Introduction

Trading comes in various facets totally different from our usual buying and selling in our local market overall, crypto trading is very volatile even more than forex trading in all ramification, the ability to buy at low and sell at high remains your greatest undo, looking at the Advent of crypto trading you will surely understand that it comes with great prospect.

I sit and see peo Walk up to me asking me questions like in a trending market when they can buy and in the end maximize profits, I repeat again trading entails alot, there are so many parameters to put in place before becoming a Guru in the trading world overall.

Before executing your buy or sell trade first you should know your trading pairs and order books, also knowing your support and resistance zones are very important, talking about crypto order books they are visible to some Exchanges but not all at this point this brings us to today topic of discuss Dark pools in cryptocurrency.

Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Nice question from you professor with my understanding I will define Dark pool as a private avenue that hastens the exchange that comes with financial instruments, as we all know the basics of financial derivative.

Dark pool is totally different from a very popular public exchange at this point the order books aren't seen in a visibility space on like other good Exchanges around, the trades placed here isn't visible too immediately they are officially been executed.

Moving forward I will hint further that dark pool is a decentralized space/avenue where various cryptocurrencies is been traded expecially exchange like kraken, they gave dark pool the space at which trading can be exploited within their domain.

The first public protocol was officially launched in 2018, by a Singapore based Public designated protocol this platform was the first platform of dark pool decentralized protocol.

How dark pool works Explained.

Every decentralized protocol has its various moderlities at which it works and dark pools isn't an exception here, one basic advantage of dark pool protocol is that decentralization model it has, by this I mean transactions here are totally not controlled by anyone and thus they are totally secured.

Talking about this in general terms there is an elimination of a third party courtesy this the identification of a third party is totally not showned and other properties associated to the trading placement's, like the various prices and volumes overall.

Key Take-Away points

Dark pool decentralized protocol grants user's the ability to trade cryptocurrencies in a wider phase with great trading viscosity.

Dark pool as we know is decentralized by this fact they are used to shuffle expanciated trades this limiting they from causing slippage, in the volatile market overall.

Dark pool brings order books to it's minimal prospect thereby making use of a zero minimal proof, dark pool trades are totally limited in general.

How Dark pool Trades works.

First an order has to be made to the platform, immediately that order is officially received the platform breaks it down like the process entailed in BTC mining process/procedures, nodes on the platform plays a vital roles in computation in order to match various orders although there is a reward inshringed as a result of the overall fee matched.

I previously talked about a zero knowledge proof here I will explain about it, basically it's seen a basicity used to verifying various transactions, the various orders that matches each other are officially recorder in a viscolized system that matches one another.

Anyhow the ones that aren't matched here I'm talking about order fragments, they will be matched courtesy the next set of orders.

Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

Globerly we have various crypto exchange so many of then but as the question demands I will say Kraken Exchange more like Kraken dark pool. Kraken Exchange is one of the so many exchanges that offers dark pool.

In general I will say dark pool is a different Exchange order book that give rise to order book that isn't visible to the market overall what this means is that if I place an order I only know the order I placed it's more like personal to me alone.

With this system I can place an expanciated buy or sell order basically the one of my choice depending on the trend formation I'm following without letting other traders to know what I'm doing to be precise.

Now let's talk on how dark pool works extensively talking about matching dark pool orders this can be executed with other dark pool other too this is basically how it works in Kraken Exchange, the dark pool we are talking about remains invisible to the third party always remember this.

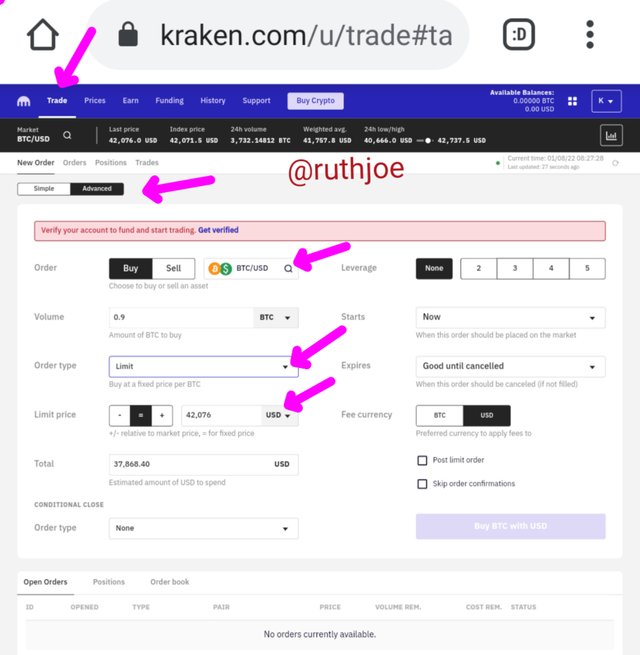

Just as we know market orders can only be executed when you are seen the order books in Kraken Exchange courtesy dark pool only limit orders is allowed, with limited order one can buy or sell above or below the actual market price.

In Kraken Exchange/dark pool margin trade isn't allowed with your balance you have to meet a maximum all basically centralizes on the availability of your balance overall. In Kraken dark pool supports BTC and ETH, I will hint extensively on this as we proceed.

What are the supported assets on the dark pool mentioned in (2) above?

In question two I briefly hinted on various cryptocurrency assets Supported by dark pool where I mentioned BTC, and ETH, this two are available on the currency pairs which means it can be traded against each other.

For the Etherium pairs we have the various pairs lined up as follows

ETH/USD

ETH/JPY

ETH/CAD etc.

From the screenshot we have the ETH as the base and the various currency pairs as the quote which means they can be negetively and possitively collorated.

For the Bitcoin pairs we have the following pairs as follows

BTC/JPY

BTC/USD

BTC/CAD etc.

What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

Nice question from your @professor one basic requirements is that you must be verified to a particular level which is a pro level please note this, since you can only have BTC and ETH the order sizes for both assets are put into consideration for BTC we have it's order size in pairs to been 100k USD in minimum.

For Etherium the order size has to be put in consideration and the minimum ranges within 50k USD in pairs lastly remember that only limit orders are well seen Supported.

Fee Attachment Explained.

Trading fee must be involve in an exchange for dark pool the story isn't different here trading fee here is seen around 0.20% to 0.36%, overall for the normal limit order we have still 0.20%, that is from 0% to 0.16%.

Note the rates depends on the time strength which is seen around 30 days trading Volume which is totally equivalent to the USD rating, executing dark pool order it has to be within a period of 30 days trading Volume.

As you keep on trading on dark pool (Kraken Exchange) the minimal lower your trading fee keep lowering to a smaller phase, I general I will say the more you trade the smaller your fee gets.

For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

Before we proceed on how block trading is performed on dark pool, this pool itself are basically used for trading you can also access Public investment that is dark pool liquidity, one of the major objective of dark pool remains to fascinating block Trading.

Further more I will highlight that block trade can simply be defined as a purchase it sale of assets between two various parties, in block trading there aren't any massive laid down rules or criteria overall, this type of trade comes in a large format as a result of price of assets/security.

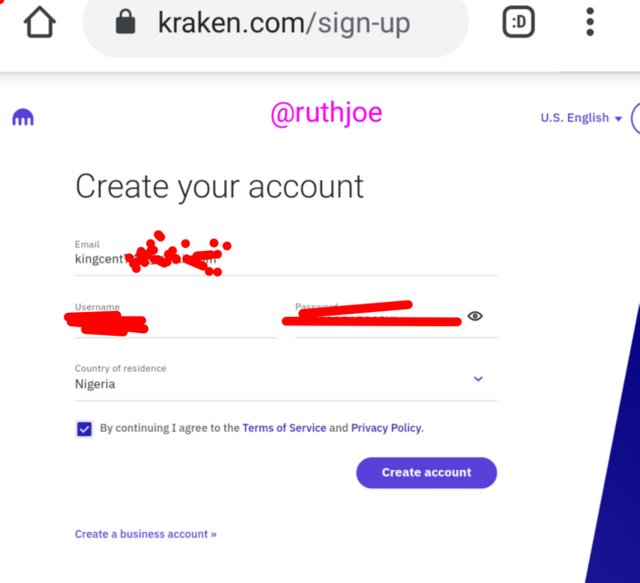

Performing block trading on the dark pool platform first you need access https://www.kraken.com/u/trade#tab=new-order click on the link and proceed with your registration procedures.

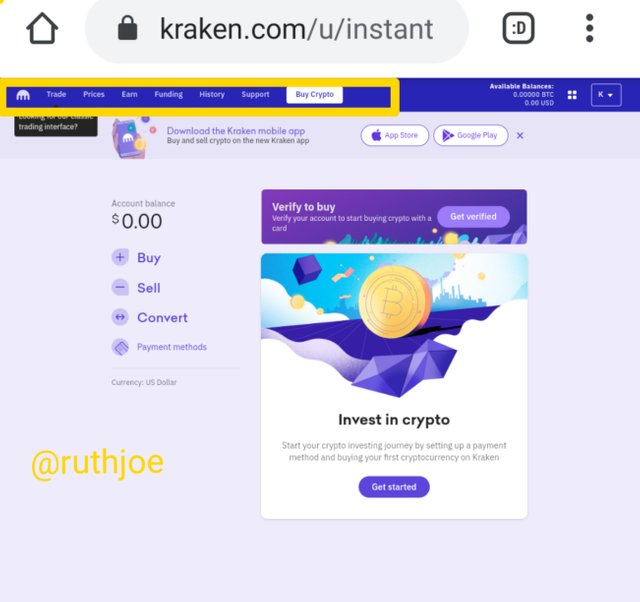

Here I tried also later I created an account live with kraken exchange

I imputed me Email address and it was officially verified by me overall

When my verification came to climax, I proceeded from the landing hom-page I switched to advance, after I have already clicked on Trade.

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

Decentralized simply means something that can't be controlled by anyone, not even a government entity over time, courtesy this I will say a decentralized dark pool is defined as an avenue for trading cryptocurrencies Kraken Exchange leads the race for a decentralized dark pool.

One major objective to consider for a decentralized dark pool is the ability to secure various verification procedures basically a digital verification procedures/methods, the various inshringed protocol has the mandate to attain a regular market price without any form of manipulation.

Now let's say a trade constituents multiple blockchain's, auto swap, this can act as a podium to fascinating trades without any third party involvement, this dark-pool is vasatile by this could employ other technology regarding cryptographic novel, at this point we will talk about Zero Knowledge Proof.

Zero Knowledge Proofs (Z.k Protocol).

This protocol is a very popular one called the Z.k protocol I will simply put this protocol is a verification system that comes to fruition between a verifier and a provider in the system overall, How it works is that the Mr A provider will be capable to convince the varifier about having an understanding courtesy a particular information.

This protocol can be used in our modern day with the motive of providing security and privacy the concert of this protocol came to fruition in the 1985 era, officially published by shafi Goldwasser and Silvio micali, the motive was that certain things can be done without revealing the source or secret's.

This protocol is used in the overall application of security and the motive remains verification credentials/system.

State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

Nice question here I will mention cryptocurrency dark pool, there are lots of cryptocurrencies in the world today, kraken is a UK Exchange that was at first marketed in 2016, in cryptocurrency dark pool trading gives rise to orders to be placed and executed in a straight phase.

In cryptocurrency dark pool traders have the ability to buy and sell cryptocurrencies at a larger facets the minimum of 50 BTC or 2,400 either, at this point it can't be showned to a third party that means another trader, this is basically how it works.

One basic advantage is that it reduces the impact of the trading market and it also gives a nice price as a result of a good trading orders, always remember that orders here can't be seen by any one except you the placer. That means their santiment isn't revealed.

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

Nice question it's very important that the fact was officially pointed out, crypto centralized Exchange dark pool, and a crypto decentralized dark pool, answering the question straight I will give a clear difference that exists between then in general.

| Decentralized dark pool. | Crypto Centralized dark pool. |

|---|---|

| In a decentralized dark pool a zero knowledge proof is basically used to verifying transactions overall. | In crypto centralized Exchange dark pool there is nothing like zero knowledge proof instead transactions are verified through personal credentials. |

| In a decentralized dark pool cryptocurrency orders are broken down to various fractions in order to match zero knowledge proof and it's not been disclosed to everyone | Crypto centralized dark pool orders are executed to match an existing orders courtesy order book and it is seen within everyone. |

| Decentralized dark pool are basically used to shuffle slippage in the crypto space over a particular period of time. | In Crypto centralized dark pool there isn't any limitations as to the amount of trade one can execute. |

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

I did intensive research and in the end I realized that coinbase was involved in a huge market sale order thereby making price of BTC to sky rocked to 60,000 at a glance,

Order placed courtesy a market sell order with a long wick climaxing to 62,500 to a range worth 60,000 this can be seen as an example of a scan wick. At this point I will pin it down to a market order triggered. Take a look at the chart above.

In a Crypto chart span wick are used to fascinating a change courtesy direction of momentum thereby making price of an assets to climaxing to a next phase in price movement, with spam wick price doesn't consolidate at all, instead it adds more light to a particular candle-stick formation.

Looking at various levels in the chart at the Support zone a sell order was seen soaring at 60,000 later it surged up to a limit purchase, making the price to climax back to 62,500 after so e few minutes, after then there was a breakout of 63,300, some hours later.

In general a hopping sum of 246 BTC that is $15 million surged up in some few minutes, that was a great upsurge I must confess. So many Exchange was indeed propagated.

Difference it could have made in Dark-pool Utility.

At that time traders in the coinbase Exchange should be thinking about placing a sell e try with Dark pool they could have gotten a sell snippa entry knowing fully well that when the price of BTC climaxed to 60,000, there will be retracement after all the order set by the whales wasn't in Public space.

Traders in the exchange if the trade was executed courtesy dark pool in my opinion I think traders could have set a limit buy order that could have yielded massive Profit in good time, we should always remember the fluctuations that comes with Cryptocurrencies.

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

In the market price of an assets I will discuss on how dark pool trades affect's it in real time, Dark pool itself are trading system with appropriate equity stringent system that doesn't show orders real time. In price movement dark pool offers it but do not Execute improvement.

Courtesy market price of an assets you will understand that experience traders trade using one lane practically trading in one direction but for those traders that aren't informed trust me they will face a huge execution risk in the market price of an assets.

Looking at a market price we know that it's been executed instantly as designated by the market Maker's let's say we added dark pool along with a decentralized Exchange you will agree with me that price will surely be concentrated by so doing liquidity will surely be reduced.

In general terms please note that Dark pool if a trade is carried out there will be an instant execution courtesy market order this is done under certain basic conditions by so doing there is a price discovery moderlities.

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Just as our people usually say anything that has Advantage also have disadvantages basically pros and cons, as the question demands I will list all at a glance here.

| Advantages | Disadvantages. |

|---|---|

| Dark pool itself gives room for trading execution totally different from spotlight of designated Public market, Public market basic deals with fundamental Analysis when news comes out they react massively. | Dark pool oversight is very minimal and the regulations been put out is seen within a scrutiny outdoor for me Investors who place their trades here are seen on cons. |

| In dark pool you can place a Large trade with any fear, aside that the trades can also be broken down before the assets becomes undervalued this is one of the pros of dark pool. | in dark pool there are always a hidden agenda, by this I mean that various Investors can't match HFT, putting private Exchange into consideration. |

| With dark pool there is basic efficacy courtesy market efficiency. | in dark pool orders placed isn't in a public domain. |

Conclusion

Thank you very much @professor fredquantum from my explanations I hinted that dark pool is seen as a financial Exchange where trading of various securites and assets takes center stage, in dark pool the regulation there is too notch. moving forward I also hinted on various cryptocurrency assets that Supports Dark-pool where I mentioned BTC, and ETH, this two are available on the currency pairs which means it can be traded against each other. I exploited Kraken Exchange and showed how block trade are been Executed.

Thank you very much professor @fredquantum for this wonderful lecture trust me I really learnt alot God bless and happy new year. Cc;@fredquantum.