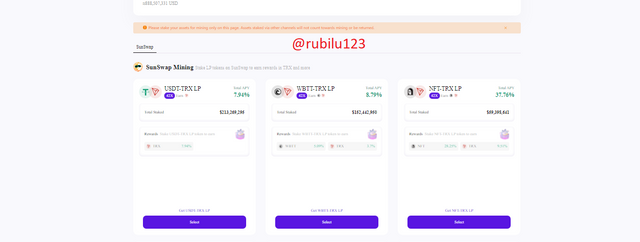

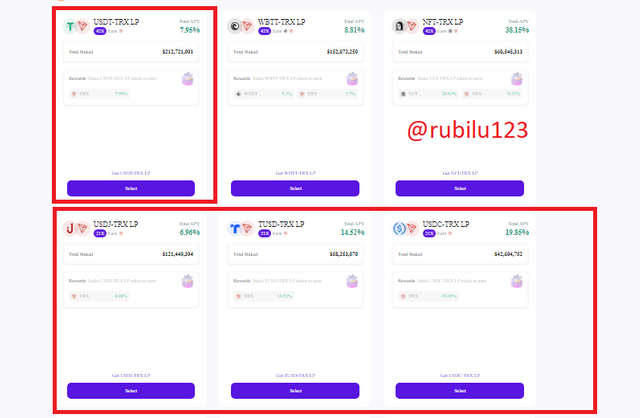

The next sub feature of the sunswap is the lp pools. This is a page where users are allowed to earn after providing liquidity by mining tokens. This is only available for users who are liquidity providers on the platform. Liquidity providers can earn tokens like trx, wbtt, tusd amongst other tokens.

Note that even after providing lp, rewards are earned on an annual per yield basis and this varries for the various pools.

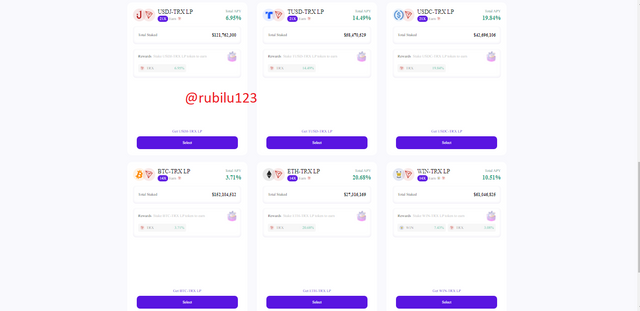

Upon clicking on the lp pools tab you can see that there are actually 9 different pools that a user can earn from after providing liquidity. They are USDT-TRON LP, WBTT-TRX LP, NFT-TRX LP, USDT-TRX LP,TUSD-TRX LP, USDC-TRX LP BTC-TRX LP, ETH-TRX LP and WIN-TRX LP.

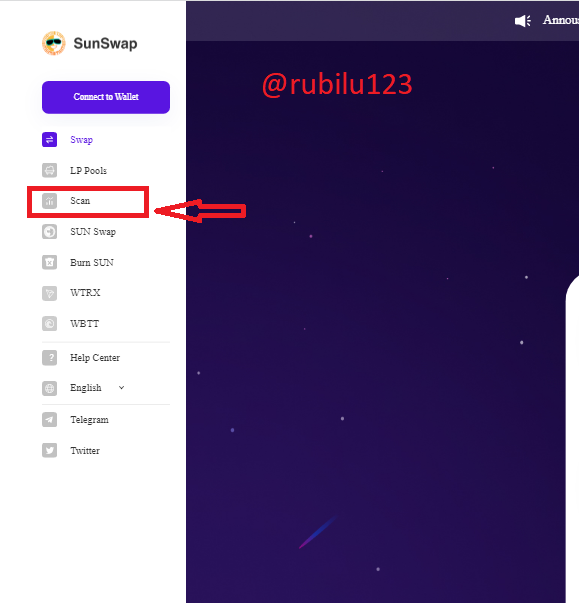

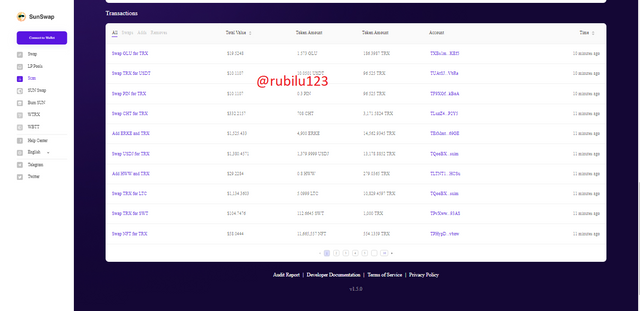

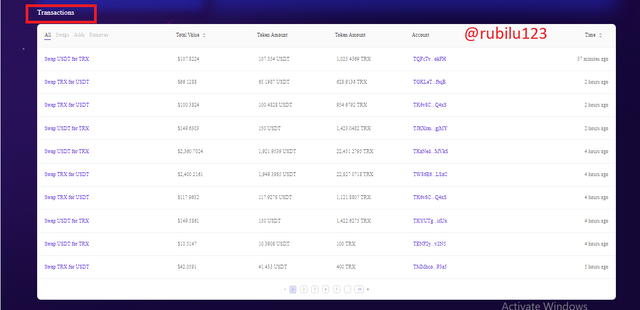

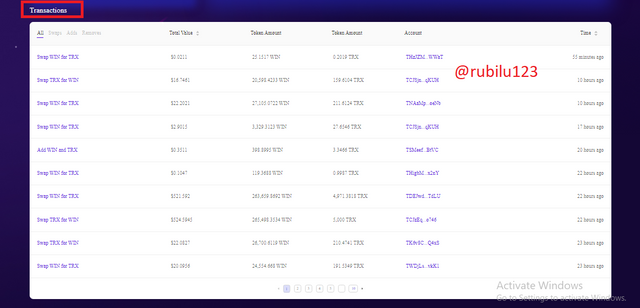

scan

The scan feature as the name suggests is just like a block explorer.A user can check or see all the transactions that occurred on the sun.io platform.This is an explorer for the sun.io platform which allows users to scan through the various Lp pair. A user can also see the live price update of the price of trx.

A user can as well add liquidity on this page and also trade pairs as all of the pairs are also listed on the page. All transactions swaps, adds can be seen on this page too.

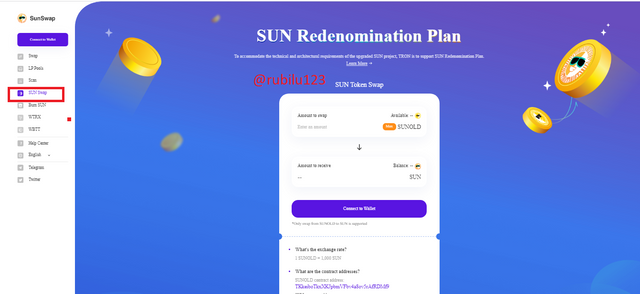

sun swap

This feature is for users who are still holding the old token of the platform which was previously know as sunold. Users can swap their sunold tokens to the new which is sun.

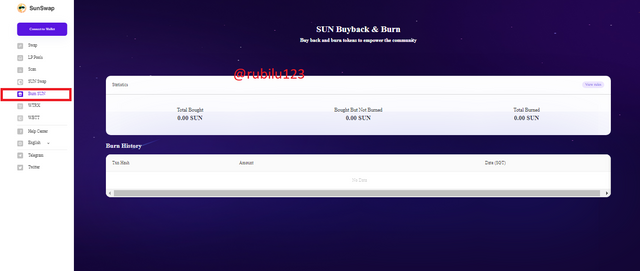

Burn sun

I stated that the platform uses part of the transaction fees to buy back and burn sun. So the burn sun feature helps Users to see the history of that has gone through this process.

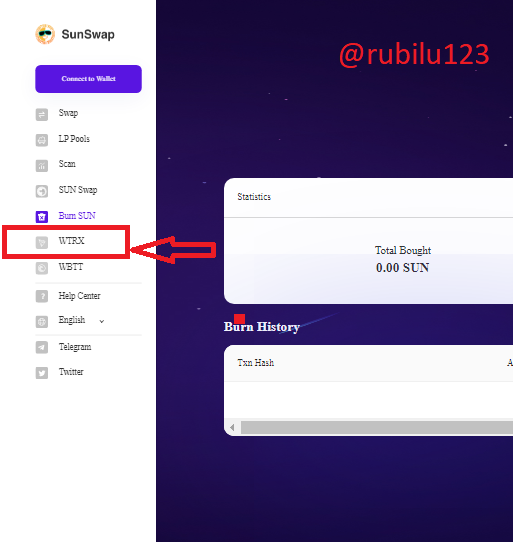

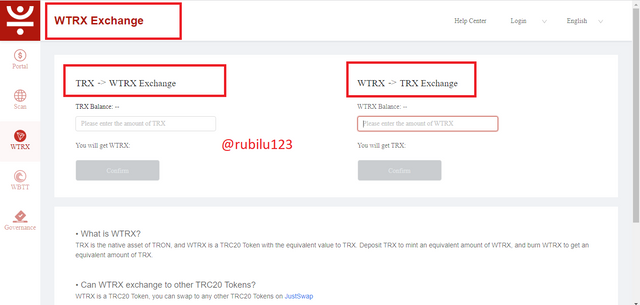

WTRX

The WTRX feature takes the user to a new and totally different page when which is known as the WTRX Exchange clicked on. This feature allows a user to mint his trx tokens to wtrx tokens. Wtrx tokens is the wrapped token for trx.

It's also allows a user to mint the wtrx tokens back to trx.

Wrapped tokens are generally created in native blockchain for the tokens. Some reasons for Wrapped tokens being created in a native blockchain is to cater for the high demand of the native token of that blockchain.

Wrapped tokens are also used to provide lp on a platform. Wrapped tokens can also be used effectively with smart contracts.

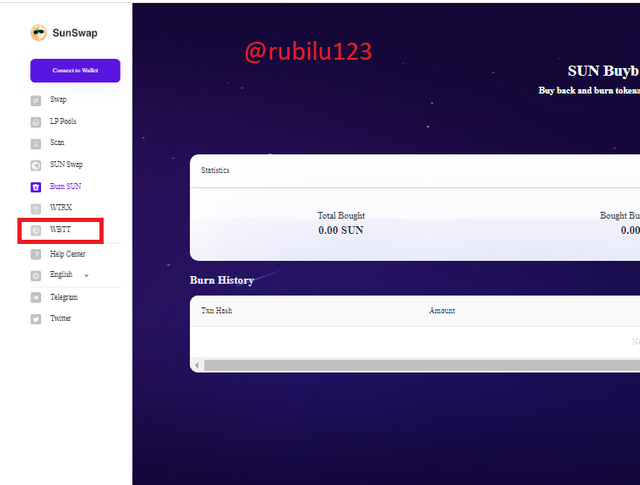

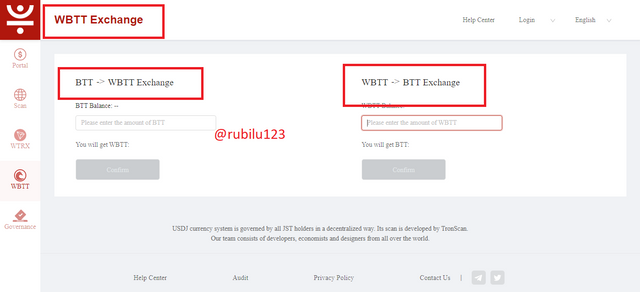

WBTT

The Wbtt feature when clicked on takes the user to a new page too. On this page a user can mint his btt tokens to wbtt which is a wrapped token. He can also mint the wrapped wbtt back to btt on this page.

**After exploring the sub features of sunswap tab I will now continue exploring the main features of the homepage.

Stake

The next feature after the sunswap feature is the stake feature.This feature allows a user to lock up his sun tokens and by doing this means he earns more rewards meaning he becomes an Lp provider.

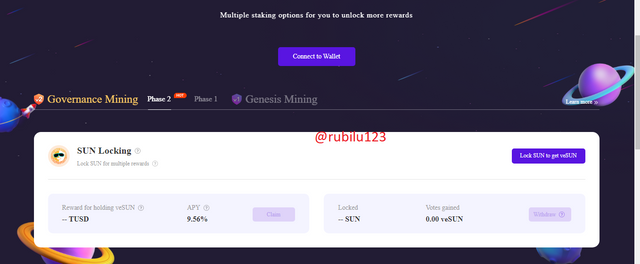

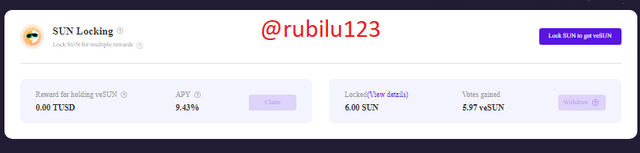

The next screenshot below displays a sun locking feature. Over here a user can lock his sun tokens for a period of time and after that he earn vesun as his rewards for locking his sun token. Here a user can earn more vesun by locking his sun tokens for a longer time. By doing this a user can take part in affairs of the platform. Things like being a part of the governance mining. The governance mining is actually is two phases know as the phase 1 and phase 2 of governance mining. The first face which is the phase 1ended on the 15th September 2021 and then on this same day the phase 2 started and will end on the 6th of June 2026.

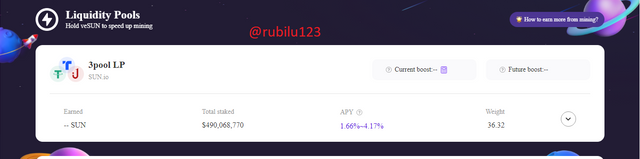

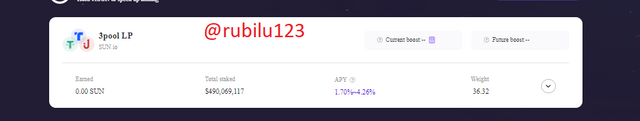

When we scroll down of the stake tab we can see the liquidity pools feature. This feature allows a user to stake on 3 different liquidity pools.

The first being the 3pool Lp. A user must stake all the 3 different stable coins in equal proportion to be able to earn 3 lp tokens.

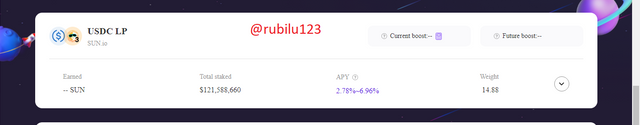

The Second being the USDC Lp. A user can earn 3sun token by swapping USDC for 3sun.

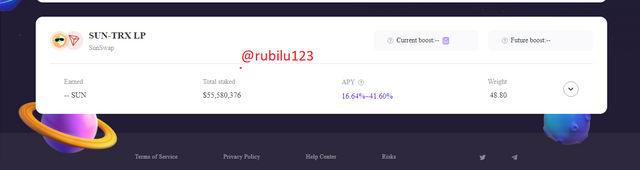

The third being the SUN-TRX Lp. A user can earn SUN-TRX by staking sun.

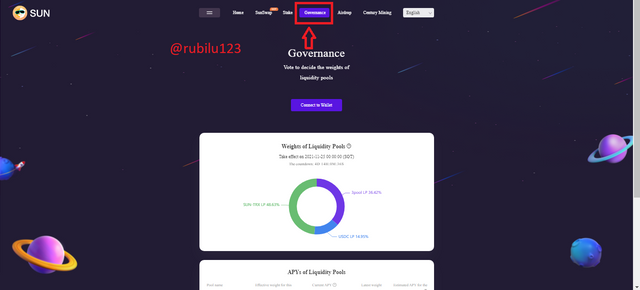

Governance

As we said earlier the sun.io platform is a decentralized platform this decision making is handed to its users. The governance feature allows user to decide by casting votes to decide on the weight of liquidity pools on the platform. When I was doing the assignment the next voting was slated for 25th of November 2021 which is exactly 4D 14H 00M 36S.

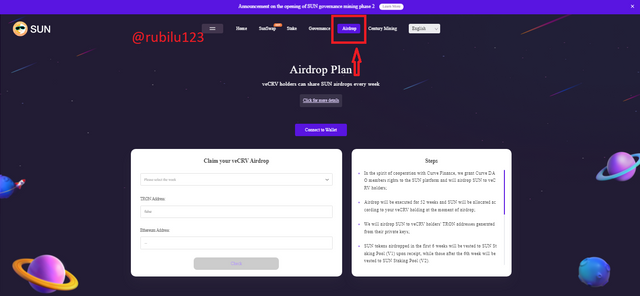

Airdrop

As the name suggests, this feature provides details as to how the platform plan to distributed to users who are holding veCRV tokens for a time range of 52 weeks. This means for users who are holding the token at the end of the 52weeks they will have the opportunity to earn more than users who held for less than 52 weeks. The tokens users will be airdropped is the sun tokens.

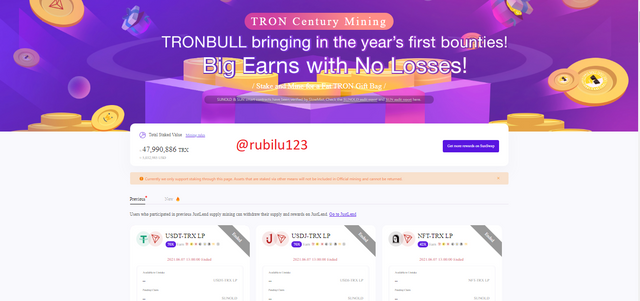

century mining

When a users click on this feature it redirects him to a new page where he can see details of the mining pools available, a user can also see details of ended mining pools.

2.Visit Sunswap and scan the different LP pools? How many different LP tokens are available in Sunswap? Based on the available data in Sun scan, how much fee did it generate in the last 24 hrs? What percentage of that fee is being utilized to buy back and burn SUN?

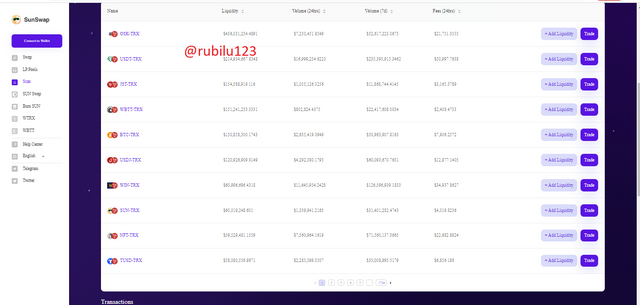

As I stated above there are 9 different Lp pools.To view the Lp pools you can visit sun.io and click on sunswap and then Lp pools. The mining page is then displayed and a user can see the Lp pools. The different Lp pools are USDT-TRX LP, WBTT-TRX LP, NFT-TRX LP, USDJ-TRX LP, TUSD-TRX LP, USDC-TRX LP, BTC-TRX LP, ETH-TRX LP and WIN-TRX LP.

Now I will scan the different Lp pools.

To scan the Lp pools click on the sunscan feature on the sunswap page.

A user can scan the lp pools by searching about each pair in the search box above or he can simply click on each pair to scan them.

The first pool I will be checking is the USDT- TRX Lp.

The results of the search are, the total liquidity is $21,880, volume of 24 hours stand at $20,218, transactions for 24hrs stnd at 59. The total pooled tokens for trx is 104,060.8111 and for usdt is 10,968.9015. At the right hand side is a chart of the pair.

When you scroll down you can see the transactions of the pair.

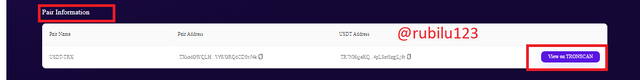

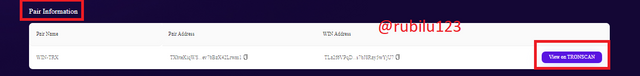

Scrolling down once more will show information for the pair where a user can view and scan information on tronscan.

I clicked on the view tronscan and it took me to tromscan.

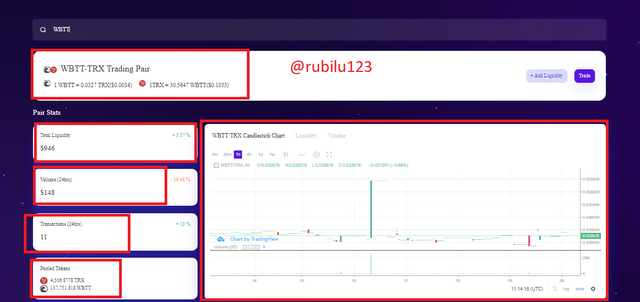

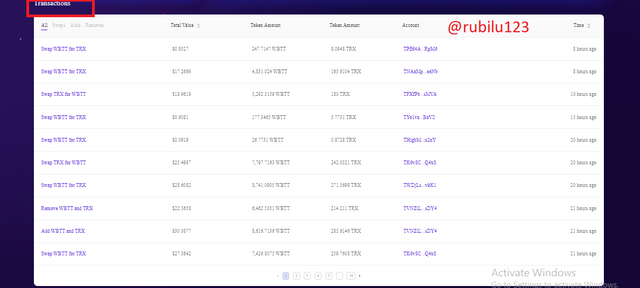

The next pool is the WBTT TRX pool.

For the WBTT TRX pair, the total liquidity is $946, 24 hours volume stands at $148, 24 hours transactions stand at 11. The Pooled tokens stand at 4,506.8778Trx and 137,751.818 WBTT. At the right hand side is the WBTT/TRX candlestick chart.

When you Scroll down you can see the transactions with the pair.

And then when we Scroll further we can see the pair information and then we can go to tronscan.

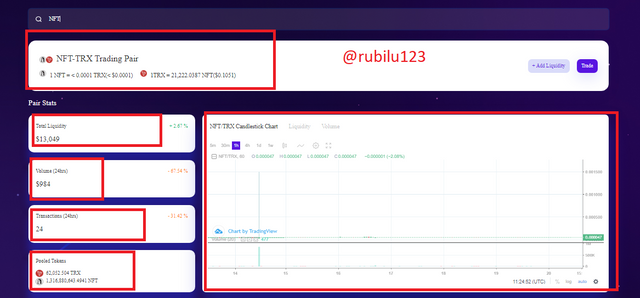

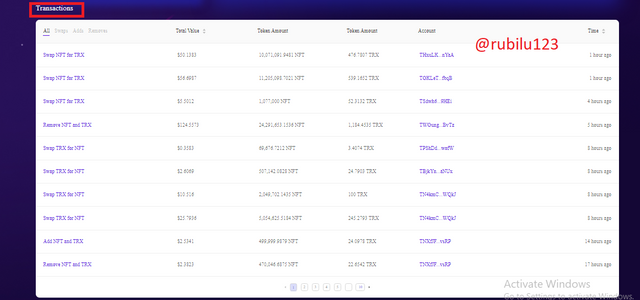

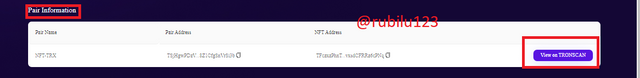

The next pair is the NFT-TRX pair.

For the NFT-TRX pair, the total liquidity stands at $13,049, 24 hour volume stands at $984, transactions in the past 24 hours is 24. The pooled tokens are 62,052.504Trx and 1,316,880,643.4941NFT. At the right hand side is the NFT/TRX candlestick chart.

When we scroll down we see the transactions section where we can check transactions that happened with the NFT-TRX pair.

When we scroll further we see the pair information and then we can access tron scan.

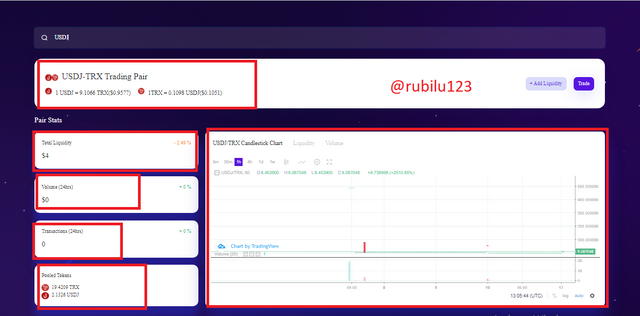

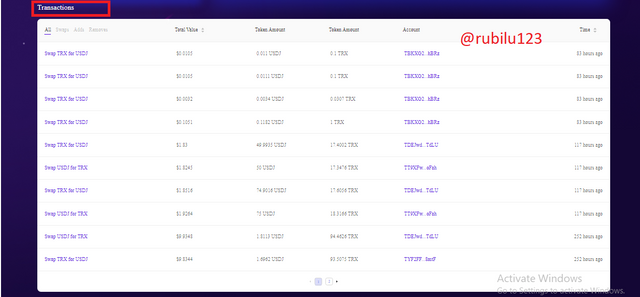

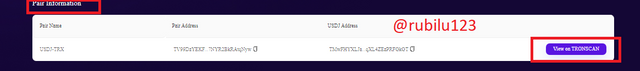

The next pair is the USDJ-TRX pair.

For the USDJ-TRX pair the total liquidity is $4, the 24 hour volume stands at $0 and the transactions in 24 hours is also 0. The pooled tokens are 19.4209Trx and 2.1326 USDJ. At the right hand side is the USDJ/TRX candlestick chart.

When you scroll down you will see the transactions that has taken place or occurred with this pair.

When you scroll down once more you will see the pair information and then we can access tron scan there too.

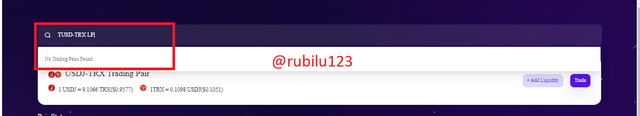

The next pair is the TUSD-TRX pair.

For the TUSD-TRX pair there was no information on it.

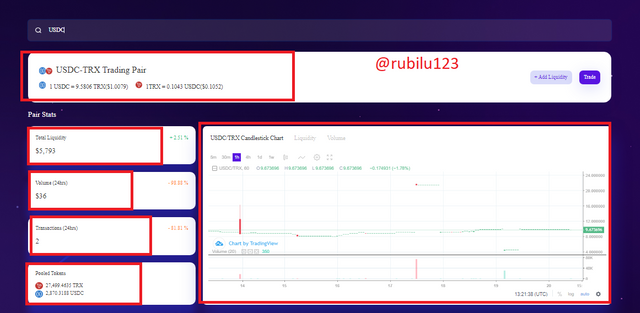

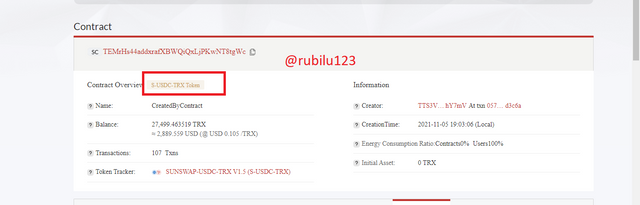

The next pair is the USDC-TRX pair.

For the USDC-TRX pair, the total liquidity is $5,793 , the 24 hour volume stands at $36 and the number of transactions within 24 hours stands at 2. The pooled tokens are 27,499.4635Trx and 2,870.3188 Usdc.

On the right side is the USDC-TRX candlestick chart.

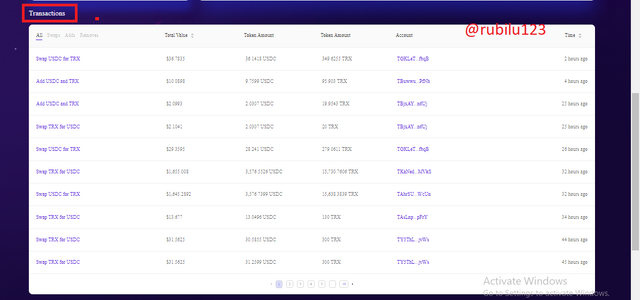

When you scroll down you will see the transactions that have been made with the pair.

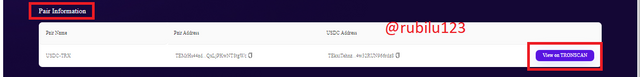

When you scroll further you will see the pair information where you can also check the transactions on tronscan.

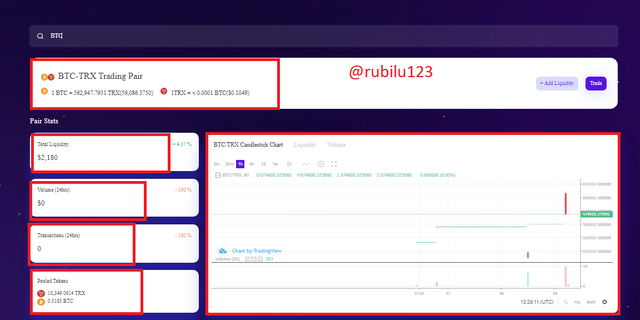

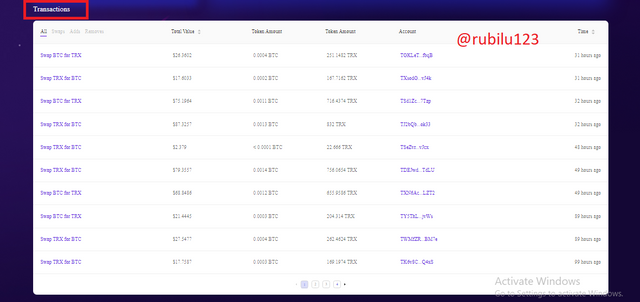

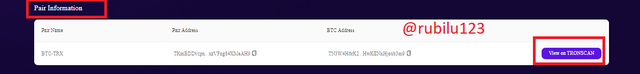

The next pair is the BTC-TRX pair.

For the BTC-TRX pair, the total liquidity is $2,180 , the 24hour volume stands at $0 , the transactions whithin 24 hours is 0. The pooled tokens are 10,349.0914Trx and 0.0183BTC. At the right hand side is the BTC/TRX candlestick chart.

When you scroll down you will see the transactions which shows the transactions that have been made with the pair.

When you scroll down again you will see the pair information and the transcan where a user can verify some transactions.

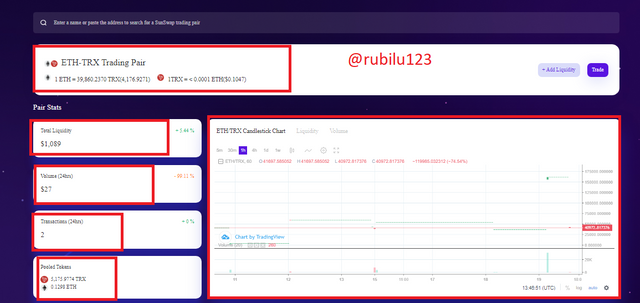

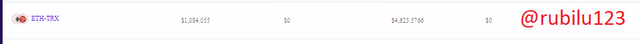

The next pair is the ETH-TRX pair.

For the ETH-TRX the total liquidity is $1,089 , the 24 hour volume is $27, the number of transactions in 24 hours is 2. The pooled tokens are 5,175.9774Trx and 0.1298 Eth. At the right hand side is the is the ETH-TRX candlestick chart.

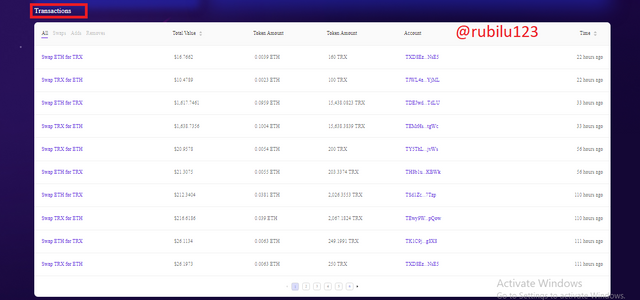

When you scroll down you will see the transactions that happened with the pair.

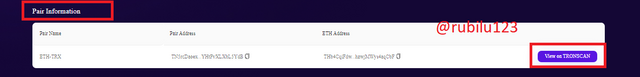

When you scroll down again you will see the piar information where you can also view transaction to see transactions.

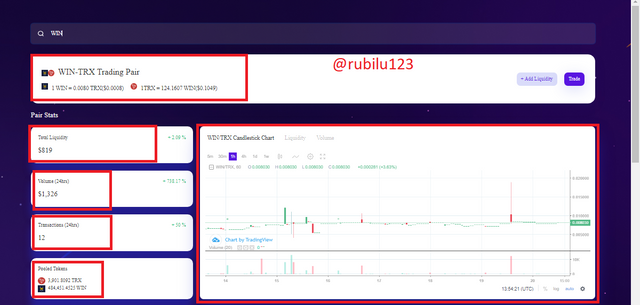

The next pair is the WIN-TRX pair.

For the WIN-TRX pair, the total liquidity is $819, the 24 hour volume is $1,326 , transactions for the past 24 hours is 12. The pooled tokens are 3,901,8092Trx and 484,451.4525 Win. At the right side is the WIN-TRX candlestick chart.

When you scroll down you will see transactions of transactions made with the pair.

When you scroll down again you will see the pair information and you can access tronscan here too.

Number of different tokens in sunswap

As at the time of writing the number of of Lp token pairs are 126. Some of this pairs include SUN-TRX, USDT-TRX, NFT-TRX amongst others.

Based on the available data in Sun scan, how much fee did it generate in the last 24 hrs?

The percentage of fees utilised utilised buy back and burn sun is 16.667% of the fees. I will now state the lp tokens, their fees generated in the last 24 hrs and percentage of fees used in the table below.

| Lp | fee | percentage of fee ie: 1/6 ×fees |

|---|---|---|

| USDT-TRX | $10,379.9601 | 1,730 |

| WBTT-TRX | $1,457.5014 | 243 |

| NFT-TRX | $21,489.8634 | 3582 |

| USDJ-TRX | $7,065.7818 | 1178 |

| TUSD-TRX | $4,433.0903 | 739 |

| USDC-TRX | $0.1101 | 0.01835 |

| BTC-TRX | $5,849.261 | 975 |

| ETH-TRX | $0 | 0 |

| WIN-TRX | $14,285.0869 | 2381 |

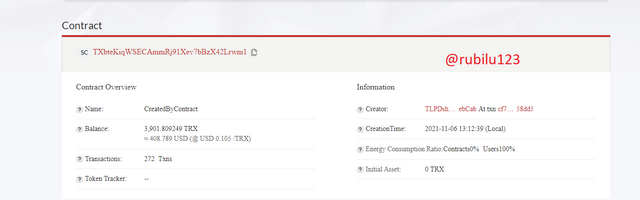

3.Stake SUN to obtain veSUN. Demonstrate the entire process with a real transaction?(Screenshot required)? Include the resource consumption statement, take the help of Block Explorer?

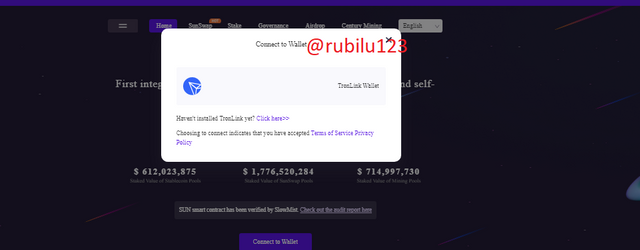

Before you lock your sun you must first connect to your TronLink wallet

- On the homepage click on connect to wallet.

Click on TronLink wallet

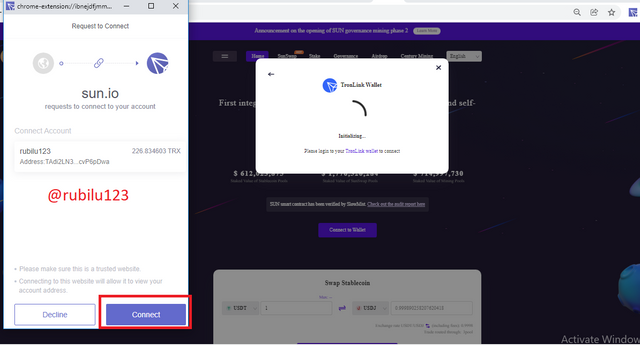

Click on connect

Wallet is connected

NB : tronlink wallet address used is my steemit integrated tron and the adress is TAdi2LN3kpEAMCRUQVHvWQhqqRcvP6pDwa

How to lock sun for vesun

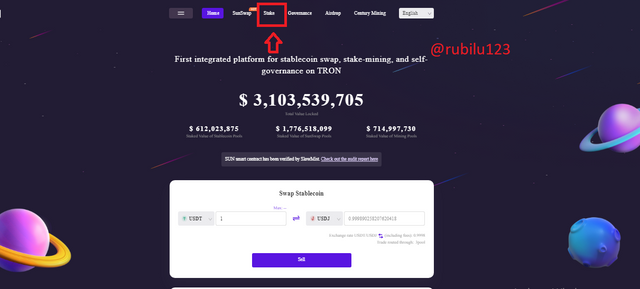

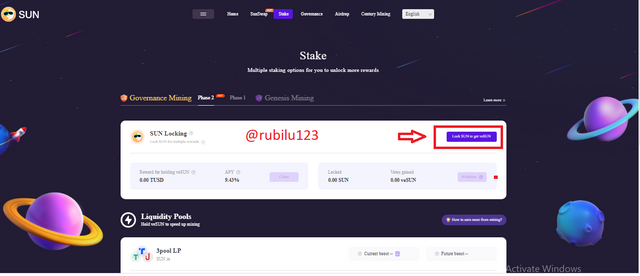

Click on stake on the homepage

On the stake page click on lock sun to get vesun

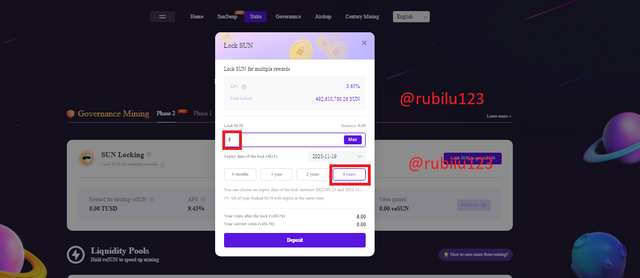

Fill in the requirements to lock sun. Enter amount and period to lock and click on deposit. I entered 6 sun for 4 years

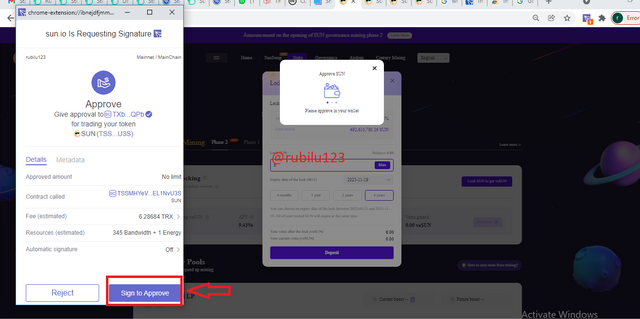

Click on sign in to approve

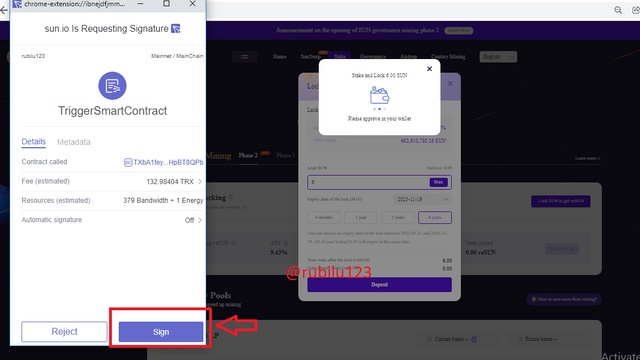

Click on sign to submit transaction

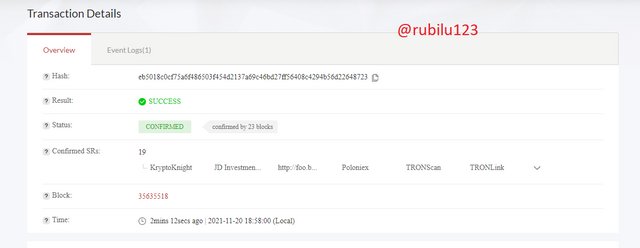

- Transaction has been submitted and it has been approved as seen.

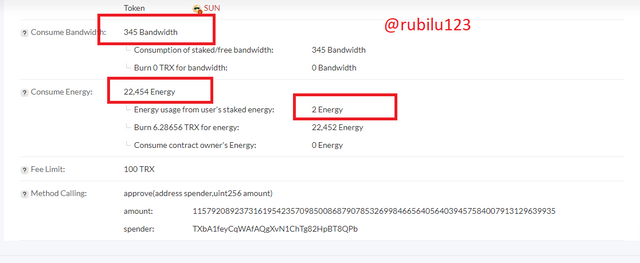

From tronscan you will see that 345 and the energy consumed was 22,454

A fee of 6.286 was burned for the energy used.

4.What is veSUN? What is the 3-in-1 benefit of holding veSUN tokens?

What is veSun?

veSun is the short term for Vote Escrowed Sun. This is a token that give users on the sun.io platform a right to vote and take part in the governance of the platform. Users who want to earn this token can take have to take part in the governance mining of the platform which is currently in the phase 2. As stated above the phase 2 sof ends on 15th September 2026.but it is worth noting that the locking period for the vesun asset is for only 4 years all though the phase 2 will last for 6 years.

vesun was initially earned by uses who tool part in the phase one of governance. Users will have to lock their sun tokens in order to earn the vesun token.

It is also worth noting that after the locking period Users who locked more sun tokens will earn more vesun token that Users who locked less. The locking period ranges ad uses can lock sun tokens from a period of 6 months to 6years. If a Users chooses to lock his tokens for a period of time he cannot take it out until the locking period is over. It is also worth noting that uses who lock their sun assets for a longer time will earn more vesun that Users who lock fir a short period of time. It is also worth nothing that a user with more vesun has more voting rights that a user will less vesun.

Users who hold vesun tokens can also control some aspects of liquidity, they can speed up the liquidity in the mining pools, and also decide on the weight the liquidity pool carry. They also earn other tokens such as TUSD.

As stated above users with vesun are the only users who can take part in the voting right of the platform. A vote is calculated by multiplying the amount of sun token locked x the difference in the expiry date and the current date all divided by a period of 4 years.

Mathematically; veSun=amount of sun locked × expiry date - Current date of locking / 4 years.

the 3 in one benefit of holding vesun tokens

Before a user earns veSun tokens he must have locked up his sun tokens before he earns it.Duting this locking period there is something that is called the 3 in 1 rewards simultaneously. The following are the 3 in 1 benefits.

- TUSD is earned by users as rewards.

Users earn vesun tokens each week as long as you have sun tokens locked up. A user who locks more sun will definitely receive more vesun tokens than a user who has locked less sun tokens. Users vesun token are and 50% of fees generated each week from the stablecoin pool is distributed to holders of vesun tokens.

- Vesun holders have the chance ro accelerate liquidity mining pool.

Users who are holding vesun tokens are given the opportunity to accelerate the mining speed by 2.5 speed maximum on the platform.

- Holders of vesun can vote.

Vesun holders have the opportunity to vote and decide the weights of the liquidity pools. On Thursdays Users have a community vitings at 8:00 am and then after the voting by the vesun holder their votes are implemented.

5. What is stablecoin swap facility in Sun.io? How many different stablecoins are supported in the SUN platform? What is its use in the context of staking & mining?

what is stablecoin swap facility

Stablecoin swap facility is a swap feature that allows users on the sum.io platform to swap their tokens. This tokens that are swap are standard trc-20 stablecoins.

The swap stablecoin feature was created to deal with volatility problems. As this feature is an inbuilt platform feature, Users are not worried about volatility when when are swapping their tokens. It also has low transaction fees to facilitate its usage by all the users of the platform.

Because the sun.io platform wants its users to use its inbuilt feature of the stable coin swap it has made it very low on transaction fee and users can deal with it without worrying about price issues as dated above.

Currently there are 4 diffrent stablecoins supported in the sun.io platform. The supported stable coins are USDT, USDC, TUSD and USDJ.

Let's us Look at it in two different ways.

In the context of staking, a user has to lock the stablecoin to earn sun and in the context of mining a user has to stake stablecoin to earn trx.

In the context of staking there are currently 2 pools available for the stablecoins listed above.

There is the 3 pool Lp

This pool holds or keeps the USDT , USDJ and TUSDT . Then a user needs to add liquidity of the same or equal amounts to all of the 3 coins to earn the 3 Pool LP tokens and a user can also earn sun tokens from this.

There is also the USDC Lp

This pools also used in keeping the USDC and 3sun stablecoins. A user can earn sun tokens by swapping USDC for 3sun and also swapping 3sun for USDC.

Now in the context of mining there are 4 mining pools. This pools are known as USDJ-TRX, TUSD-TRX, USDC-TRX and SUN-TRX Lp. A user can stake any of these to earn trx.

Conclusion

I must admit that this lecture was enjoyable but the homework task was not an easy one but I did learn a lot of new things I didn't even know existed.

Sun.io as we now know it was previously called justswap not until recently when it was acquired and the changed from justswap to sun.io. I did explore a lot of great features on the sun.io platform. I have leant that by providing liquidity on the sun.io platform a user has a lot of benefits. Some of the benefits being the user can vote and make decisions on the weight of liquidity on the platform. By staking his assets on the platform he can accelerate the rate of liquidity on the platform.

Part of the fees are given back to users on the platform but to users who have staked their tokens on the platform and the more your stake the more your rewards. Part of the fees is also used in buying back sun and then burning it to keep the platform going. When we calculate, it is actually a small portion of the fees used.

On the sun.io platform users can also swap for wrapped tokens of some of the tokens on the platform.

The second phase of the governance is currently ongoing and it is supposed to last for 6 years but users who have locked their tokens can only lock them for a maximum of 4 years and a minimum of 6 months. A user who locks his tokens for 4 years will definitely earn more than a user who has locked his assets for less than 4 years.

Once a tokens is locked for a period of time a user cannot withdraw or unlock the token until the time has reached.

Thank you.