As-Salaam-mu-Alaikum !

Good day steemians, it’s a blissful moment making up to submit my homework post for @yousafharoonkhan for the splendid lecture on Exchange order book and its Use and how to place different orders. Gradually as time went on, this community has become more useful and educative as well. I would like to acknowledge the crypto Academy community and the professors for giving us such a big opportunity to educate us more about the crypto world. As usual, lecturing to the extreme .

Here Is my presentation to my homework.

1.What is meant by order book and how crypto order book differs from our local market? With examples.

The fundamental understanding of an order book is that it’s presents and make available list of the current buy and sell orders for an asset arranged and structured by price.

An order book shows the list of buy and sell order currently airing and price value of the asset as well as order history. The order book gives aid to traders and are useful because it helps determine the buyer and seller interest at specific price level

When we consider the local market in which we are, taking this example a scenario. A person worth 50steem visits the market with his scale of preference being;

| Items | Estimated price |

|---|---|

| 1. Bag of rice | 15 Steem |

| 2. Bottle of oil | 7 Steem |

| 3. Chicken | 13 Steem |

| 4. Vegetables | 10 Steem |

| 5. Salt | 5 Steem |

| 6. Fish | 5 Steem |

Upon reaching the market he realized obviously different selling prices, some quite a little higher than estimated and others one steem bellow estimate. With this knowledge, the buyer considering his worth as well as scale of preference, he would choose to buy from sellers with lesser prices. However he could obtain all his needs on his scale of preference

Considering both market, it’s relatively simple how the crypto order book differs from our local market.

In the crypto order book there is an uncertain price change which happens in a disorganized way . A fall or rise could happen at any given moment and at any rate too but in the local market price change is considerably stable. It takes time to realize to realize a price change in our local market

Moreover, in the crypto order book one crypto asset is traded in pairs more than one with other crypto currency’s . For example Bitcoin can be traded with other coins as pair indicated below.

2. How to find order book in any given exchange through screenshots and also describe every step with text and also explain the words that are given below.

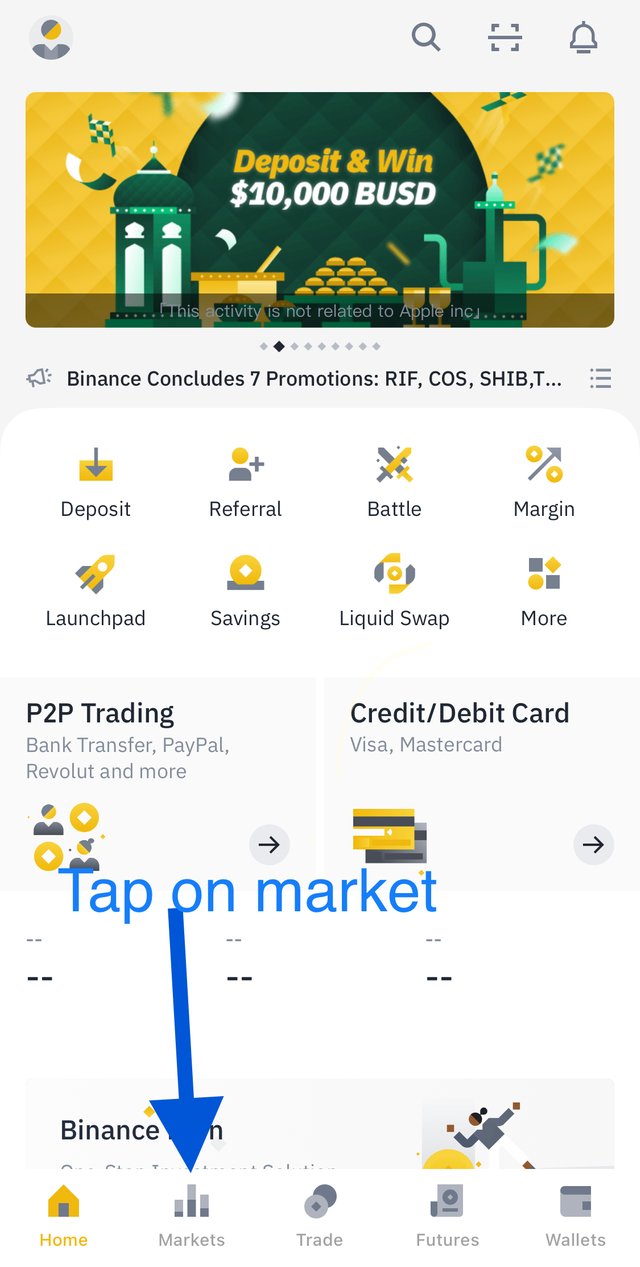

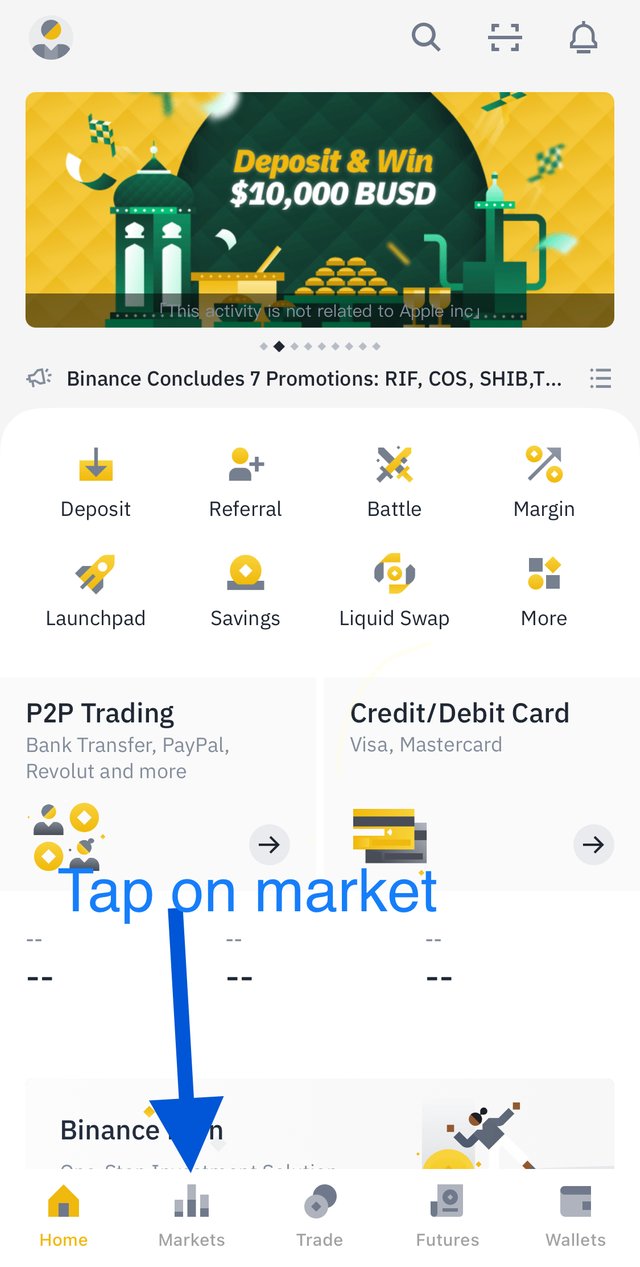

To begin with, lunch your binance app. Bottom there after launching your app is located “market”. Tap on market.

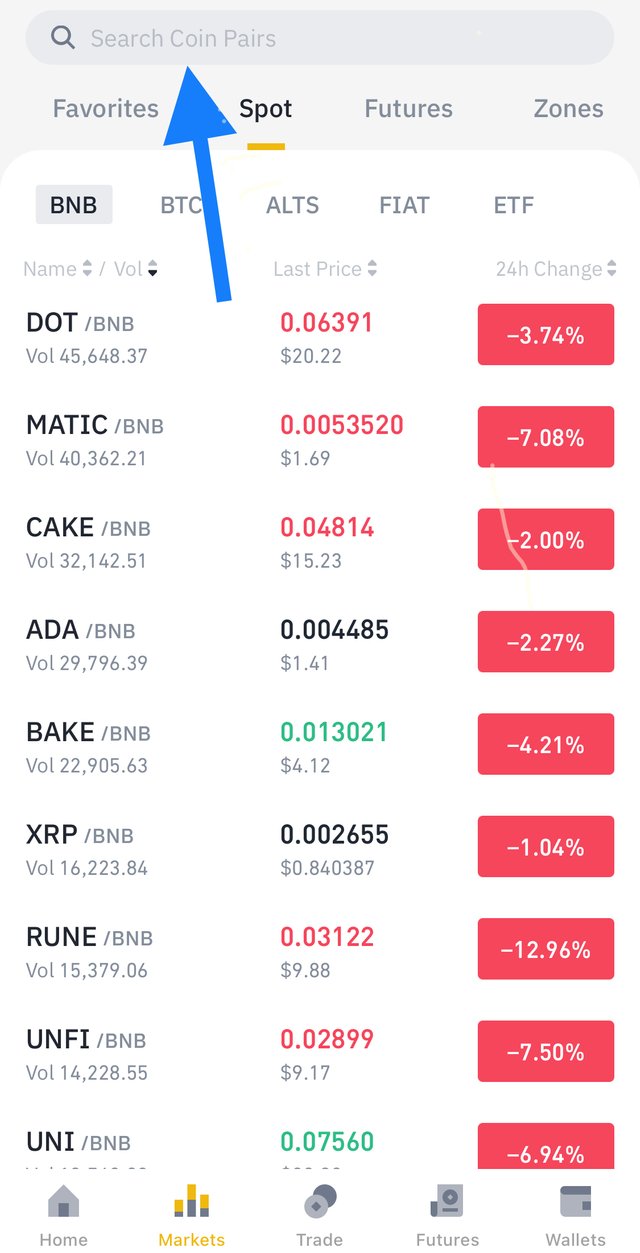

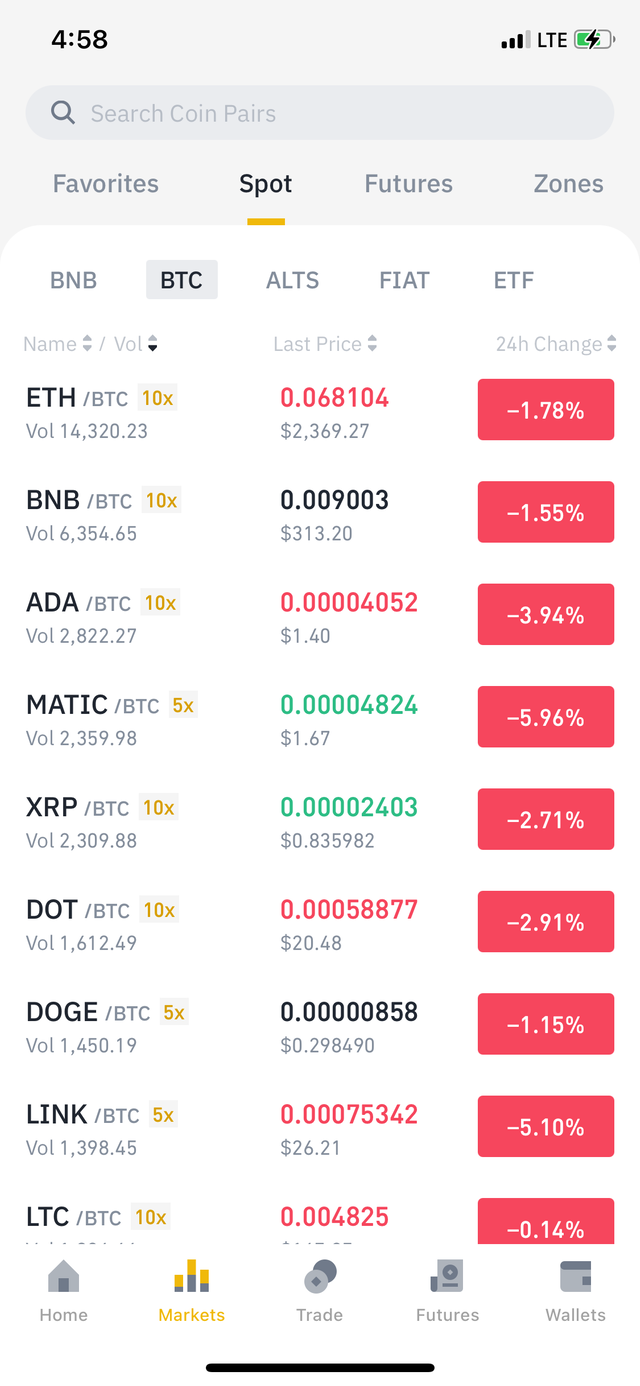

Next thing you see are different pairs of crypto coins currently present at market.

From the given options choose the pair of preference of which you would like to trade on. You could also search for your preferred pair by using the search bar at the top.

After tapping your preferred pair, you will find your order book boldly written with a small dash beneath it.

The green highlighted portion of the order book shows the sell orders where as the red highlighted portion indicates the buy orders.

my explanations to the given words.

- Pairs: basically means two things moving in conjunction. Pairs as use in crypto means two different crypto currency’s traded for one another. For example, ETH/BTC Ethereum and Bitcoin. When you have Ethereum(ETH) and you want Bitcoin(BTC) all you do is trade your Ethereum for Bitcoin with the current exchange rate.

- support and resistance: Support here means the point at which the falling price rate of a crypto currency tends to make a rise. Where as resistance is also basically the point at which the price level of a rising crypto currency tends to fall.

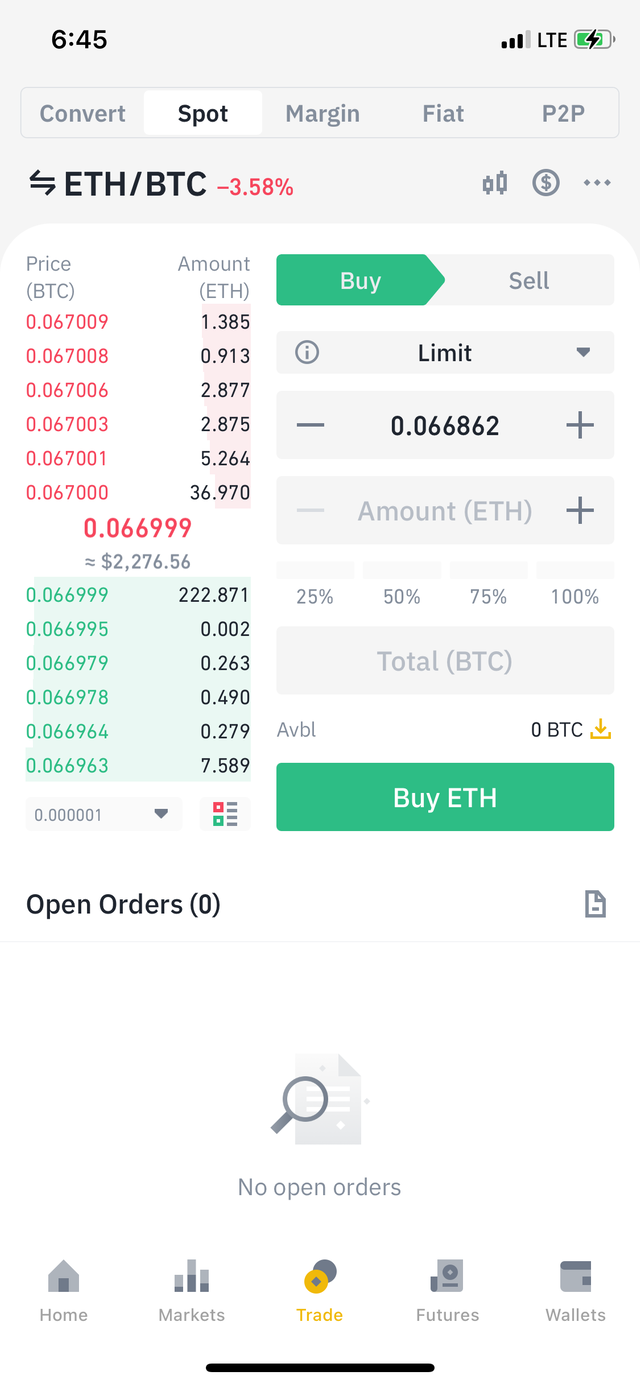

- Limit order: this is the order requested in an order book giving boundary to price limit. Limit order helps users to trade to a given limit set by themselves. Limit order is also meant to stop trade when it reaches the set limit.

- Market order:this is an order issued to hastily buy or sell coin at the uptimum price currently available. For example, selling your steem at a time where steem value rapidly rises.

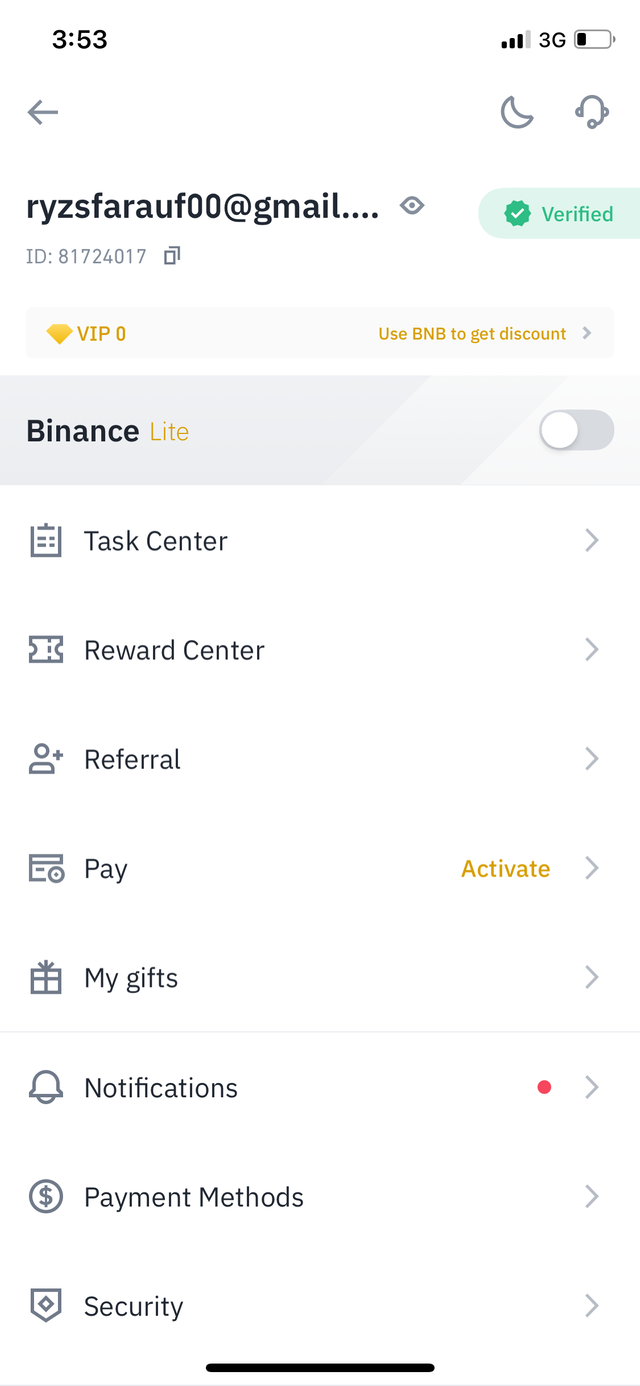

3. Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear.

Here is my screenshot of my verified binance account.

Most important future of order book are the Ask and Bid.

- Ask: this is a sell order with selling price set by people holding and willing to sell the asset. It is the minimum price that someone is willing to sell their assets. The diagram below shows the list of sell order placed by orders.

- Bid: this is the uptimum price a that a buyer is willing to pay for an asset. The diagram shows the list of buy orders placed for the given assets.

4. How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.

To place a buy and sell order in stop-limit trade and OCO, the following steps are required.

In the stop-limit trade, one chooses the point at which he’s willing go into the market to make a trade either by selling or buying. Here the individual decides at what given point he wants to enter into trade an at what rate he’s willing to place a buy or sell order at a given price.

- While in your Binance account please go to market as shown earlier.

- Search the pair of the Crypto asset you want to buy or sell from the list of pairs available and select

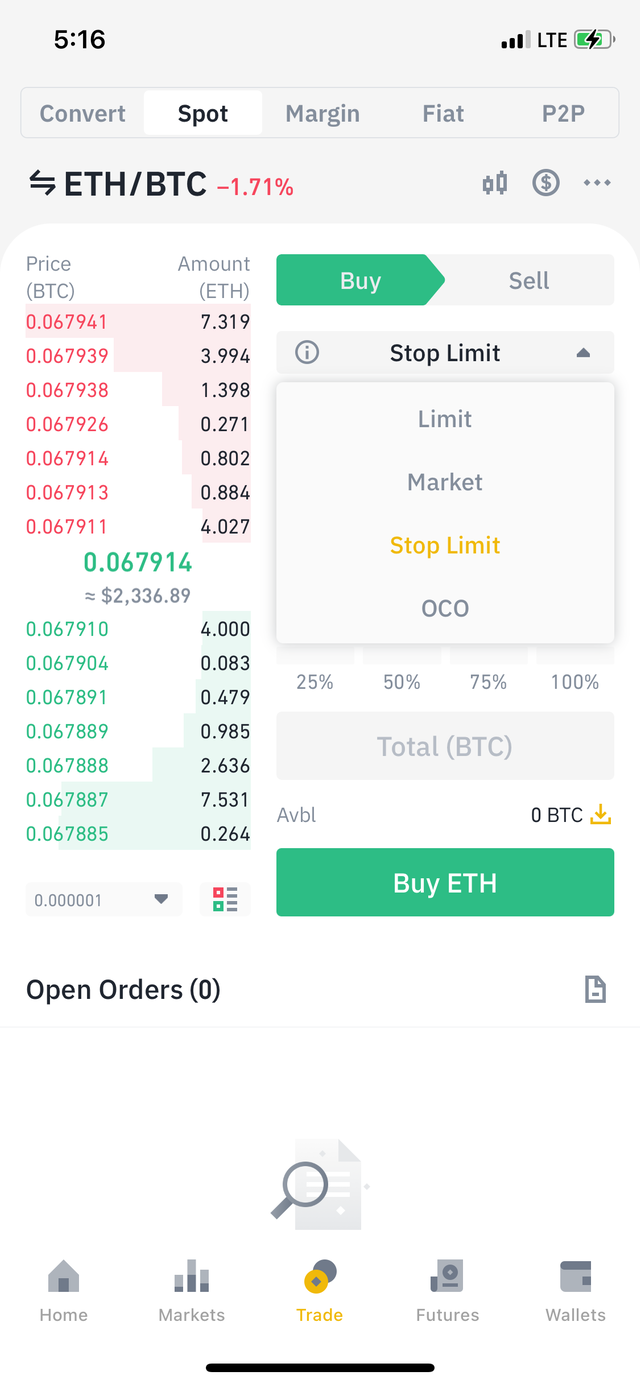

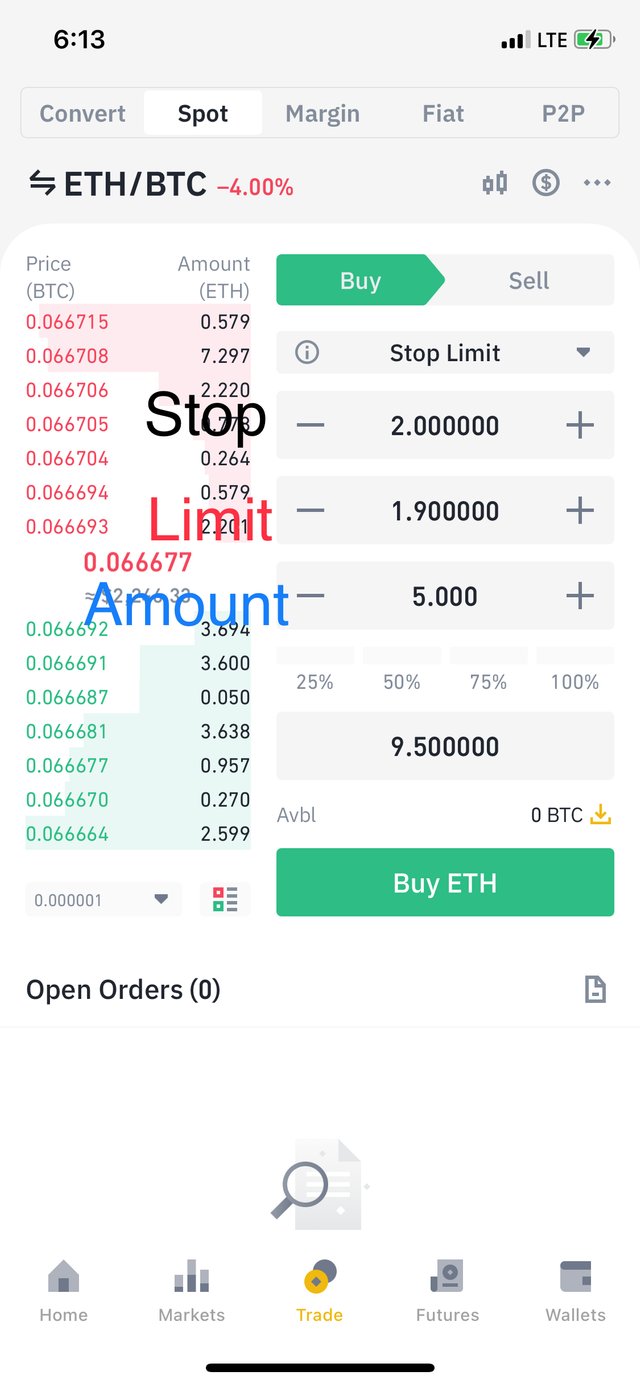

- After selecting choose either buy or sell option below and choose stop limit

A stop-limit buy order. This indicates that when there is a price level equal or below the stop amount an order of 5 ETH should be placed at the limit amount which is 1.90 BTC. This order tells us that an order to buy 5 ETH will be placed when value is at or hence below the stop amount of 2 BTC.

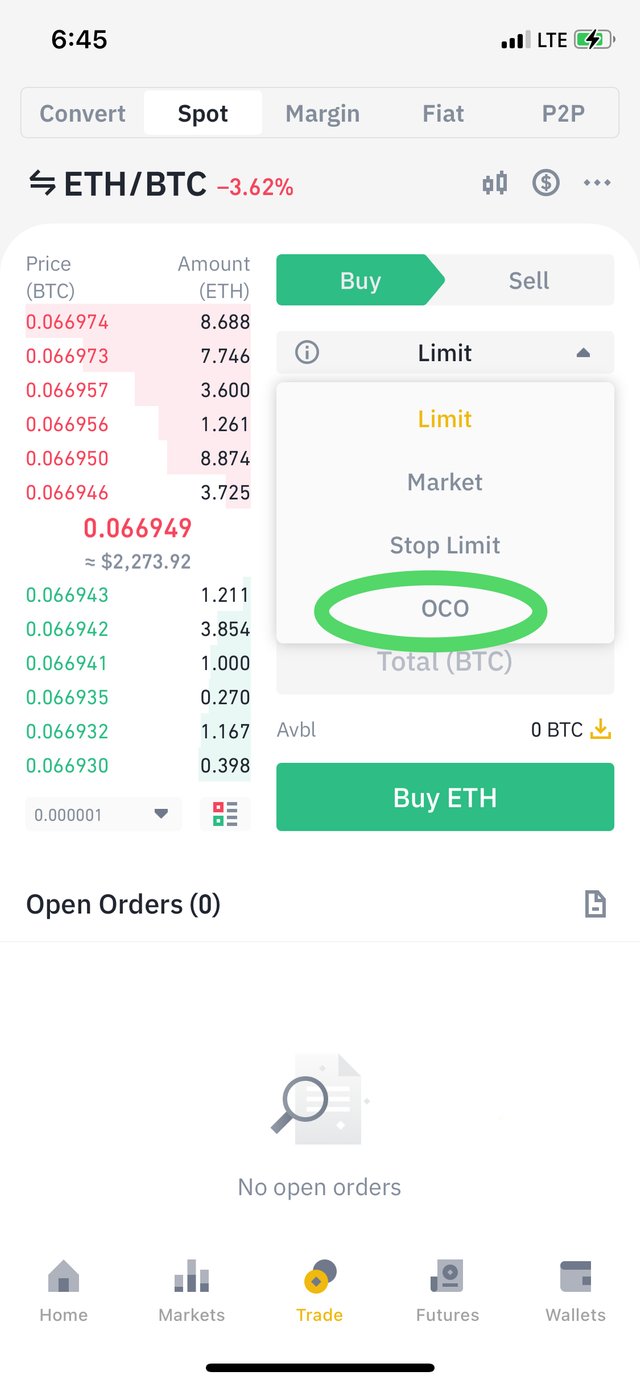

Using same process as mentioned earlier, sellect your buy or sell option .From the Trading section, Select OCO limit trading and place your order to buy or sell .

Choose OCO .

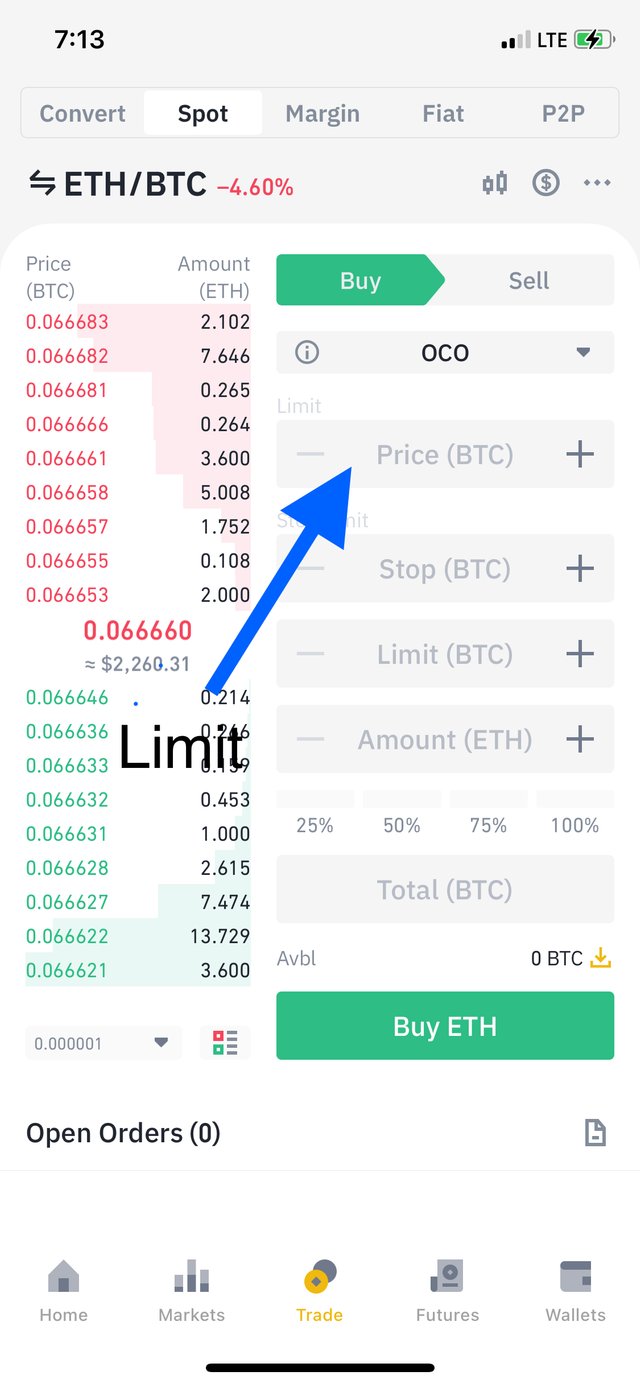

With the OCO trade style it slightly different from that of the stop-limit trade. Here you are given another option which is the limit. This new option enables the seller to sell at a relatively higher price gaining more profit when the price value rises to the set limit. This trade option ensure loss is not gained.

5.How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding.

From your lecture i learnt and realized that the order book is very key if profit gaining is concern. The order book present various option as to which when considered and utilized will yield a lot more profits than expected. Illustrated here are the key options of the order book which maximize profit.

The market order: with this option of trade, the seller examines the time as to which the price value of the asset rises abnormally so as to sell at a higher rate to gain much more profit .

Limit order: in this system of trade the trader makes the order as to which price level he’s willing to place an order whether a sell or buy. In selling with limit order the seller will place his order above current price so as to gain more when the price value rises.

The stop-limit order: with this type of trade ,considering the buy order , the trader places an order to buy asset at a lower price to gain more. Thus the trader will set the stop amount higher than the limit amount so that anytime there is a fall in price value purchase order will be issued.

OCO order: basically from my understanding I will say the OCO trade order acts best in terms of loss protection. This is to say that the OCO order ensures that loss is eliminated from the options hence rather profits is toggled as to which amount of profit is gained.

In Conclusion

I would like to thank @yousafharoonkhan once again for giving us such a wonderful lecture.I think however we need to take caution whenever we are involved in any kind of trading. We shouldn't let our emotions take over ourselves or else we might lose in trade.Order book is really most helpful.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

you did not place the stop limit order , in limit order screenshot look your order placement is incompplete

last question is very much short , need more technical reivew that how order book help to gain profit , so there are many feature that need to mention in this regards

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 5

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor, I will work hard on my research and do a lot better next time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit