Hello everybody, Hope you all are fine and in good health!

My this post is a Homework Task assigned by professor @imagen which is about Fibonacci retracements

Q.1)

Fibonacci is a well known Mathematician. He played a significant role in explaining and thus reviving old mathematical concepts and in addition to that he made several additions to the field of mathematics, science, technology. He was born in Italy then Pisa in 1170 in the house of a merchant called Guglielmo Bonaccio. His father named him Fibonacci and now he is popularly known by this name.

He spent his early childhood in North Africa He received his education from the Moors and traveled in Algeria. He went on business trips to Egypt, Syria, Greece, Sicily, and Provence and during his travels, he learned many new concepts, the accumulation of which led him to publish his most famous writing Liber Abaci when he returned to Pisa.

In this book, he introduced the decimal number system to the world. His most significant role in the field of Mathematics that provided support to various other sectors is the Fibonacci number sequence.

Other most significant achievements are in the field of the geometry of solid and plane figures, obtaining square and cubic radicals, formulas for extracting square and cubic roots, real life mathematical problems, golden ratio and much more. His famous applications other than the one discussed above include Flos, Liber quadratorum or the book of square numbers, and Practice geometriae.

His books are filled with solutions to practical problems faced by the merchants and the traders, he provided examples for various commercial and simple mathematical problems such as the profit and loss system. Fibonacci's books were so effective that people understood the concepts and one of the major effects was the use of decimal numbers in daily life.

Q. 2)

In Fibonacci number sequence the relation is maintained in such a way that every coming value is the sum of the two previous values. Golden ratio is the relation developed if we If we take the ratio of two successive values in Fibonacci's sequence and then dividing each by the number before it

Such as

1/1 = 1, 2/1 = 2, 3/2 = 1.5, 5/3 = 1.666..., 8/5 = 1.6, 13/8 = 1.625, 21/13 = 1.61538

The relation can also be found by the algebraic expression: (a + b) / a = a / b

If a graph is plotted for these values:

Then

Golden ratio is often represented by the Greek letters Phi (Φ, φ) or by the letter tau (Τ τ). It was initially discovered as an irrational number used to describe the relation between two variable lengths of a line segment. The decimal representation of the golden ratio is exhibited by various natural objects and is related to the construction of history such as the shape of the great pyramid of Giza, the parts of the Parthenon in Athens, the Atomic Leda in the box, and in the structures of various musical compositions.

It can be seen in the pattern of growth of various flower petals, in the spiral shells of the animals, the growth of a seed, the proportion of distance between the navel and the feet of the human body.

History:

The use of the Golden ratio although not by this name dates back to the Greeks. They thought some length proportions to be the most pleasant to the eyes and the Greeks then named it the golden ratio. It was previously known as the golden mean. The Renaissance artists used the Golden Mean in their paintings and sculptures for balance of the design and to make them look aesthetically beautiful. The use of golden ratio can also be seen in Egyptian pyramids intentionally or unintentionally. The name golden ratio was coined in 1800 by Martin Ohm.

Q. 3)

Tradingview is a very popular platform for watching trends or doing analysis.

We can see many Fibonacci indicators on many different trading platforms. The most popular are the Fibonacci retracements and Fibonacci Extension on tradingview.

Here I will show a screenshot of how we can use Fibonacci retracement and in the last question I will be explaining the Fibonacci extensions.

On the toolbar click on Gann and Fibonacci

Click on Fibonacci retracement

Chart: ADA/USDT

To apply It on an up-trend we must begin from the beginning of the trend and place the second point at the top of the up trend

In case of the downtrend the line is drawn as its first point at the beginning of the trend and the second point at the lowest point.

It is subjective to use any type of settings as preferred by the trader. Many traders like to use it with other indicators to indicate accurate trends. In addition , many traders trade between two levels buying at the lower and selling at the higher level.

Q.4)

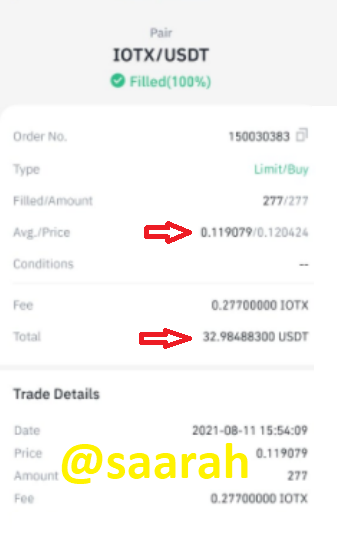

I placed my investment in IOTX on 11th August when the price tag was about 0.1190 the situation of the market can be seen in the screenshot below.

I applied the Fibonacci retracement indicator. If the market were to continue from here it would have reached 1 level or if it were to reverse the levels below are 0.786, 0.618, and 0.5.

After an interval of a day

The market in this chart can be seen to retest the resistance level set earlier and a rise can be expected in the candles to come. At the end of the day it reached up to the level of 0.78 and dropped below.

After an interval of 2 days:

Even after 48 hours, the resistance became the support. The market dropped below to reach a situation as shown below

Various traders place buy signal at this point and not when the trend is bullish to sell at a price.

Q. 5)

Fibonacci extensions are also one of the fibonacci sequence based indicators that can be applied to the chart from the tools option. It is expressed as percentages of the decimal fractions of the Fibonacci sequence. It further complements the Fibonacci signals.

The support and resistance levels in the market are very crucial for placing the right bids and Fibonacci extensions help us identify the right support and resistance lines on the chart. In addition they are also used to confirm an uptrend and the downtrend. Most traders like to take entry positions for buy and sell under 50% level.

The extension was applied

Conclusions

Fibonacci indicators are widely used by traders to identify support and resistance levels. The development of Fibonacci sequence is the major principle under the Fibonacci retracement and extension tool. The golden ratio is widely applied in various construction and architectural projects for drawing balanced dimensions.

In trading it indicates continuity and breakpoints or retracements in the trends. It also explains the extent of the spread of the trend. Traders mostly used the levels of 61.8%, 100%, 138.2% and 161.8% for taking confirmed signals.

Gracias por participar en la Tercera Temporada de la Steemit Crypto Academy.

Realizastes un buen esfuerzo. Tienes algun dominio de los temas, sin embargo, debes extenderte mas en tus explicaciones y analisis, agregando una mayor porcion de informacion relevante.

Continua esforzandote.

Espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit