Hello everybody, Hope you all are fine and in good health!

My this post is a Homework Task assigned by professor @awesononso which is about Blockchain Rewards

Q. 1)

In your own words, explain mining and block reward.

Mining usually reminds us about the process of searching for some valuable underground metals or minerals.

The term crypto mining refers to somewhat the same thing. In crypto mining, cryptocurrencies are earned by solving some complex cryptographic equations by using computers. During this procedure, the miners validate the data blocks and add transaction records to a public ledger. This is known as the blockchain.

When we talk about blockchain mining, we refer to a procedure of adding transactions to the existing blockchain ledger. Here the transactions are distributed among all users of a blockchain. On the other hand, mining is mainly related to bitcoin. Other technologies which employ blockchain are also used in the procedure. Using a blockchain employs mining as well. In mining, a hash of a block of transactions is created and it is nearly impossible to duplicate it. This strengthens the integrity of the entire blockchain which is functioning without necessitating a central system.

The process of mining requires a steadfast computer system having a fast CPU. It also demands a higher consumption of electricity and consequently more heat is emitted than typical computer operations. The miners in return are rewarded for doing these complex operations.

Block Reward

A Block reward is a cryptocurrency that is rewarded to the miner in return for successfully validating a new block. This reward block consists of two main parts: the block subsidy and the transaction fees. The block subsidy represents the newly generated coins and it holds the biggest part of a block reward. The other one shows the total amount of fees that are paid by the transactions included in the block.

As we see that the total amount of a block reward is made of the block subsidy, so mostly the people consider the block subsidy as a block reward.

Q. 2)

What do you understand about Bitcoin Halving?

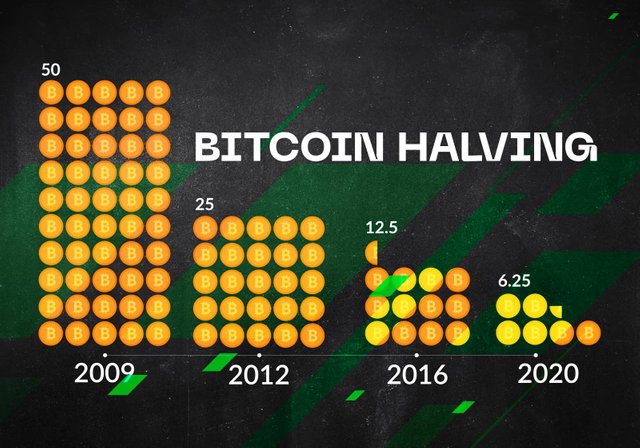

After the period of every four years, Bitcoin halving takes place, and this is enthusiastically observed by investors worldwide.

Bitcoin halvings are lined up to happen every 210,000 blocks – after every four years. And this would continue until the Bitcoin network reaches up to the limit of its maximum supply of 21 million bitcoins. At the time of halving, the total amount of bitcoin as a reward for processing transactions is cut by 50%.

When the first halving of Bitcoins occurred in 2012, it increased the reward for mining a block from 50 BTC to 25 BTC. Again in the year 2016, the halving event reduced the reward bonus to 12.5 BTC per block mined. At the last halving on May 11, 2020, it left only 6.25 new BTC which were created with each new block mined.

This procedure of halving is quite important as it indicates one more dramatic decrease in Bitcoin’s limited supply. The maximum number of bitcoins available is 21 million. As of May 2021, there are roughly 18,715,050 million bitcoins in public hands, with just 2,284,950 million left to be released via mining incentives.

Q. 3)

What are the effects of Halving on miners?

When Bitcoin was first introduced in 2009, the miners received 50 BTC as rewards for processing per block. At the time of the first session of Bitcoin halving, this reward was reduced to 25 BTC, then to 12.5 BTC, and finally to 6.25 BTC.

These mining rewards are responsible for the introduction of new bitcoins into circulation. So in this way, whenever the reward of Bitcoin is cut in half, the entrance of new bitcoins also gets slower. This is the exact point, where we see the real emergence of supply and demand economics. By the time, the supply is reduced, the demand also gets affected (increases or decreases), and consequently, the price changes relatively.

This verdict is circulating in the cryptocurrency community about the effect of bitcoin reward halving on miners. This is true that the halving in the mining reward is not at all welcomed by miners, but that is an integral part of the Bitcoin source code.

While cutting off the mining reward, the miners will be getting a reduced amount causing a big question on profitability.

Similarly, the established mining pools would also find it difficult to balance the operating costs and mining rewards

We know that Bitcoin could only perform well when it is present in a functioning blockchain, and obviously, this is quite costly to maintain a blockchain. In case it costs more than $12,500 to mine a coin, then consequently the price of a coin would be approximately close to $12,500 or it could be higher to reward miners to continue their efforts of mining to the blockchain. As we observe that Bitcoin prices are currently below $10,000, the average miner is actually on the losing end.

If it so happens that the price of Bitcoin continues to be below the cost to mine it for long, miners would discontinue their mining efforts.

Q. 4)

What is the current block height on the Bitcoin blockchain? How many more blocks before the next halving? (Screenshots and Full working)

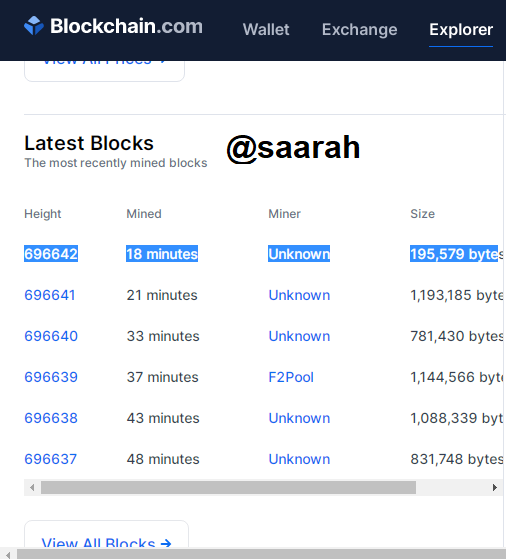

From the above screenshot taken at the time of homework assignment, we can see the height of the Bitcoin block to be 696642 blocks.

We already know that bitcoin has gone through halving three times. Next would be its fourth halving and this would occur when 210,000 blocks are mined.

So we can say that for the next halving which is the fourth one, we require 210000 blocks making 210000×4 = 840,000blocks.

Bitcoins current block height = 696642 blocks

In this way, we can conclude that the blocks left for the next halving = 840,000–696642 = 143,358 blocks.

Q. 5)

Do you think Steem’s inflation rate reduction can affect other coins? Why?

Observing the Steem Whitepaper, we can conclude that Steem is serving as a fundamental or core value to stabilize all other tokens on the Steem blockchain.

Steem is a distributed blockchain and the inflation rate of other coins does not depend on Steem. It could be determined by the way the users support them. The inflation ratio is only effective on its value.

Q. 6)

What is the current block height on the Steem blockchain? How many more blocks before the next 0.01% reduction? (Screenshots and Full working)

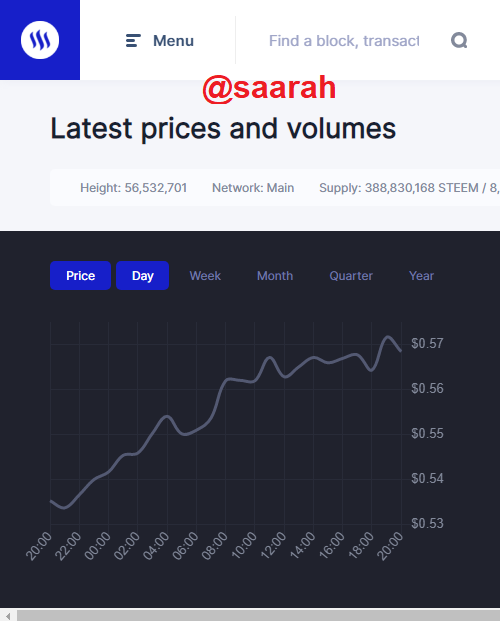

From the screenshot taken at the time of the homework assignment, we can see the block height of Steem is 56,532,701

We also know that the inflation rate of Steem declines by 0.01% at every 250,000blocks.

So we can calculate it like this:

Current block height = 56,532,701

Total number of reduction=56,532,701/250,000

=226.130804 or = 226

So, the next reduction will be 227

And 227*250,000 = 56,750,000

And 56,750,000 - 56,532,701 = 217,299 number of blocks is the number that must be mined before the next reduction.

So, Total Number of blocks remaining until next reduction = 217,299

Continuation of last week’s work:

1. What is the current value of BTC on the day you are performing this task? If you purchased $2,500 then,

a.) How many satoshis would you have?

b.) what is the value of a satoshi for that day?

(Show full working and correct to 3 s.f)

(1 satoshi = 0.00000001 BTC)

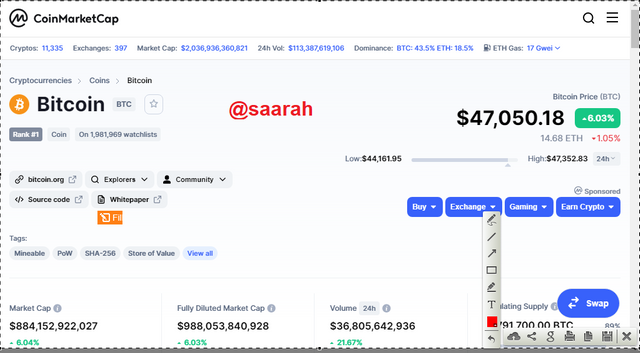

The current value of BTC on the day this homework was done was $47,050.18.In case of purchasing $2500, what would we get?

Let's find out

1 BTC Value= $47,050.18

The number of Dollars we have in Bitcoin = $2500

So we can calculate the number of bitcoins we will get with $2500 by dividing 2500 with 47,050.18

And We will get 2500/47,050.18 = 0.05313476 BTC

0.053135 BTC (3.s.f)

a.) How many satoshis would you have? b.) What is the value of a satoshi for that day? (Show complete work and correct to 3 sq. Ft.) (1 satoshi = 0.0000001 BTC)

1 satoshi = 0.00000001 BTC

So, to convert my $2500 into Satoshis

It will be like, Total SAT = 0.053135 / 0.0000001 = 5, 313,000 SAT (3 s.f)

(b)Value of Satoshi for this particular day

1 satoshi = 0.00000001 BTC

Therefore, 1 satoshi = 0.00000001 * 47,050.18 = $ 0.000470 (at 3 significant Figure)

What is the current value of BNB on the day you are performing this task? If you purchased $30 then,

a.) How many Jagers would you have?

b.) what is the value of a Jager for that day?

(Show full working and correct to 3 s.f)

(1 jager = 0.00000001 BNB)

(Screenshots of current value should be provided)

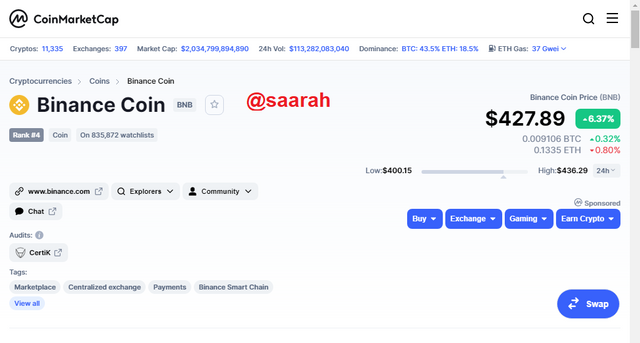

The time I did the homework assignment, the value of BNB was $427.89.

In the case of buying$30, I would get;

Let us understand.

The price of 1 BNB=$427.89

The current amount of BNB=$30

So, 30/427.89 = 0.0711148 BNB

That means, we will get 0.0711148 BNB in $30

A.) Now, we see that how many Jagers I will have in $30

1 Jager = 0.00000001 BNB

The total amount of BNB we have=0.0711148

Then; we would do these calculations: Divide 0.0711148 by 0.00000001

=7,111,480 Jagers.

I would have 7,111,000 Jagers (3 s.f)

B.)

1 Jager=0.00000001BNB

1BNB= $427.89

So therefore, 1jager = 0.00000001×427.89=0.0000042789

=$0.00000428 (3 s.f)

Conclusion

Bitcoin mining is a popular source to earn rewards for processing transactions in the blockchain. This means that miners work tirelessly in processing transactions to be rewarded. This effort demands the much time and energy it takes to run the computer hardware and solve complex equations.

The mining reward is halved after every four years. This halving process is a strategy adopted by Bitcoin as a simulated form of inflation in which the halving would take place every four years until all bitcoins are released into the crypto market

Steem is a distributed blockchain that does not at all affect the inflation rate of other coins.