Hello everybody, Hope you all are fine and in good health!

My this post is a Homework Task assigned by professor @stream4u

TECHNICAL DETAILS ON REVERSE STRATEGY:

We are discussing the long Bullish or Bearish development, so how about we assume the market or a particular crypto resource is in long bearish and the day will end, will think about Long Bearish, which is day change is equivalent to - 20% or more than it.

Before the day cycle total, the resource's cost will pull back sooner or later, which implies the vendor leaves their position, and a few purchasers enter, which attempts to pull the price from the base. Here, we need to note down the initial cost, High Point, Low Point and the most significant is the Close Point.

PREPARATION FOR THE REVERSE STRATEGY:

Reverse Strategy relies upon the Close Price and following day Opening Price. The initial cost ought to be close/close to the one-time relative fee. Assuming it is, we will take a quick purchase position. The stop loss will be a past low spot, and the objective will be the past high point. If value arrives at the past high end and assuming you can hold, sit back and watch if the value of the resource crosses to the past high point. If it does, the open objective will be accessible for you. Available objective methods anyplace you can take an exit, or for the most part, the new purpose will be a past high point a day before yesterday.

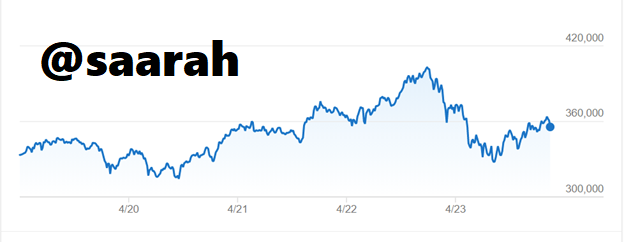

Ethereum (Current graph) (Weekly)

The graph above clearly shows that moves to new highs or lows bring about reversals. Consequently, these examples will keep on working out in the market going ahead. An investor can look for these models, alongside affirmation from different pointers, on current value outlines. The prices will go down in the next week due to the evidence of resistance shown in the previous weeks; hence, there are uttermost chances that the prices will continue to go down in the upcoming week.

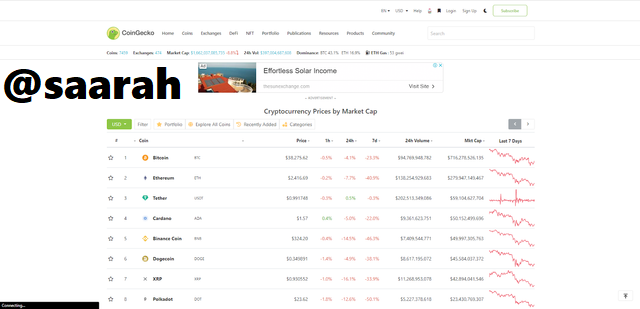

REVIEW OF COINGECKO:

CoinGecko is a site and versatile application used to total data concerning the exhibition of most of all cryptocurrency accessible. Utilizing constant information takes care of, CoinGecko shows value data, exchanging volume, and value changes over periods from 60 minutes, to multi-week to as far back as the accessible data will permit. Additionally, crypto resources are positioned by market capitalization, with the most considerable positioning most elevated.

HOW CAN COINGECKO CAN BE HELPFUL:

Numerous crypto investors depend on CoinGecko as an all-inclusive resource for factual data to help illuminate exchanging choices. Additionally, CoinGecko is incredibly helpful for staying aware of the most recent tokens and most sizzling patterns in crypto. This is because CoinGecko screens the development of the crypto business and the different ventures that exist inside it. Also, CoinGecko tracks on-chain measurements, open-source code improvement, and upcoming occasions inside the company.

COINGECKO FEATURES:

CoinGecko gives bunches of various components to help you keep on top of your portfolio and figure abundance gains under the CoinGecko 'Devices' tab. Here, you can look at the best crypto costs for marking, stacking sats, and that's only the tip of the iceberg!

Crypto Exchanges (Spot)

Trust score is displayed on a scale of 1-10 on the COINGECKO exchange overview page, which gives an idea of suitable spot crypto exchanges.

Market Capitalization

The market capitalization is calculated on the COINGECKO as the market cap is shown on their home page.

Listings

COINGECKO provides coin tokens or exchanges listed free.

Price

The cost of crypto assets is determined dependent on the pairings accessible and gathered by CoinGecko from the different trades for a specific crypto coin.

Trading Volume

The trading volume for a crypto coin on CoinGecko is the trading volume of all trading sets of the crypto asset.

WEEKLY PRICE FORECAST FOR CRYPTO COIN: BITCOIN

As demonstrated in the weekly chart, we see that the BTC cost has confronted generous obstruction in the previous few weeks. The money has battled to move above $60,000. Simultaneously, it has moved beneath the 23.6% Fibonacci retracement level and is presently moving toward the 38.2% retracement level.

Another striking thing is that the money has dipped under the 25-week moving usually. Along these lines, in my view, the bearish pattern will probably proceed as bears focus on the half Fibonacci retracement level at $32,798. Notwithstanding, a move above $50,000 will refute this pattern.

WHY BITCOIN?

I selected BITCOIN as The Bitcoin price profoundly bears an area after an unexpected change in conditions. The BTC is exchanging at $42,965, 35% beneath its record-breaking high of close to $65,000. Its market cap has dropped to $800 billion while all cryptographic forms of money have tumbled to $2 trillion.

There are a few reasons why the costs of Bitcoin declined. To start with, Elon Musk stated that Tesla might sell or has effectively sold its Bitcoin possessions. The declaration came to a couple of days after the organization chose to eliminate BTC as a payment choice.

Technical Analysis

BTC is falling, and it will continue to fall in the following weeks too. This is what technical analysis says. Moreover, BTC didn't stay high in prices for continous 7 Months and it has already passed 6 Months. So, according to technical analysis, BTC will drop again below this price.

Possible value for Next 1 Week

As because of the Technical analysis, BTC will drop again to $30,000 because some wrong news about crypto are coming from China and Elon Musk. Moreover, We have seen that One of the big fish Justin Sun just bought over 4000 BTC which can help the BTC price to be stable at $40,000 for next 1 week.

CONCLUSION:

We learned one of the technical strategies is the Reverse strategy which will be applicable when there is a long bearish or bullish pattern trend like around day change - 20%/at least +20 than it, stop misfortune, and target subtleties referenced previously. Moreover, now we know that bit coin will fall in the following week and its circumstances.

Hi @saarah

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit